Market Update: Is a Big Bear Market Rally in the Wings?

I think Friday - where the markets all finished more than 2.5% higher for the day - could turn out to be a significant day for us.

It's not that I think it's "the bottom." But could a pretty good multi-week rally be starting to take shape? I think that's a strong possibility.

Such a rally would fly in the face of nearly everyone's prior expectations, including mine. With that in mind, I put more stock ideas into the goodBUYs portfolio last week, which is starting to harbor quite a few nice gainers, and outperform the market by a mile.

But there were certain things about Friday's rally that I thought were important.

- Travel stocks - airlines, cruise lines, ticketing firms - rose sharply last week. The JETS travel ETF rose 8%.

- Bank stocks took off as well. The widely followed XLF financial sector ETF rose 3.5%.

- The XLY consumer discretionary ETF rise 2.3% on Friday, hitting its highest level since mid-December.

- The number of stocks advancing in price (versus those in decline) improved dramatically, and so did the number of stocks making new highs (versus those making new lows).

So we're not out of the woods yet. But a number of sentiment-type indicators are lining up as excessively bearish - which often leads to rallies that surprise traders and investors, time and again.

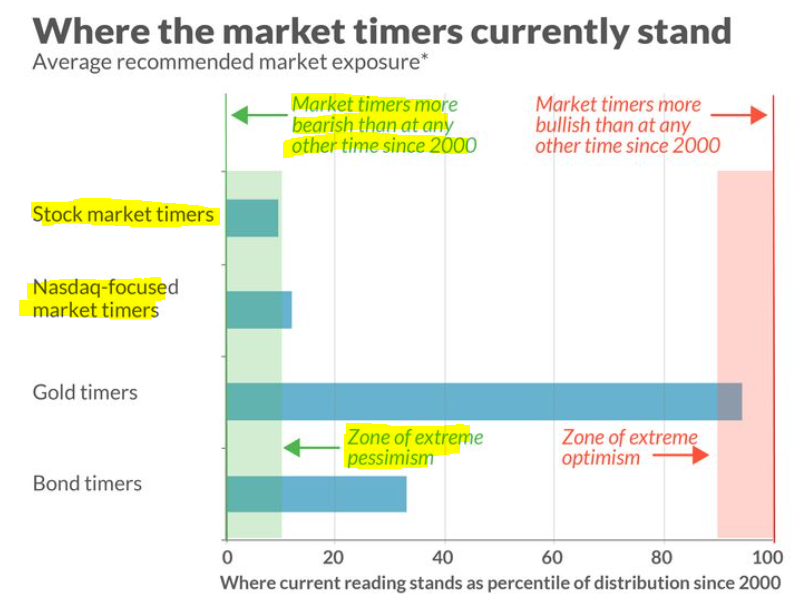

For example, Marketwatch's Mark Hulbert has been tracking newsletter gurus' bullish- and bearish-ness for more than 20 years. Bearishness among stockmarket newsletter gurus is at some of the highest levels since 2000:

The point being, from a statistical and historical view - when the majority of my sort of people (newsletter gurus) all get uniformly bearish, then we're all uniformly wrong and it's time to prepare for a rally.

Cathy Wood's ARK Points the Way?

