Market Update: Impact of the Debt Ceiling Deal

I hope you had a great Memorial Day weekend!

It was only a handful of weeks ago [Market Update: Going Higher] that I wrote:

"I think the Nasdaq - with the S&P 500 eventually joining in - will continue to trudge higher from here. At least through Memorial Day. Potentially through July 4th or possibly to Labor Day."

One holiday down, maybe two more to go. And yet I would continue to caution about becoming particularly enthusiastic.

After the Debt Ceiling Deal

As you know by now, the White House and House leadership announced a series of compromises to remove the impasse on raising the US government's debt ceiling. It still has to be voted on in the next couple of days to avoid triggering potential default on portions of the US debt.

Presuming we see a successful vote by then, I believe the main impact for the market is to remove a degree of uncertainty. From a short-term perspective, that's bullish (more on that below).

See the pink band in the chart above? It illustrates a "gap" in the price of the Nasdaq QQQ (Nasdaq 100) ETF - created last April as the bear market exerted its early gravitational pull.

I remain convinced that's where we're headed in coming days - the pink band on the chart - as more and more market bears finally throw in the towel.

So basically we're talking about a purely technical move higher of perhaps 5%, or 10% max.

But for it to become anything else, such as the "new bull market" that more people on Wall Street want to advocate for...we need to see much better participation by other groups of stocks.

And it just hasn't happened.

So far, the extent of this rally for smallcap and microcap stocks is to see a few days of strength... followed by a few days of selling or indifference on the part of Wall Street, and regular investors like you and I.

