Delta Variant & The Contrarian Opportunity of 2021

NOTE: Originally published August 9, 2021. But here on August 18 - with the small-cap Russell 2000 index starting to perk up today (+0.50% compared to breakeven or marginal losses in the S&P 500, Nasdaq and Dow indices) - I want to update things a bit right here at the top...

The projected peak in Delta variant cases from reputable sources is all over the map - some say August, others September, or even October.

But it's worth noting that University of Florida biostatisticians recently published their own projections, coming up with today's date - August 18 - as the peak for Delta variant cases in the state of Florida.

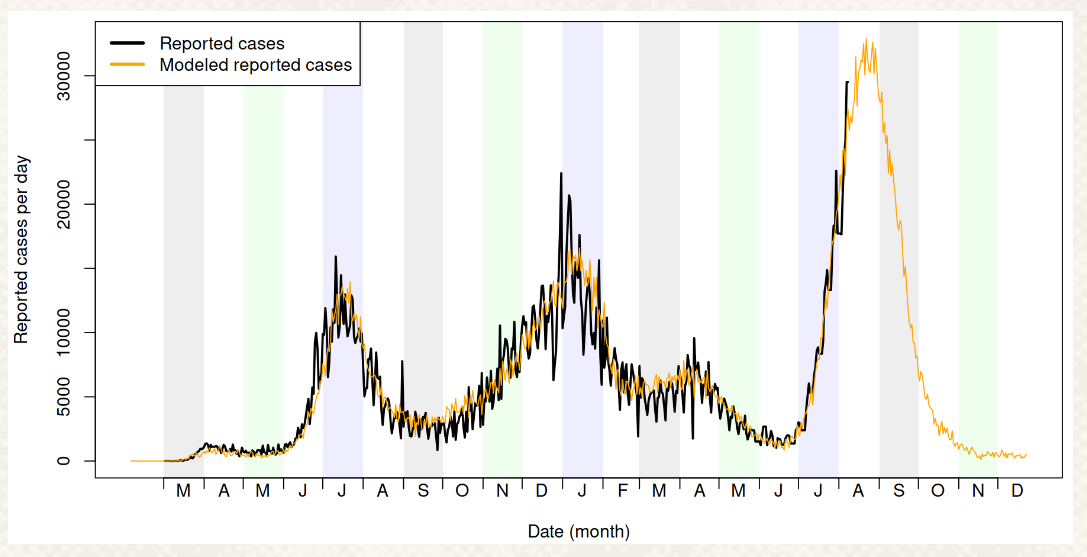

According to a more detailed analysis on the UF Emerging Pathogens Institute website, here's the study group's chart - last updated on August 14:

It's important not to go too overboard on this stuff. Stocks don't move like clockwork. The market will do its own sweet thing in its own sweet time - including unexpected selloffs, corrections and bear markets.

But if the UF projections turn out to be even somewhat on the market - and the market begins to strengthen in coming days ahead of the Labor Day holiday - you'll have a better sense of what might be driving it higher.

For the record, I hate the word "contrarian."

When I think of a "contrarian" I think of some cranky old white guy who thinks the world is going to hell in a handbasket where there's no hope of improvement, ever.

I am old-er. I am a white guy. But I'm not cranky. I think the best days for the world, for our country, for the human race, for the environment - are still ahead.

The path forward is never straight. There are always zig zags and switchbacks in the road towards human progress, or in our quest to become successful investors.

What's the mark of a true contrarian?

Anyone who is willing to bend his/her brain a little, so we don't blind ourselves to new potential opportunities as they come along.

When the News Moves On: Crisis and Opportunity

Lately, fear of the Delta variant has spooked investors, and for good reason. Hospitals in vulnerable parts of the country are filling up. We see the video and listen to the interviews. It's heartbreaking.

But we've seen COVID surges come and go a few times already by now. So last weekend I started googling around for information on how long the Delta variant surge might last.