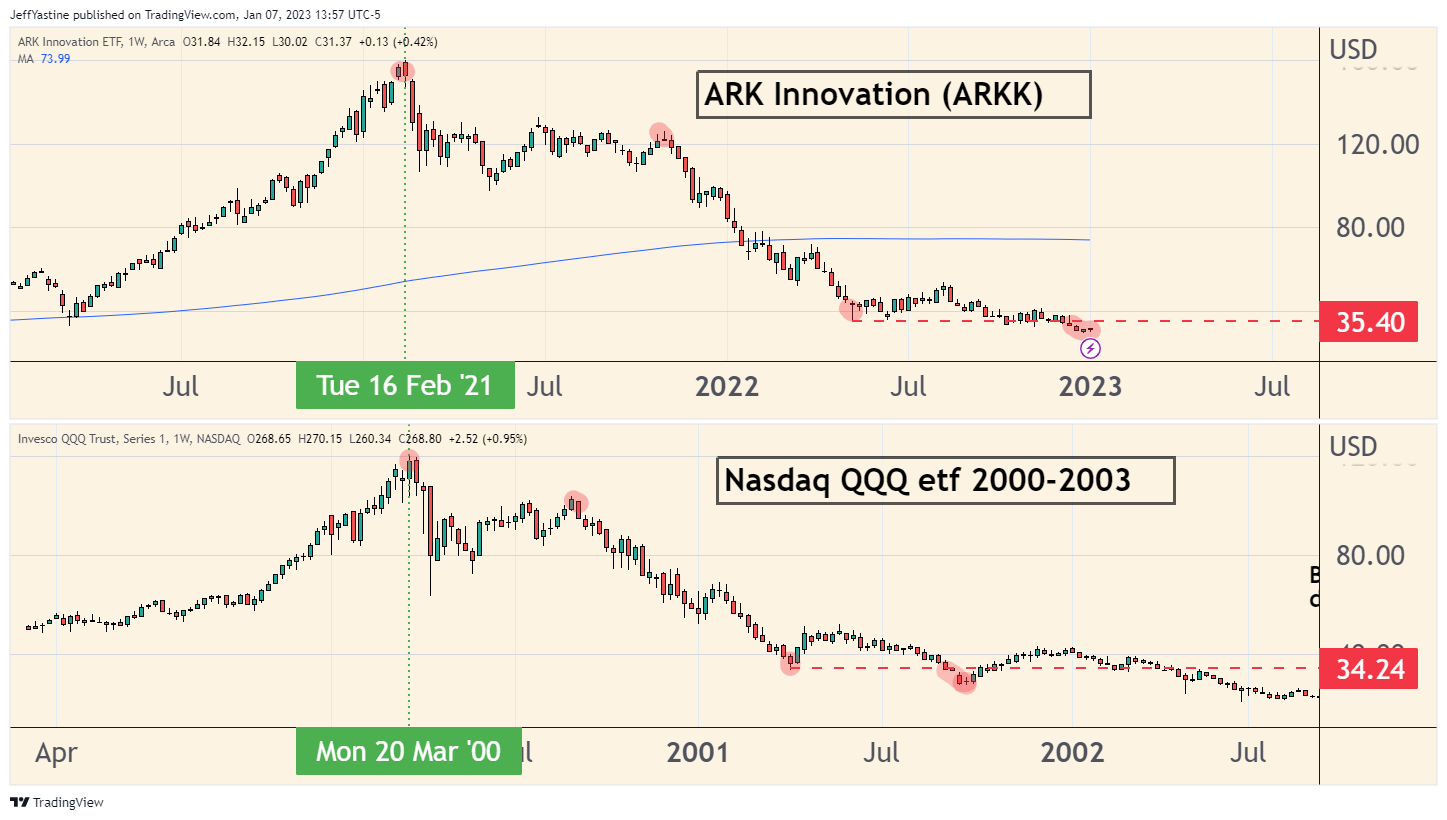

For many, many months, I've said that we should keep our eyes on Cathy Wood's ARK Innovation ETF (ARK) as a proxy for whether the market is likely to move up or down - because it's heavily traded, down 80% from its highs, and represents the riskiest of stocks.

The theory is that if really risky stocks can't move higher...neither can the overall market all that much.

I've also pointed out many times how ARK's decline is practically a mirror image of the 2000-2003 dot-com meltdown of the Nasdaq QQQ ETF (which represented the same kinds of ultra-risky unproven stocks back then when the internet was new).

It's important to note the 2 charts don't line up exactly on a day-for-day basis, but the correlation is close enough visually to take note.

If we line up the charts and zoom in...ARK's chart would also appear to be pointing to a counter-trend rally of at least a few months' duration, much as the Nasdaq QQQ's experienced a 50% bear market rally in the last 3 months of 2001:

