Market Update: "Come On In, the Water is Fine!"

Many thanks to my longtime subscriber and friend Osman, who asked a great question by email this weekend:

Hi Jeff. I wonder how I get [to make] money on this market condition... Because I always lost money during this time [in the past]. Thank you.

I added the parentheticals, but I'm sure you get the point even without the additional context. He's asking "How do we make money - and avoid losses -in this crazy, extremely uncertain market environment."

My response is basically: "Very very carefully."

That's why I titled this post with the old warning-that's-not-a-warning that "the water is fine, come on in."

From a trading and investing sense...we need to continue thinking of our potential risks first, and our potential rewards second.

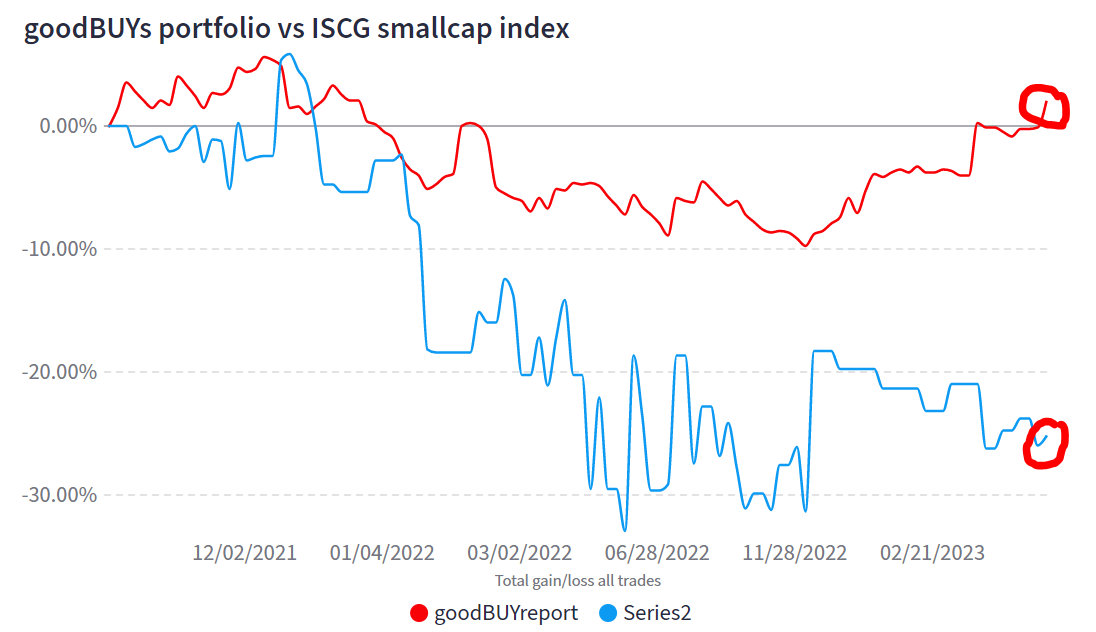

From that perspective, the goodBUYs portfolio is doing well. We're up 12% since the start of the year, and up 2% since inception (which coincided with the start of the current bear market), while far above our benchmark index:

The new positions added in the past few weeks are gaining traction and slowly building profits. But if the current market rally falls apart and all my positions "go south" at the same time, it's not going to damage the portfolio with irreparable losses.

That's the whole point these days. Take small risks. Be content to ride stocks higher if those new positions do well. If they're not living up to expectations, keep the loss small and move on to a better stock.

The Water's Fine...Until It Isn't

All this is just a very long way of saying that my market view remains the same as what I wrote last Sunday ("Dangerous Work for Bulls & Bears").

I think the market is likely to push higher, at least through the end of the month - or all summer. In the simplest terms possible, I think the market is likely to move higher simply because too many people became too bearish.

People are still very bearish, as demonstrated by last week's survey from AAII (the American Association of Individual Investors):

As I noted in last Sunday's article...when this kind of bearishness occurs, a rally is a typical reaction, for weeks or a number of months, until the "bearish camp" is reduced sufficiently in size.

