Chart of the Week: The "Mega-Cap" Conundrum

A conundrum, by definition, is a confusing or difficult problem or question.

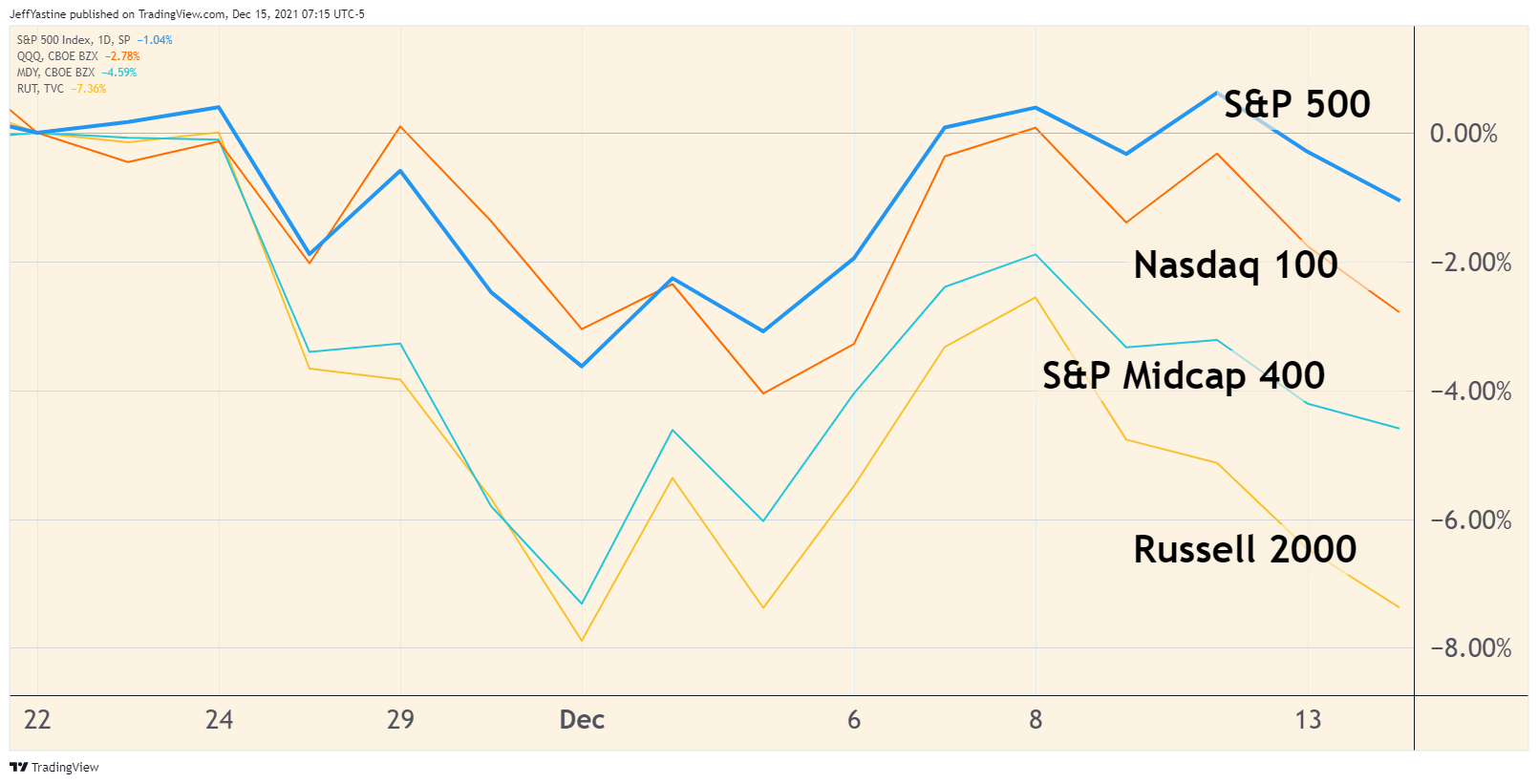

I think the chart below demonstrates the current challenge for all of us as investors...

The S&P 500 - at least until yesterday - had been rock-solid for the most part. It set a new all-time high last Friday. I even brought up the idea over the weekend that the index might mount a breakout to even higher-highs (and maybe, just maybe pull everything else up with it).

Instead the index reversed lower in a big way on Monday and Tuesday.

Meanwhile, the "rest" of the market, including the tech-loaded Nasdaq 100, is reversing at an even faster pace:

If we drill down a bit...

Literally 20% of the S&P 500's current level can be attributed to just 5 stocks. Apple and Microsoft together make up the first 10%. Then there's two classes of Google stock (class A and class C), plus Facebook and Amazon, that make up the rest.

Why It Matters

So, from a price perspective, beyond those 5 stocks - the odds are against us in whatever new stock we attempt to buy.

It's like trying to swim upstream against a strong current. The probabilities say we're going to lose ground in most cases.

So what can we do about it?

#1: We can play good defense.

In other words, don't let small losses turn into big ones.

I had to put out a sell alert on a new favorite stock in recent days because it lost a lot of ground fast, giving us a 14% loss in the goodBUYs portfolio. I still like the stock. But I'd rather conserve my cash in a market environment like this one. My portfolio cash is like fuel in the gas tank, or the seed corn that a farmer will use to grow next year's crop.

#2: Respect the odds, but don't give up the hunt for great stocks.

In the paragraphs above, I said that picking stocks in this environment is "like trying to swim upstream against a strong current."

But that doesn't mean we can't try to find a few "strong swimmers."

The key is making smaller (and/or fewer) bets, so each loss means less to your overall portfolio. Eventually, when the tide turns and the market starts "acting" better - you'll see it in your stocks' performances and you can go back to a more normal "betting size."

We can also expand our views of what kinds of stocks to buy.

Instead of focusing only on the "next Amazon" that's going to go from $10 to $1,000, we can look for turnaround ideas, boring undervalued companies, and out-of-favor sectors.

For example, I still think the airline sector is still worth looking at. The JETS ETF I mentioned last week has weakened - but has yet to make a new low and could still explode higher if we could finally get some good news about the omicron variant.

Likewise, I recently recommended a major undervalued retail chain that's building a competitive e-commerce operation, and already occupies an important part of the healthcare sector.

That stock is up 5% or so for us so far, holding its own nicely against the "outgoing tide."

It will never go up 500% in a year, like some speculative stocks have in the past 18 months. But it could rise 50-100%.

Best of goodBUYs,

Jeff Yastine

Member discussion