Nvidia: The Real Meaning of Last Week's Earnings Report

A few weeks ago, a young friend of mine - knowing I write this blog and maintain a trading service - asked me my opinion of Nvidia (NVDA). Did I think the stock was a buy?

I said I had no doubt that the company would issue a great earnings report, and the stock could go higher. The bigger question (and danger) I told her, was whether Nvidia's shares could sustain that high price in the weeks and months beyond.

If not, I said, then there's a major risk that all of the report's good news was already priced into the stock.

I think that's what we're looking at now as a major risk to Nvidia's shares (and by default, the tech sector).

Considering NVDA's massively great earnings news, the stock's reaction was underwhelming:

Bearishly underwhelming, I'd say.

There was an early burst of exuberance at the opening bell. The shares temporarily hit new all-time highs on an intraday basis. From there it was all downhill, with the stock finishing lower both Thursday and Friday.

Yes, it's only 2 days' worth of sessions. But the stock's disappointing reaction of the stock sends a warning.

In short, the reaction of the stock may be saying that all of NVDA's great earnings news (and the predictions of its management in the post-release phone call with Wall Street analysts) is fully discounted into the price of the stock.

When you're a young or inexperienced investor, it's tough to wrap one's head around the idea of a company reporting great news - and yet the biggest risk is the stock going down, not up. I mean, how can that be correct?

Yet, as I tell my subscribers all the time, stocks move up (and down) in anticipation of future events.

This headline from Barron's is a good example of the quicksand investors might step into with Nvidia's stock in coming weeks and months...

The article basically says that, based on what analysts expect NVDA to earn in the next 12 months, the stock is very cheap.

That sounds very tempting.

But the chip industry tends towards boom-and-bust extremes. It's the nature of things owing to the supply-and-demand that comes out of the tech industry's product cycles.

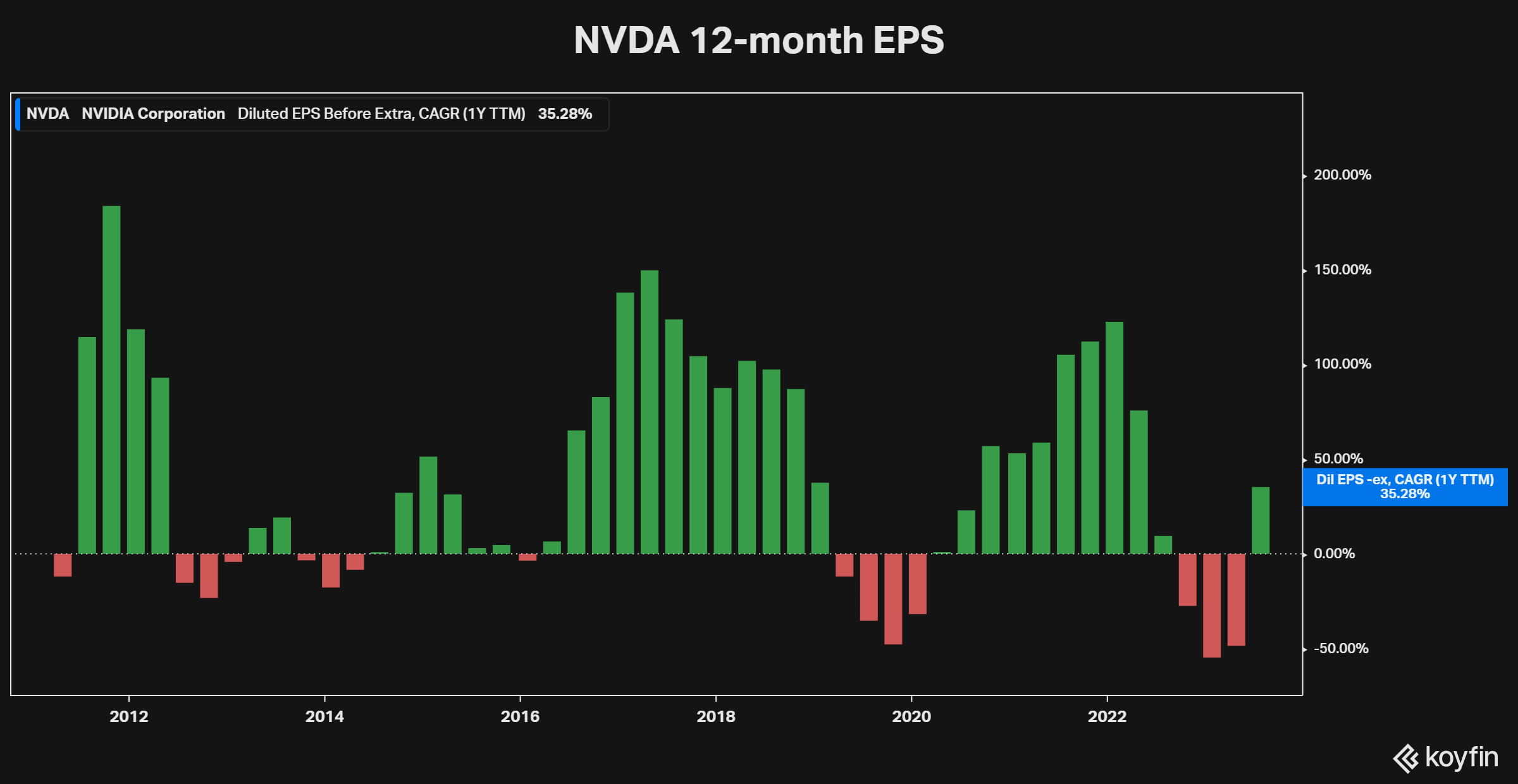

As a result, NVDA, and chipmakers in general, tend to report very "lumpy" profits - fantastically great in some years, so-so in others, and occasionally downright disappointing:

So that's the risk for NVDA investors. Analysts may be projecting bigger and bigger profits for NVDA. But the risk is that the reality turns out to be something less than fantastic.

And owing to the nature of Nvidia's "megacap" status, if the stock starts having trouble, then the rest of the market is sure to follow.

Best of goodBUYs,

Jeff Yastine

Member discussion