Market Update: Going Higher

I'll let you in on a little secret...

Back in the early 1980s, I was a teenage driver with a newly-minted license. And within a year, I had my license suspended by the state of Florida.

Though I didn't know it at the time, the episode taught me a lot about being a successful investor and trader, and how to recognize dangers - and opportunities - in the stock market.

More on that below.

As a teenage driver, I didn't drink. I didn't deliberately drive in a dangerous or reckless manner. I was never in any serious accidents that caused injury to anyone or myself.

But I got in more than my share of fender benders (OK, they were more like "dings" on the old-school chrome bumper of my Dodge Dart).

Then I had a few speeding tickets on country highways where I figured...hey, you know...what are the odds a sheriff's deputy is running radar all the way out in the middle of nowhere with no other cars on the road?

So after getting something like 13 points against my license in 12 months' time...the state of Florida had enough.

Goodbye driver's license. Hello DMV "safe driving" school.

Ultimately, the DMV did me (and my fellow drivers with whom I share the road) a big favor. The class instructor was channeling the Roy Lee Ermey gunnery sergeant character in Full Metal Jacket when he loudly told me and the rest of the DMV class....

- I had dangerously lousy driving habits, and to that point...

- I was a stupidly in-attentive driver.

- I dumbly lacked "situational awareness."

I quickly developed much better driving habits - and haven't had an accident or moving violation ticket since.

Yes, just like in trading, luck plays a role.

But developing better habits - highly attentive, with much-improved situational awareness - has helped me avoid more near-accidents than I care to think about (especially here in south Florida, with the worst drivers and highest insurance rates in the nation).

Investing and trading is the same thing. Losses go with the territory - especially in the midst of corrections and bear markets.

But a little extra attentiveness and situational awareness helps us understand what might happen. And by seeing the possibilities, we lower our risks in dangerous market environments - like now.

Too Many Bears

For example - as noted in recent posts - I think the Nasdaq - with the S&P 500 eventually joining in - will continue to trudge higher from here. At least through Memorial Day. Potentially through July 4th or possibly to Labor Day.

Sounds crazy, I know:

Don't get me wrong. I'm not bullish in any sort of enthusiastic way.

But there are still waaaaay too many bears out there among average traders and investors like you and I.

For example, the Commodity Futures Trading Commission (CFTC) each week reports the aggregate positions of various groups of commodity traders.

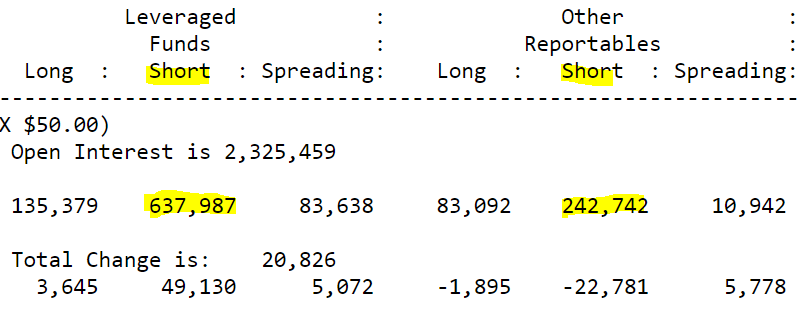

Pro traders (dealers and asset managers) are "net long" the S&P 500 via futures contracts. But leveraged funds and small traders (called "other reportables" by the CFTC) are still heavily "short" the market:

Based on the data above, my hunch is that the market will continue to move higher - inflicting more pain on those folks maintaining stubbornly "market short" positions until they throw in the towel, and are forced to become "net long" the market.

And believe me, I see why folks would stubbornly maintain their bearish positions. As the chart below shows, even while the Nasdaq is very slowly puffing its way up the tracks - the rest of the market is still stuck at the train station:

As the old market saying goes, "Whatever appears obvious in the stock market [in this case - that the stock market is close to dropping into the abyss]....is obviously wrong."

I think the market may continue to inflict painful surprises on bearish investors.

Debt Ceiling Surprise?

For example, there's a lot of (well-founded) fear out there about the US debt-ceiling stalemate in Congress. Early June is the supposed deadline before we see s a debt default.

But things being what they are in Washington, I'm going to bet that we could see a short-term political deal - the equivalent of "kicking the can down the road" until next fall.

If such a deal were to be struck, it could easily lead to another knee-jerk rally that takes the Nasdaq still higher, and perhaps breaks the S&P 500 upward, out of its recent "flat-lining" chart pattern:

The important part to remember about all of this...

None of this means that investors and traders are really all that excited about the economy, or the stock market's prospects. A summer rally - if it happens - would merely feed off the capitulation of short-sellers who need to get out of their losing positions as they decline in value.

Once those short-sellers have truly capitulated, that's when we'll see the next phase of the bear market begin.

Best of goodBUYs,

Jeff Yastine

Member discussion