Everybody Back in the Pool for Profits?

Well, so much for my call earlier this about it being "too early for tech."

(I mentioned the other day that my crystal ball was perpetually cloudy, right?)

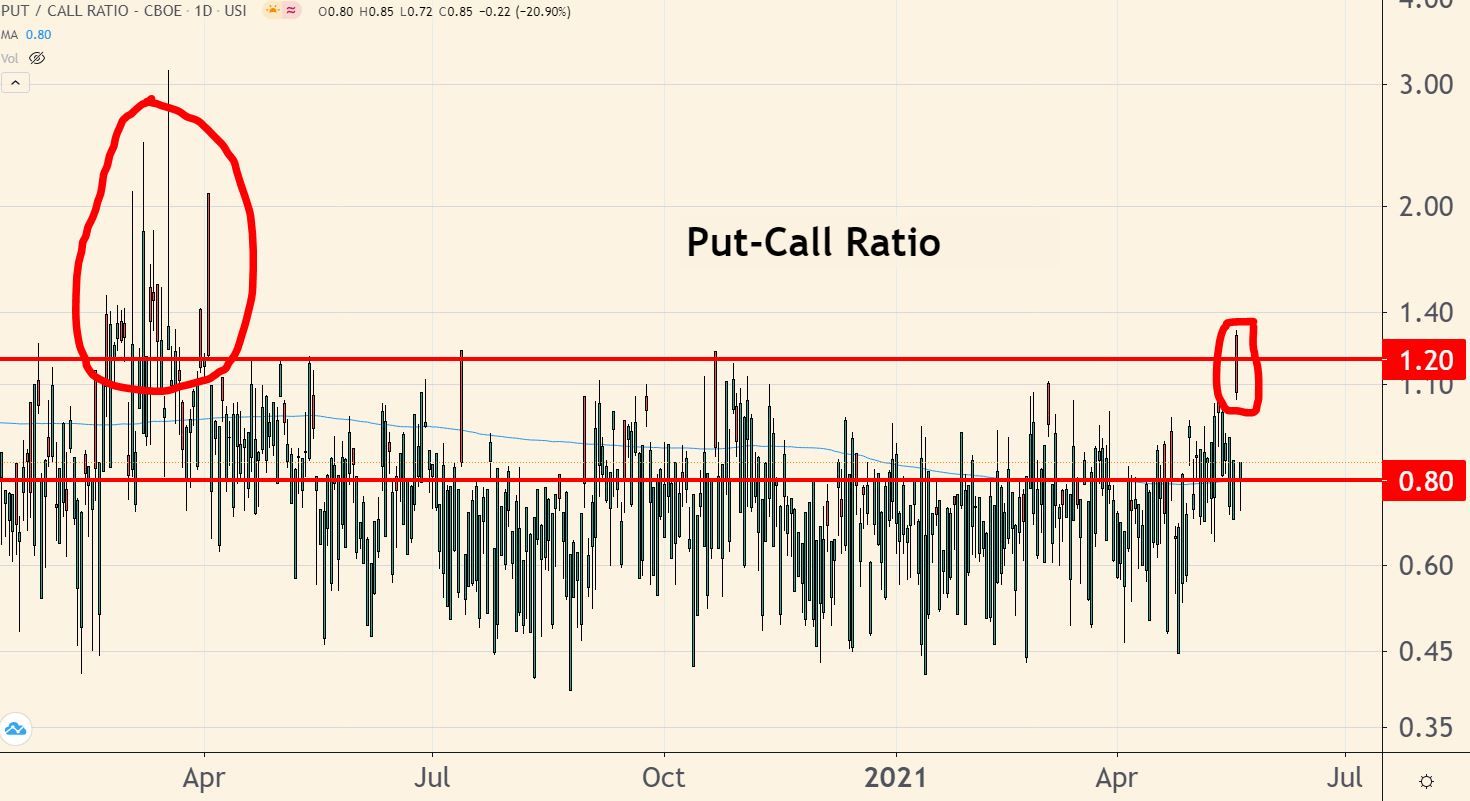

Here's one clue as to what may have happened. At one point during the Nasdaq selloff (and with cryptocurrencies like Bitcoin down 30% for the day), a measurement called the "put-call ratio" hit its most-bearish level in many months.

If you're not familiar with them, "puts" are options contracts where someone bets the price (for a stock or ETF or index) is bearish and is going to fall. "Calls" are a bullish bet that it's going to rise.

The chart below hopefully illustrates it in a way you can understand. When people start aggressively buying lots of puts (such as last March), the ratio moves above the upper red line. When they buy lots of calls, the ratio moves below.

So the big selloff in Bitcoin prices, combined with the Nasdaq's weakness, in the first half of the week apparently scared enough people into loading up on puts in a huge way (circled on the chart) on the presumption that the market was about to fall even further.

One thing to remember about stocks - when enough people do something all at the same time, quite often it triggers an opposite force, a counter-reaction.

That's what happened through most of Wednesday's session and on into Thursday. With so many people leaning heavily to the bearish side, a counter-reaction set in with the Nasdaq tech stocks leading the way sharply higher.

Excuse me while I go to the hospital to have my whiplash treated (kidding!)

The best I can say is that the market just isn't ready to go down yet.

In fact, given the vigor of the rebound in the last day or two, it's possible that investors are getting ready to fling the index sharply higher for a summer rally.

Maybe it lasts. Maybe it doesn't. Sometimes it's helpful not to look too far ahead, keep your focus on the individual stocks in your portfolio and let those stocks' price action going up or down be your guide. My stock portfolio had a good day yesterday, especially with a favorite of mine (Moderna #MRNA) up more than 5%.

Lastly, I'd like to consider my own reactions over the past week.

There's plenty out there to make one lean somewhat to the cautious side about the markets - universally-loved, highly overvalued stocks in sectors like tech, and - as became apparent in the recent release of the Federal Reserve's minutes of its most recent meeting - the central bank may even consider raising interest rates if the economy continues to improve.

Yet, as traders and investors, we have to consider the market's reaction to our own theses.

If we're not getting the reaction we expect (in this case, a market decline) we need to reconsider our viewpoints, and do it quickly.

Best of Good Buys,

Jeff

Member discussion