Buy Alert: Oil Service Co's are Running Hot

NOTE: If you're not a paid subscriber, you're getting this premium recommendation as a free preview, and an invitation to join our growing family of investors and traders who want to participate in the stock market in a smart way that accommodates both opportunity and risk.

No doubt you've probably seen headlines in recent months about Warren Buffett's newfound interest in oil stocks, especially Occidental Petroleum (OXY).

I'm not recommending Oxy, though I think oil patch stocks are a great place to look for gains while traditionally hot areas of the market (like tech stocks) have turned ice cold.

Oil itself is behaving as I'd written about months ago - making new highs as the Ukraine war started and then knocked down as the global economy cooled (thanks to higher interest rates). Then, the Biden administration began selling off large chunks of the SPR - Strategic Petroleum Reserve - to knock the wind even further out of oil prices.

But here's the thing - oil prices don't have to go parabolic for oil stocks to keep rising from here:

The oil sector has been woefully underfunded in recent years, as I noted in videos and stock writeups last year.

So far, most of the action has been in the drilling & exploration sector. But I think the biggest gains from here are going to be seen in what's called the oil-service sector, which has been largely overlooked up to now.

Oil service companies are the ones that:

- Own fleets of drilling rigs and lease them out.

- Help maintain production and rig operation sites.

- Provide specific services, like engineering and geotechnical expertise.

- Sell equipment like specialized pumps and valves.

One company I like a lot, and will be adding to the goodBUYreport portfolio is called DistributionNOW (DNOW).

DNOW is sort of the "Amazon of the oil patch" in that it owns large distribution warehouses around the globe, strategically close to oil-drilling areas both onshore and offshore:

