Market Update: The Game Just Got Tougher...

I have to admit I had some trepidation two weeks ago...

That's when I announced I was adding a short-sale of Apple (AAPL) to the goodBUYs portfolio, which is now up more than 6% for us.

I mean, I'm an optimist. Short-sellers see the world as half-empty. I see it as half-full of amazing potential. I love to see my stocks, your stocks or anyone's stocks - go up.

But there are also times when we have to be realists. We have to recognize those points (though few and far between) where the stock market could be putting our financial plans and dreams in great jeopardy.

And this is one of those points.

Friday's "Jay Powell at Jackson Hole"-inspired market selloff was a doozy, the end of a tough 2 weeks overall for the market:

On its own, Friday's selloff doesn't have to be a big deal. I mean, it seems every other week ends with a big market decline - followed by an equally large Monday rebound.

But one of the reasons I use a hybrid approach to the stock market - combining both fundamental analysis (sales, earnings, etc) and technical analysis (staring at charts) - is because it allows me to study the behaviors of past bull markets and bear markets.

Those behaviors don't repeat exactly, but they "rhyme" (so goes an old stock market saying). Recognizing when that might be happening gives us an advantage.

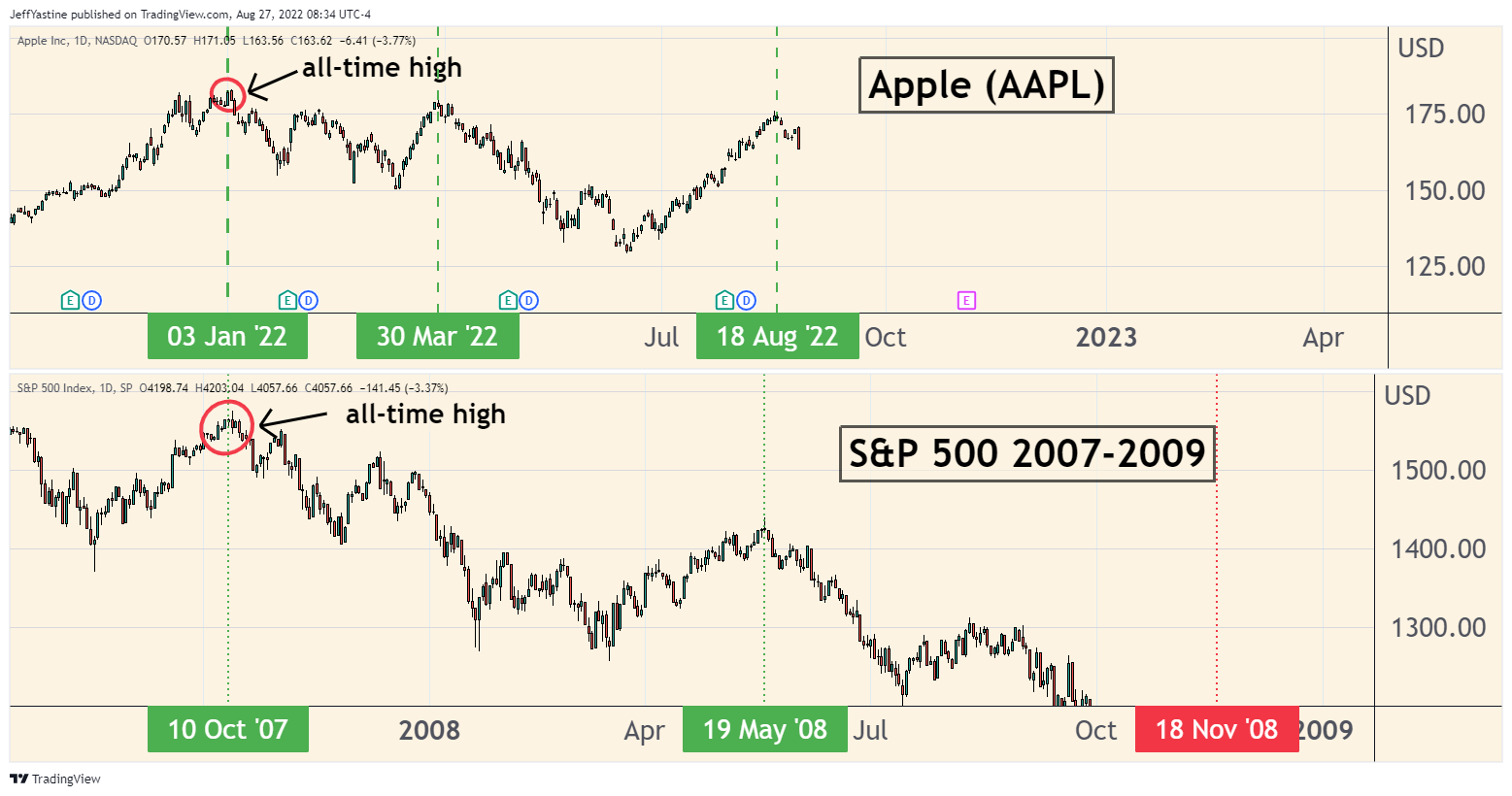

And the rhyming pattern for Apple - and by extension, the rest of the stock market - isn't looking good. Here's a comparison of Apple today vs. the S&P 500 in 2008:

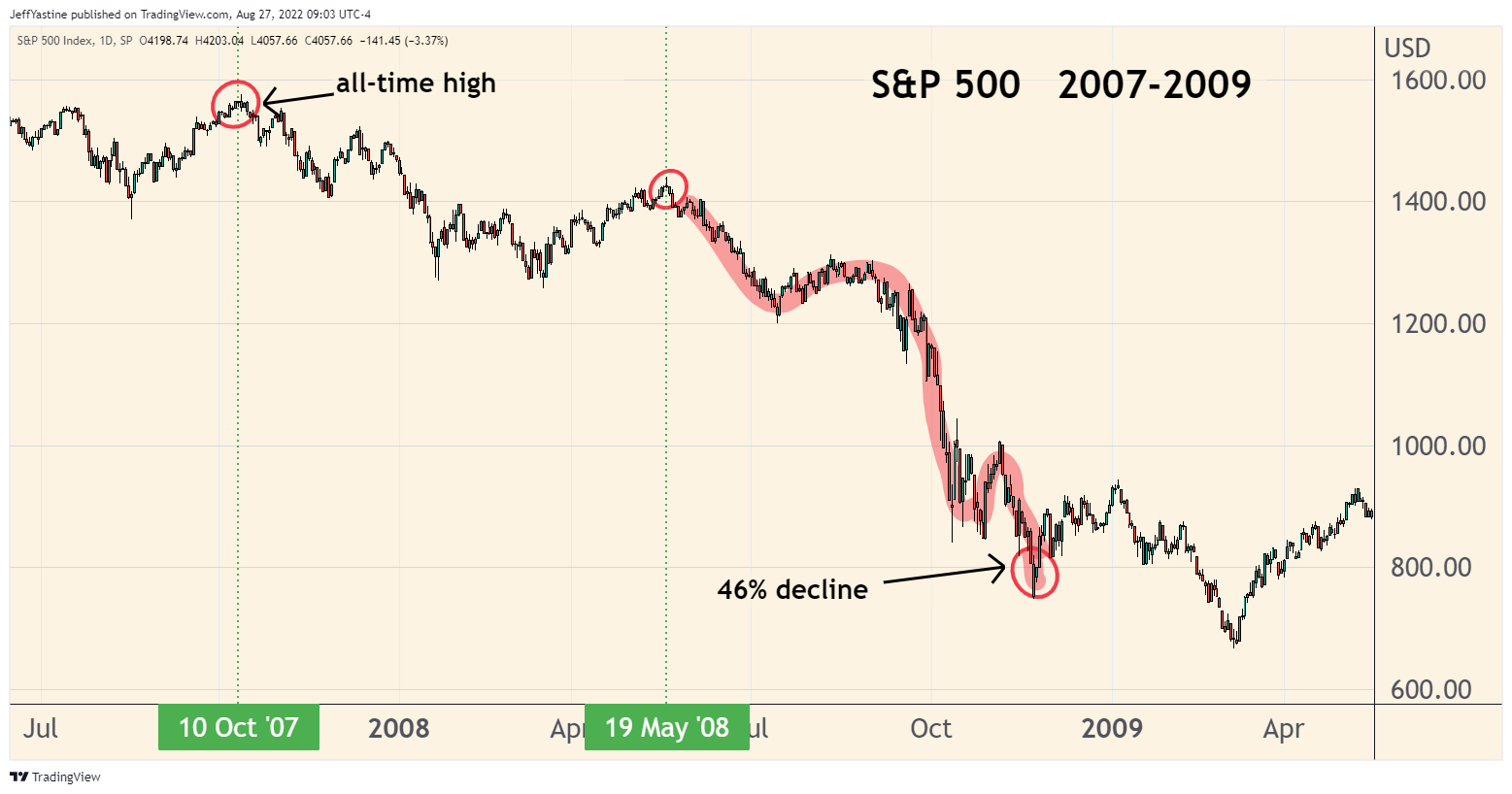

The decline in 2008 was so extreme that it messes up the proper scaling-comparisons in the chart above. So here's another look at the 2008 decline in full:

