This Week: The Bear Market's Next Big Test

One of the hallmarks of any stock market - bullish or bearish - is that it keeps you guessing...

The "rules" about the market's ups and downs are always changing. It's up to us, and our imperfect powers of observation and data-keeping, to figure out what those rules are.

For example, in the last stages of a bull market, everyone knows the "buy the dips" rule, right?

No one is afraid. There's no fear.

Once everyone figures this out - it's almost a guarantee that the rules will change to put us all in guessing mode again.

That's why this week - with the Federal Reserve meeting on Tuesday and Wednesday - ought to be a very interesting test. We may see a hint as to whether the bear market is nearing its end (i.e. true capitulation from investors) or if we're still in the middle innings of the bear-market ballgame.

Let me explain...

One of this year's "rules" - as noted by market analysts - has been the S&P 500's amazingly positive reaction on each and every date when the Federal Reserve raised interest rates:

- March 16: +2.24%

- May 4: +2.99%

- June 15: +1.46%

- July 27: +2.62%

I mean, generally speaking, "rising interest rates" is supposed to be a bad thing, right?

Yet if you bought the SPY or QQQ at the closing bell on the day before a Fed meeting announcement - and then sold at the closing bell on the day of the announcement, you'd be having a positive year of performance.

And if you held those purchases even a week or so longer, you'd be up by double-digit percentages, while the market itself is down by double-digits.

Of course, as the chart above shows, each of those "Fed day" rallies eventually proved to be a setup for yet another bear market decline. Bear markets live on this cycle of hope and disappointment.

Which brings us to this week's Fed meeting and rate-hike announcement, due on Wednesday around 2:15pm ET.

If we really are nearing an end to the bear market (as I suspect)...we need to see more evidence of total capitulation on the part of investors.

In other words, we need to see investors sell into the announcement (and sell into it in a big way), rather than view it as an excuse for a buying opportunity/"relief rally" as has been the case on each of the previous 4 occasions this year.

What I'd really like to see is the market decline below its prior late-June lows (the red line on the chart above), if not this week then in coming weeks leading up to the next release of consumer price and inflation data.

An extended decline as the Fed raises rates yet again, and lasting for more than a day or two, would be a good signal of absolute pessimism.

We're close. I see a lot of anecdotal signs of that pessimism.

- People seem a lot more interested in shorting stocks, for example. Last week Apple (AAPL) became the most shorted stock in the S&P 500.

- I also see a lot more rueful jokes on Twitter as people express their disappointment with their portfolios and 401(k)s - something I saw a lot of in 2009 during the depths of the last bear market.

- The past 2 weeks saw several days - typically very rare except at the tops and bottoms of markets - with 90% or better "downside volume" where 9 out of every 10 stocks in the S&P 500 headed lower.

