Market Roadmap: More Bearish Clues

The first bear market I ever experienced was the one in 1980-1982. I had just graduated from high school and was only at the very beginning of my stock market journey.

As a newbie, I always thought a bear market was an "event" - like a car accident, breaking an arm, or getting fired from a job - it's something bad that you can't see coming.

It just sort of happens.

That's certainly how the news headlines often portray bear markets throughout history. Here's one of my favorites from a February 10, 1926 edition of the New York Times:

Imagine someone saying "bear market" today, and you can't get a flight out of the airport for the next 2 weeks!

But I eventually learned that the start of a bear market is really more of a process - a series of negative signals that we can either choose to ignore or accept.

To use the car accident analogy, it's nighttime, raining, in rush-hour traffic, I'm speeding, talking on my phone, and trying to fetch a bottle of water that just rolled under my seat - and then my car accident occurs.

I can ignore any one of those factors, and the odds say I'll probably be safe. But the more of them I ignore, the more likely the final result won't be good for me.

And so it is with sharp corrections and bear markets. There are always clues that most of us ignore.

Utility Stocks: New Clues to a Coming Downturn?

Obviously we're not in a bear market at this point.

And there's some chance the Nasdaq could still keep squeaking higher through the end of October, perhaps driven by anticipation that the Fed will signal a pause or halt to additional interest rate hikes. I think we may get such a hint from chairman Jay Powell, as soon as tomorrow, when the Fed concludes its latest meeting on interest rates.

Meanwhile, the bear-market pressures build inside the economy - and in the stock market... if you know where to look.

