What They Don't Teach You at "Trading School"

Times like now used to just kill me as a newbie trader...

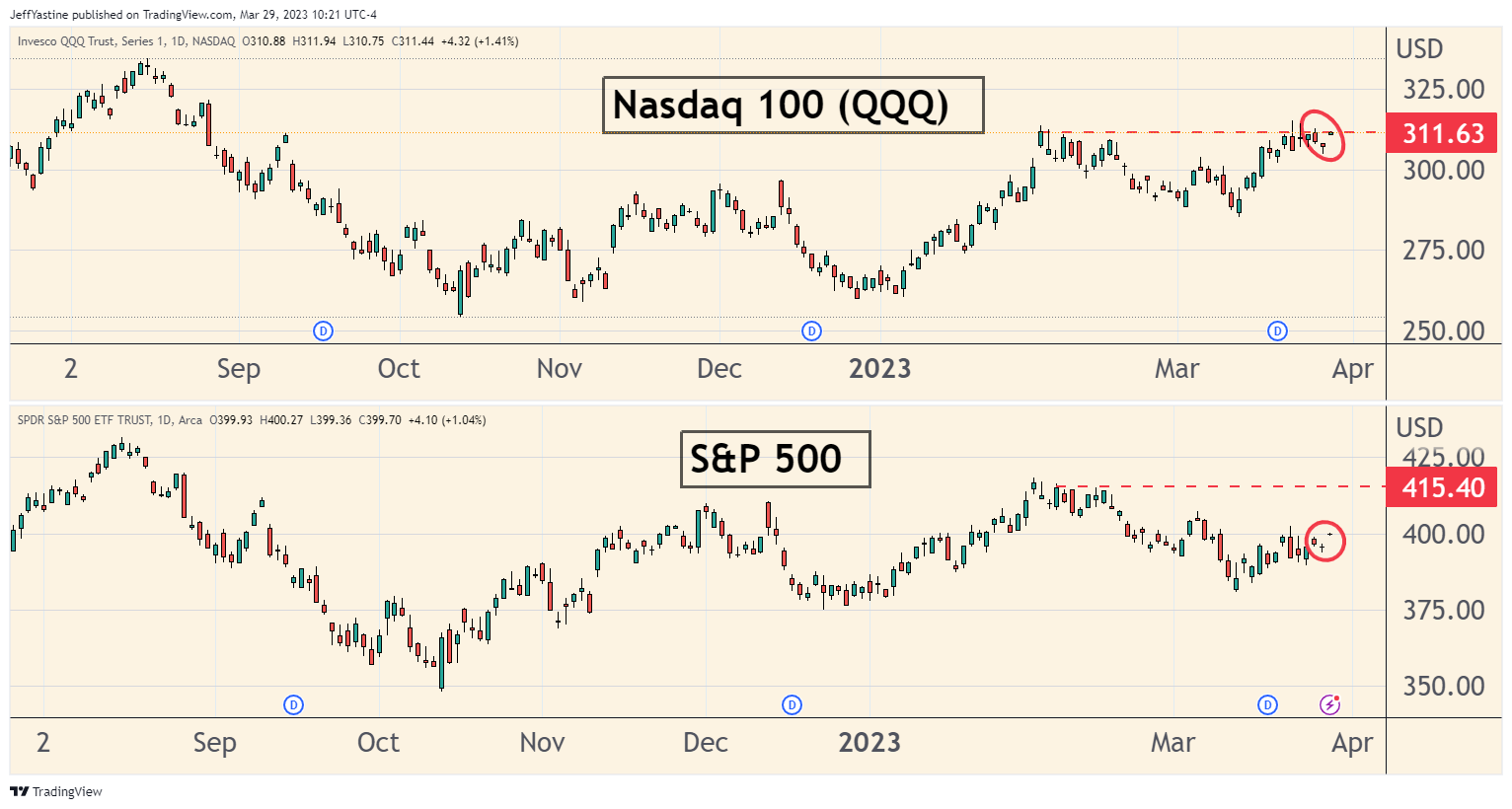

If you haven't noticed lately, the stock market indexes are listless. Boring. Dulls-ville. Yet there's been a slight upward bias, at least for the Nasdaq (though not for all the other indexes so far):

Years ago, my newbie trader self would read commentary from gurus much like CNBC's Jim Cramer these days. This was his bullish-leaning headline from yesterday:

And so my newbie trader self would buy a bunch of stocks thinking the proverbial "train is about to leave the station."