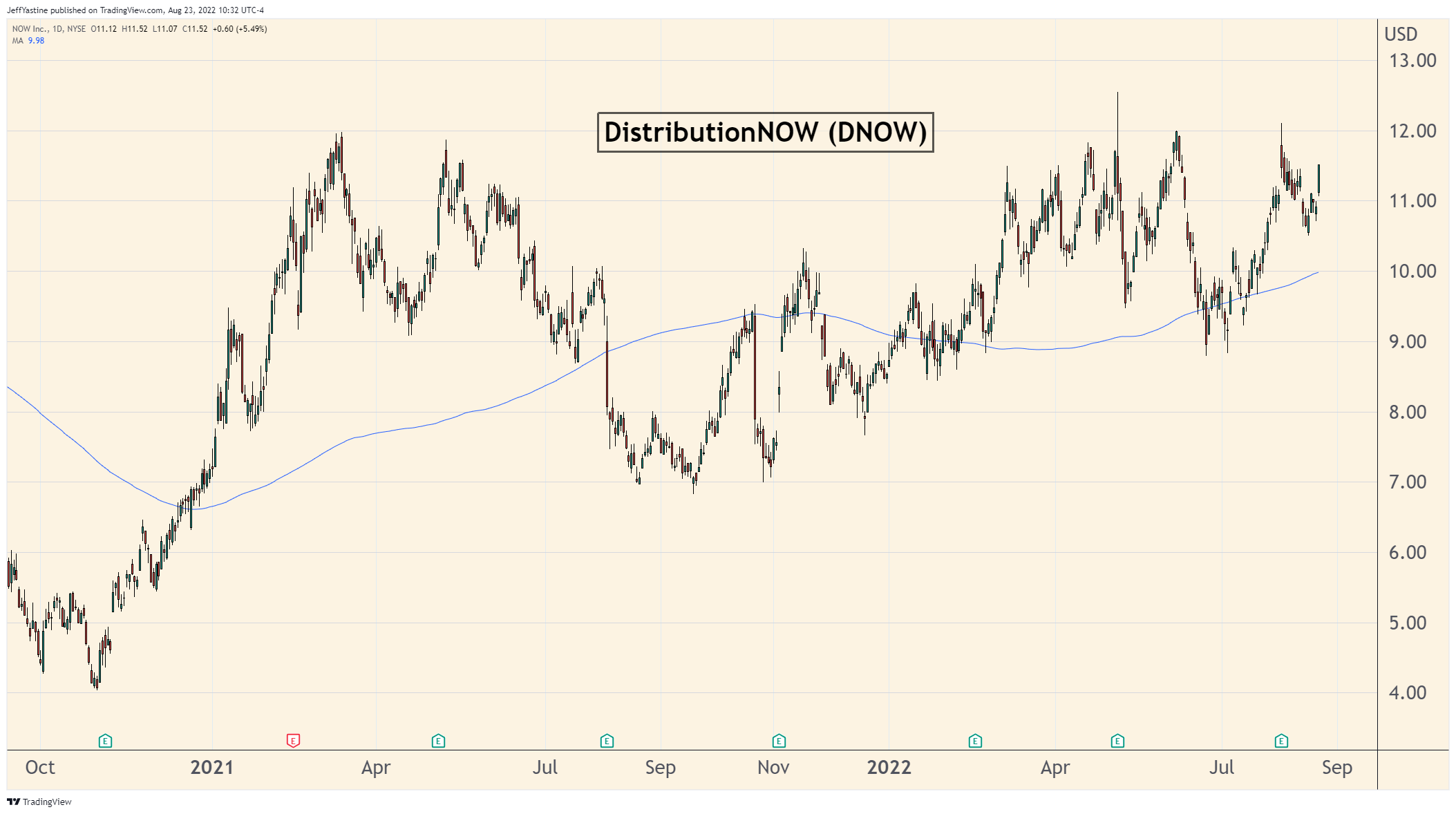

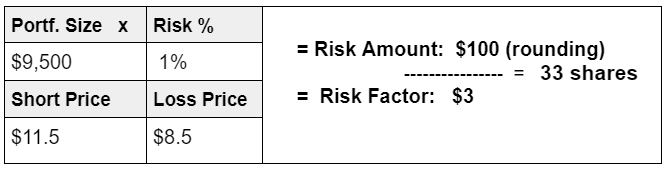

As always, we're keeping in mind risks and potential rewards, relative to the size of our portfolios. If the stock falls below $8.50, we'll go ahead and move it out of the same goodBUYs portfolio:

But my expectation is that DNOW could hit at least $15 within the next 6-9 months, and could rise even higher if oil prices stay at these levels or higher.

The company had its IPO in 2014 - just as oil stocks, after a nice run from 2009, fell deeply out of favor with investors. This long-term chart of DNOW ought to provide some perspective on the potential opportunity in front of us:

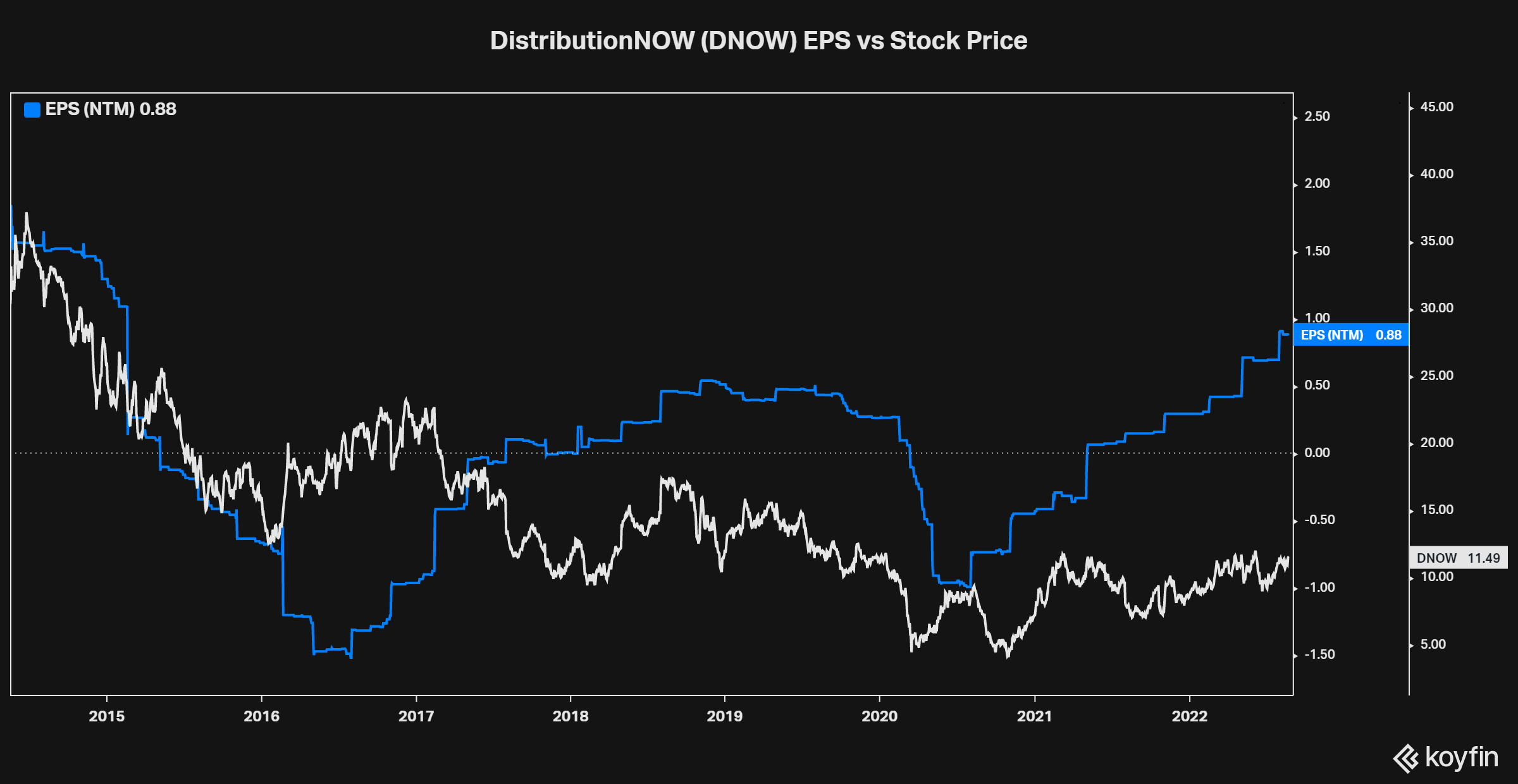

And perhaps this chart tells that opportunity best. The company's earnings per share (the blue line) has started to march higher since bottoming during the pandemic - while the stock itself (the white line) has languished in a narrow low trading range:

I don't think that trading range will last much longer. Analysts expect DNOW's earnings to hit $0.94 a share next year, which would allow even further upside gains in the stock.

Jeff

Member discussion