Market Update: Feeling Bullish Yet?

The problem with a lot of stock market commentary (including my own) is that it's hard to leave room for nuance.

For example, over the past few months I've been saying that the market needed to climb higher. We had too many bears. When that happens, the market tends to go in the opposite direction. And that's been the right call.

With that in mind, last Friday saw an important, bullish-on-the-surface, stock market milestone...

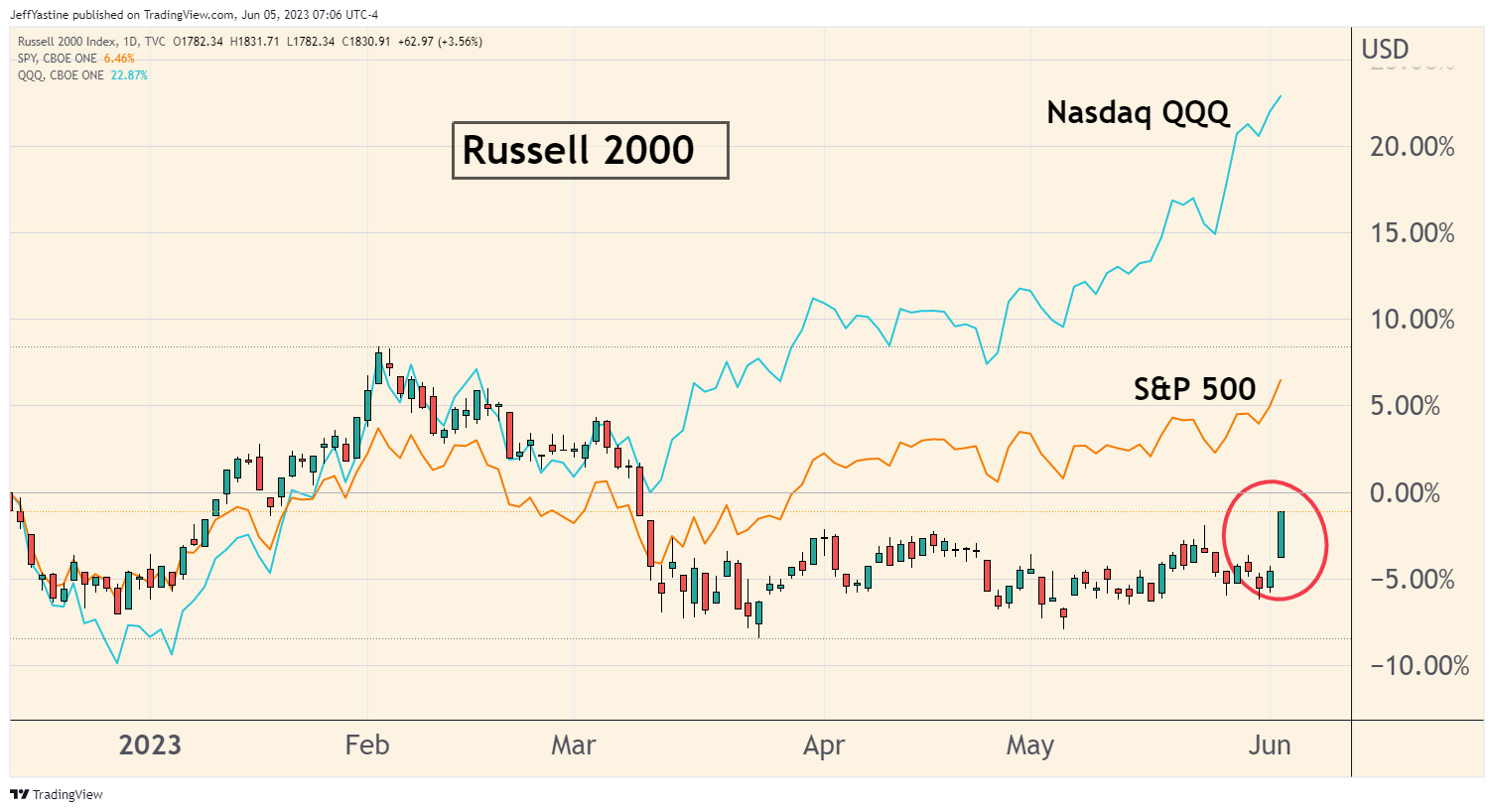

The small-cap Russell 2000 index finally "lit up" and zoomed higher, joining its the Nasdaq and S&P 500 brethren in their march higher to "post-bear market" highs.

In fact, last Friday also marked the S&P 500's gain of +21% from last October's bear market lows. That's the traditional definition of a new bull market. And the Nasdaq 100 is now up nearly 40% over the same time period.

It's only one day so far, but when investors finally start buying the Russell 2000 smallcap index - representing the smallest, fastest-growing, and riskiest part of the stock market - it tells me that a lot of bears and fence-sitters are being converted into bulls.

