Why the Stock Market is Up, But Your Stocks are Down

Let me send you an early wish for Thanksgiving happiness...

Well, I can sum up the state of the stock market in 3 charts...

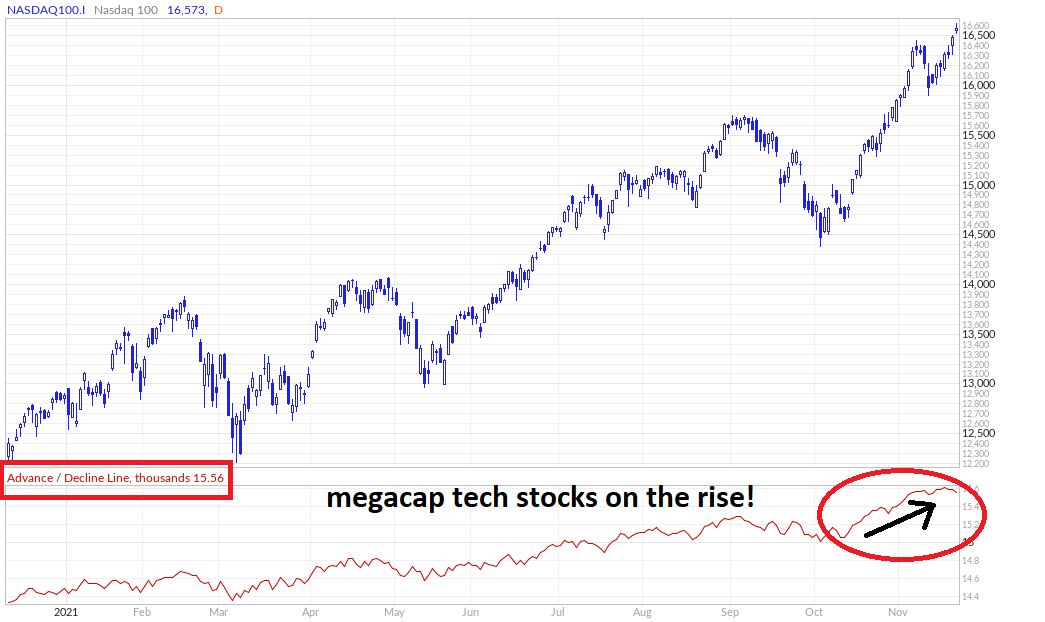

If you own megacap tech stocks like Tesla, Meta, Amazon - anything in the Nasdaq 100 (or its ETF equivalent, the "QQQ") - you're doing well.

This chart below shows us the Nasdaq 100 index on top, and its "advance-decline line" just below. The advance-decline line shows us the general trend of stocks within the index either moving up or down:

Yet if we show the broader group of tech stocks, as represented by the Nasdaq Composite (with about 2,500 stocks in the index), the story is one of share prices getting weaker and weaker...

The only reason the Nasdaq Composite Index hasn't "keeled over" is because of the mathematical influence of those Nasdaq-100 megacap stocks in the computation of its price.

And then there's the micro- and small-cap stock indexes, which really are starting to fade from the weight of months of steady selling:

So we're in this weirdly bifurcated stock market.

As far as how to deal with it, I have two insights...

- I'll say keep playing good defense since a lot of perfectly good stocks are 20-30-40-50% lower (and more) and could head lower still before things resolve themselves.

- Don't get discouraged. We can't abdicate responsibility for losing money on our stocks (OK, OK, I can't abdicate responsibility since they're my picks!) But the point is, we're trying to row upstream against an outgoing tide right now, so it's just plain more difficult.

The main thing, in times like now, is keep your powder dry (cash to put to work in your account), so we want to take only small risks so that no single bad bet (or a series of them) will sink our portfolio, and most of all - keep your confidence intact.

When the trend turns, it'll suddenly seem like your stock picking has suddenly become much better again, because we're kayaking down the river with the stock market "current," instead of trying to fight our way upstream like now as many stocks head lower.

As a final observation before getting into the portfolio review, sometime in the next 24-48 hours, President Biden is supposed to announce his pick for the next term as Federal Reserve chairman.

Most observers think he'll re-nominate Jay Powell for another 4 years at the helm of the central bank.

But there's an outside chance Biden may choose Lael Brainard, who's currently one of the Fed governors. Among economists, Brainard is considered an inflation "dove" - meaning she'll be inclined to quash any specific talk about rate increases for the foreseeable future.

If she's chosen, that might be the catalyst needed to lift lots of waning stocks - like small- and micro-cap companies - out of the stock market dog house.

Best of goodBUYs,

Jeff Yastine

Member discussion