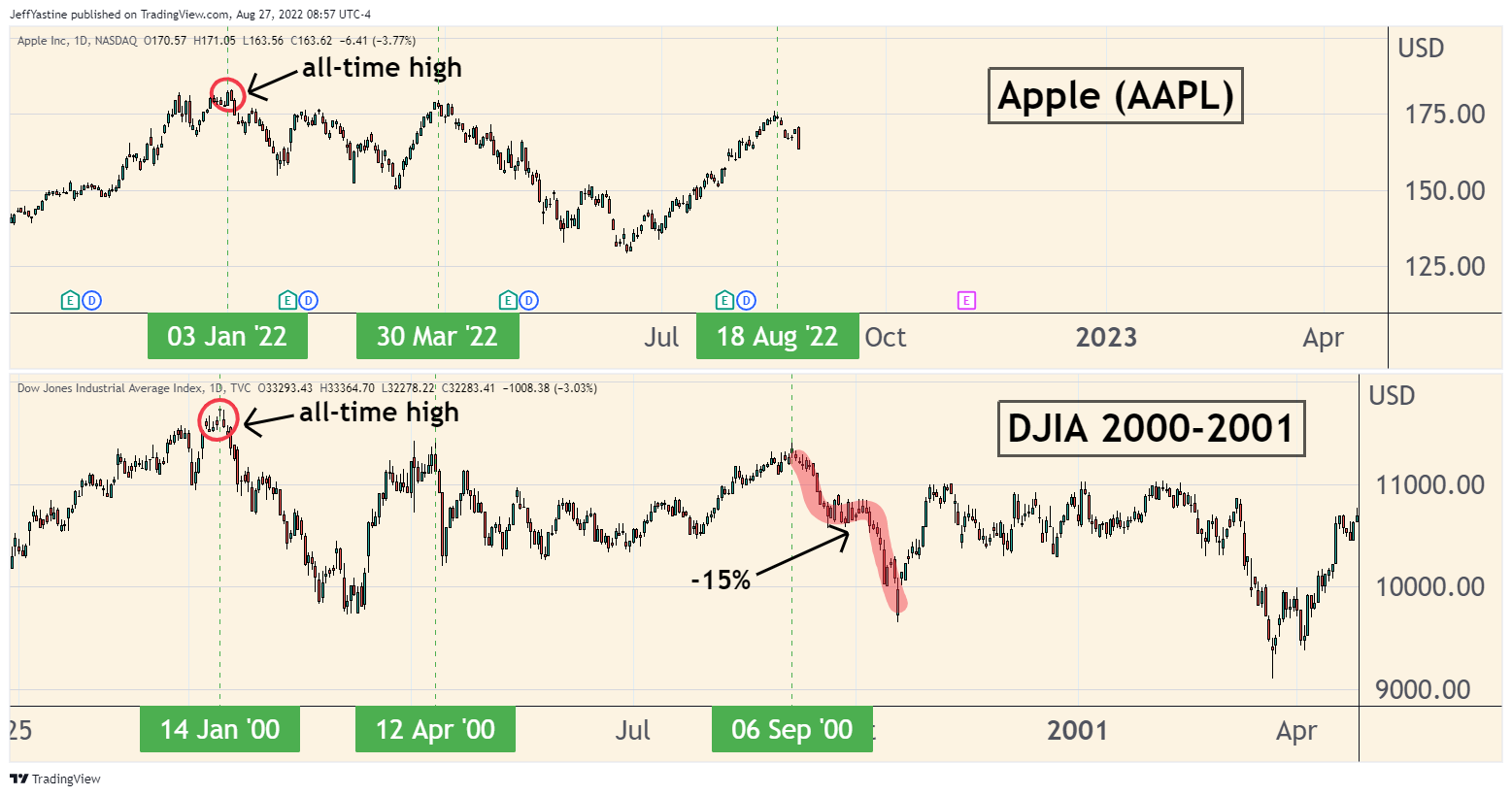

Apple's chart patterns also happen to closely match the 2000-2001 collapse of the dotcom bubble (chart below).

I'm not saying this is what's going to happen. But I'm saying we should be prepared, at least mentally. I'm trying to prepare the goodBUYs portfolio for that possibility as well.

That's why I decided to short Apple's stock.

By the way, late Friday, news reports indicated that the federal government could be preparing an antitrust case against the company as well - which can't help the stock either.

