Will There Be a "Stock Market Crash of 2021"?

Crashes - where the market falls by double-digit percentage amounts in a period of a few days, weeks or months - are exceedingly rare.

In my opinion, far more money has been lost by people worrying about crashes and staying out of the market for many months or years at a time (and therefore missing out on huge opportunities in individual stocks).

But I can also see that Stock Market Crash 2021 is a trending term on Google, so obviously lots of people are thinking about this kind of thing.

Watch the video or read below!

I've been telling folks myself to be cautious in recent weeks; I posted videos in recent weeks about the importance of raising cash - and for me personally, shorting some tech stocks because I thought there was an opportunity to make some money there.

So let me see if I can put it in some even-handed perspective, and what to look for in coming weeks...

They're rare, but crashes do happen of course.

2020: The "Crash of 2o20" - We don't remember it that way in the news headlines, but we experienced our own crash when the indexes all fell 40% in about 5 weeks with the onset of the pandemic.

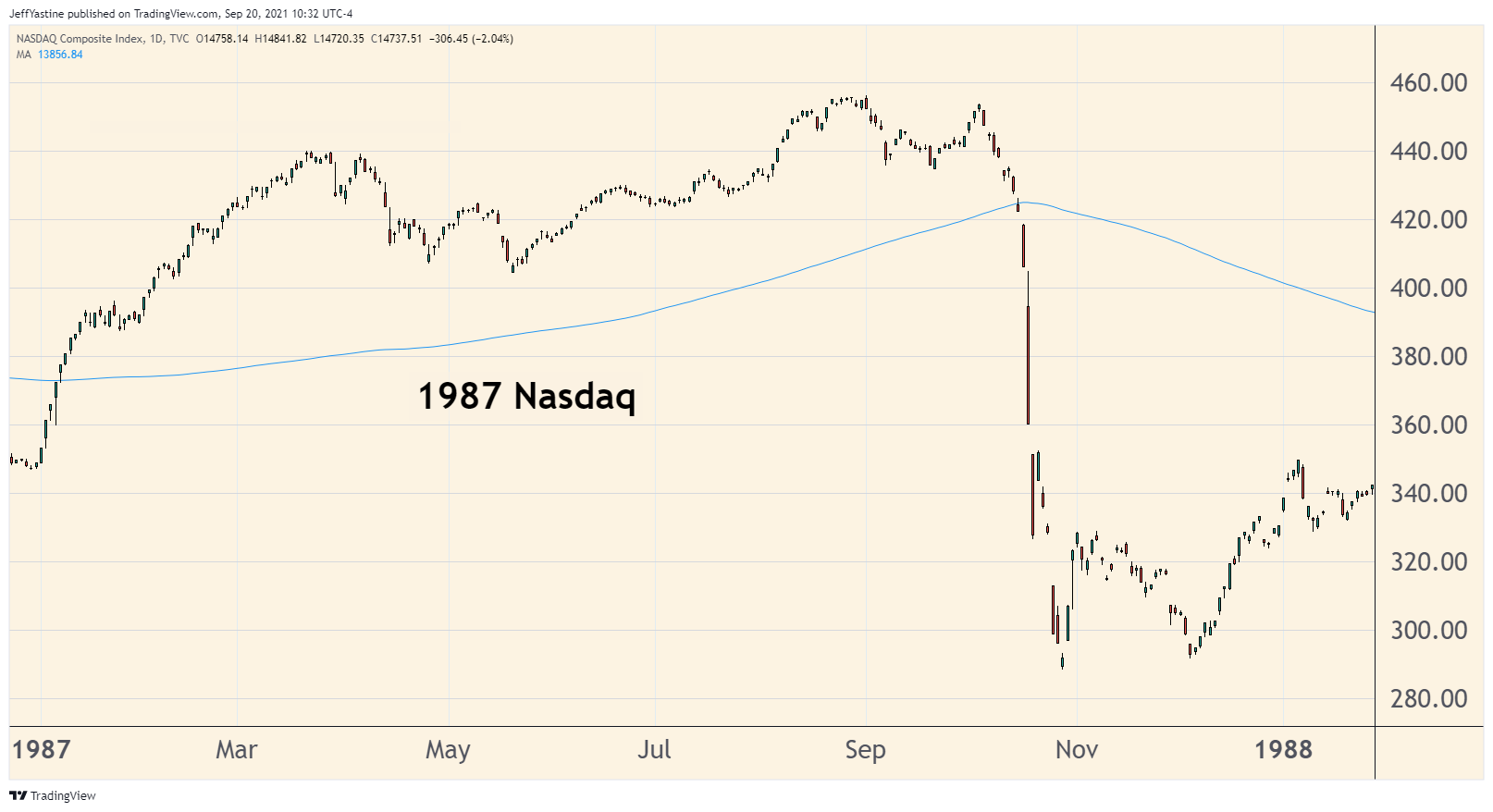

1987: The "Crash of 1987" - It's most remembered because the stock market fell 25% in a day.

