Buy Alert: Revisiting this "Green Revolution" Stock

A little over a year ago, I first recommended this stock - Bioceres Crop Solutions (BIOX) at $12 and within a handful of weeks, sold it at $15 for a modest 20% gain (click here for the original recommendation).

At the time, I was concerned about the bubble-like stock valuations of many smallcap stocks and figured I should take profits before it gets dragged lower in price.

But Bioceres' stock has survived the small-cap bear market in very good shape, moving sideways over the past year.

And the story behind this Argentina-based company has only gotten better since then. We can still buy the shares for a little less than last year's sale price.

I take all that as a good sign of strength.

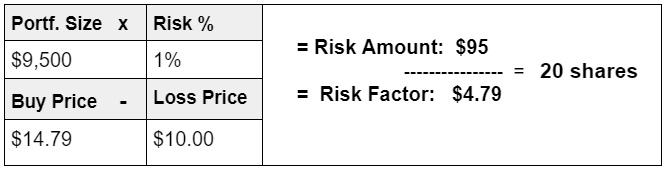

So here's how the new stock will look in the goodBUYs portfolio, always keeping in mind risk of loss in this thinly-traded, micro-cap stock:

For newer subscribers, what's the big deal behind BIOX?

It owns a patented, drought-resistant, genetically-modified wheat and soybean variety known as "HB4" that's beginning to come on the ag market in commercial quantities.

Genetically modified food staples have been a tough sell, controversial and banned from use in farmers' fields in most countries.

But drought in many ag-production areas of the world - and the ongoing war in Ukraine, a major wheat producer - is changing government policies banning "GM" seeds.

As Bloomberg noted a few weeks ago, Australia became one of 2 countries (Argentina, where BIOX is headquartered, is the other) to approve commercial production of HB4 wheat by its farmers:

According to testing data, HB4 wheat gives a farmer an increase in crop yields of more than 13% across all environments (lots of water, little water) and growing areas.

But in traditionally “low yielding” areas where drought and other conditions are present much of the time, the same seeds can increase wheat harvests by 42%.

HB4 is also finding friendlier policy changes among major importers of wheat.

- A month ago, China approved the use of HB4 wheat.

- Brazil approved HB4 wheat consumption late last year.

- Canada approved HB4 soybeans a year ago.

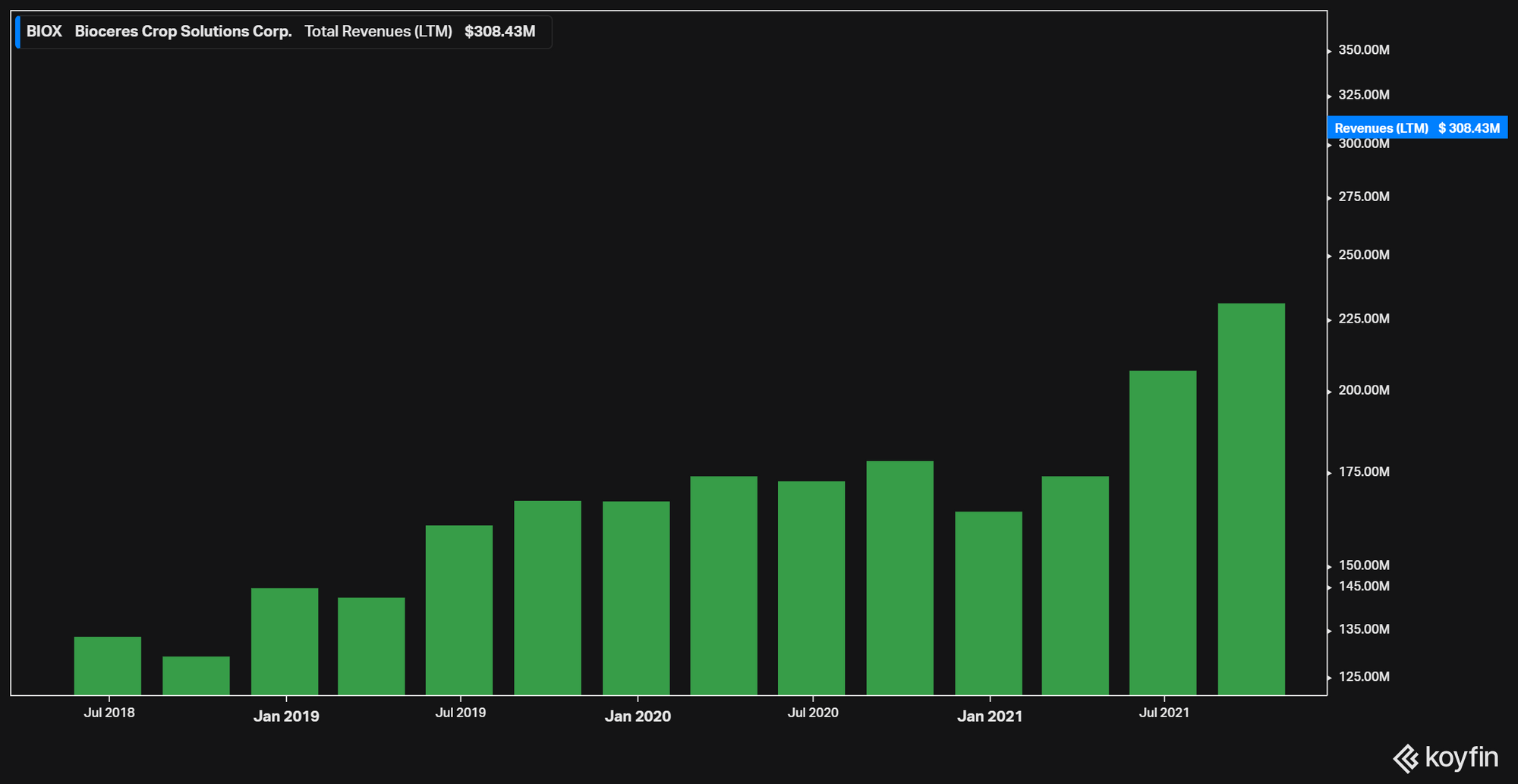

Nor is BIOX a revenue-less, profit-less microcap company. With 200 other patents under its control, and brand name products like RizoSpray and Microstar PZ under its control, the company is already seeing a steady rise in revenue, as well as posting some quarterly profits, over the past few years:

To sum things up, BIOX has plenty of reward and risk.

It's a microcap stock ($600 million market cap) that's thinly traded, with all the risk that implies. It's also one of those stocks that could just "lay there" for months at a clip, and then shoot up by a large percentage in a day or two based on approvals for HB4.

But with developments around the world, and the constant need to keep up production of major staples like soybean and wheat in the face of shifting climate conditions, Bioceres Crop Solutions could be a major beneficiary of ongoing trends.

Jeff

Member discussion