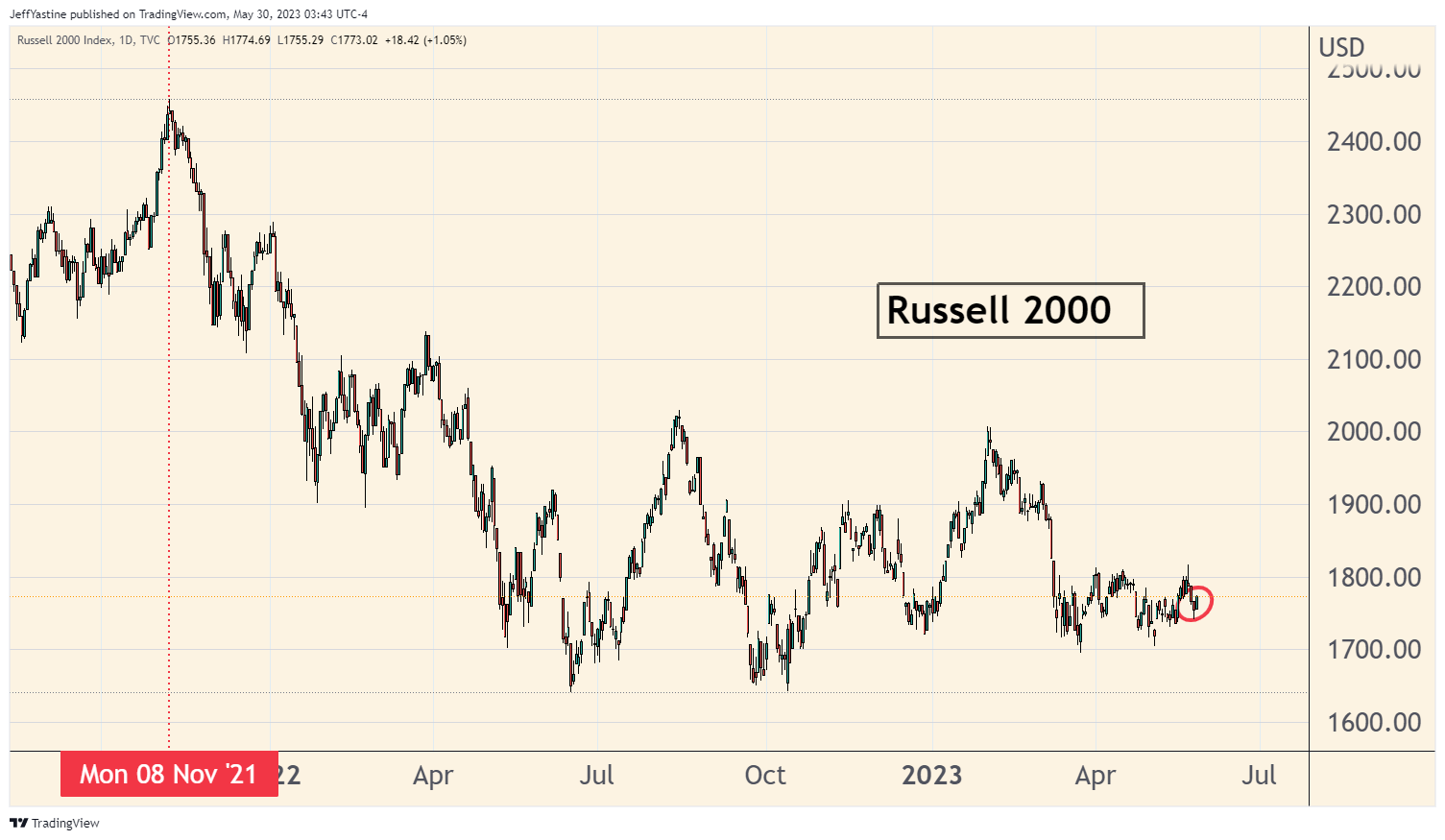

That's why the Russell 2000 - after all the fireworks we've seen in the Nasdaq - is still below its highs of February, March, April and May:

One Wall Street brokerage - comparing the Russell 2000 versus the Nasdaq 100 (QQQs) - noted that the current underperformance exceeds the runaway markets of 2020, as well as the 1999-2000 dotcom mania.

Maybe this will change as soon as next week if there's a successful vote on the debt ceiling deal, for all I know.

But (as I've been saying for a while now)...I have real trouble working up any kind of bullish enthusiasm when so many sectors of the market can't - or won't - follow the Nasdaq's lead.

FAANGs+2

For example. remember my comparison chart from a week ago, showing the performance of the "FAANGs+2"?

Those 7 stocks were up 51% then...and after last week, they're now up 65%! Meanwhile the rest of the S&P 500 (if you remove the performance of those same 7 stocks from the index) looks even worse, down 11.5%:

Most slow-motion rallies on Wall Street eventually "broaden out" as investors become emboldened by the rally in one sector (like the biggest tech stocks now) and start buying other sectors or stocks. This one has not, at least not yet.

Blow-off Top?

Presuming things continue as before - with smallcap and other market sector unwilling or unable to play "catchup" - I think we're looking at a brewing, classic "blow-off top" for the Nasdaq.

If I'm right, then we'll continue to see mega-cap tech stocks refuse to sell-off, and instead work their way higher into the pink "price gap" I noted earlier in this article.

And they'll continue to keep the Nasdaq pinned firmly in bullish-sounding territory until the next US holiday (July 4), and potentially through Labor Day (September 4), with the chart looking approximately like this:

The "look" of the chart matters little. The main thing to keep in mind is that this could be a very "slow" summer for the markets.

As investors, it could also be very frustrating. Basically, it means several months of continuing "bullish-sounding" headlines about the leadership of the major "mega-cap" tech stocks - while everything else drifts in the breeze.

It's easy (and very reasonable) to think: "It can't keep going on like this."

And yet it can. It's happened many times before. I'll save that analysis for a future post. But for now, just remember that this is a bear market's way of lulling us into lowering our guard until enough of us have flipped to the enthusiastic-bullish side of things.

Only then will the next phase of a bear market begin.

Best of goodBUYs,

Jeff Yastine

Member discussion