Market Update: The "Tale of 2 Indexes"

In recent weeks I've been saying that the odds point to higher stock prices.

It's been a modest rally at best, but so far that's been the right move.

As I look out to the last 5 weeks of the trading year, I think we're entering what I'll call the "tale of 2 indexes"...

For reasons I'll explain below, I think a major index like the S&P 500 (and the Nasdaq QQQ) has a good shot at continuing to grind its way higher at least through the middle of December.

But we'll need to stay cautious beyond that point because a certain "closet index" I watch carefully, is telling us that this market rally isn't yet "broadening out" the way a healthier market, after a sharp decline, typically does (more that below as well).

So let's take the S&P 500...

Major Indexes Churning Higher

Don't look now but after last week's plodding-higher performance, the index is within about 1% of hitting its 200-day moving average for the first time since March:

Traders tend to use the 200-day moving averages as a "back of the envelope" measure for a stock or index that's either improving - or deteriorating.

So if I'm right, and the indexes continue to grind higher, I think the story we'll hear on financial media - rightly or wrongly - is that future prospects for the economy perhaps aren't as bad as many feared.

For example, Black Friday sales rose 2.3% compared to last year, hitting a record $9 billion. Toy sales were up 285%, exercise gear jumped 218%, and online sales soared 221%.

On the surface of those headlines, that's welcome news and could be helpful to usher in a few more weeks of holiday cheer, leading up to December 13-14, which promise to be the 2 biggest news-related trading days of the month...

- December 13: The US Bureau of Labor Statistics releases new inflation data, in the form of the November CPI (consumer price index) report.

- December 13-14: The Federal Reserve holds its last meeting of the year; so far, the betting is that we'll see another rate hike of 0.75%, though some think it could be a smaller 0.50%.

I'm willing to bet that we'll see some nice rallies in and around those dates.

It almost doesn't matter what the headlines are - seasonally, people are in a buying mood.

Please also don't forget that Wall Street has a vested interest in keeping the rally going for a while longer - it could well mean the difference between getting a nice year-end bonus or not.

So I think we're going to see a lot of aggressive trading, and generally higher prices between now and the middle of December.

"Closet Index": Stone Cold

I've made no secret that I like to keep an eye on Cathy Wood's infamous ARK Invest (ARKK) ETF.

Despite being down more than 60% this year, and down 77% in the past 22 months, it remains one of the 25 or so most heavily-traded ETFs, and the only actively-traded ETF in the group.

As such, it represents both the promise and peril of owning many of the smallest stocks with huge growth possibilities - but also huge risks.

That's why I think this ETF is worth watching. Until ARKK's "high risk, high reward" corner of the market starts acting better, then the longer-term health of the current market still has a big question mark over it.

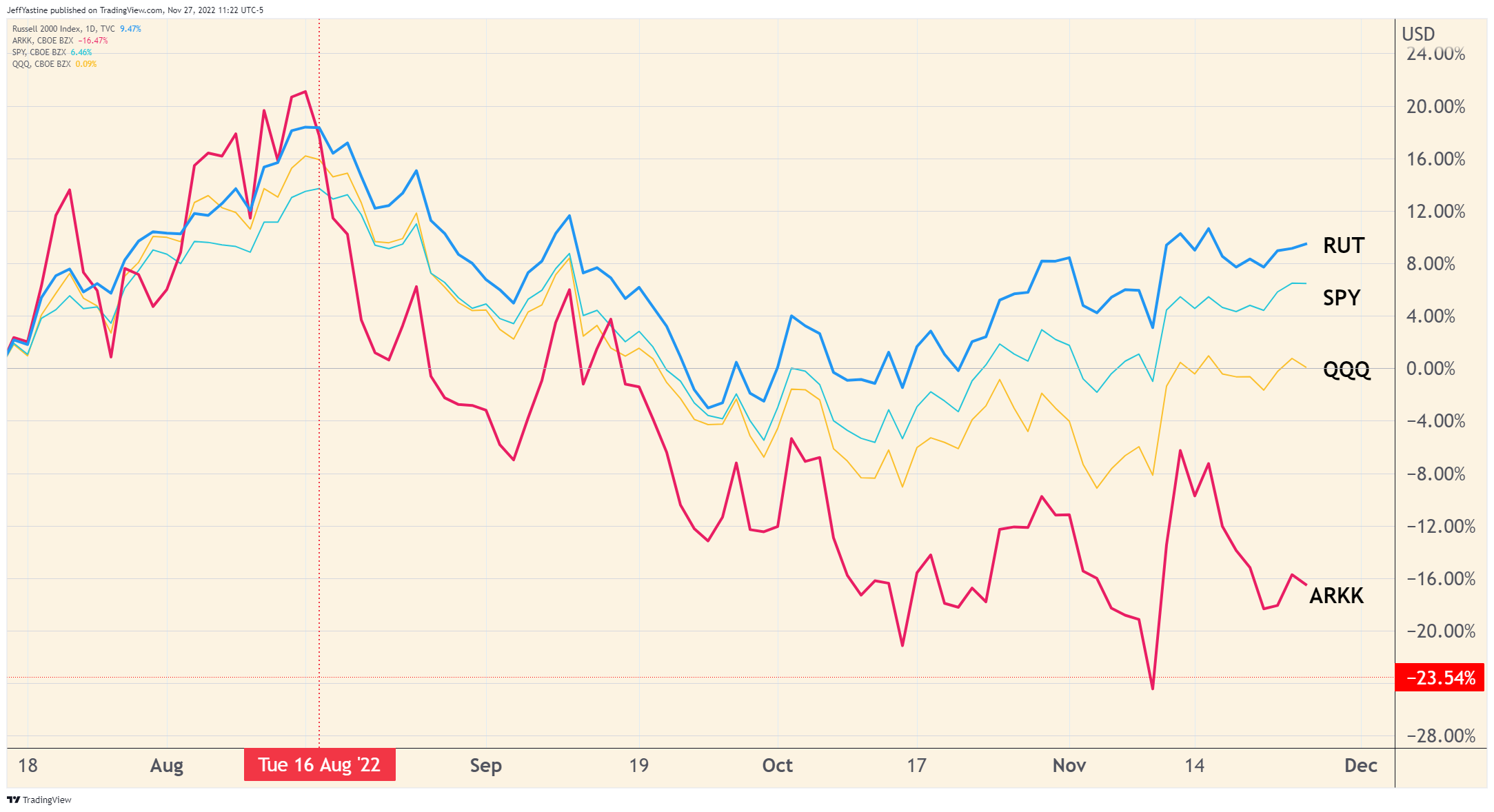

And as you can tell from the chart, investors in this riskiest corner of the market still see things as "half empty" rather than "half full":

In fact, ARKK has rebounded the least since the last bear-market rally in August, and is closer to its lows of the year than any other index:

One caveat: I suppose it's possible that ARKK's chart could improve dramatically once we hit the start of January. From a seasonal standpoint, that's when small-cap stocks are at their best as investors make their buys for the coming year.

But still...the stocks in ARKK are, generally speaking, representative of the kinds of companies that would be the leaders, and biggest winners, in the next bull market to come.

The fact that these stocks remain among the weakest groups is a yellow warning flag on our market rally, until proven otherwise.

Member discussion