Weekly Update: Our "Ring Strategy" with Mr. Market

I watched a Ken Burns PBS documentary about Muhammad Ali's life this week that has some relevance to today's stock market.

Part of the documentary was nostalgia for me. As a kid growing up in the 1970s, Ali loomed large. I wasn't the only one going to school with The Champ's image on his lunch box, let me tell you.

Even my dad, who wasn't a huge boxing fan, got caught up in the hyped-up excitement of Ali vs. George Foreman in 1974.

As Burns' documentary notes, this particular match was the so-called "Rumble in the Jungle" in Kinshasa, Zaire (today's Democratic Republic of Congo).

It's also where Ali unveiled his now-famous "rope a dope" strategy.

Ali's plan was to stay close to the ring ropes and let Foreman tire himself out with ineffective punches in the early rounds, so he - Ali - could dominate the match in the later rounds and win.

That's exactly what happened.

Foreman, exhausted by the 8th round, was knocked down by an Ali punch. He was too slow, too tired to get himself back up off the mat before the ref finished his 8-count, and that was it.

Ali won by a technical knockout.

Metaphors aside, "rope a dope" is the way I like to think of my overall attitude to the stock market now.

The general trend is that the broad market indexes keeps hitting new highs. Yet the vast majority of stocks are either drifting or heading lower. Until this changes for the better, we need to...

- Let the market do its thing, be patient, and don't take big chances.

- Do the difficult work of culling the portfolio of losing stocks while those losses are still small.

- Stay alert for new opportunities.

Market Update

We'll need that "rope a dope" strategy because Mr. Market just isn't giving us as much to work with these days.

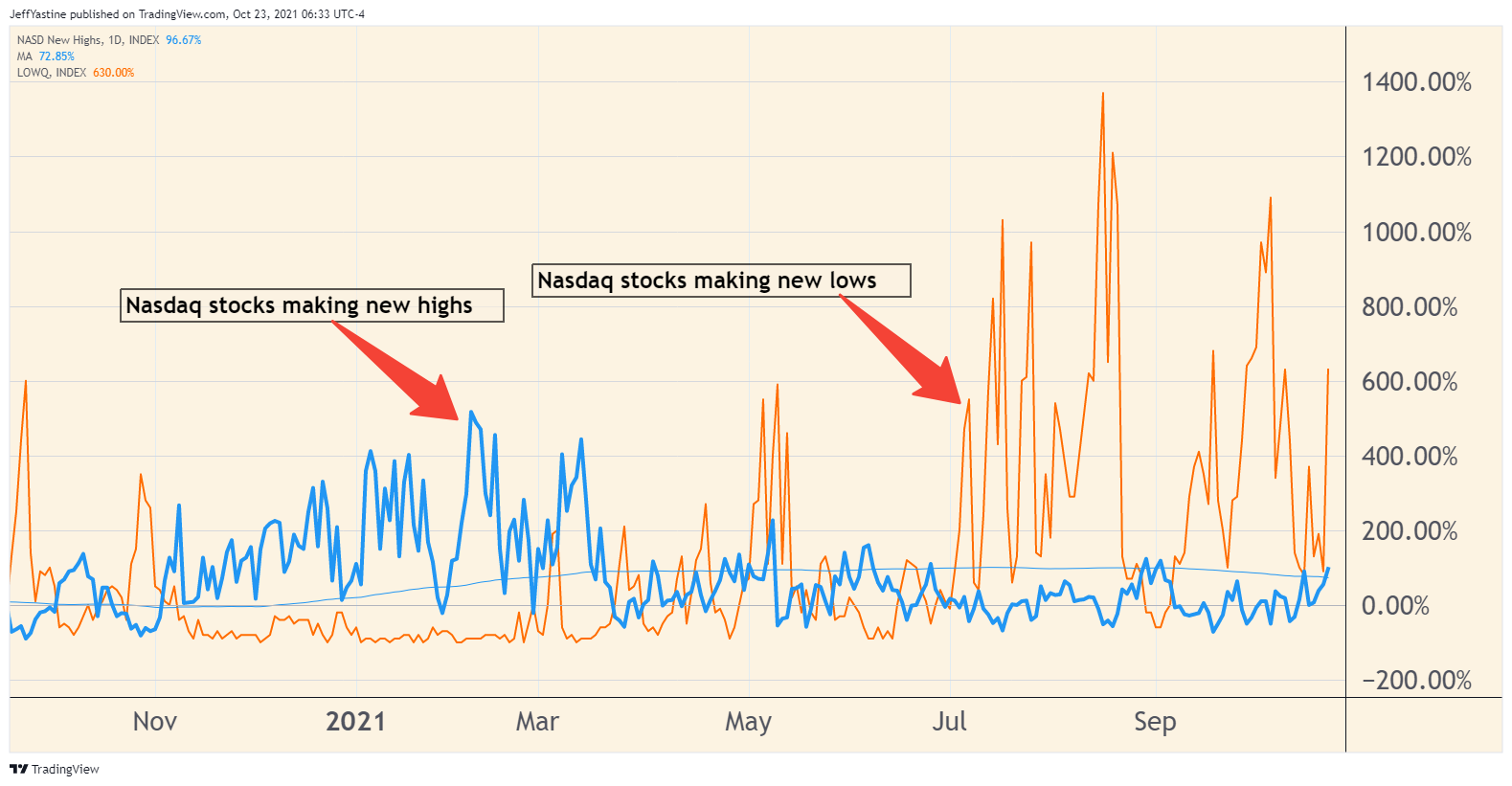

This chart - with Nasdaq stocks making new lows (in orange), and new highs (in blue) - tells it best...

Basically, it's a case of the "generals" - megacap stocks that have the highest mathematical influence in the S&P 500 and Nasdaq - bounding higher. That's why the indexes are at or near all-time highs.

Meanwhile, growing numbers of "soldiers" - small and midsize companies - are becoming stock market casualties.

Eventually the cycle for these smaller, fast-growing companies will turn. Until then, we'll need to be patient, and enjoy the show that the major indexes are putting on right now.

With big energy stocks leading the way, both the S&P 500 and DJIA both set new all-time highs last week (the Nasdaq is still about 2% below its old highs).

It wouldn't surprise me to see yet another "melt up" in coming sessions - to the blue uptrend line on the chart (a move of 4% or so for the S&P 500) as we head towards the next Federal Reserve meeting coming up November 3-4.

That blue uptrend line has functioned as the touchstone for this long-running market rally - hitting it, pulling back, hitting it, pulling back - for the past year and a half.

So it makes as much sense as anything to see the market - despite rising energy prices, the threat of rising interest rates, and not-great consumer sentiment - power its way up to that blue line again.

But the big question I've been posing in recent updates remains unanswered...

Is what comes after the Fed meeting - a widening "melt up" for the markets that includes more small- and medium-sized companies?

Or is the current rally a Wall Street "set up" to get regular folks to buy while pro traders head for the late-year exits?

I guess we'll find out soon enough.