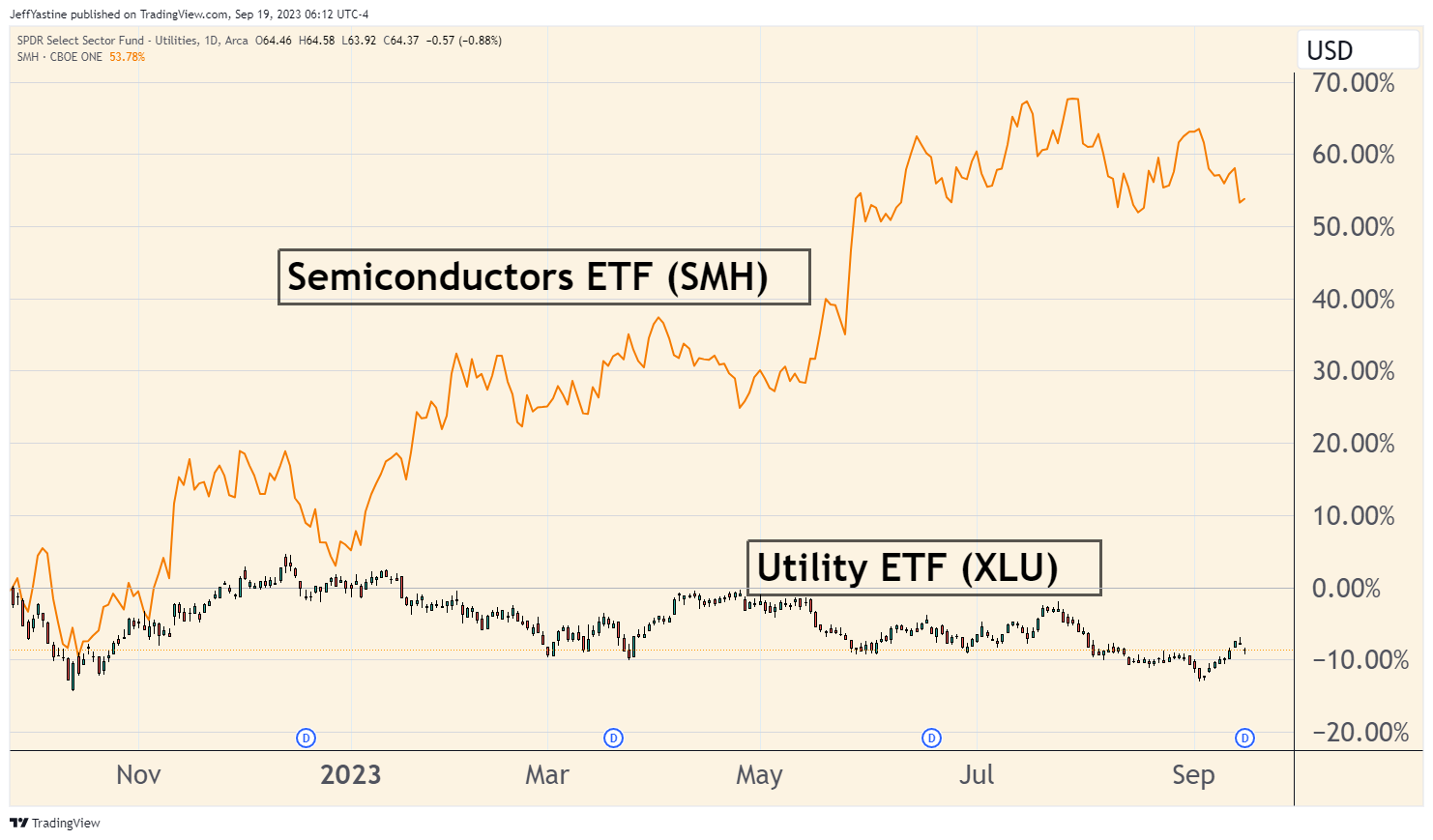

For instance, utility stocks. They've underperformed over the past year, which is to be expected in a period of rising interest rates, and faster-growing alternatives (like the semiconductor stocks) for investors to buy:

But when investors sniff the wind and believe they smell an end to the rate hike regimen, utility stocks historically start to do better.

As stable, boring dividend-payers, they don't attract much attention from investors. But when Wall Street institutions sense there's a bear market coming - utility stocks historically are where these investors seek "safety from the storm."

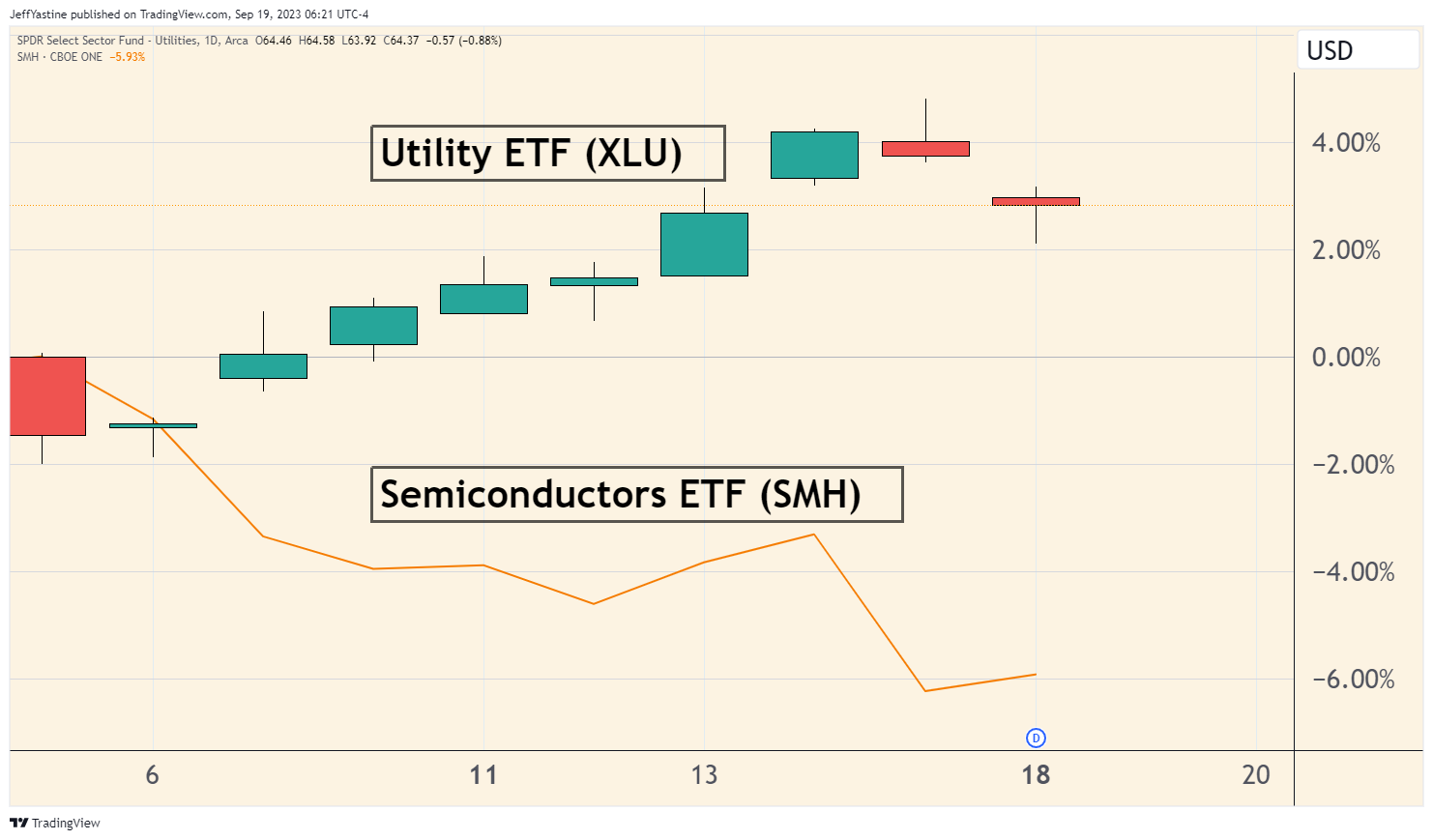

Both reasons, I believe, are why utility stocks are suddenly doing better than semis over the past few weeks:

Meanwhile, other warning signs that I've been pointing to for months...continue to show important divergences.

