Are Tech Stocks Repeating the "Oil Spike of 2008"?

As I noted to premium subscribers yesterday (with new stock recommendations for the portfolio)...the stock market "short squeeze" is on.

For the last number of weeks, I've been noting to subscribers and on Twitter that there are just too many bears out there.

When things get really lopsided (too many bears and vice-versa), it's not uncommon to see an "equal and opposite reaction" like the one underway now, with the Nasdaq pushing higher and higher:

Let's see what happens, and enjoy the rally. I think it can keep going through Memorial Day and (if there's a debt-ceiling deal) through July. I added some new stocks to the goodBUYs portfolio in recent days and think there's an opportunity to make some dough.

But let's not become complacent...I think the bear market is merely hibernating.

All we need to do is look at the latest Bank of America global fund managers survey to understand the dangers.

For a little background, the investment bank has taken this widely-watched and well-respected poll once a month for years, in order to gauge what top fund managers are thinking.

The newest survey - out this morning, May 18th - sends chills up my spine...

"Big Tech are increasingly being viewed as the equivalent of “Treasury Stocks”, i.e. they represent companies that are far too ubiquitous and central to technology and business to completely vanish or tank in a short period of time."

If tech stocks sound like a "can't lose" proposition at this point - let's look at another time when...

- The economy was slowly weakening.

- The stock market looked "iffy" at best.

- Bearish sentiment reigned supreme.

- Asset managers were looking desperately for a "safe place" to invest their funds.

Oil: "Safety Stock" of 2008

Allow me to set the scene in that fateful summer of 2008 (I covered all of this as a financial news reporter at the time)...

With a looming real-estate slowdown and a slowing economy, we'd already experienced some earthquake-sized financial events...

- January 2008: Sales of existing homes dropped to their lowest levels in a decade...

- March 2008: Home foreclosures rose 57% in a year's time.

- March 2008: Bear Stearns, an important Wall Street investment bank, collapsed...

- April 2008: The Federal Reserve - already alarmed at the slowing real-estate sector - cut interest rates 3 times in the prior 4 months.

- June 2008: The S&P 500 declined nearly 20% from its all-time highs of the prior year...

- June 2008: The US economy was barely keeping its head above water, and would soon fall into recession...

You'd think the price of oil would be in the gutter too.

