My Moderna "Fail" & What We Can Learn From It!

It's going to happen. You buy a stock, ride it higher and higher, and then...

It pulls a Wile E. Coyote on you...

Watch the video or keep reading below:

Such is the life of someone invested, like myself, in Moderna (MRNA) - down about 35% in recent days.

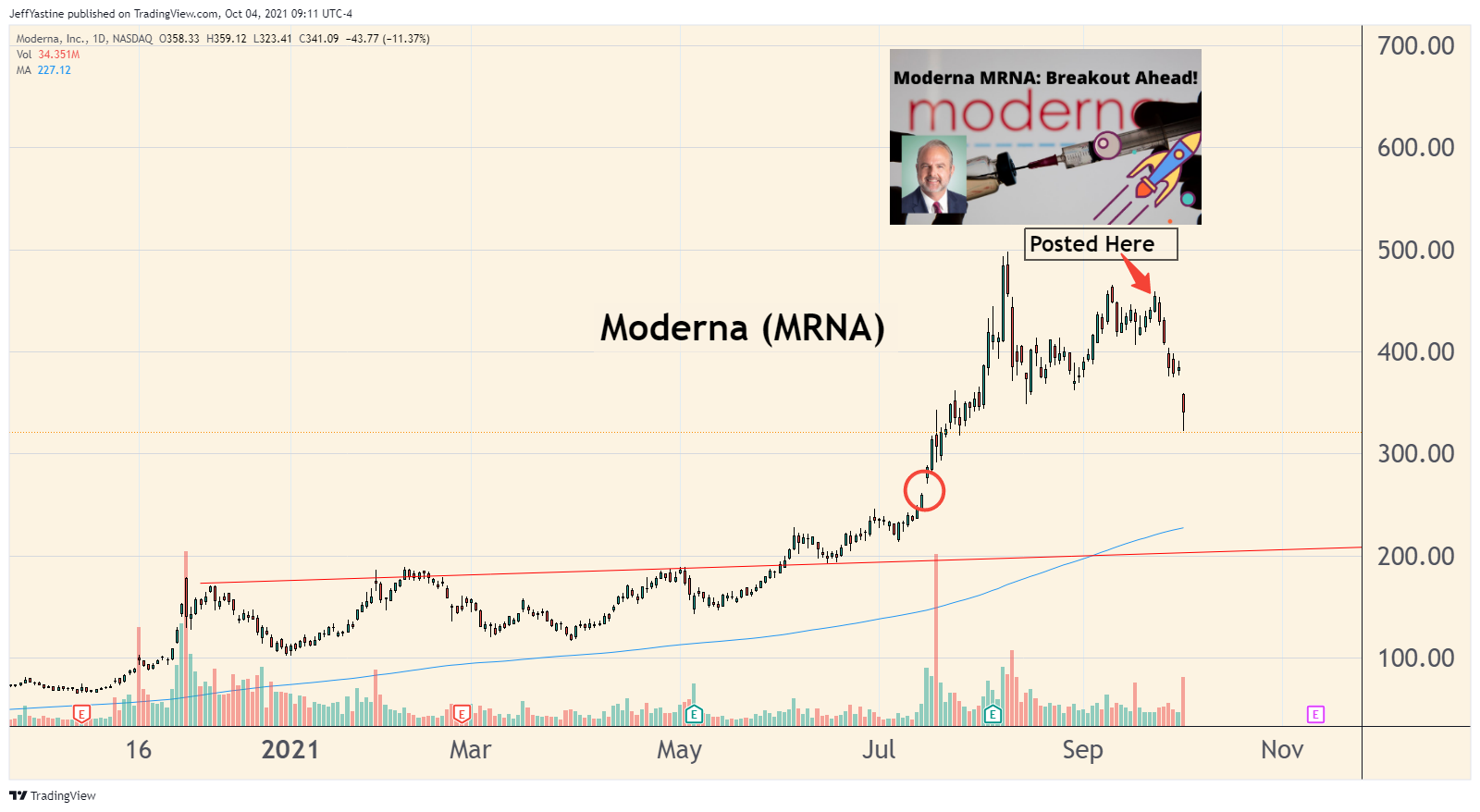

I'm also the guy who posted a video only days before, saying he thought there was "an imminent breakout ahead for the stock" which turned out... would have been the perfect time to sell:

Someone said in the comments column of that video...it "didn't age well." That's for sure.

The reason for the stock's decline is being blamed on Merck's announcement on Friday that it's developed what may be a highly effective antiviral pill against Covid-19.

But at the end of the day, MRNA was the proverbial "crowded trade." Too many bulls (like me). So when a bit of news comes along that upsets a carefully crafted bullish narrative - down goes the stock.

It doesn't help that the overall market has gotten weaker at the same time.

The only way to avoid these kinds of situations is to have a highly polished crystal ball. Or sell as soon as you have a small profit in a stock.

But if you're on the hunt for stocks going up 100%, 200% or more...you just learn to live with these occasional selloffs.

You can decide to take some money off the table and sell a few shares when it makes a new high. A lot depends on how many shares someone owns.

But owning growth stocks of any kind is sort of like going to the dentist - occasionally there's going to be some pain involved.

I continue to believe that a $600 stock price within the next 18 months is within reach for Moderna's stock.

But where MRNA goes from here in the short-term depends on the overall direction of the stock market. If we see the makings of a rally, we'll see a bounce in the stock - maybe to the $400 level, is my guess.

If the market keeps getting weaker, MRNA could fall to $250.

There's an old traders' saying that "gaps were made to be filled." MRNA has just such a gap at the $250 level.

Gaps can be created when a stock leaps higher - or falls into the abyss.

But when a stock bursts higher, a chart "gap" represents a point where the crowd suddenly gets overly enthusiastic about a stock.

As that enthusiasm wanes - if there's enough pessimism in the air - a stock will sometimes keep dropping until it "fills the gap" as the last of these overly-enthusiastic buyers from months earlier finally throw in the towel and sell.

That's not a prediction. There are plenty of stocks that have chart gaps that never gets filled. But if I were looking for a line in the sand, where the stock might fall in the face of a weaker market, I would be watching for $250.

How to Deal with Stock Uncertainty

Last week I filed a video where I said that in the face of persistent market weakness, investors and traders need to follow what I call the 'prime directive.'

In other words, watch that your losses don't get out of hand. So if I owned Moderna's shares at the highs, I'd sell what I had in order to keep my portfolio losses from getting out of hand.

If you lose 10% of your portfolio's value, it takes 11% to get back to breakeven. If you lose 25%, it takes a 33% gain to get back to breakeven. It's possible to come back from those losses, but the first thing we have to put down the shovel and stop digging the hole.

Raise your cash levels. At some point the market, and stocks like Moderna, will begin to "behave" better - and we have the confidence, and cash on hand, to take advantage of those opportunities.

Best of goodBUYs,

Jeff

Member discussion