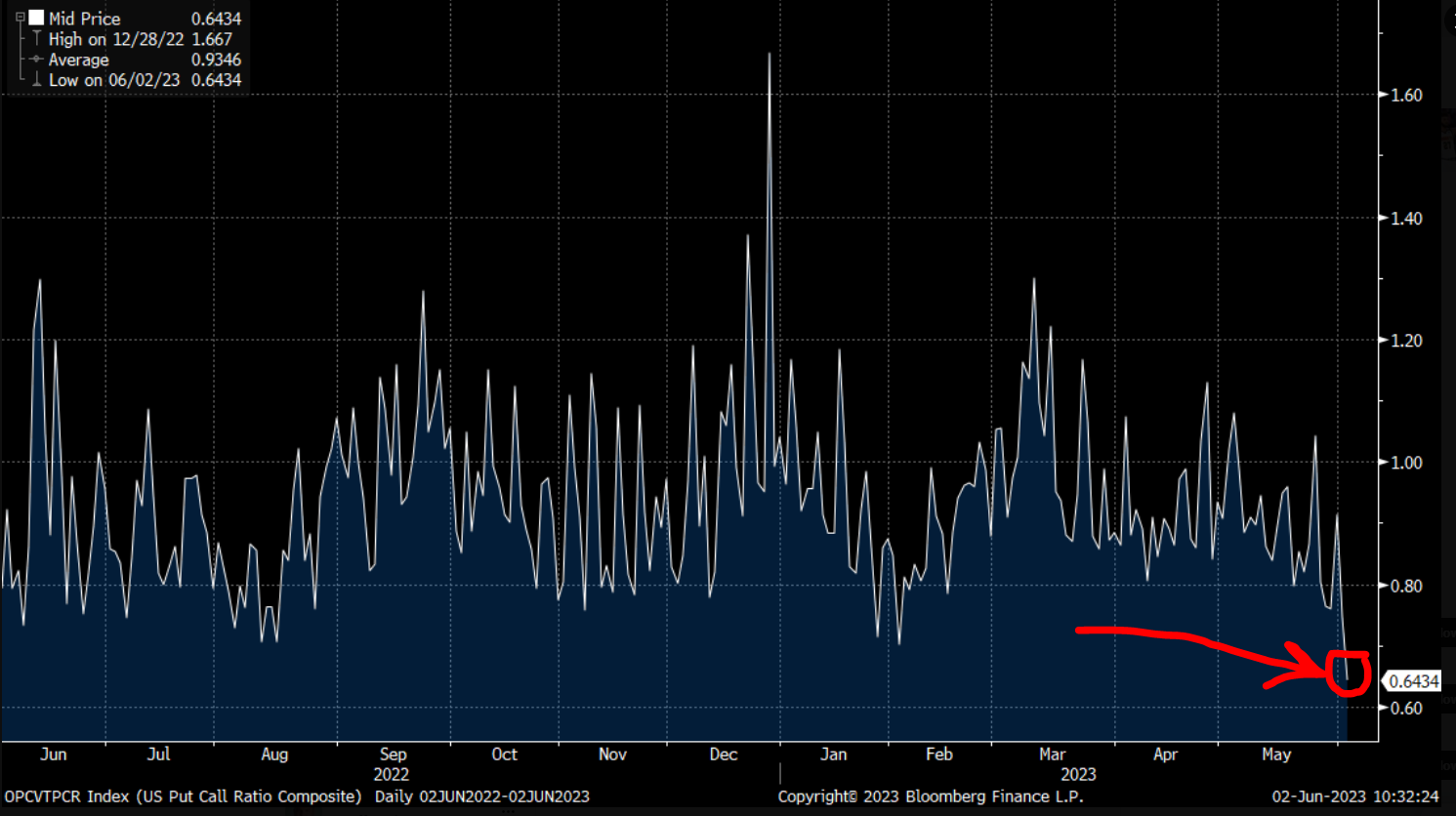

One last piece of that conversion puzzle is what's called the "put/call ratio." When people are feeling really bearish, they buy option puts (betting the market will go down). When the feel really bullish, they buy option calls (betting the market will go up).

Look at the put-call ratio as of Friday afternoon - record amounts of call buying:

The "Nuance"....?

The record amount of call buying leads to my last point...

