The Case for Shorting Tech Stocks

There's an old saying in the markets.

Stocks take the escalator up, but they take the elevator down.

Translation: when stocks fall, then tend to fall really fast.

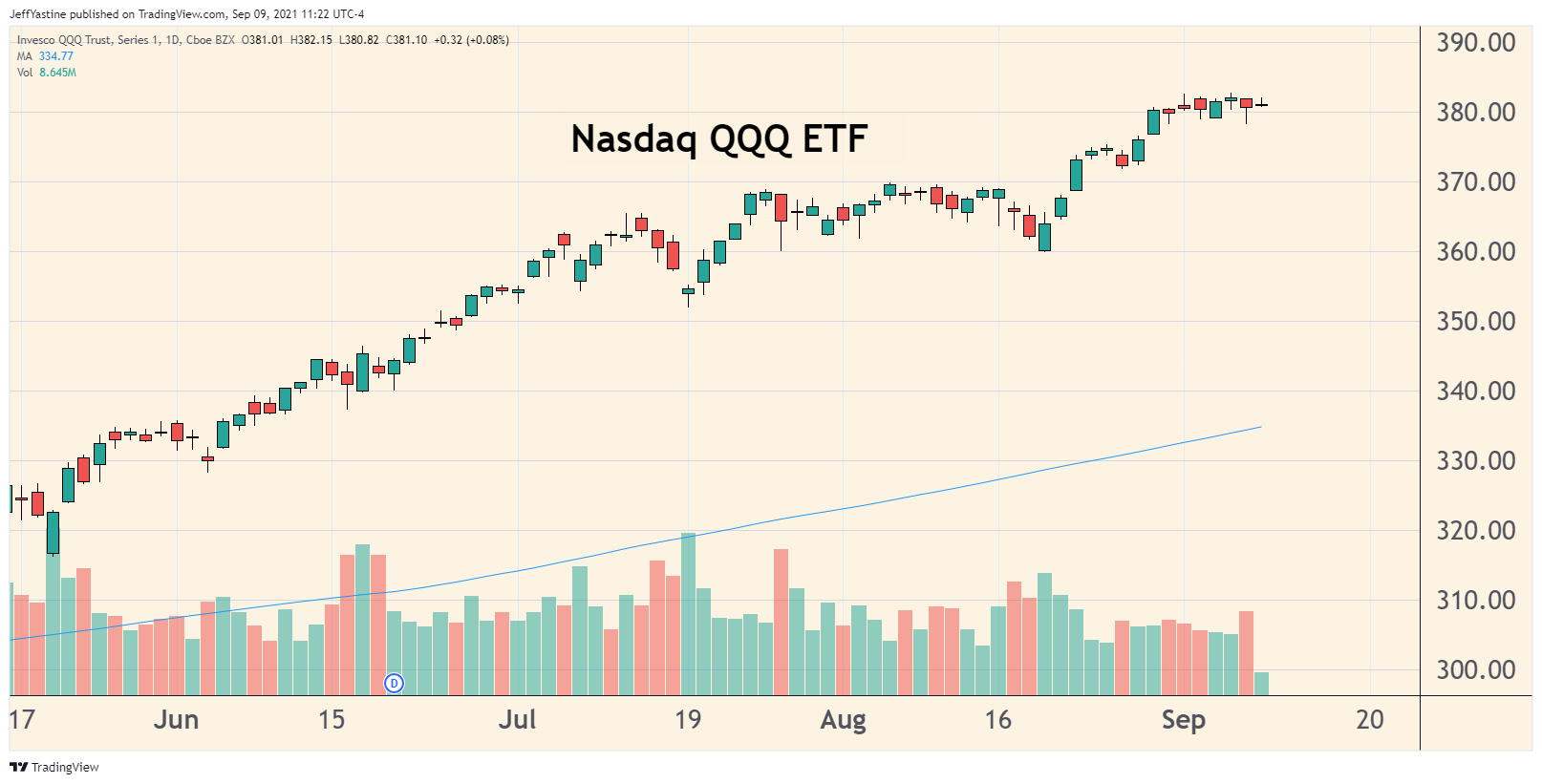

With that in mind, the market action of recent days is interesting - and for me, a potential profit opportunity - by shorting key tech stocks.

Watch the video or read more details below!

No I don't have a death wish. Certainly, the big tech companies - Apple, Amazon, Google, Facebook...you know the ones I'm talking about - have been on a huge tear for months now.

Past plunges in these stocks have typically lasted for a day or two before buyers swarm in and push the stocks higher still.

But the trading action of the last few days - in my opinion - speaks of institutions, not retail traders, deciding to hit the "sell" button.

And, when the markets occasionally run to extremes, as this one potentially has - then trying to time a "top," even a temporary one, with some small, well-placed short sales - has the kind of tactical odds I like.

To put all this in context, my expectation is that the bull market will continue this year. But I think we need to see large cap tech stocks hand off market leadership to small cap stocks and other inflation-friendly sectors as we head into the fall and 2022.

If I'm right, the transition might be bumpy. Institutions can't move lots of money out of a small group of very big stocks with trillion dollar market values - without causing some ripples in the market's pond.

So how can I benefit from that?

I can selectively short key tech stocks.

If I'm wrong, I'll be happily so. I have plenty of long positions that will do well if the bull market just keeps plowing ever higher. I can cover my shorts for small losses.

On the other, if I'm right and the big tech stocks start to weaken here, they're all going to go down at least to some degree. There's always the chance, however remote, that the selling could 'overshoot' and move lower than we might expect today.

I'm not exactly hedging my portfolio doing this. But I'm doing what I always try to do...position myself for the chance at profiting from a market trend.

Using Apple as an example, I think I've done at least 2 videos in the last 6 months noting what I would consider its vulnerabilities as a stock. It's overvalued (relative to the profits it earns) and everyone sort of takes it for granted that the stock will always head sideways or higher.

I've been wrong about Apple. I've tried shorting it a couple of times, but covered the short very quickly for small losses, staying out of its way as the stock climbed higher and higher. I'm OK with that.

But the situation for big tech stocks hasn't changed. They have been moving higher without a break since March. As big as their profits might be for the past quarter, we as investors have even larger expectations that they'll carry the market higher still on the back of even bigger profits to come.

High expectations and high prices aren't a good mix. Usually at the times we least expect, it becomes a good excuse for investors to sell - a little at first, and potentially a lot later.

Most folks don't like to short stocks - and for good reason, since to persist in doing so for many weeks, months or quarters, in the face of ever-rising earnings - means losing lots and lots of money.

But I don't mind taking small short-term tactical risks if I think the odds are worth it.

Another reason I will occasionally look at shorting stocks?

I have other positions, like Moderna (MRNA) in my portfolio that I like to hold for long periods of time. I'm not interested in selling them. But if a trickle of selling today turns into something bigger in coming weeks - well, that stock and others are likely to be dragged down either a little or a lot.

By taking on a handful of tactical short positions, I've now positioned myself to make some money even as other parts of my portfolio are losing ground. I like that. It actually adds to my confidence to start buying stocks when the market is low, fear is high, and great growth stocks are much cheaper to buy.

Best of goodBUYs,

Jeff

Member discussion