GoodBUYreport: Why I'm Shorting AAPL...

I received a lot of feedback after last week's blog post, where I stated I was going to start selectively shorting a few stocks, starting with Apple (AAPL).

For one, I realized that many people don't know what shorting is - a simple way, not involving options - to benefit from a decline in a stock's price. That alone should probably tell us a lot about the vulnerability of the market, and its potential for a deeper selloff.

If you want more extensive answers on shortselling, google it and click to Investopedia or any of the big brokerage sites for how it's done, plus risks and rewards.

Others think it's sort of un-American, or a bad thing to do. I don't agree. If the market begins to head lower again, I want to be in position to profit from that.

Selling stocks short - though risky, like all speculative endeavors - is one of the few ways to generate value in a portfolio during a bear market.

But I have 3 other reasons why I chose Apple as a short-selling target:

Reason #1: In many ways, Apple IS the stock market. When the stock moves lower or higher, as it's done in a big way over the last couple of months, the rest of the market is dragged along.

Reason #2: The shares are one of the more over-valued out there, and very much a "safety" stock for many on Wall Street.

Apple's current stock price gives it a p/e ratio of nearly 30 (which means there's an expectation of 30% annual profit growth)... despite the fact that its annual profits are only growing at a pace of 5 -10% a year.

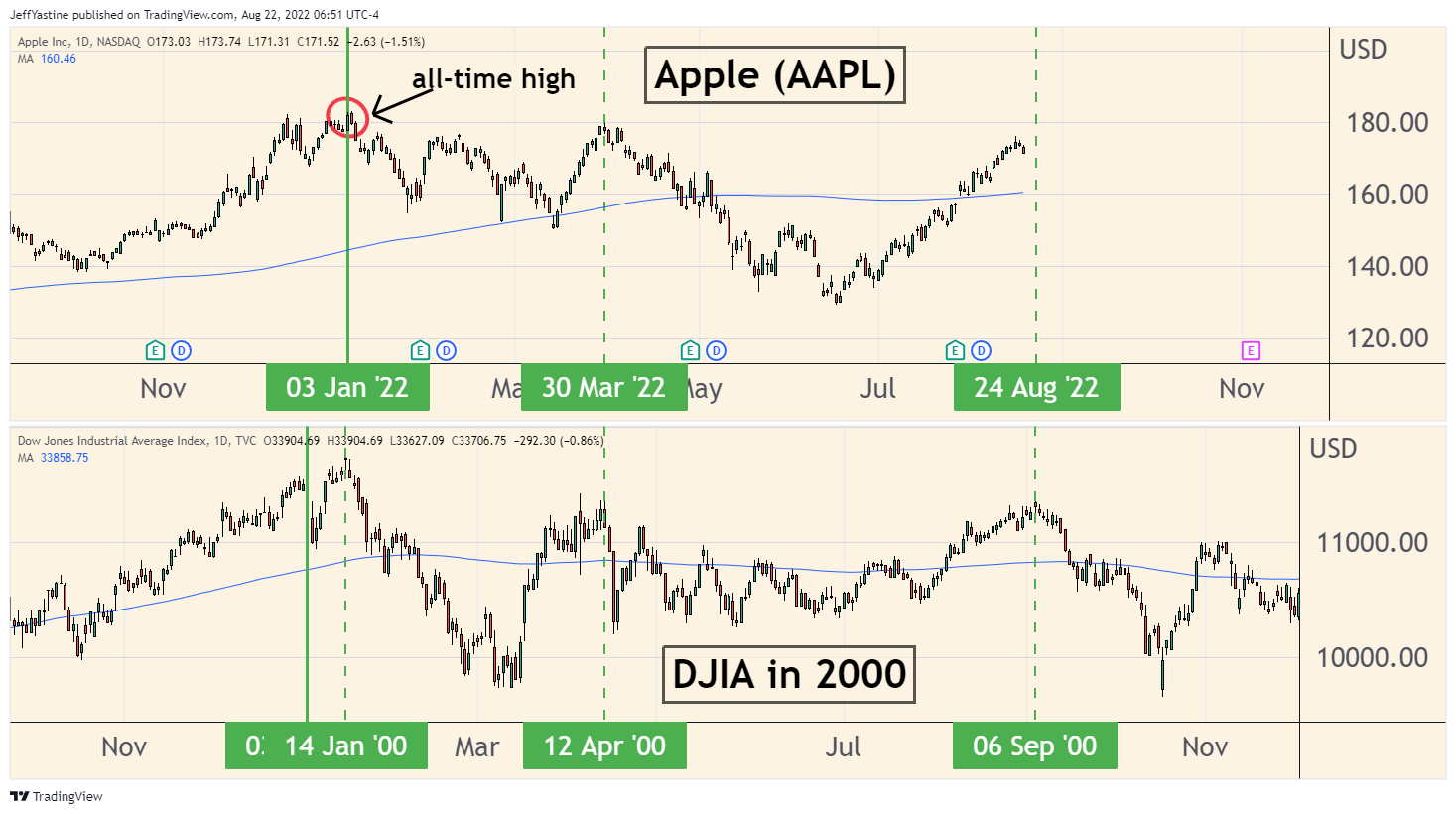

Reason #3: Apple's chart this year looks very much like what the DJIA did in 2000, just before the major indexes began a major down-leg in that bear market:

And it also has to do with this chart of the S&P 500, comparing now to the same index in 2008 as the index began its next downturn:

The current downturn since the start of the year is my 8th severe correction or bear market of my trading & investing career, depending on how you want to keep score.

They're all different, and yet they're all the same.

They're different in that some only last a period of months, while others - like the 2000-2003 and 2007-2009 bear markets - go on seemingly forever.

They're the same in that when they eventually come to an end...very few people care to invest or trade. Popular interest in the stock market is almost non-existent, and stays that way for many months - even when the market finally recovers and begins to rise again.

Compare that description to the popular reaction to the current market rally since late June. I mean, some strategists are already proclaiming a "new bull market."

I'd love to believe. I want to believe. But my experience and memory of prior bear markets says....not so fast.

Hence, I want to be short at least a few stocks just in case my suspicions are confirmed in coming weeks.

As for a more immediate short-term view, it wouldn't surprise me to see the markets make at least one more attempt at a new rally high.

The S&P 500 touched its 200-day moving average (the blue line on the chart) early last week - I think it could move up and touch the red trendline between now and Labor Day.

Likewise, the Nasdaq stopped just short of its 200-day moving average. It seems out of character to expect an index like that to not make at least one more attempt towards that technical milestone:

But anything's possible in the markets. Perhaps the weakness we saw last week and (so far) this morning, are the start of the next down-leg. The markets always keep us guessing - a point I try to remind myself about constantly, both for its implied risks as well as its potential rewards.

My overall point is...the market is at a very vulnerable point. Perhaps I'm completely wrong and the bull market really is about to take off again. But I'd rather hedge my bets in case my suspicions are proven correct.

Jeff

Member discussion