Why Tech Investors Need to Buy Oil & Alt-Energy Stocks NOW

Hi goodBUYers! Watch the video or keep reading below...

The major indexes were all up very nicely on Monday and appear to be off to a good start here on Tuesday morning as well.

I've been saying for a while now that "as the virus goes, so goes the stock market." That's what's happening today.

To that I'll add "...so goes the energy market."

Oil prices were up as much as 7% on Monday:

More on energy stocks in a moment.

The market strength isn't just that the FDA granted full official approval to Pfizer-Biontech's COVID vaccine (I expect Moderna (+7% today)'s vaccine to be granted similar approval any day now as well).

Perhaps less appreciated, the market strength also reflects the odds that the Delta variant may be peaking.

For example, former FDA commissioner (and NBC News consultant) Dr. Scott Gottlieb said this morning he believes the infection rate has turned the corner in the south.

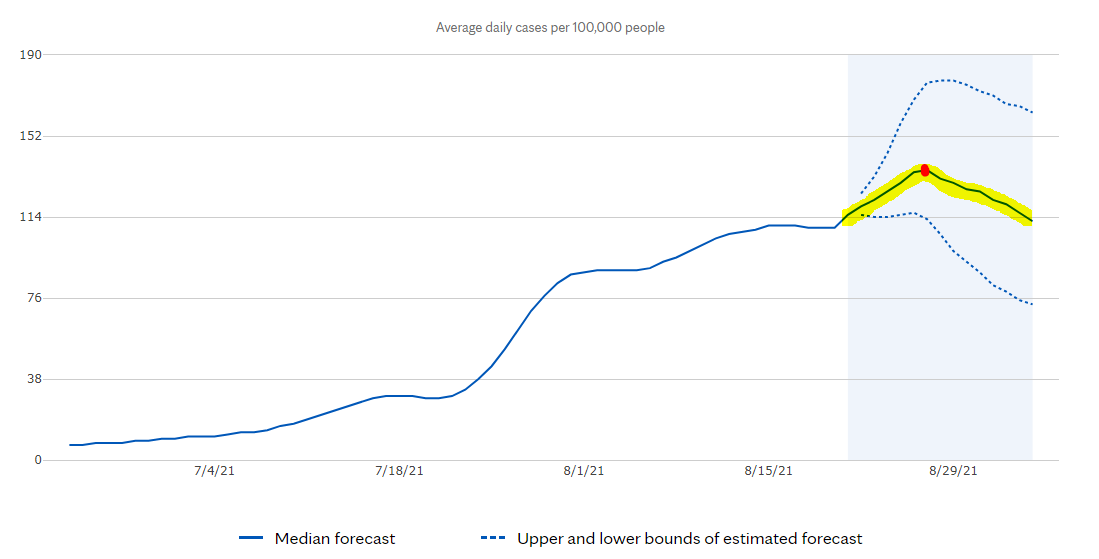

Gottlieb could be wrong. But I've been tracking the Delta situation via the Mayo Clinic's website. Interesting that it shows Florida - a Delta hotspot - getting ready to peak August 27 (derived via a 14-day statistical forecast).

The actual day of the peak doesn't matter so much. But if Florida's in the process of peaking, then other states may likely do so in coming weeks as well.

Gottlieb has also said he thinks that the Delta variant may be the last wave of the pandemic. After this, he believes COVID could become "endemic" much in the same way we have a flu season each fall and winter; it generally doesn't last the entire year.

So we could be an important inflection point.

What does that have to do with oil and tech stocks?

Let me see if I can sketch this out for you, and think a couple of steps ahead...

If the Delta variant is on its way out weeks or several months from now (if we take a more global perspective), then it puts a return to global economic growth back on the front burner. That's the idea I laid it early this month in

This is an idea I laid out early this month in an article/video titled "Delta Variant & The Contrarian Opportunity of 2021."

Owning a valuable, unappreciated asset like an oil stock or alternative-energy shares is one way to capitalize on that trend.

I've recommended 2 such stocks for the goodBUYs premium portfolio in recent weeks. I think both are going to give us strong gains over the next 6 months to a year.

It's also interesting that oil prices are up about 6% today after dropping last week to its lowest price level since May.

Couldn't this just be a "bounce" - a bounce that may not last? Yes, there's always that possibility.

But what's interesting is that we also have almost every oil and oil service stock up big, with large percentage gains across the board today as well.

It means that large institutions are likely putting lots of money to work across the entire sector.

"Big money" institutions don't invest for today or next week. When they put large amounts of money to work, they're aiming at a target at least a year or two years away.

They're looking at the overall global economic situation and saying "The global economic environment is changing. Let's start making large bets now on where the economy is headed in the future - a future that may look quite different, in terms of prices and which stocks are perceived as most valuable own - from how it appears today."

But if oil prices, and energy stocks are becoming a good bet now - it also creates a complicated situation for many of the most popular tech stocks.

Right now the FAANG-type stocks are the place to be, no question.

They've been the key parts of the 'stay at home' economy, and the heart and soul of our digital world. Their business will continue to grow for a long time to come.

But their stock prices reflect much of that growth already.

So there's an 8 letter word that tech investors need to keep in mind.

It's called "rotation."

When large institutions decide they've ridden a particular investing trend as far as it can go for this cycle, they will quietly begin to sell.

Ordinary investors - that means you and I - are still enthusiastic and keep buying.

That's how "mom and pop" wind up holding the bag for Wall Street banks and hedge funds - without realizing that the situation is changing.

Meanwhile, Wall Street strategists are busy creating a new narrative for the next market cycle.

What's new? Alternative energy stocks certainly.

Let's say oil prices go to $100 a barrel? Then solar, wind energy, hydrogen and other kinds of energy stock become just that much more popular as an alternative, to resurgent oil prices.

What's old? The big tech plays that pretty much everyone and their brother already own in huge proportions.

That's why I say - if you own tech - it's not a bad idea to put some money to work in new- or old- energy stocks while their cheap and still under the radar of most investors.

Best of goodBUYs!

Jeff

Member discussion