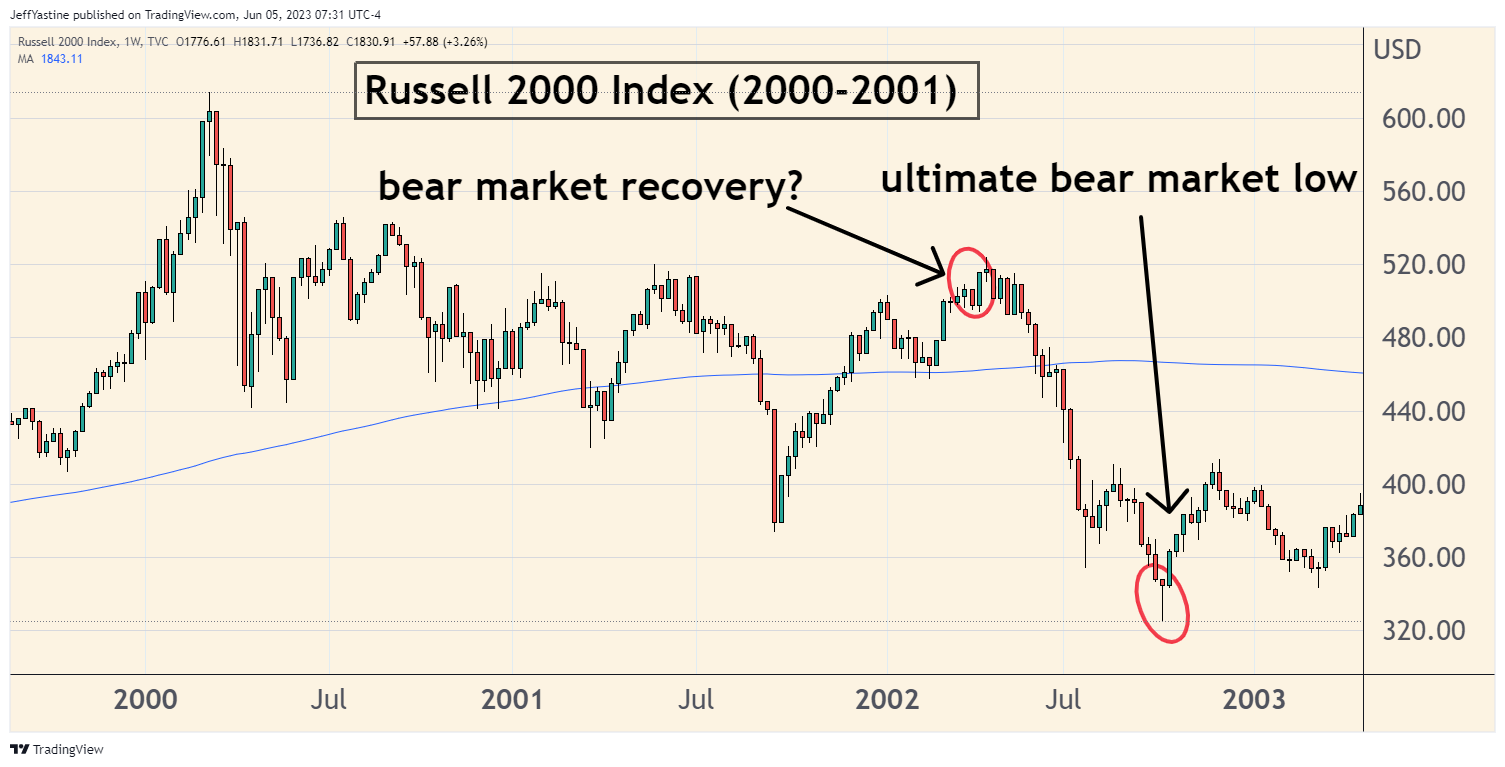

As bullish as everything sounds right now, just keep in mind - bear markets have a way of faking us out.

Bear markets put us to sleep, thinking that the market is healed - and then hit us hard, just when we're starting to commit ourselves to major stock market purchases again.

The best example I know is in the 2000-2002 bear market.

After the first 18 months - and a 40% decline - we had a terrific recovery rally. Just like now, the Russell 2000 smallcap index was slow to start, but ultimately rallied sharply over a 7-month period, and made a new "higher high" in mid-April 2002:

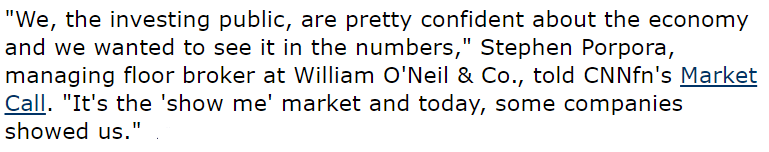

Here's a great bullish-sounding headline, and quotation, from the very top of that 2002 rally:

Sounds pretty good, right?

But once folks grew used to the idea of a recovery...the bear market resumed in a horrific 40% plunge in 6 months' time:

I think the market has strong probabilities to continue to work its way higher over the next month, and possibly into the Labor Day holiday at the start of September (a prediction I've been making for a while now).

But the Federal Reserve may not stop raising interest rates (as some strategists want to believe) at its next meeting (June 14-15)...

And don't forget that the entirety of this rally - until Friday - was driven entirely by just a handful of S&P 500 megacap stocks.

Lastly, remember that it takes 12-18 months for the Fed's rate hikes to filter their way into the economy, so there may still be plenty of un-discounted economic "bad news" out there for many of the largest companies.

All this is a long way of saying - enjoy the rally - but be careful out there.

Best of goodBUYs,

Jeff Yastine

Member discussion