Taking 50% Profits on this Chip Maker

Some of you have gently chided me after last week's sell alert on Moderna (MRNA).

We only took in a 10% gain - instead of a near-50% gain, had I put out the selling note just a handful of days earlier when the stock was at peak post-earnings momentum.

There's always a risk to that sort of thing, since you really need to hold stocks for bigger gains in order to pay for the inevitable small losses that one has in the normal course of trading and investing.

But then again,

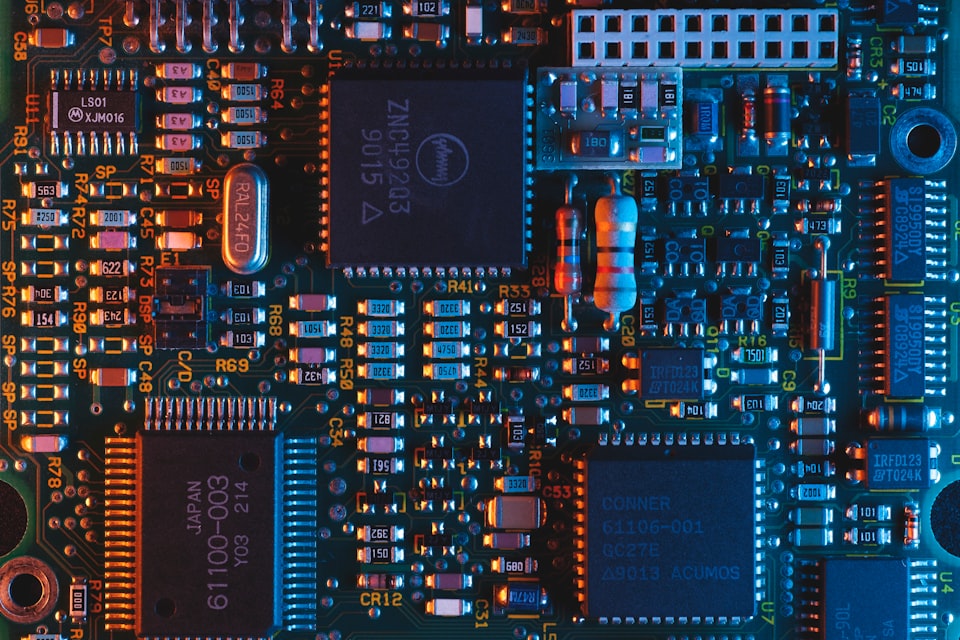

But this is one of those situations where the stock could move sideways for a while until the overall market situation and MRAM's rising profitability build to a level that can draw in buyers and break the stock above the long-term red downtrend line in the chart below:

If I owned the stock - and wasn't interested in taking the trade for a quick profit - I'd keep holding it. Sometime in coming quarters - or the next year or two, Everspin is going to break out, and in a big way.

It's really just a matter of whether the stock just muddles along at current levels (fighting the overall pull lower by a weak stock market), or succumbs temporarily to market selling pressure and gets drawn back towards its prior support levels on the chart in the $4 - $5 range.

Jeff

Member discussion