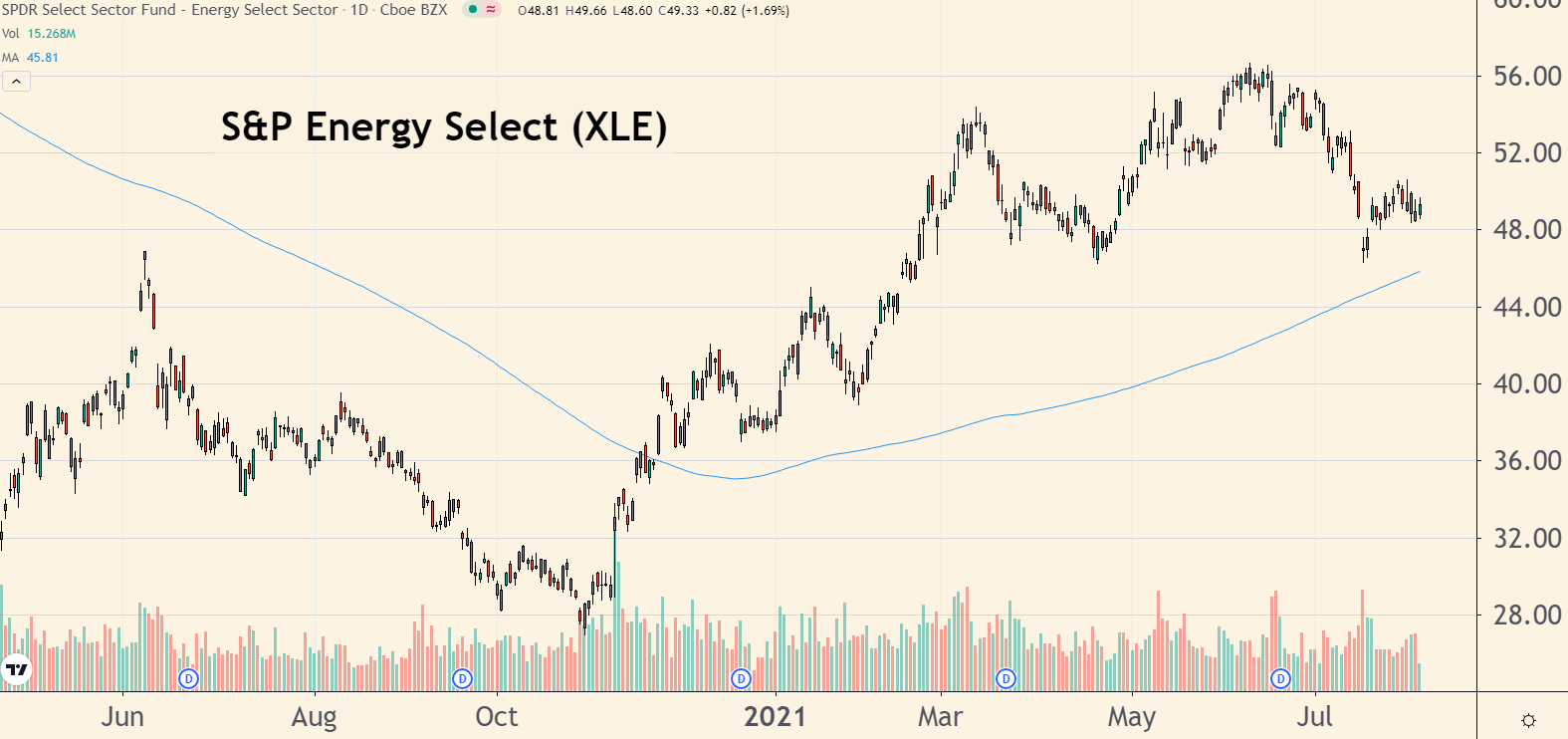

I was surprised to read in reputable sources like Reuters and elsewhere that the surge in Delta infections in the United Kingdom has already come and - for the most part - gone.