Later, I realized I was like Charlie Brown, with Lucy holding the football. Gotcha! And down would go all my stocks, for big losses.

For all I know, the train is about to leave the station (though I doubt it). If all the major indexes suddenly improved in dramatic fashion, I'd change my tune.

But it helps to know little bits and pieces of other factors...things that often escape new traders, and make the stock market look stronger (or weaker) than it might otherwise be.

End of the Quarter "Window Dressing"

For example, we're approaching the end of the first quarter of 2023.

With that in mind, do you notice a sort-of pattern in the "end of quarter" periods I've highlighted in red in the chart below?

Interesting, isn't it? It's not the kind of thing that's guaranteed. You can't trade off it and "take it to the bank."

But if you ever look at an index and wonder...why is it so strong (or conversely, why is it so weak) in the face of evidence to the contrary... sometimes it's helpful to look at the calendar.

The "end of the quarter" is a big deal for Wall Street. The staffs at mutual funds and hedge funds are prepping their customers' account statements, showing what's in their portfolios at the end of the period.

Fund managers don't want to appear out of step with the rest of Wall Street. They want to make sure they own the "good" stocks - whatever those are at that moment in time - when their quarterly statements go out to clients.

Like birds flocking together, it creates a whirlwind of buying. And remember, indexes like the S&P and Nasdaq are weighted by market capitalization. So if the buying (or selling) is concentrated in the market's largest stocks, then it may make those indexes appear better (or worse) than they really are.

Lead Up to Holidays

The week or two before major holidays is another period on the calendar to take note.

Again, there's no way to take this sort of thing to the bank. For example, last year we saw a major selloff occur into the Christmas/New Year period. There was no "Santa Claus rally."

But the lead up to major "feel-good" holidays like Memorial Day, July 4, Labor Day and yes, Christmas/Chanukah, are good periods to "expect the unexpected" - in both directions!

