Giving Up on Stocks?

I'm writing this to everyone because I know what you're thinking right now...

The major indexes are all down heavily on a Friday afternoon. It's been a tough 9 month bear market already. Chances are next week will be tough, too. The liquidation phase of a bear market is always very harsh.

As I noted earlier this week, I think we're within 2 or 3 weeks of a big rally, and maybe even a new bull market.

Unfortunately, if one is still heavily invested at a time like this, the last days of a big selloff often comes with the steepest losses. They are some of the most emotionally-searing days an investor will ever experience.

When you own stocks, the cavalry never arrives soon enough:

So maybe you are new to the stock market. Perhaps you've known some success over the past 2 years, but you bought a lot of stocks at the top and stayed fully invested. Or you traded out of big winners into new stocks you thought would do just as well - and didn't cut your losses quickly enough. Regardless...

It might seem hopeless. But I'm here to tell you that it's not. Take a step back. Take some deep breaths. Go for a walk.

This too will pass.

This is my 15th market correction or bear market since the mid-1990s...

In that time, I've made plenty of mistakes. But I learned from those mistakes to recover those losses and become a smarter, more knowledgeable investor.

It's not just stock-picking. Much is gained just by methodically limiting my losses, cutting losers quickly and - as a bull market becomes a correction or bear market, steadily building up cash on the sidelines.

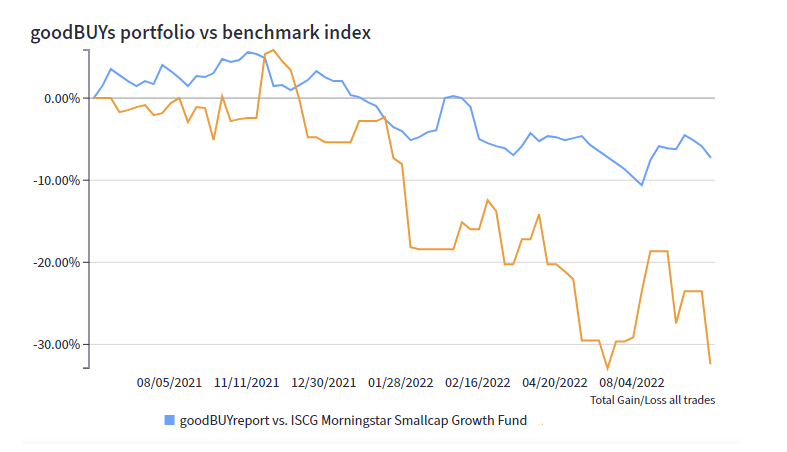

For proof, I'll offer the performance of my newsletter's goodBUYs portfolio - started coincidentally in March 2021 as the seeds of the bear market first sprouted:

As I tell subscribers all the time, in a bear market the winners are those who lose the least.

The point is...it's a lot easier and quicker to make back losses when your portfolio is down 5% than when you're down 30% or worse.

But regardless, bear markets are still humbling experiences. Even when you limit losses, as I do - it doesn't feel good to be wrong so much of the time.

The one thing I'll console you with...

Times like now really are when the biggest winning stocks of the next decade are born.

In 1973-74, the S&P 500 fell 50%. So did shares of 2 unknown, recently-IPO'd companies. Intel (INTC) soared 2,000% in the next 10 years. Wal-Mart (WMT) soared 3,000%.

Fedex (FDX) came public in 1978 in the depths of that decade's 2nd energy crisis - the stock went on to rise 1,800% over the next decade.

Apple (AAPL) went public in 1980, and fell 50% as the S&P 500 started a 2-year bear market. Between 1982 and 1987, the stock climbed 600%.

Microsoft (MSFT) went public in 1986 and promptly lost 50% of its value in the stock market crash of 1987. By 1997, Microsoft's shares were up more than 5,000%.

I could go on. But hopefully you get my point - which is that even one stock that goes up 1,000% or 2,000% can make an entire investing career.

So don't give up the ship.

Accept whatever mistakes you made in this bear market. Learn from those mistakes.

Commit yourself to not making those same mistakes again (which can largely be summed up by riding small losses into large losses in the hope of watching a stock or index finally turn around).

But don't give up on yourself or your hopes and dreams for what you want to achieve.

Five or 10 years from now, you'll look back on this period and be glad that you stayed the course.

Jeff Yastine

Member discussion