Likewise, new Delta infections in India - which were also surging to worrisome levels weeks ago - have since fallen dramatically.

It's great news taken at face value (though I would hope that everyone continues to make all efforts to become vaccinated for the common good of our fellow humans everywhere).

Even experts aren't exactly sure why this may be the case - especially when one country has one of the highest vaccination rates for COVID, and the other has one of the lowest.

But if it's happened in the UK and India, then there's at least some likelihood it may happen here soon.

Buy the Rumor?

So that's the potential opportunity ahead of us, as I see it.

If you've ever heard the phrase 'buy the rumor, sell the news' - we could be facing just such a 'buy the rumor' situation in the stock market now, as we await more information on the Delta surge in this country in coming days and weeks.

If true, I see a couple of different opportunities.

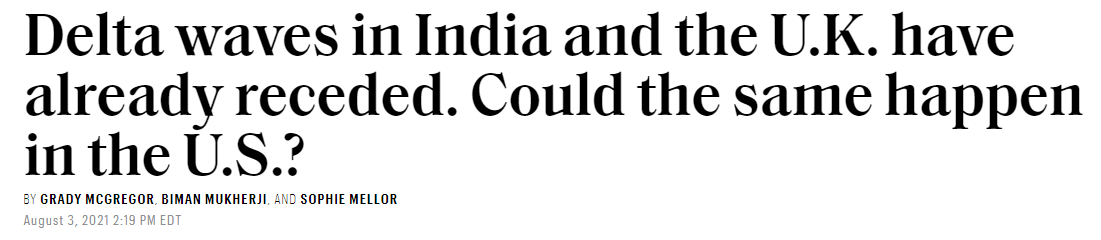

- As scary as the market may be at this point - climbing inexorably higher - it may not be a good idea to get too bearish on the market.

Investors have a tendency to fear the month of August (and September and October) as months where the stock market often takes a bearish turn. And yes, it's true that we have to respect those possibilities.

But as I noted in a video earlier this week, the market sometimes has a tendency to rise in August straight into the Labor Day weekend - a likely scenario in my opinion.

Also, if there's some rotation out of big cap tech stocks and into small-cap Russell 2000-type stocks (which haven't been as strong as stocks in the S&P 500 and Nasdaq in past months) - that would be a healthy development and take pressure of the same-old same-old "FAANG" companies having to always lead the market.