Russell 2000 Weakness

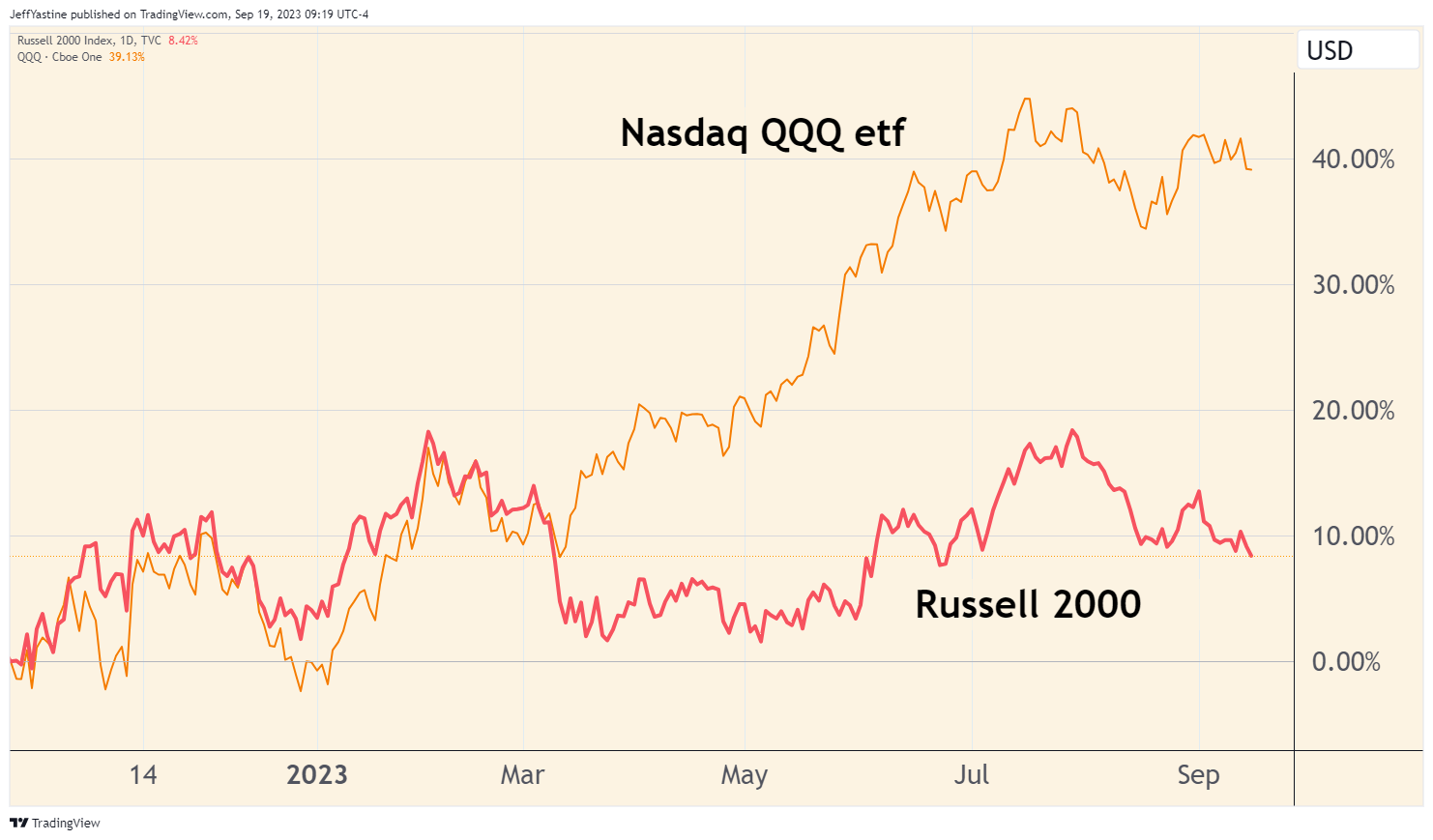

For example, in a strong healthy market environment, the major indexes all move higher, almost in lockstep. Smart investors are eager to take risks.

