Market Update

If you want to know my biggest worry - the setup for yet another set of market lows - just skip to the last chart at the bottom of this post.

With all that in mind, the most interesting things, good and bad, about last week were...

#1: Small cap stocks outperformed.

The best example was seen in Friday's selloff.

After a strong liftoff for 3 sessions following the Memorial Day holiday, the Nasdaq 100 (the QQQ ETF) index lost 2.7%. Basically, it (and the other major indexes like the S&P 500 and DJIA) finished at the lows of the week.

Yet the Russell 2000 (the IWM ETF) only fell 0.7% for the session.

Why would small-caps (and also microcap stocks) start to perform better when the biggest tech stocks experience more bouts of selling?

As a trading friend noted, small-caps (and especially many biotech names) led the way lower for more than a year now. On the other hand, the major blue chip indexes only began to weaken 5 months ago.

So perhaps small company stocks are also the first to start bottoming?

Perhaps another reason for the strength is a headline like this one, published Thursday in Marketwatch:

The hard part, when reading a headline like the one above, is summoning the courage to actually start buying promising smallcap stocks.

We have to will ourselves to do it - always with an eye for a "bail out" price to keep our losses small - since stocks aren't popular to own right now.

Nor do we know if "the bottom" is in on the stock market, or whether our stocks - like those in the goodBUYs portfolio - might still sink lower or move sideways at current prices before they finally begin to rise again.

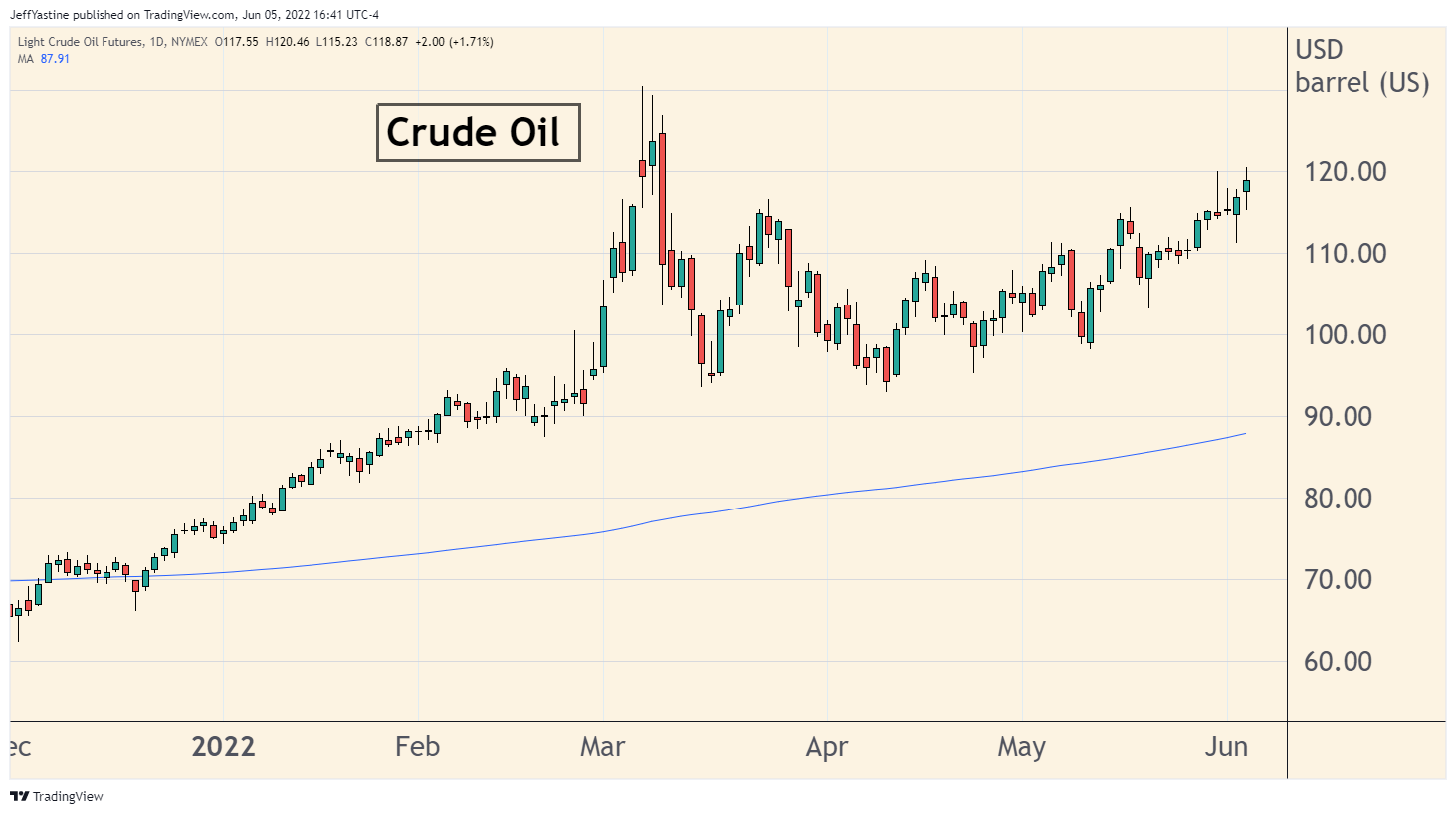

#2: But oil prices still show no sign of reversing lower (yet).

As I've noted before, until oil prices start to break lower - it's hard for the Federal Reserve to make a case for wrapping up its "higher interest rates" objective, and therefore the potential for stocks having truly bottomed:

With the chart above, 2 things could happen:

1) Crude prices accelerate above the March highs around $122 a barrel on their way to $150 or $200. That doesn't sound particularly good for the stock market in the short- or long-term.

2) We could see oil prices push slightly above the old March highs - and then reverse lower. Keep in mind that important "double tops" have a way of happening at a moment when people least expect.

A reversal, if and when it comes, would be a bullish signal for stocks to move higher.

#3: After Friday's selloff, many large stocks are in danger of posting "lower highs" (yet again).

If the selling continues in the coming week, it could set up yet another push lower for the major indexes - which might be the last scare that the market needs to put in a true, sustainable bottom.

I noted this possibility in a post sent out to everyone on Thursday (see "Head Fakes & Breaking the 'Lower Highs' Habit").

In fact, 2 quality big-cap stocks that I said I'd love to see surge higher - Meta Platforms (FB) and Citigroup (C) - instead faded lower through week's end:

Is the Market Signaling "Still Lower"?

The longer we go without a nice, strong reversal back up to the prior weekly highs (circled in red in the chart below) - the more the market could be telling us that there may still be some serious weakness ahead, along the lines of this potentially:

Maybe just maybe we're looking at one more set of lows before there's enough outright fear from investors, and enough of the Fed's rate hikes "priced in," before we see a sustainable rally.

Something to think about as we watch the coming week for clues.

Jeff

Member discussion