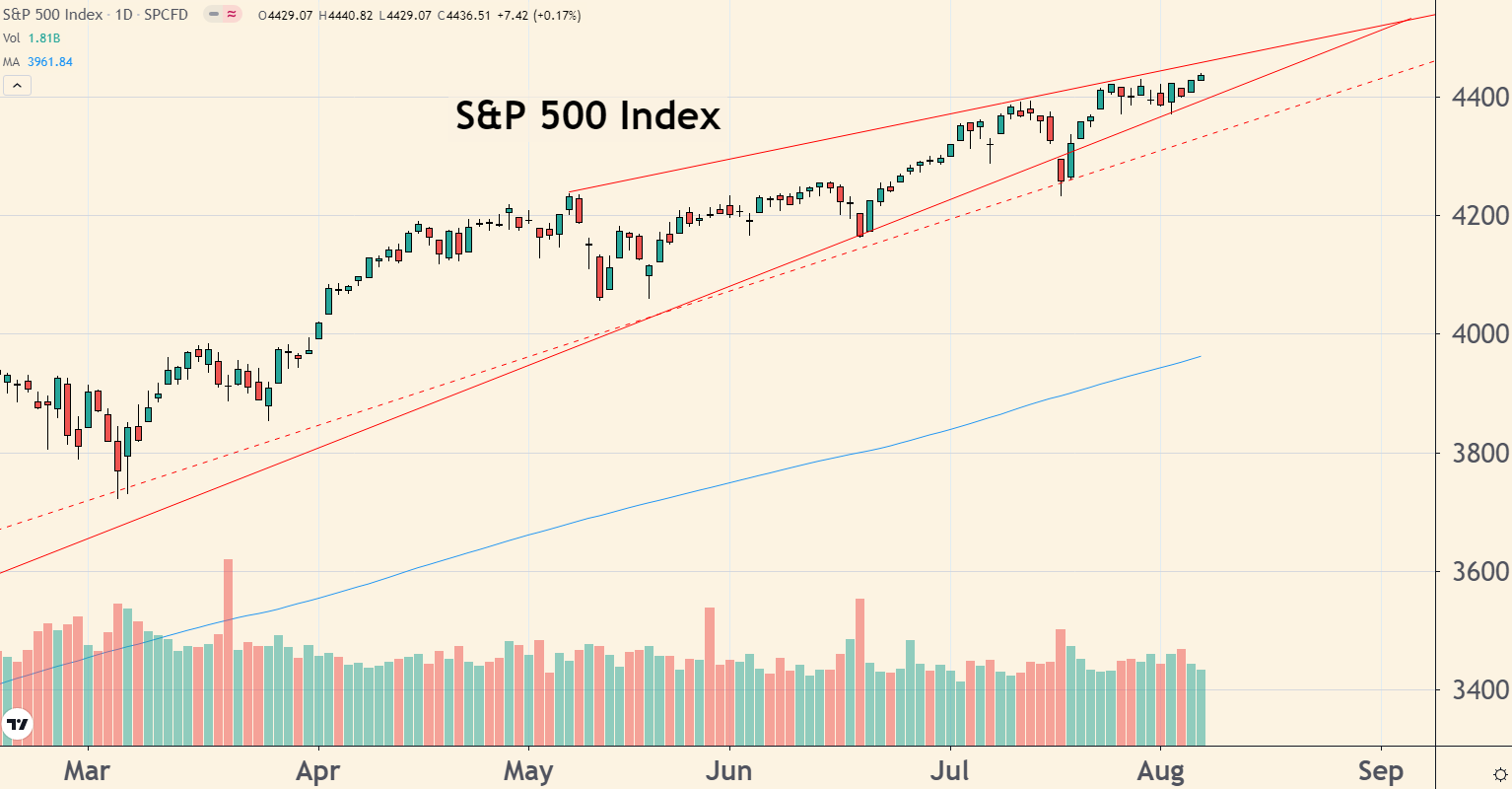

2. Oil stocks may be an important opportunity.

If the delta variant surge disappates quickly, demand for oil and gasoline is going to surge to even higher levels. I recently added one oil stock in the goodBUYs portfolio and want to add more.

A rise in oil prices would push an ETF like the S&P Energy Select (XLE) nicely higher:

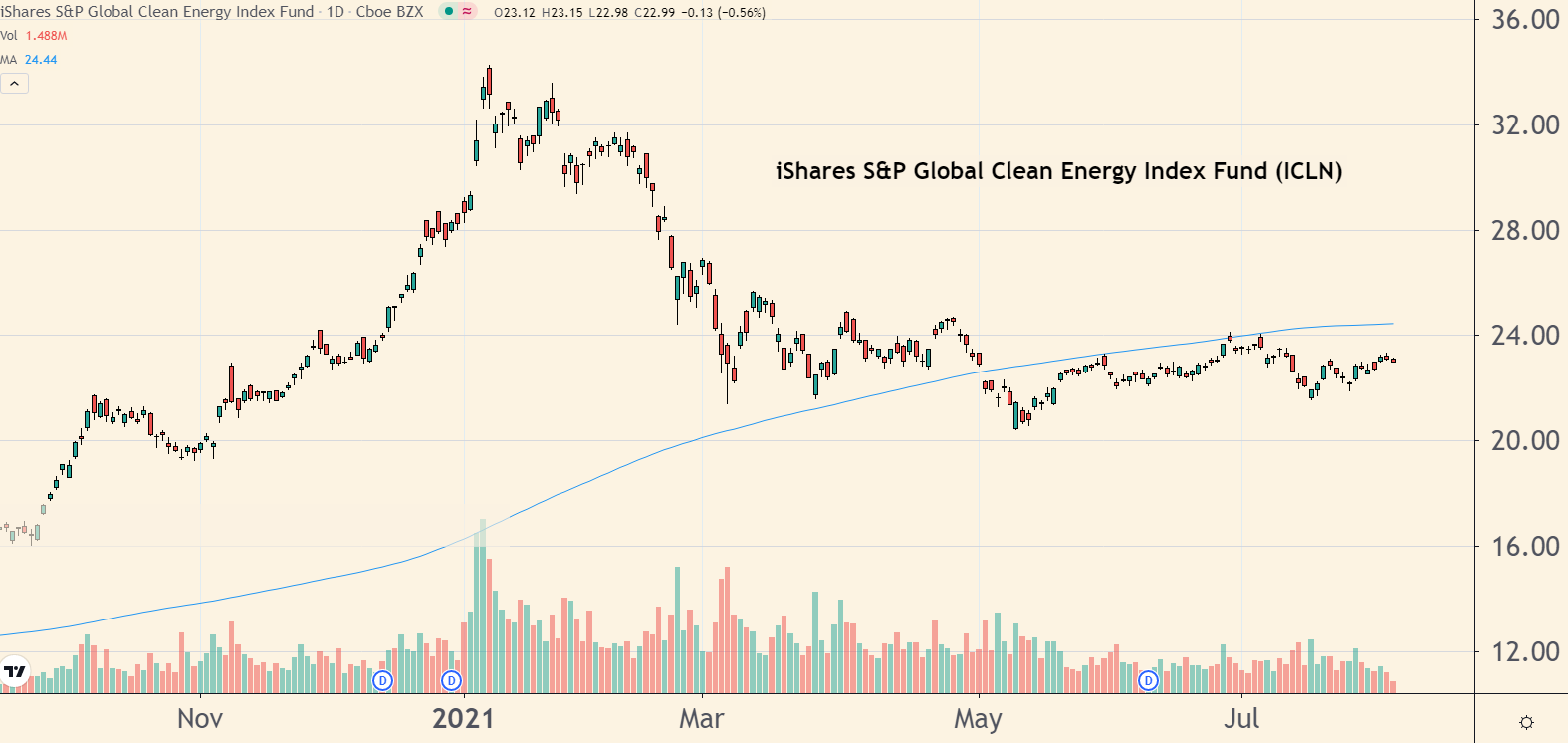

3. Select types of green energy stocks - which fell out of favor early this year - could be ready to come back.

I like choosing individual green energy plays, so I can zero in on the best values. But if oil prices rise sharply higher, that would make ETFs like the S&P Global Clean Energy Index Fund (ICLN) a goodBUY. The ETF is 32% below its alltime highs from early this year.

- I'm on record as expecting oil prices of $100 a barrel by the end of the year - it creates bigger demand for solar- and wind-power as companies look for alternatives to high oil prices.

4. Emerging market stocks may be "in play."

Sometimes the best investment ideas are the ones that we're least paying attention to. That's certainly the case with emerging market stocks. China-related stocks are in the dumper. Others, in key markets like Brazil, India and elsewhere, are drifting.

So if it turns out that the Delta variant dissipates quicker than many realize, the global economy is likely to rev into a higher gear. If so, then emerging market stocks - where growth is fastest - may well be in high demand.

From an ETF perspective, a broad plain vanilla fund like the iShares Emerging Market Index (EEM) might be worth a look.

While EEM has made a great move from the pandemic's lows last year, the current price is only the equivalent of where this ETF was literally 14 years ago - which shows you how out of favor emerging market stocks remain at this stage.

Best of goodBUYs,

Jeff

Member discussion