The Hidden Formula

What's the Hidden Formula?

I created the "Hidden Formula" to give myself a proven, simple way to buy the right number of shares - yet visualize and accommodate the potential risk of any stock I want to own, from the stodgiest blue chip to the most promising but unpredictable biotech.

Answer the "4 Steps" in the interactive boxes below.

- To enter numbers, click on each box and either punch in numbers directly from your keyboard or use the little arrows to adjust each number.

- For dollar-denominated figures, no need to enter "$" because the worksheet will add it automatically.

- Play with different combinations of portfolio sizes, risk levels, buy prices and "sell for a loss" prices.

- Refresh the page to reset the values in the worksheet.

*Please remember that the Hidden Formula is for educational and informational purposes only. It won't prevent you from losing money on bad stock ideas. It won't help you if you lack discipline and patience. If you have trouble selling a stock for a loss (because it means admitting you're wrong), the Hidden Formula won't help you there, either. And if you lack a healthy respect for the capriciousness and inherent risks of the stock market - it won't prevent you from destroying a portfolio through your own poor choices.

The Hidden Formula is not about "get rick quick." It's about how to avoid "getting quickly poor" when the markets, random bad luck, and our own stock-picking decisions, work against us.

But no matter your style of investing or trading, the Hidden Formula will help you understand the important relationship between risk and reward when it comes to purchasing a stock with hard-earned investment & retirement funds.

Let's go over an example so you can see how it works...

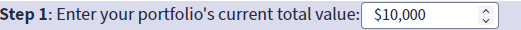

Let's suppose I'm a young investor. I have a small portfolio of $10,000 that I want to grow and add to, over time. Now I'm ready to buy my first stock.

But I can't decide how many shares I should buy. How many shares is too many, considering the size of my portfolio, and my uncertain appetite for risk?

Step 1: I input "10,000" in the box (use your keyboard, mouse or the up-down arrows to input the amount):

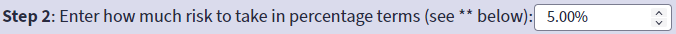

Step 2: In percentage terms, how much of a loss am I willing to risk with a new investment or trade?

I would never want to personally risk more than 1% of my portfolio's total value on any one trade or investment. That way, I can be wrong - and lose money -10 times in a row and (at least in theory) only accrue losses of approximately 10% in my portfolio.

But for the sake of the example, let's say I want to "swing for the fences" and risk 5%, or $500. That's how much I'm willing to lose on the trade if it doesn't work out. So I input that amount in the box:

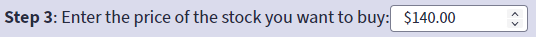

With Step 3, I'm going to determine my "Risk Size." Let's say I'm interested in buying shares of Procter & Gamble (PG) (though we could just as easily be choosing Tesla, Apple or some other popular stock of the moment).

Step 3: So now I'm going to input the example's $140 price of Procter & Gamble stock:

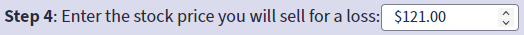

Next, I want to at least consider the possibility that I could be wrong, and perhaps PG's stock will fall sharply after I've bought it.

Step 4: For the sake of the example above, I input my "sell for a loss" price of $121 a share:

Answer: The worksheet automatically computes 2 numbers and gives me the answer.

- It subtracts the price in Step 4 ($121) from the price in Step 3 ($140).

The answer, $19, is called my "Risk Factor."

- It divides my "Risk Size" ($500) by my "Risk Factor" of $19

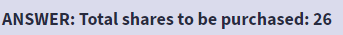

The answer is what gives us an unequivocal response to the key question - "How many shares can I buy?":

The Hidden Formula also prepares me for the potential reality of my investing or trading decisions...

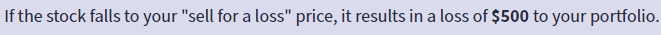

For example, in terms of risk, I'm "swinging for the fences" remember? I'm willing to risk losing 5% of my portfolio's value purchasing Procter & Gamble's stock at $140.

But the Hidden Formula is telling me that I stand to lose $500 if I'm wrong and PG's stock falls to $121 a share:

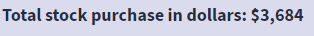

Further, the Hidden Formula also tells me that I'm devoting more than one-third of my entire $10,000 portfolio to just 1 stock. Do I really want to do that?

In reality, some people would want to take that amount of risk. Others would not. There's no one correct-all-the-time answer. What works for one person doesn't work for everyone.

We all have individual appetites for risk, types of stocks we want to own, and specific financial goals - and we have to live with the success or failure of our choices.

But the last part of the Hidden Formula is in many ways the most important...

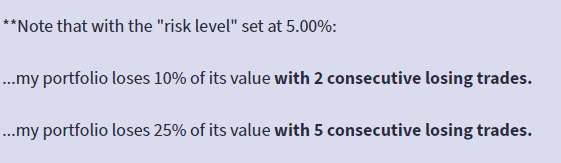

What if a terrible bear market starts (which increases the odds I'll have multiple bad trades in a row)?

Or perhaps it's only slowly dawning on me that I really have no business picking stocks on my own?

The Hidden Formula tells me how many additional bad trades in a row (at my specified "5%" level of portfolio risk) will result in specific levels of loss:

Personally, I would hate those kind of odds - losing that much on just a handful of trading and investing choices. My personal default risk level is 1% of my portfolio's value. During tough market periods, I sometimes go with even one-half of 1%.

The way I see it, when it comes to losses - the bigger the hole we dig for ourselves, the harder it is (and the longer it takes) to climb out.

But everyone is different. Some people like taking bigger risks. Others do not.

But that's the point of using the Hidden Formula. Instead of flying blind, I now have a much better sense of the risk with every trading decision...before I purchase any stock.

Jeff Yastine