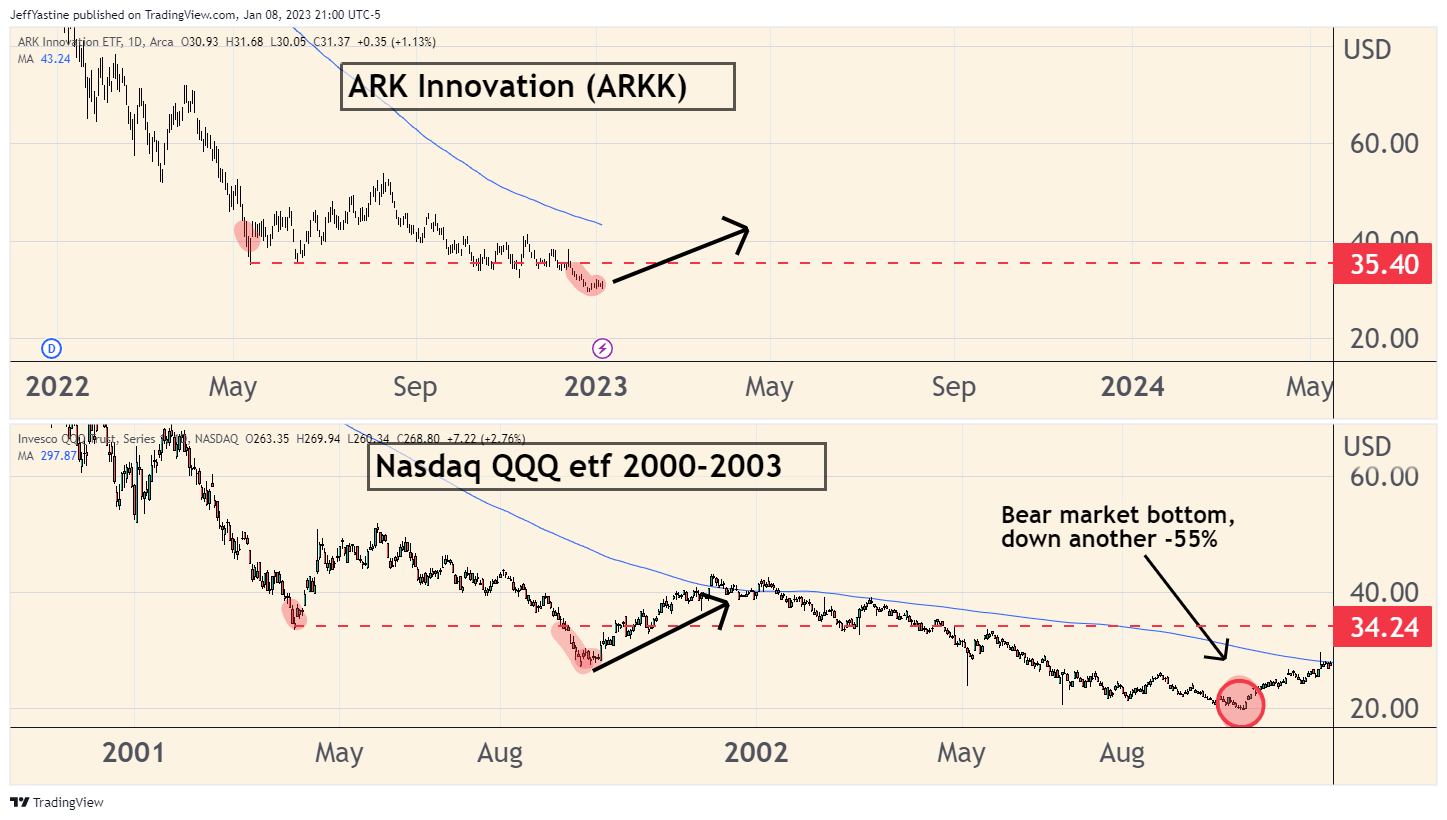

Now, before we all start singing "Happy Days are Here Again" I should point out what happened AFTER the Nasdaq had its 50% rally... it precipitated yet another 55% bear market decline enroute to the final low 9 months later:

What to Look For

But let's take these things a step at a time. For now, everyone's leaning bearish. Friday's rally might just be an indication that buying stocks in advance of a surprise rally might be the way to go.

This coming week is the start of what's called "earnings season." Most US companies will be reporting their latest quarterly profit reports over the next 3-4 weeks. No doubt there will be LOTS of disappointing numbers...which may serve to knock the wind out of the stock market when they ring the opening bell on some mornings.

But one of the hallmarks of a healthy rally is when stocks get sold in the morning (with headlines about the market suffering big intraday losses)...and then recover in the afternoon to finish unchanged or better.

So let's look for more of that in the coming week to confirm whether our hunch about a bigger bear market rally is playing out.

Jeff

Member discussion