(RE-SEND) Spooky Week to Start November?

Not to sound overly dramatic, but sometimes life comes down to a few big moments.

This week could be one of them, at least as far as our investing lives go.

I'm going to sketch out for you a key warning sign I'll be watching for, for the coming week.

As I've noted over the last 3 weeks or so, the Federal Reserve holds its last meeting of the year on interest rates this week.

The meeting starts Tuesday, November 2nd and finishes up the following day. Around 2:15 ET Wednesday, the Fed will release its public statement, followed by Fed chair Jay Powell's press conference.

The reason why I think the meeting could be momentous?

It has less to do with the meeting itself, and more to do with the stock market's anticipation of that meeting - bidding the key megacap stocks higher and higher (and increasingly leaving the rest of the market far behind).

The S&P 500 and Nasdaq are closing in on the blue uptrend line that's marked intermitten peaks of this rally for the past 18 months...

And yet the smallest, highest-growth companies - those in the Russell 2000 small company index - still remain comatose.

Until last week, I was harboring the hope that the Russell 2000 small cap index would suddenly snap to life and start marching upwards, just like its megacap brothers.

It came frustratingly close - then failed, just like it has for the last 7 months.

In fact, I'm wondering if the Russell 2000 is trying to tell us something important with its inability to make a new all-time high - along with its pattern of "lower highs" since then...

And while all of us are still enthralled by the prospect of owning the most cutting-edge companies via ultra-popular ETFs like ARK Innovation (ARKK) - the pattern, while not exact, looks ominously similar to the deflating of the 2000-2001 dotcom bubble.

I hate sounding bearish. I really do. It's not in my nature.

But I'd rather look like a fool and be wrong - then be right but never raise a cautionary note to you in messages like this one.

Beware the "Pop and Drop"

Of course, I really could be wrong. It wouldn't be the first time.

So for the coming week, I'll be looking for a classic "pop and drop" pattern - played out over no more than one or two days - as an indicator of a potentially larger selloff to come.

The start of the 2007-2008 bear market happened in just such a way. Then, as now, the stock market rose in an unstoppable manner for months.

The "pop" was on October 31st - the day the Federal Reserve concluded its final meeting of the year.

The "drop" came the day after as the Nasdaq lost 7% over the next month, with a bigger decline waiting in the new year:

The other kind of "pop and drop" takes place all on one day. The market opens sharply, hugely higher - then sells off to finish either unchanged or at a loss.

That's the kind of thing I'll be looking for, this Wednesday as the Fed meeting concludes, and Thursday's session as well.

And what if I'm wrong?

Well, then there shouldn't be too much to worry about. As I've been noting for a while now, lots of really good stocks are drifting sideways to lower.

So if I'm wrong and the market is really about to explode higher, we should see a broadening of the indexes and lots of currently out-of-favor stocks suddenly move sharply higher, and not just for a day or two.

No one would be happier than me if this were to happen.

As for our goodBUYs portfolio, we'll take it a day at a time...

Array Technologies (ARRY) had a huge week, rising nearly 20% as it appears the infrastructure bill and its clean-energy provisions - being pushed through Congress for months now - may finally get key approvals in the coming week:

Array reports its Q3 earnings on November 11.

Moderna (MRNA) reports its Q3 earnings on Thursday.

Analysts are expecting the company to report a profit of $9.12 a share for the quarter. I think MRNA could instead show a profit of $12 or $13 a share.

If the company does "surprise to the upside," I think there's a good chance we could see a sharp rally to fill one or both of the indicated gaps in the chart in the $370 and $400 price range.

By the way, Moderna's CEO was interviewed by Bloomberg in recent days.

The article, "Pfizer Won the First Round, But Moderna Sees Final Victory Ahead" is worth reading.

The point of the article? The company is focused on its technology, not sales deals. Nor will it go out of its way to compete with Pfizer, just for the sake of competition or what analysts might think.

As an innovator and pioneer of mRNA biotechnology, that's the right attitude for long-term success.