The instinct to short a stock doesn't come naturally to me. But if the chart comparisons above turn out to be only half-accurate, shorting may be one of the only ways to can make money in our portfolios over the next few months.

Taking Profits

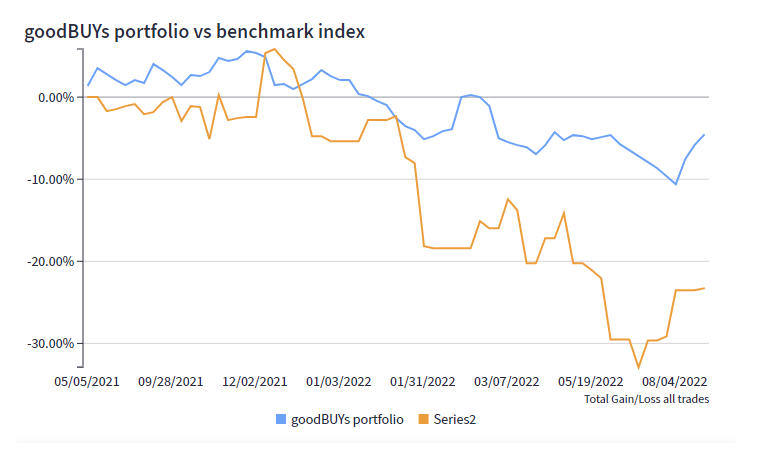

To that end, we've cashed out some profitable positions in the goodBUYs portfolio in the last few weeks. We're slightly negative for the year, but still well ahead of our benchmark (ISCG - Morningstore smallcap growth) by 18 percentage points, and outpacing the S&P 500 and Nasdaq indices as well:

Everspin Technologies (MRAM), our nextgen memory chip manufacturer, exited with a 40% gain on Friday.

The reason, quite simply, was to cash in profits before they begin to evaporate, presuming the stock market continues to head south in coming weeks:

I've had a few subscribers since ask me in emails whether it was a good idea to take profits this soon.

"If it's such a great stock," asked one, "why not hold it through whatever downturn is coming?"

It's a great question. So here's my response...

The worst sins an investor or trader can make are...

1- Letting a small loss turn into a big loss, due to not selling a declining stock.

2- Letting profits turn into losses, period.

I used to be a researcher, writer and advisor for several stock gurus who believed they were right, and if their stocks went down - well, the market just had to be wrong. That's fine up to a point.

But if you look at a guru's portfolio (mine or any other) and you see a series of sustained losses of 50%, 60%, 70%, 80%, or 90% in his/her "model portfolio"...I'll show you someone who's doing things very, very wrong.

He or she is committing the equivalent of "newsletter malpractice."

Getting back to MRAM, if the stock market were behaving better, or if the Federal Reserve were in the process of cutting rates instead of continuing to raise them - I'd lean towards continuing to hold the stock. My bet would be that MRAM's share price could work its way higher over time.

But in the absence of either scenario right now, I think it's better to take profits where you can, when you can, while you can.

Moderna (MRNA) exited with a modest 10% gain on August 17.

The start of Moderna's decline 2 weeks ago caught me by surprise.

I think the stock has a big future ahead of it. But with the federal government making a recent unexpected announcement that it will no longer pay for COVID vaccinations (deferring those duties to the for-profit private healthcare system), Moderna faces a tougher immediate future, especially while the stock market works its way lower.

The newest portfolio pick - added early last week - exploded higher just a few days later...

DistributionNOW (DNOW) - added August 23rd - broke out of a multi-year trading range - up nearly 11% in the goodBUYs portfolio.

DNOW is an oil-service stock. The company earns profits by operating a series of massive warehouses around the globe, from which it supplies the oil exploration, drilling and production industry with pumps, safety equipment, valves and every other kind of widget under the sun.

We'll need to be patient. In this kind of market environment, stocks rarely sail effortlessly higher the way they did during bull-market days. But I think DNOW can make its way to $15 in the next 6 to 9 months, and $20 in 12-18 months.

As for the rest of the portfolio, Kornit Digital (KRNT) and ReNew Energy (RNW) - both are fractionally higher in the portfolio. They were added in early August, but only with small amounts of committed capital, because I've been concerned that the market rally of recent weeks could be a "bear rally" in "bull's clothing."

If the market selloff continues, I will likely move those out of the portfolio as well.

Lastly, this all sounds rather negative. But keep up your spirits. If I'm right, we could see another once-in-a-decade opportunity in coming months, to buy stocks at great prices.

Until then, it makes sense to cut losses, conserve capital, and play "good defense."

Jeff

Member discussion