And that appears to be exactly what happened in the stock market last week. As much as the market gets beaten up at mid-week...it bounced right back on Friday afternoon:

To me, it appears we may have the makings of what chart-watchers call an "ascending triangle" (noted in red in the chart above).

My best guess - in keeping with last week's theme - is that the major indexes will continue to work their way higher within the confines of that triangle until it hits the apex...which happens to coincide roughly with the end-of-May Memorial Day US holiday.

I've seen ascending triangles many times. They will frustrate you because you'll see "big days" (like last Friday, and the Friday before that), followed by lots of baby-step activity where the market neither goes higher or lower.

What Would Make Me Turn More Bullish

Last week I said this about the market:

"I would become more enthusiastic if the riskiest sectors of the market, like small- and micro-cap stocks, improve dramatically and catch up with the performance of the S&P 500 and Nasdaq indexes."

That is actually happening, which is great to see (so far as these things go, anyway).

For example, on Friday:

- The Russell 2000 small-cap ETF (IWM) finished +2.4% higher

- The iShares Microcap ETF (IWC) rose +2.5% - the best of all the major indexes.

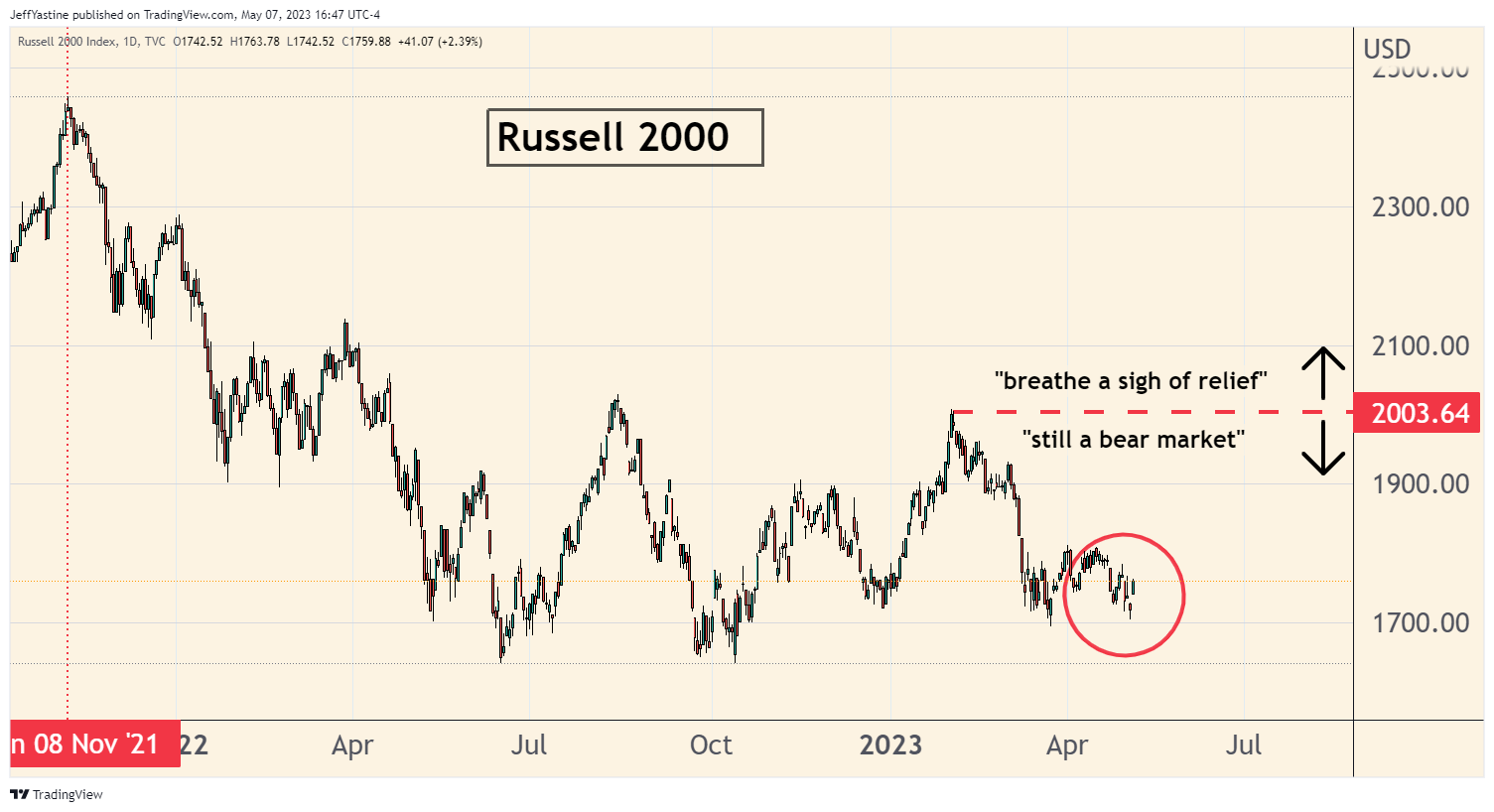

But take a look at the chart below - both indexes have a long, long road ahead in order to the bear market in the rear-view mirror:

See the red dotted line on the chart above? We need to see the Russell 2000 rise roughly 12% (from current prices) and move above that line - the index's most recent near-term high, notched in early February.

I'm not saying it can't happen. A move like that would put a steak knife through the heart of our 17-month-old bear market.

But until we see such a rise...well, let's just say we ought to view the index with suspicion.

Chop, Choppy, Choppiest

Even if we get a nice summer rally into July and August, I believe this will remain a very difficult, choppy, and dangerous environment - especially as we head into the fall.

For anyone who puts on big trades - buying lots and lots of shares & taking risks that are too large (relative to his/her portfolio size)...the possibility of losing an uncomfortably large amount of money is very likely - in my opinion.

Here are my reasons for thinking this remains a dangerous period for complacent traders and investors:

- The Fed still hasn't hit the "pause" button on interest rates.