But this time around, the Russell 2000 smallcap stocks - representing the smallest, riskiest stocks of the future - continues to badly underperform:

These are important divergences that I've only seen in the lead-up to other damaging bear markets.

For example, in 2007 the Russell 2000's performance became worse and worse - even as the Nasdaq went on to notch one final multi-year high (on October 31st, 2007 to be exact) before the 2007-2009 bear market began in earnest:

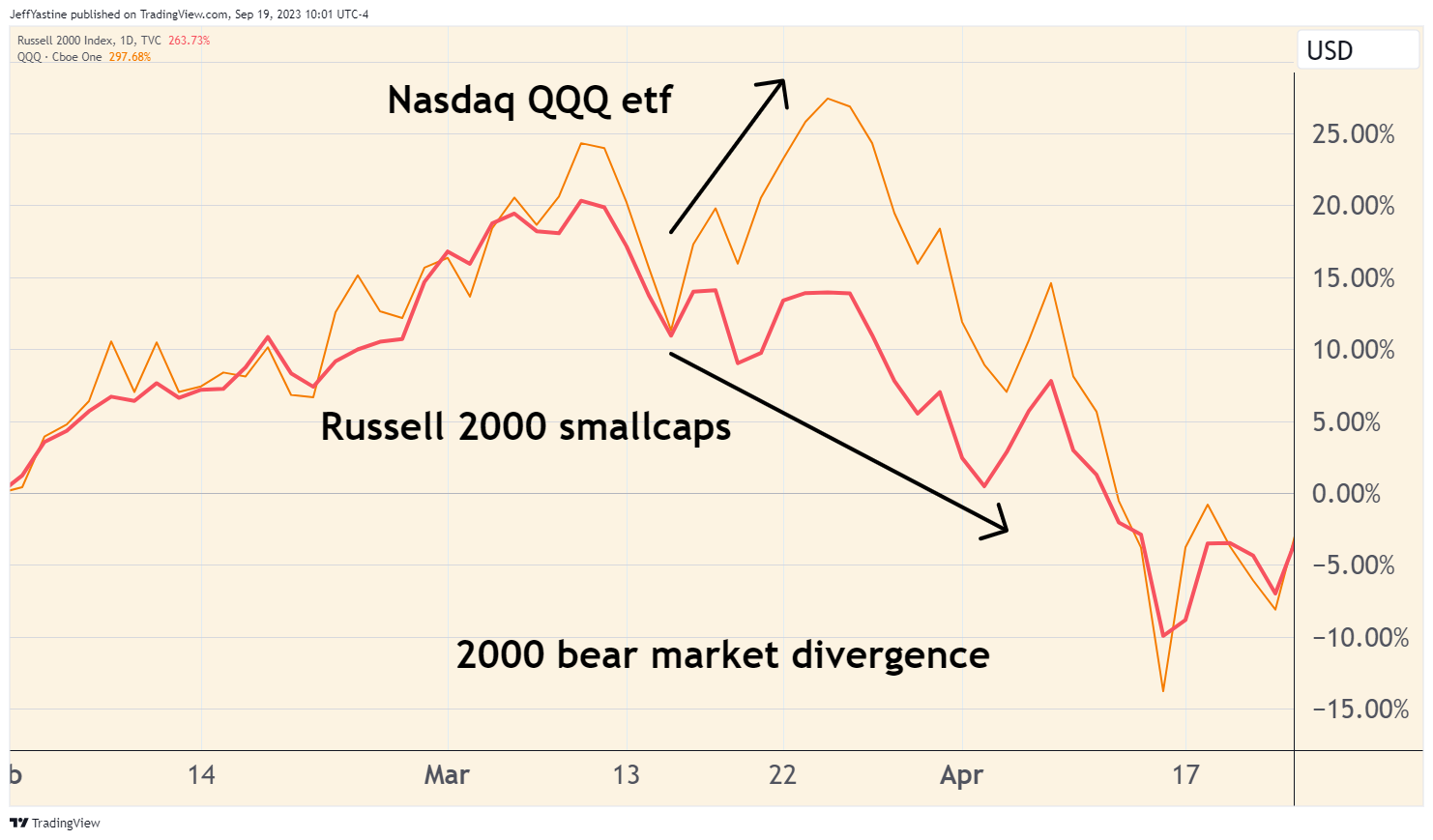

And it's worth pointing out there was yet another similar divergence back in early 2000 in the weeks before the dot-com bubble of that era turned into a bust:

So keep these divergences in mind. For most of us, the hard part of a bear market is simply accepting that the environment has changed, and doing so early. Most of us onle come around to that way of thinking when it's too late.

The sooner we embrace the possibility of a change in the market's winds, the better off we'll be.

Best of goodBUYs,

Jeff Yastine

Member discussion