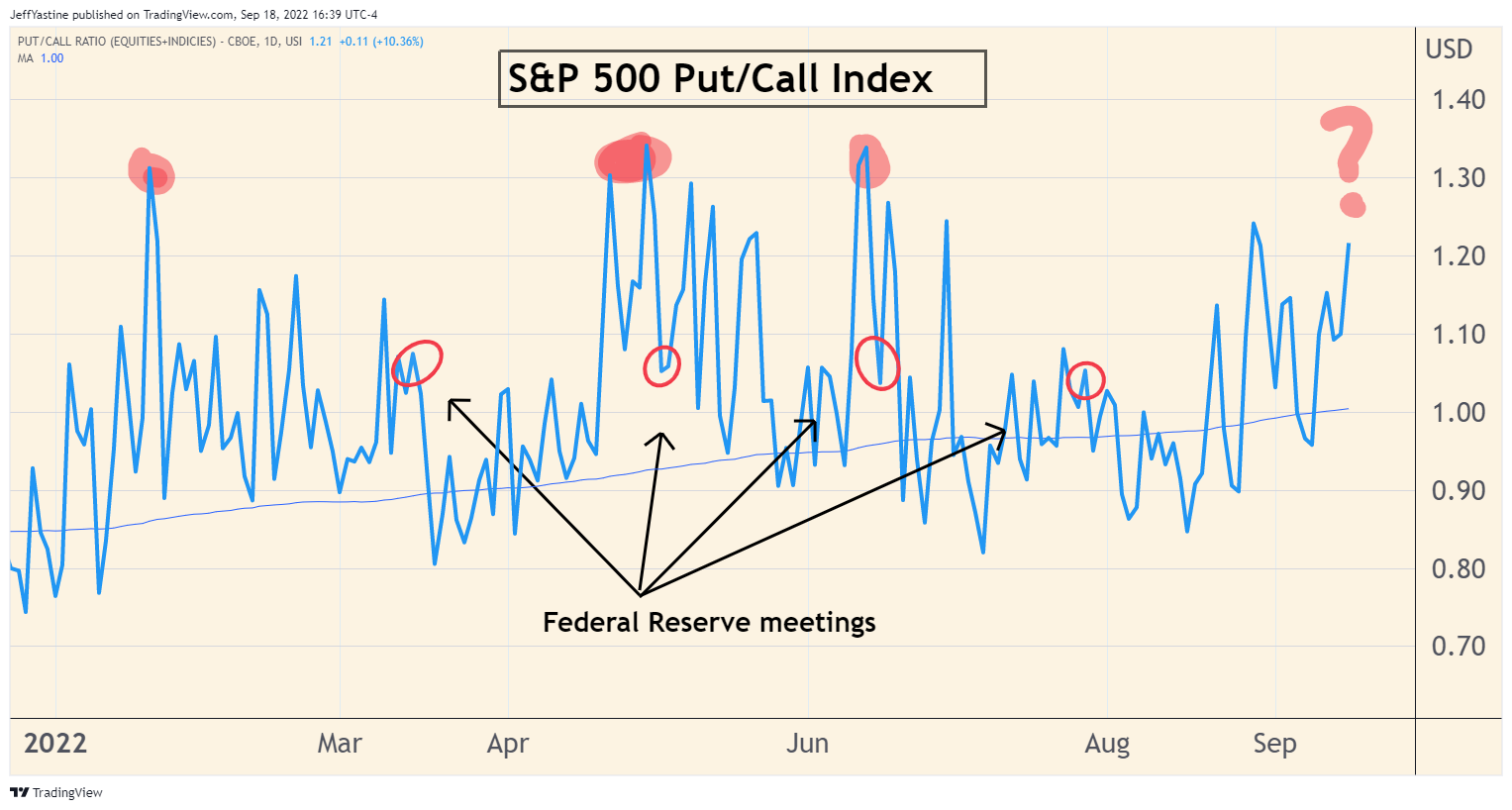

Another way to show pessimism is with a chart of put and call options buying. We've seen it reach extremes for a day or two this year when the market goes into a sharp swoon, and investors load up on put options purchases.

But just as quickly, along comes the approach to another Federal Reserve meeting, and another knee-jerk market rally - and the cycle of hope and disappointment keeps going.

