Ehang (EH) Air Mobility: Exiting with a 56% Gain in a Month!

About a month ago, in an article I titled "Drone Redux Opportunity?," I noted my renewed interest in a US-listed Chinese stock, Ehang (EH).

Since then, the stock is up 56%!

It doesn't happen that way all the time, of course.

But when it does, it's one of the joys of my 'fusion' method - using both fundamental revenue and profit data, and chart-based technical analysis - to pick new stock ideas.

Ehang, make no mistake, is a highly speculative stock purchase.

But in this case, I liked the stock for 2 reasons. Partly it was because the company is operating the only such human-carrying production drones anywhere in the world.

Yes, there are numerous other companies, such as Blade Air Mobility (BLDE), building human-carrying drone aircraft. But most such machines either exist as an one-off experimental aircraft, or have yet to be built.

Ehang, on the other hand, has demonstrated numerous versions of its 2-person "Model 216" at numerous highly-public events in China, Canada, the United States (in January 2020 in North Carolina), and elsewhere around the world.

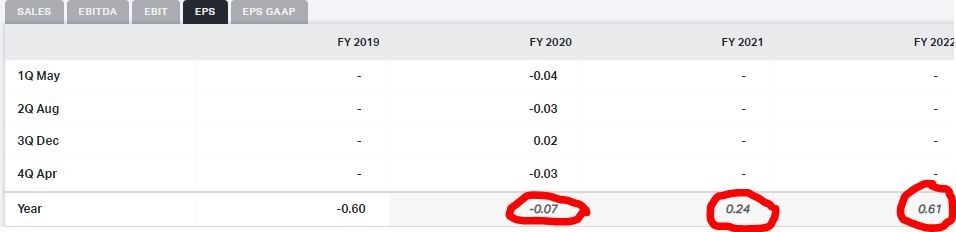

I typically take the financials of spec stocks like this one with a grain of salt. We can't lose sight of the fact that purchasing these stocks is really more about the "story" of the stock. Most companies of this type have no profit, and quite frequently very little revenue either.

But there are a few analysts who think the company could actually become a profitable enterprise on a per-share basis in the near-future.

The technical reason I liked the stock was because - after a huge parabolic climb (and descent) earlier this year - appeared ready to begin a secondary rally.

But as noted in the chart above, I'd already been into the stock once before, recommending it in a YouTube video at around $9, and suggesting it was time to sell as the stock moved amazingly above $70 only a few months later.

Like I said, they don't all turn out that way. When they do, it's nice to see.

It's even nicer to take profits, rather than see those gains evaporate if a parabolic climb turns into a parabolic descent.

So that's the choice faced now - sell the stock with a nice gain of more than 55%?

Or or keep holding for (hoped-for) bigger gains down the road?

Answer: I'm going to take the profit here, and move on.

There's a very good chance I could be selling early.

But I have a handful of reasons for doing so.

- Any stock - after undergoing a huge, parabolic "round trip" (way, way up - and a nearly equal move way, way down) in a very short time - almost never gets up yet another gigantic rally of equal size only a few months later.

- Usually - after such a big up-and-down move - there are too many traders who either own the stock and want to get out at a decent price (and so, decide to sell), or they were burned as the stock fell, and are now eager to sell at the first sign of a extended bounce.

- Right now the US stock market is effortlessly bullish. Almost everything is going up. That situation won't last forever. A big selloff - inevitably sooner or later - will almost certainly drag Ehang's share price lower.

The fourth reason is a little more subtle.

If the only speculative stock I owned was Ehang, I'd be more inclined to ride it higher still.

Or...

If the sentiment of most investors about the stock market were more dour and pessimistic, rather than effervescent with stock market optimism at all-time highs...I'd also be more inclined to rise the stock longer.

But if you have a fair number of speculative stocks in a portfolio, it's no fun to see all of them get hammered by huge amounts, all at the same time - especially when a long-overdue selloff comes our way.

Basically, I have some spec stock ideas that I like to hold for longer periods.

Others, like Ehang, fall into the "just trades" category.

Best of Good Buys,

Jeff

Member discussion