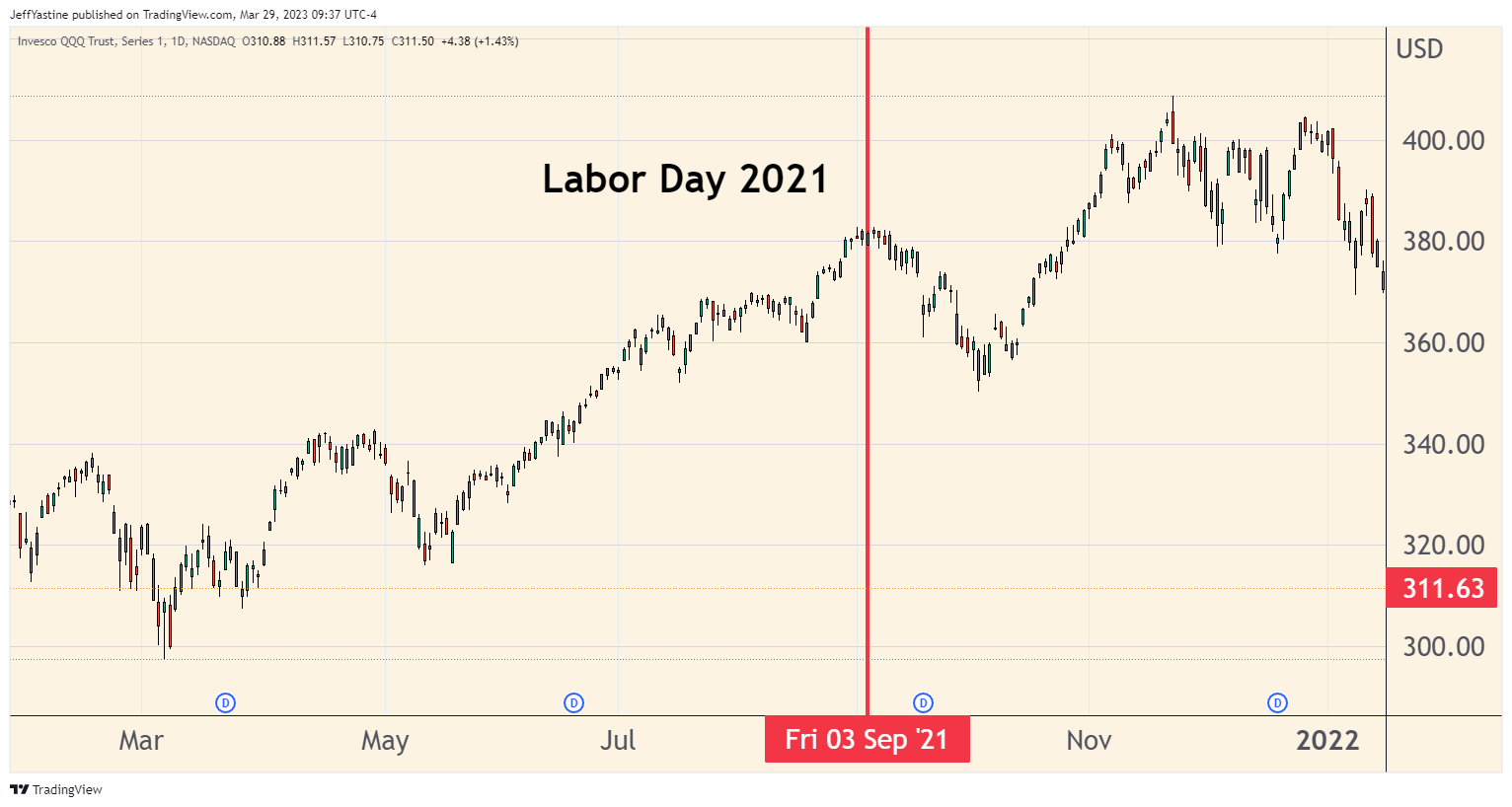

For example, Labor Day lends itself to some cherry-picked examples where the markets run hot up through the holiday, then cold afterward.

Here's Labor Day in 2021:

Labor Day in 2018 also featured a sharp rally...with a double-top a month later - then a 19% correction through year-end:

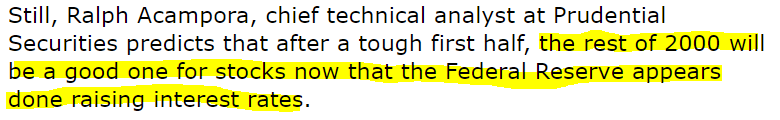

The most famous Labor Day break I can think of is in 2000.

I remember that time well. By late August, the "dotcom collapse" and bear market appeared to have run its course. Here's the headline from CNN's financial site at the time, with a very bullish quote from a market strategist of that era:

But really, traders were waiting for Labor Day to come and go before the worst of that bear market began:

Options Expiration Periods

Lots of people love trading options. Options are highly leveraged. A little money goes a long way. So you can (theoretically) make a lot with a small bet.

Pros love options too. They employ various options strategies to hedge their multi-gazillion dollar portfolios, so if their stocks go down they will make back some portion of those losses as their bearish-leaning options go up in value.

But, like the yogurt sitting in your refrigerator, options also come with expiration dates. Some expire weekly. Others expire monthly, quarterly and for even longer periods.

But the point is, when a large chunk of options are all going to expire at the same time - the result can be extreme choppiness. Momentum-based trading strategies stop working. Lots of stocks tap-dance sideways for days at a time.

Again, these sorts of periods can lull us into thinking the markets are more buoyant (or weaker) than they really are.

For the heck of it, I'll note that March 21st is one such major options expiration period.

Will we finally see the end of our current choppy "dullsville" period?

We'll soon find out whether that means more bullish (or renewed bearish) days ahead....

Best of goodBUYs,

Jeff Yastine

Member discussion