Market "Melt Up" or..."Set Up"?

Sometimes we have to be careful what we wish for.

Allow me to explain...

Back on October 10, I told GBR's premium subscribers that the market had likely bottomed for now - the trend of rising oil prices points toward an improving economy, while analysts were eager to upgrade tech stocks going into the Q3 "earnings season":

"If I'm right, then it's possible we could see marginal new highs by the time we get to the first week of November."

So far, so good. We got to the "new highs" part even sooner than I thought.

As a follow-up last weekend, I told premium subscribers this:

"It wouldn't surprise me to see yet another "melt up" in coming sessions - to the blue uptrend line on the chart..."

Again, so far so good. Yesterday, the S&P 500 and DJIA set new all-time highs and give every indication of aiming for that blue-uptrend line drawn on the chart.

I think we're going to get there by the first week of November.

Notice the red line and arrow on the far right of the chart?

That shows us the date when the Federal Reserve's next meeting on interest rates wraps up. It starts November 2nd and finishes with an announcement and press conference at 2pm, November 3rd.

I think that meeting could be an important turning point for the stock market.

Market "seasonality" - its tendency to rise or fall based on various calendar months and/or holiday periods is well known.

But once in a great while the markets sometimes rally into Fed meetings, which tends to make folks more than a little giddy and complacent.

From there, Wall Street pros drop the hammer and quietly start selling when everyone else is wrongly pounding the table to buy.

So we need to watch the market carefully between now and the Fed meeting. If the market continues to rally into the Fed meeting week, which is what I expect to happen, we could be getting set up for a bigger and unexpected selloff in the weeks after.

The Main Event

The highlight of November 2-3 meeting will be the central bank likely confirming that it will start "tapering" its bond purchases in coming weeks.

The Fed has been telegraphing its intention about all this for months now:

In other words, the central bank is going to slowly withdraw extra monetary liquidity from the US economy.

It's like giving your kid a lillipop to keep him quiet and artificially-soothed in the backseat during a stressful afternoon running errands in the car - and then taking it away later as you pull back up to the driveway.

What does that mean to us?

Well, my point is... I'd be more inclined to give credit to an end-of-year bull rally if the market were falling/descending into the Fed meeting (and therefore discounting the impact of the bad news).

Instead, the market appears to be ignoring the Fed's message, that the market's "lollipop" sugar high is being taken away.

Perhaps investors are right. Perhaps the market "melt up" we're seeing now will continue to gain strength. With the Fed meeting out of the way, we'll see an even bigger, broader end-of-year rally like we experienced in 2020.

But every once in a great while, Fed meeting dates turn out to be important market-timing events.

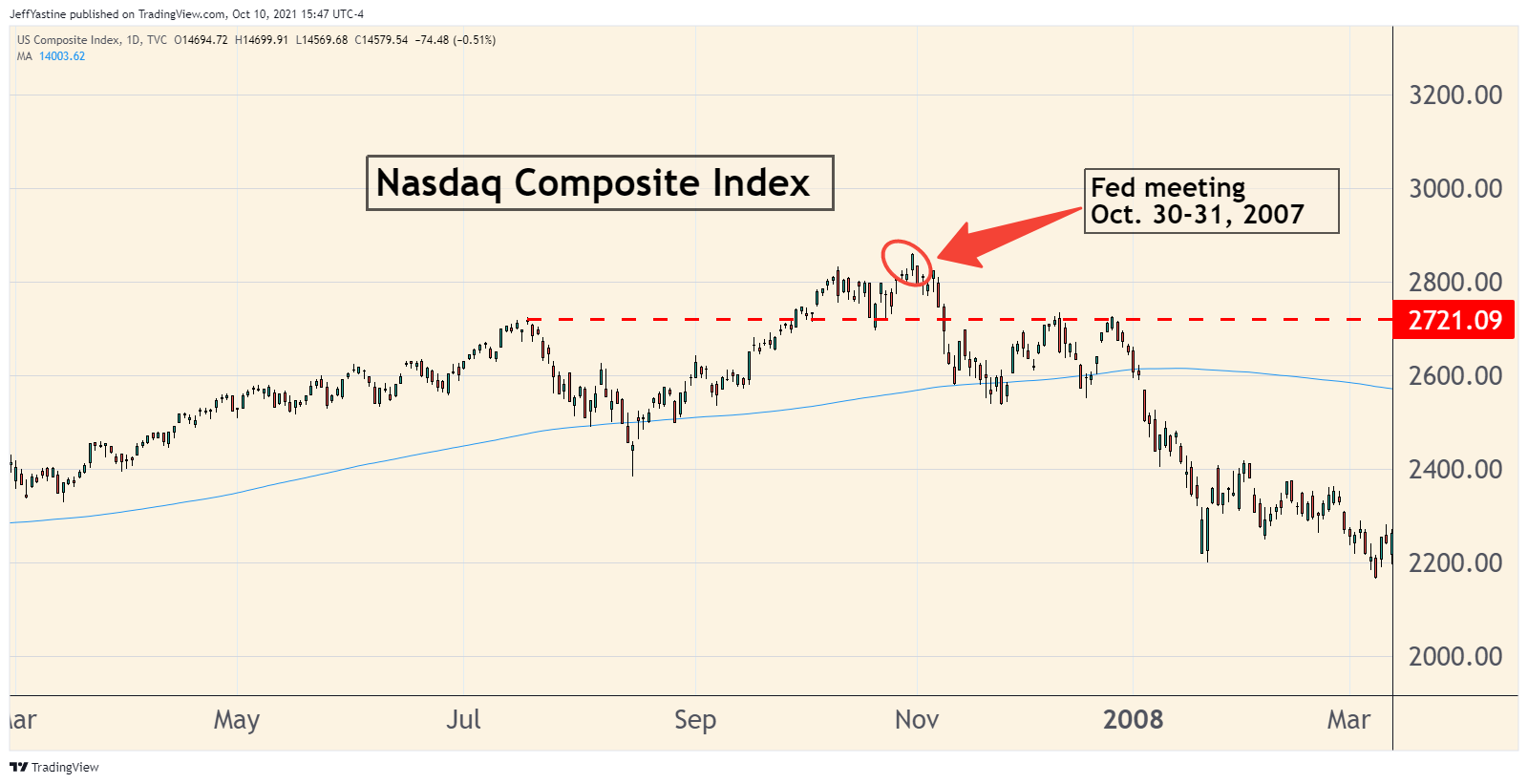

For example, the Fed meeting on October 30-31, 2007 turned out to be the "tippy top" of the entire 2003-2007 bull market.

I remember that month because there was plenty of troubling news going on in the background. But the market was headed higher anyway. So no one cared, since it obviously wasn't enough to disrupt the bull market (or so everyone thought)..

Oil prices were hitting record highs. The hot sector was banking, fueling the housing boom. All of the largest companies on the S&P 500 were banks and financial companies. Foreclosure rates were also rising to troubling levels in certain states.

But most of it was "explained away" as not being a big deal.

The Fed had its late October meeting, and suddenly everything changed.

By Thanksgiving, the Nasdaq fell 10%. Over the next 18 months, the index fell a painful 55%:

So am I predicting a grinding bear market ahead?

I try not to get caught up in making big macro-economic predictions. I'd rather focus on identifying good buys in the stock market.

But keep your eye out for the first few days after the Fed meeting wraps up November 3rd.

Perhaps its onward and upward from there.

But if that turns out not to be the case, then a little caution isn't a bad idea as we see what a post-pandemic economy - and stock market - really brings.

Best of goodBUYs,

Jeff Yastine

Member discussion