Head Fakes & Breaking the "Lower Highs" Habit

I used to love playing basketball as a teenager.

But if you're not blessed with great height or leaping ability (like me), you have to find other ways to get open to take your shot.

Enter the "head fake."

You've seen NBA players do it a million times on ESPN... jerk your head and upper body upward, making it look like you're about to take a jumper. As your defender leaves his feet to block the shot, you dribble past for the layup under the basket.

For investors though, stock market "head fakes" are the bane of our existence.

With that in mind, as impressive as last week's strong rally was - I'm sure you've wondered if that's what we're looking at now.

We won't know the definitive answer of course, until after this rally either breaks out or breaks down. So we can't let it keep us from investing in stocks likely (in our best judgment) to move higher.

But when I drive, I'm always scanning the road ahead for hazards. I like to do the same when I'm trading and investing.

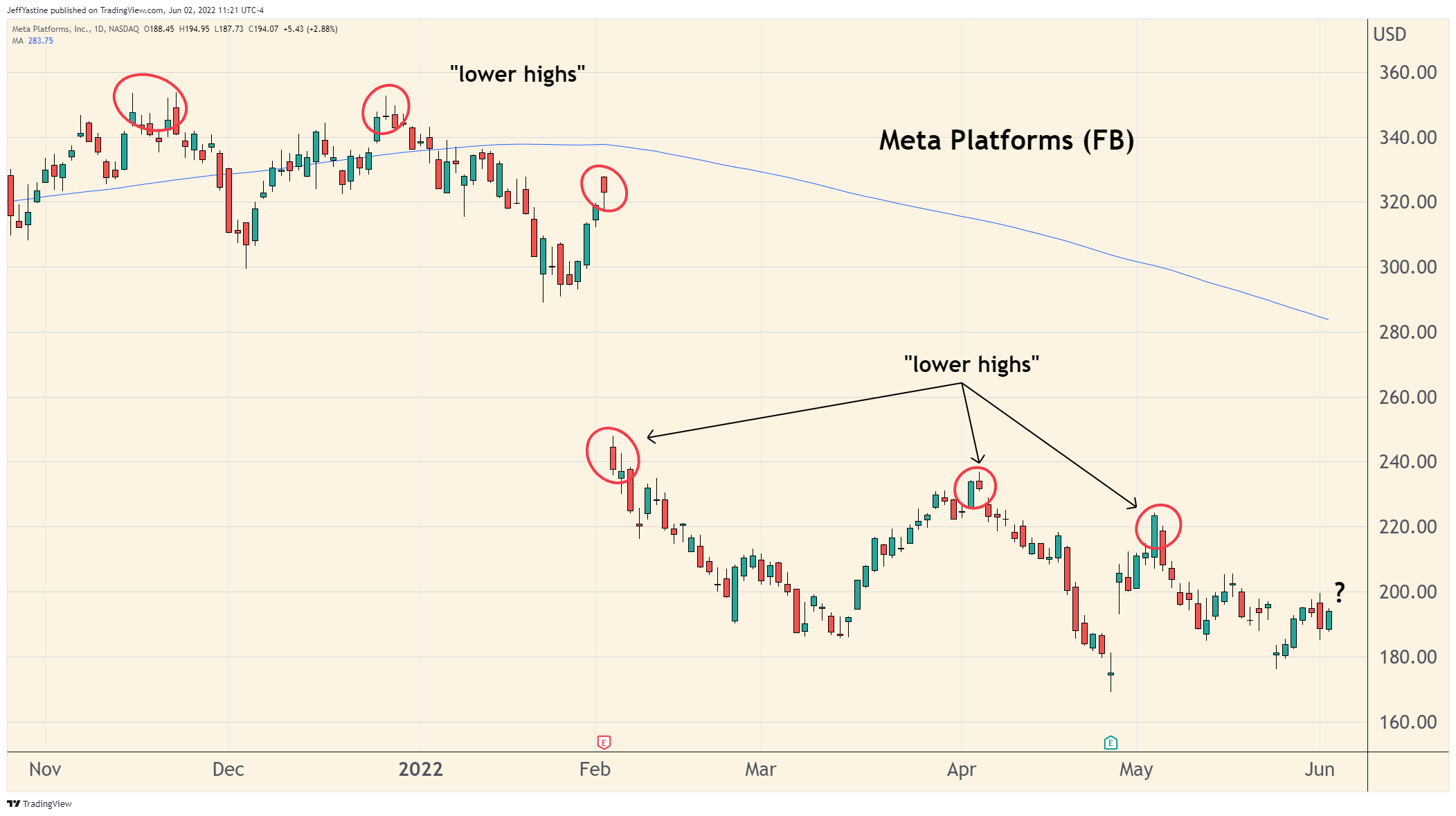

So I'm looking at whether the popular, biggest tech stocks - like Microsoft (MSFT), Nvidia (NVDA), Google (GOOG), Netflix (NFLX) and others - can finally break the bear-market cycle of posting "lower highs" on their charts sometime soon.

Otherwise, we may be in for more drifting and disappointment.

As a megacap tech stock, Meta is a good example to keep an eye on. I like the company. I traded it personally over the past week or so for a small gain. But even with last week's big market rally, the reaction in Meta's stock is...meh.

I mean, with the surge of buying we saw last week, Meta's stock couldn't even make a new 2 week high, much less for the prior month. So I'd love to have my doubts proven wrong by seeing the stock surge up to $220 to $230 in coming days.

Otherwise the bearish pattern of "lower highs" may continue to prevail. And given FB's megacap status, could portend another month of drifting lower for the markets.

I'd also keep my eye on banking stocks. Any sustainable "market bottom" rally is going to be led by strength in financial companies.

So I want to see a stock like Citigroup (C) (or really any large bank, for that matter) reverse course and at least poke its head up above last week's "market surge" high around $54, and above that, $58:

A pattern of "lower highs" is an easy thing to miss - like not seeing the forest because of all the trees.

But if you're hunting for a bottom in a favorite stock or index - a rally like we saw last week could be a great opportunity, if many key stocks can finally break their "lower highs" habit in coming days.

Jeff

Member discussion