1929: The "Crash of 1929" - This event took the market down 40% over roughly 2 months. But it was the headlines of "Black Monday" and "Black Tuesday" (October 28-29) that captured the popular imagination because the market fell 13% and 12% on those successive days.

We tend to think of crashes as the market just falling off a table - our 40% crash in 2020 was one such example.

But those sorts of crashes are rare. Most crashes and serious corrections tend to happen over a period of weeks, where the market slowly weakens - with a rally or two in between - before the "crash" - the event that makes the news headlines - actually begins.

There are other "mini-crashes" that happened over the years. But taken as a group, these events are so rare that we don't need to concern ourselves with them 99.99% of the time.

But as the Wall Street Journal noted in 2017, a group of academic researchers gave 53% odds of a crash happening (which they defined as a 40% decline over a 2 year period) "following a 100% [stock market] increase over the prior 2 years."

To me, a 40% decline over a 2 year period is really a bear market, not a crash.

But setting that point aside, the info may be useful to us, since the S&P 500 is up about 96% since the "pandemic panic" last year.

Likewise, the Nasdaq is up 120% over the last 18 months as well.

Again, we're talking probabilities. Nothing's written in stone.

But the reason crashes (and bear markets) sometimes happen after a huge rise in the market over a brief period of time...is simple emotional logic.

- After such a fantastic climb, few of us want to leave the party early (and miss out on a shot at even bigger gains).

- Past corrections have been brief and (in the rear-view mirror) turned out to be buying opportunities.

- We have high expectations of future gains, since everything's been going so well in our past stock market experiences.

In the case of a crash, something comes along to suddenly alter our expectations, and we all try to climb out the same small exit window at the same time.

The Best Defense

Again, we're talking an extremely low probability event.

But if a crash (or correction or bear market for that matter) was going to happen in our future, the most straightforward way to prepare is by doing the same things one should always do at all times when investing and speculating in the stock market anyway.

- Keep losses small, raise cash.

If you have new stock positions and they're starting to slip lower in a way that's uncomfortable to you - either cut the position entirely, or at least sell whatever amount will help you to sleep at night.

- Keep in mind your sector risk.

If you own 20 stocks but they're all tech stocks (or energy stocks, or gold stocks for that matter)...sorry, you're not diversified or protected.

- The more speculative a stock is, the harder it will fall.

Stock markets go through so-called "risk on" and "risk off" phases. A crash/correction/bear market is an extreme "risk off" event. So the more speculative and risky a stock is (meaning it's a new company, or it has little revenue, no profits, or some combination of those) the more likely it is to fall and fall hard.

- Trade "small" or stop trading entirely.

After a long bull run, we all feel a natural inclination to be constantly investing and trading in the market. That sort of behavior works against us if a garden variety selloff turns into a substantial correction or crash.

So the best way to make sure such events don't derail your financial goals is to lessen your amount of trading activity.

It's OK to step away from the financial poker table for a while.

If you decide to keeping trading, buy fewer shares. Take smaller risks. If you're used to buying 100 shares in a typical trade, buy 50 instead.

I always try to remind myself of some hard financial math, regarding portfolio losses and getting back to breakeven (if I'm new to the markets) or my portfolio's prior all-time high:

- If I lose 10%, it takes an 11% gain to get back to breakeven.

- If I lose 20%...it takes a 25% gain to get back to breakeven.

- If I lose 30%...it takes a 42% gain to get back to breakeven.

The point being, if your activity - or the market - is digging a big hole in your portfolio, the best thing you can do is stop making it even deeper.

We have no idea if that's really the case for us or not in coming weeks.

But if we're patient, and keep our confidence (but not hurting ourselves with huge losses and overtrading)...we'll find plenty of opportunities later, and often at lower value-laden prices.

Best of goodBUYs,

Jeff

Member discussion