How to Deal with Market Whiplash

Crash, Correction - or Back to All-Time Highs?

Overall, I like the look of the stock market after the last day and a half. With third quarter earnings season starting next week, it could easily be the catalyst that takes the market back up to its old all-time highs.

But let's remember that in a challenging market environment like this one, it's not the downswings of the markets that hurt us most - it's the speed and magnitude of the swings up and down, and the emotions they create in us - that gets us into the deepest trouble.

Watch my new video or keep reading below!

For example, in each of the last handful of sessions, the S&P 500 has swung down, then up, then down again, then up again, by an average of around 2%.

The rally from yesterday's low point during the trading session to the current price of the index around noon ET today...is more than 3.5%.

Pro traders love this kind of volatility. Experienced investors likewise.

But for regular investors, or especially if you're new to the markets, it can create a stomach-churning mess of your emotions and your portfolio.

Here's what I mean...

When the market is plunging (and likely many of your favorite stocks are down by even larger daily percentage losses), the pressure to sell and relieve the emotional pain is huge. It's hard to resist.

So you sell and feel better, even though you sold at the lows.

Then the market starts rallying again and suddenly you're worried..."My gosh, I'm going to miss the boat. The big rally is starting without me!"

So then you plunge back in and start buying stocks again.

And on and on it goes.

So how do you navigate a challenging market?

Mainly, go slow.

If you're going to buy stocks, buy less than you normally would. If you're going to sell something, sell some but not all.

Let the volatility work for you, and not against you.

Why should that matter?

Well, one of the hallmarks of market tops is that we feel a compulsion to buy - or we'll miss out on the next big move.

I'm not predicting a bear market or market top. (Read below for my general take on the market from here).

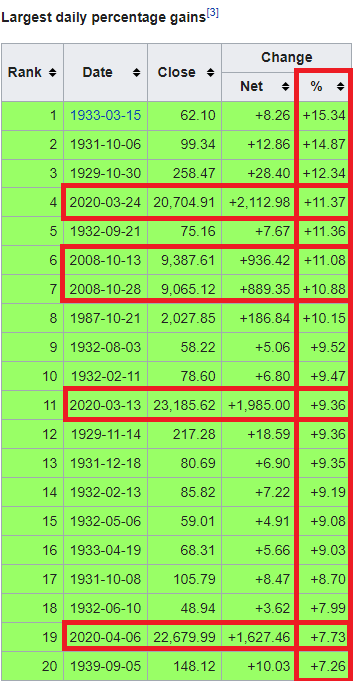

But for safety's sake, I'll point out that some of the largest-ever one-day percentage gains have been registered in the midst of bear market declines and crashes.

So all this is just a long way of saying to take a breath.

If the market keeps plowing higher in coming days and weeks - if it really is the "next leg up" the "melt-up" or whatever term the permabulls are likely to tell us - then it's going to last for a good long while. There will be plenty of opportunities to buy into stocks of many kinds.

But as the table above shows, bear markets have a way of luring us in with huge upswings. No one likes missing the boat. And therein lies the trap.

Market Status Report

I actually like the look of the market here. For example, the Russell 2000 small companies index - the riskiest part of the market - just won't go down.

It keeps going sideways, even as the Nasdaq and S&P 500 suffered some weak sessions lately.

Taken at face value, that's a good sign:

The "earnings season" for the third quarter starts next week, with companies reporting their revenue, profits or losses for the period.

That could easily serve as a catalyst to take the major indexes back up to their old highs from late August/early September.

So maybe, just maybe that's where the big "meltup" begins.

But if the market gets that far, we need to stay alert.

If the stock market reaches its old highs in coming weeks, institutional investors may be looking at the earnings reports coming out - amid higher oil prices, rising inflation (however transitory), and the prospect of higher interest rates - and thinking, "Is this the best it's going to get?"

In other words, are our favorite stocks already priced for the best of everything?

If the answer is "yes," then we'll need to be careful for a more serious potential market decline somewhere over the horizon.

So be careful out there. Go slow.

Best of goodBUYs,

Jeff

There are some things I really like about the current market. More on that below. Hopefully we can get past the current difficulties and uncertainties and enjoy a fall rally soon.

- Congress with its debt ceiling issue, oil prices, the Federal Reserve raising (or not raising) interest rates,

For instance, the Russell 2000 small cap index looks great. It keeps moving sideways, not even making new lows for the month, while the Nasdaq and S&P 500 were experiencing some difficult sessions in recent days.

So taking these charts at face value, things are looking promising. Money's rotating out of some of the overstuffed stocks in the major indexes and perhaps some of it is finding a home in small-company stocks.

Member discussion