No "Fed Rally"? Why That's a Good Thing for this Market

Thinking through the Federal Reserve's latest rate-hike announcement yesterday, a few things are coming into sharper focus.

For one, we're finally seeing the average investor take the Fed seriously - because it's the first time all year with no "Fed rally."

That's good. It means the vast majority of investors on Wall Street and Main Street are losing their bullish enthusiasm.

It's one of those harsh but necessary shifts in sentiment that must happen before we can see a sustainable rally and/or market bottom.

How do I know this for sure?

Let me ask you a simple question...are you still interested in "buying the dip" on stocks, now or anytime in the near future?

Probably not. Few people are these days.

But it's taken this long - 9 months - for "buy the dip" to finally wear out its welcome with the majority of investors.

If you need evidence - as I noted over the weekend - one of this year's big surprises "has been the S&P 500's amazingly positive reaction on each and every date when the Federal Reserve raised interest rates."

- March 16: +2.24%

- May 4: +2.99%

- June 15: +1.46%

- July 27: +2.62%

Then came yesterday's market reaction to the #5 interest-rate hike:

5. Sept. 21: -2.25%

And the market is heading even lower today...

"Buy the dip" is finally dead. It means we're close - I believe within 2-3 weeks - of a significant year-end rally, and maybe just maybe...a new bull market.

If I'm right, then we're looking at some kind of double-bottom. Or what I like to call an "undercut low" where the market slices through a prior low, making investors even more pessimistic - before finally turning inexplicably (at the time) higher.

My guess is that the next report for consumer prices and inflation - the September CPI, due out on October 13th - will play a critical role in breathing new life into the stock market.

If you're saying to yourself..."Well, what about inflation? What about the Fed? What about a potential recession?"

Those are all good questions. The simplest response is to note that the stock market anticipates events - good and bad "over the horizon" - and reacts accordingly.

So the things we're uncertain and worried about now - are the reasons why I was telling subscribers to raise cash, and take fewer risks a year ago. They're the reasons the Nasdaq is down 31% and the S&P 500 is down 22% year-to-date.

In other words, by the time this stuff is all over the news as "accepted wisdom"...it's no good to us anymore. It's already "priced in" to a large degree in the market.

And what are the positive developments no one is talking about yet?

- Inflation is beaten. The news sounded terrible on last week's August CPI report. But the annual pace of inflation continues to slow, from 9% in June, to 8.5% in July, to 8.3% in August.

- Oil prices are down 33% since June. Remember how everyone was talking about the potential for $180 a barrel, in the spring?

- Apartment rental rates may have peaked in August, according to Bloomberg.

- The war in Ukraine is coming to an end. Russian leaders are talking about a 1-million man mobilization to save their military effort. It's the kind of wishful command all autocratic governments make when their backs are against the wall.

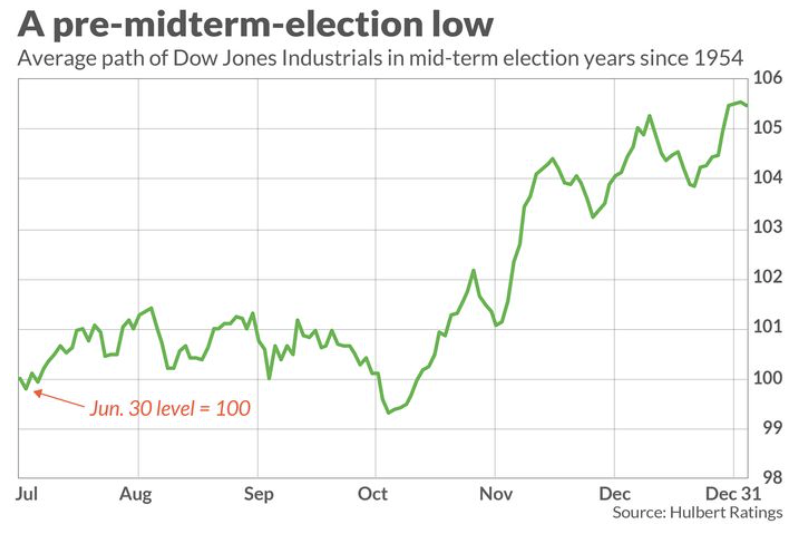

- The November midterm elections are less than 2 months away. From the stock market's perspective, the outcome of the election isn't important. It's getting the uncertainty of it out of the way.

A week or so ago, Marketwatch.com's Mark Hulbert posted a study about midterm election years. If you average the stock market's performance across the 17 midterms since 1954, your chart looks like this:

As investors, we have to live with uncertainty. But to me - going by the chart above, and the accumulating pile of improving news - then betting on a market rally starting in early October seems like a pretty good bet to make.

Jeff Yastine

Member discussion