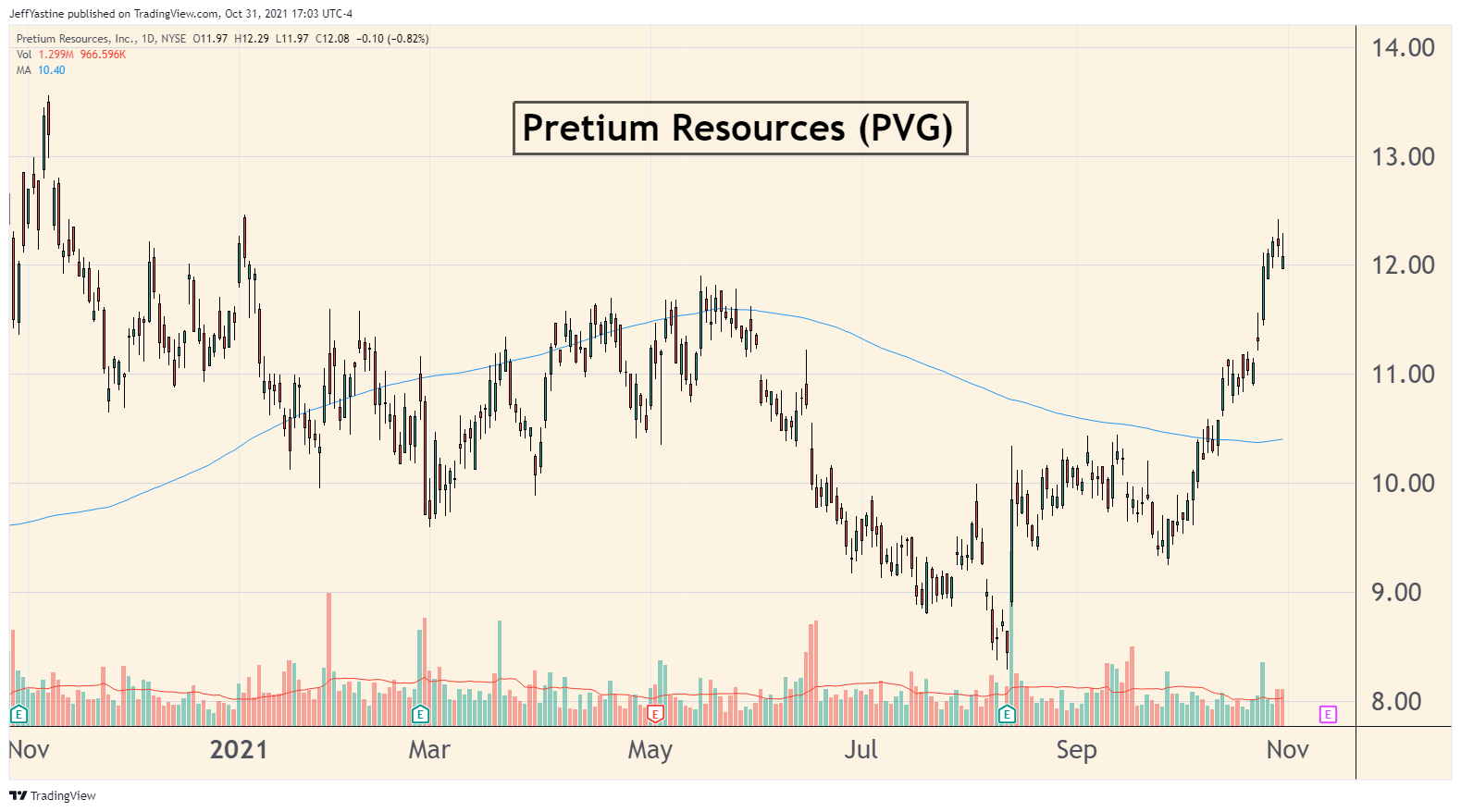

Pretium Gold (PVG) had a strong week, rising another 6%. The company reported a new high-grade gold exploration discovery at one of its properties in British Columbia.

The company says the discovery is near its "Valley of the Kings" deposit and believes that the sites, so close together, "would make it relatively easy to integrate into future mine plans as an independent source of ore" to supply its mill in the area.

We have a gain of around 9% on this stock, while our other gold miner Sandstorm Gold (SAND) is down 2%.

