Market Update: Following the Breadcrumbs...

Oh boy, look out...

My 16-year-old son - with all the absolute confidence of that age - has suddenly become focused on the stock market.

I'm proud of him (especially that he's choosing to get interested now, in the midst of a bear market when investing and trading is hardly "cool"). Maybe the apple doesn't fall far from the tree.

But I also have the distinct pleasure (i.e. frustration) of trying to explain in simple terms an activity that defies truthful easy explanations:

SON: "So Dad, when the market is going down...that's good, right? I should be buying stocks. That's what the books say."

ME: "Yes, that's correct. But the books also leave out a few things. You could buy a stock, and it might keep going down for months, even years. Are you prepared to wait that long before your analysis is finally vindicated?"

Long pause as he goes upstairs to review more posts on TikTok or wherever....

SON: "So Dad, I've been reading about technical analysis. What about using Bollinger Bands as a way to play the market's current volatility?"

ME: "Bollinger Bands are a great technical analysis tool....for some kinds of markets."

SON: "What does that mean - some kinds of markets?"

ME (deep breath): "Well son, you'll find that technical analysis tools all work nicely some of the time. You'll make money. And at other times...not so nicely. You'll lose money."

SON: "So technical analysis is bad?"

ME: "No. It just means...well, the stock market is a confusing place. Imagine a basketball game where the players get to switch jerseys without telling anyone - and the height of the rim occasionally shifts from 10 feet off the ground to 15 feet, and later gets lowered to 7 feet, then back again."

SON (another long pause): "Wanna play some Madden Football on the Xbox?"

ME: "Sure, I'll be right there. I just wanna look at one last chart..."

More Market Clues?

We're currently in one of those periods where it's hard to tell who the players are, and no scorecard is available at any price.

So we follow the breadcrumbs.

For example, if the economy is about to do better (presuming the Federal Reserve "pauses" on interest rates), then retail stocks ought be improving too.

But that's not really the case at all. Target (TGT) - which aims at a slightly higher consumer demographic than Walmart - has all the appearances of a stock wanting to move lower, not higher:

Same for Kroger (KR), the largest US food-only supermarket chain. The stock's down 7% in the past few weeks:

What about banks? If the economy's about to be freed from the tyranny of Fed-driven higher interest rates, than we should see a boost in lending activity and improved profitability at some point in coming months.

And bank stocks ought to move higher, in anticipation of that trend. While a few bank stocks such as JPMorgan (JPM) and Citigroup (C) are starting to look better lately, many other well-regarded super-regionals and majors are not.

Truist (TFC) (the old SunTrust and BB&T bank chains) is a well-regarded, well-run banking group based in Atlanta. The stock ought to be on the march higher. But that's not the case, at least not yet:

I realize I'm only giving you anecdotal bits - not the full picture. That's just how it goes with the stock market.

Some on Wall Street want us to come in and join the party. They know best, right?

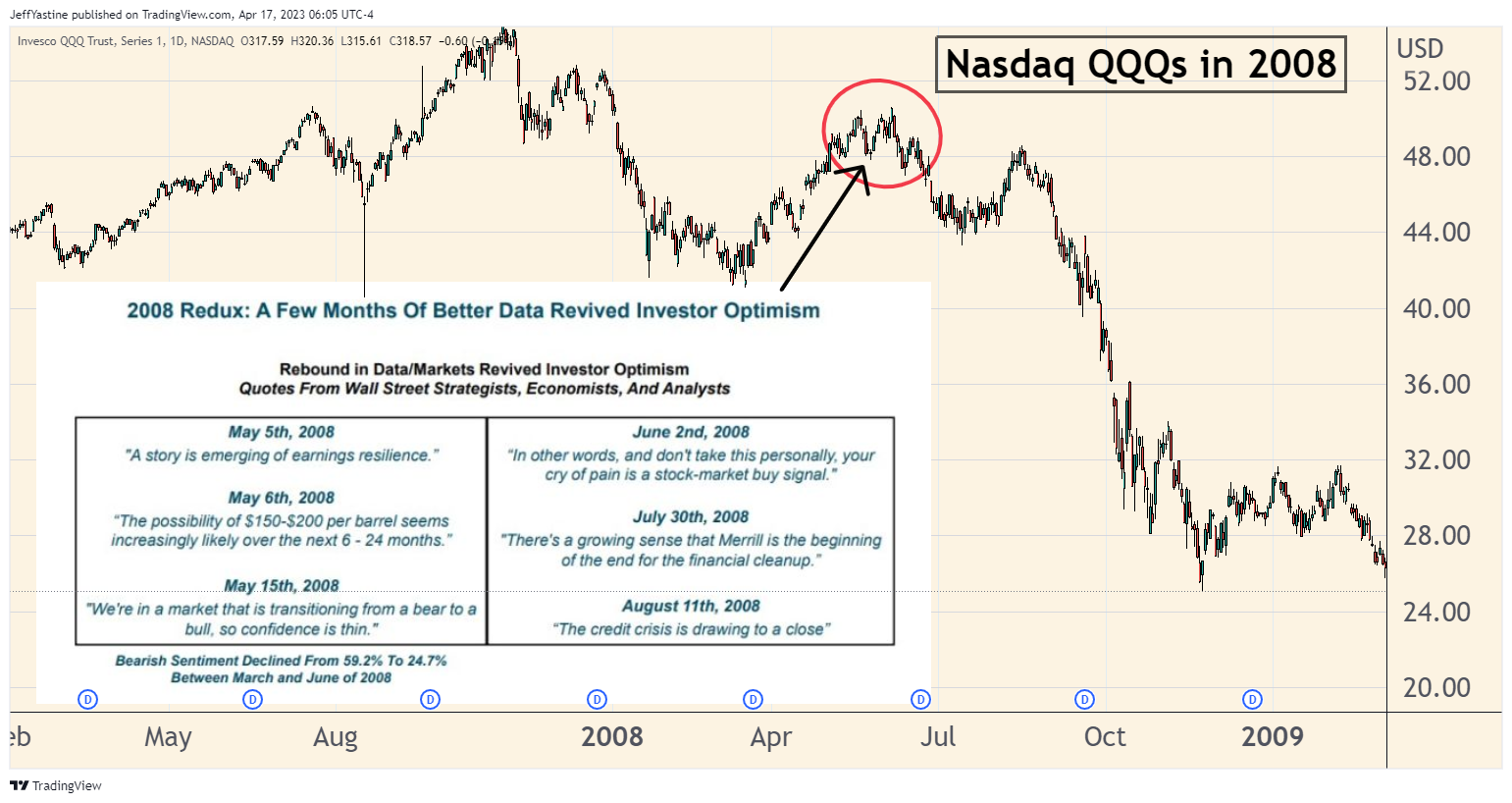

Well, not exactly. I found this Twitter observation about the comments of market strategists in April 2008 particularly noteworthy. I'm cherry-picking a sample that supports my bearish-leaning ideas, of course. But I'm repeating it here as a way of demonstrating how wrong Wall Street can be at exactly the wrong times:

I'll continue to monitor the markets. But don't let the lack of market activity lull you to sleep. Lots of things are happening under the surface.

If things begin improving, well, the breadcrumbs should tell the tale.

So far though, the bearish story doesn't appear to have changed that much, at least not to me.

Jeff Yastine

"

Member discussion