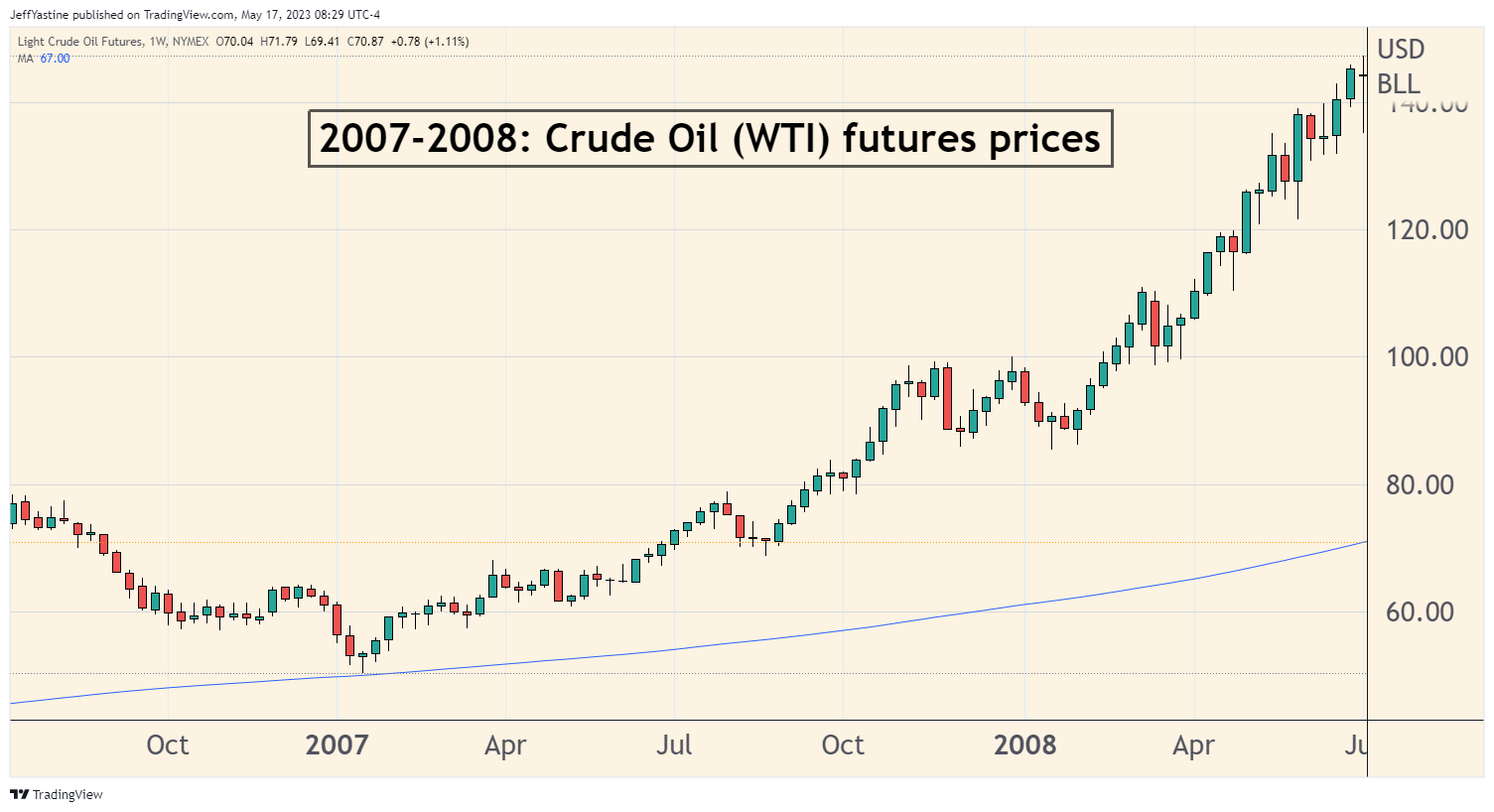

But through all that bad economic news, the price of oil kept rising and rising.

It doubled from $50 a barrel to $100 in 2007. And as the stock market peaked and fell into a bear market in early 2008, oil rose nearly 50% higher again - hitting $145 a barrel by July of that year.

I remember that time very well as a financial reporter. Plenty of market experts voiced opinions to me that maybe the looming housing crisis wasn't as bad as feared. Otherwise, how else does one explain the huge run in oil prices?

After the run-up came a gigantic, one-for-the-ages collapse in prices:

Researchers at the Federal Reserve later dug into the 2008 spike in oil prices and came up with an intriguing hypothesis...

They speculate that the run-up in oil prices "was driven by a mistaken notion that an investment in commodity futures can be used to hedge equity risk."

In other words, hedge funds, investment banks and other financial institutions were afraid the economy and stock market was going to decline in a big way. So they started looking for a "safe place" to invest - an asset class or security that would go up, even if the stock market goes down.

Until July of 2008, they found it by buying oil contracts.

As Fred Bullard, president of the Federal Reserve Bank of St. Louis, noted in a 2013 speech:

"Anecdotal reports during the first year of the [2008] crisis suggested that financial firms whose MBS-based portfolios were souring were desperate to earn substantial revenues elsewhere.

The “elsewhere” may have been global commodity markets, which boomed during the second half of 2007 and the first half of 2008.

The Warning to Us Now

The warning from 2008's parabolic rise-and-collapse of oil prices should be pretty obvious by now.

Whenever 99% of all asset managers crowd into the same small boat - whether it's a commodity, real-estate, the stock market, or a tiny subsector of stocks - it's bound to flip over sooner or later.

So let's not become complacent about the newfound popularity of "Big Tech" stocks.

Best of goodBUYs,

Jeff Yastine

Member discussion