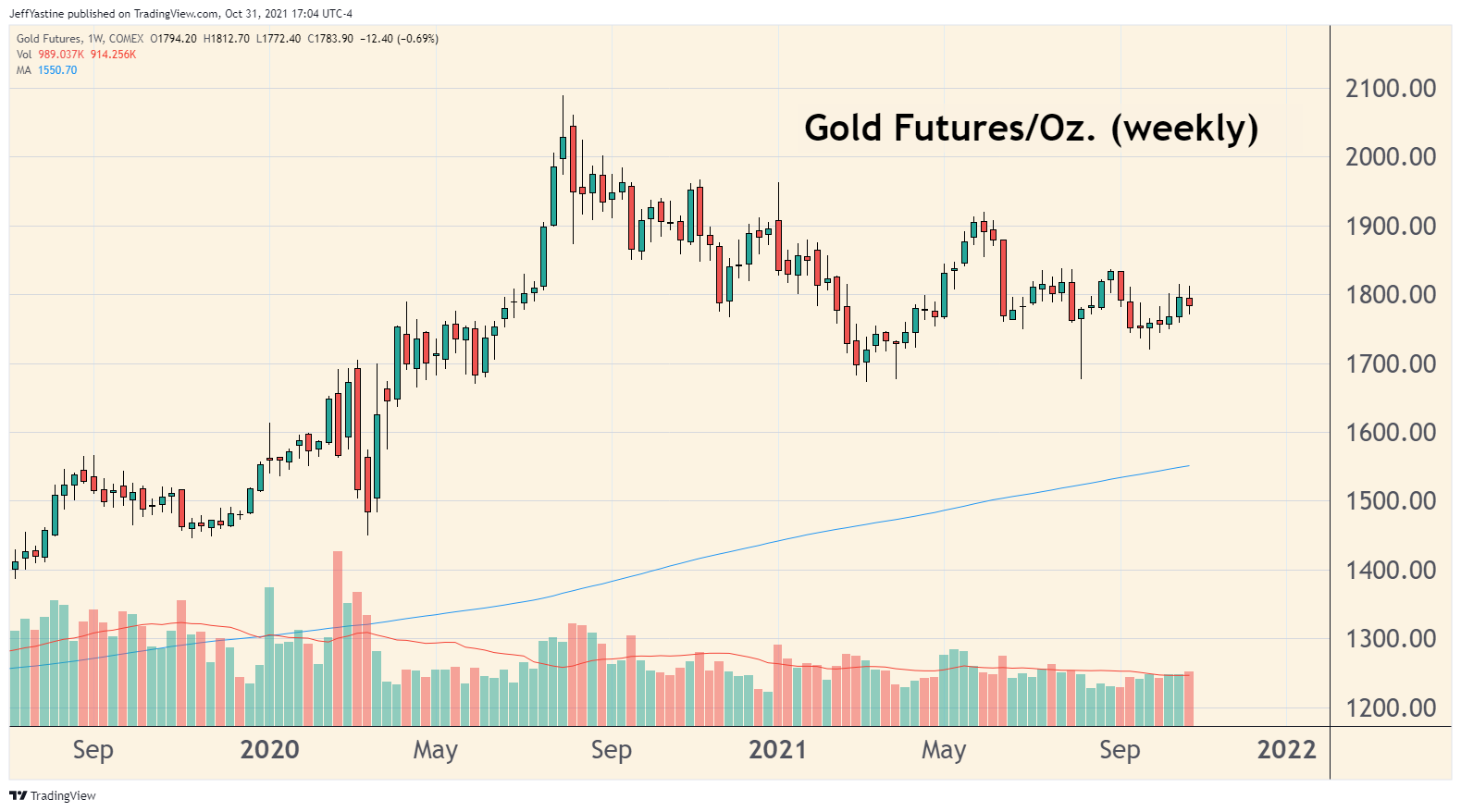

The bigger picture with both is what happens with gold prices in general, which finished more or less unchanged for the week (see the weekly bar chart below).

I think next week's Federal Reserve meeting could be equally important to gold prices. If I'm right, we could see a significant rally in the days following the meeting.

I'll be watching the markets carefully this week (obviously). I'll weigh in with more observations as we move through the Fed meeting and beyond.

Best of goodBUYs,

Jeff

Member discussion