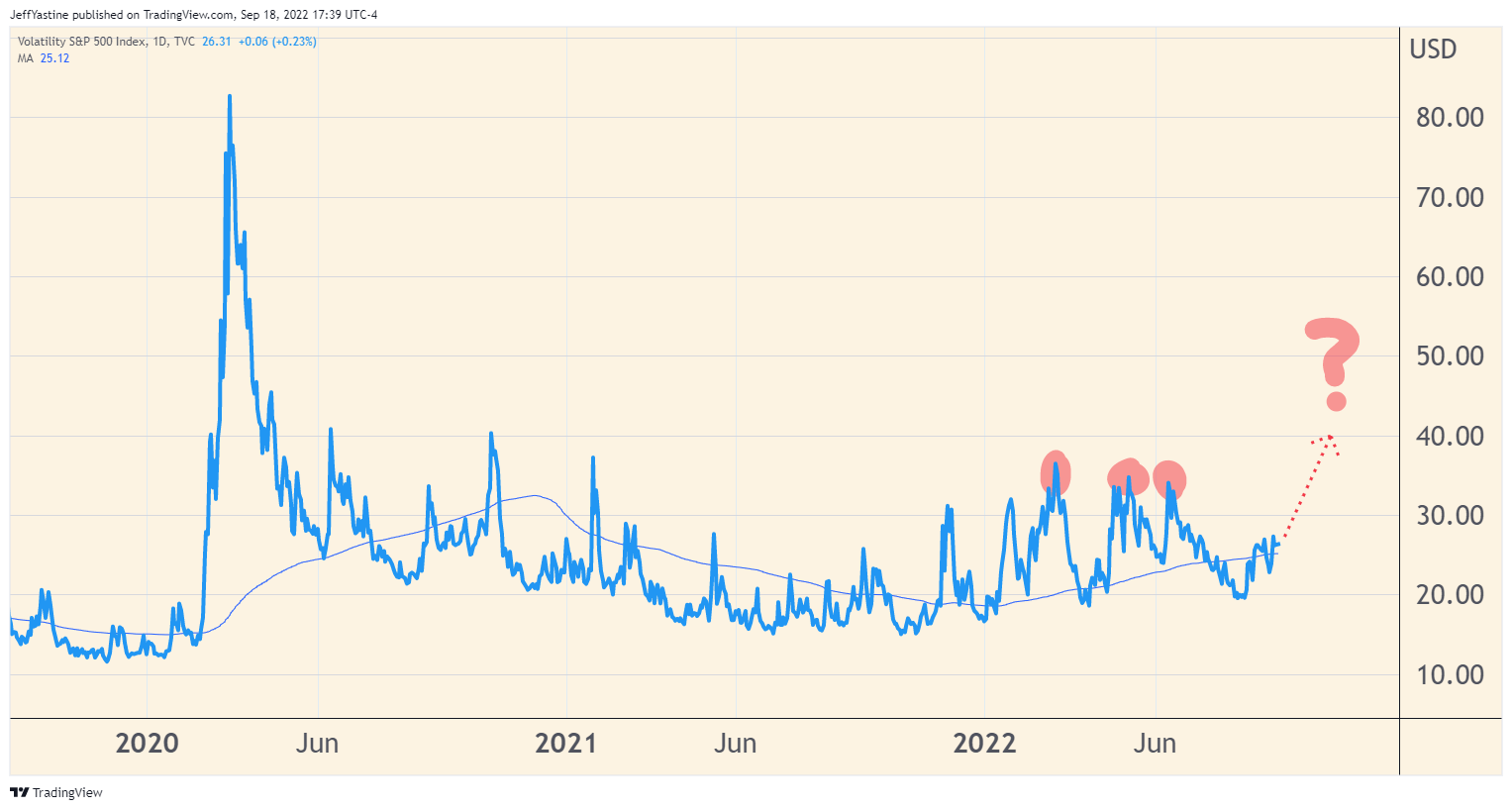

Another chart watched by many investors is what's called the "VIX"...which measures overall market volatility. When it spikes sharply higher, it shows investors are betting on increased future volatility - which typically happens during periods of extreme market stress.

But as you can see from the chart below, it's actually lower now than earlier in the year, and far below where it was in the depths of the pandemic.

A surge in the VIX above its 2022 levels thus far would indicate a climactic level of fear, of the type necessary for a sustainable market bottom and rally to begin.

So that's what I'll be watching for this week - whether we see yet another "Fed meeting rally" that begins the hope-and-disappointment level all over again.

If we see the opposite, we'll know the "rules" have finally changed - and maybe just maybe we really are approaching the end of the bear market.

Jeff

Member discussion