- The higher the stock market goes from here, the more the Federal Reserve may decide that it is "OK" to keep raising interest rates.

- It's still early in the year...we still have the summer doldrums, and then the fall (a typically vulnerable period when the stock market can fall hard) ahead of us.

- The debate over the US debt ceiling may be put off until the fall...which only adds to the level of uncertainty for the stock market.

- It takes 12-18 months for interest rate hikes (or cuts) to be felt in the economy. So we're barely seeing the impact of last year's rate hikes and will see more and more of those impacts as the year goes on.

So as far as making money or losing it...the best I can say is what I've been trying to demonstrate my philosophy in the goodBUYs portfolio:

- Let's not be in a big rush to get fully invested: Let's add one stock at a time (so we are slowly increasing our exposure and stock market risk) and see whether that stock moves higher or not. If it's not demonstrating the ability to work its way higher...sell it quickly and take a small loss, and move on to another prospect.

- Focus on risks...and taking small risks, not large ones: I'm only adding enough shares to each new position so that if a stock falls to our "sell at a loss" price...that loss only amounts to 1% or less in the value of our portfolio.

- Let's use "wide stops": The idea is to give a stock a lot of "wiggle room" so that an increase in volatility doesn't result in an immediate and massive loss in the portfolio.

- Allow stocks that have demonstrated an ability to move higher...to keep moving higher.

To that last point... the idea is that if the stock market is going to keep surprising investors and move higher... then some (though not all) stocks will also keep working their way higher as well.

Our goal should be to own those stocks and ride them until we have a nice profit (and try not to be greedy in the process).

That's it. We are the sum of our habits. If we have good habits as automobile drivers, we tend to have the ability to avoid major accidents most (though not all) of the time.

Likewise, if we have good habits as investors and traders - taking limited risks, cutting losses and letting our winners run - we may have setbacks on occasion, but should be able to get to our financial destinations without having major accidents that destroy our portfolios and our confidence.

Best of goodBUYs,

Jeff Yastine

Member discussion