Taking Profits, Cutting Losses

I think it's pretty clear that, from a stock market perspective, we're back where we were for much of last year...

There's the "Magnificent 7" stocks. Investors are plowing money into these companies as the first, last, and best options for buying the growth of the technology sector.

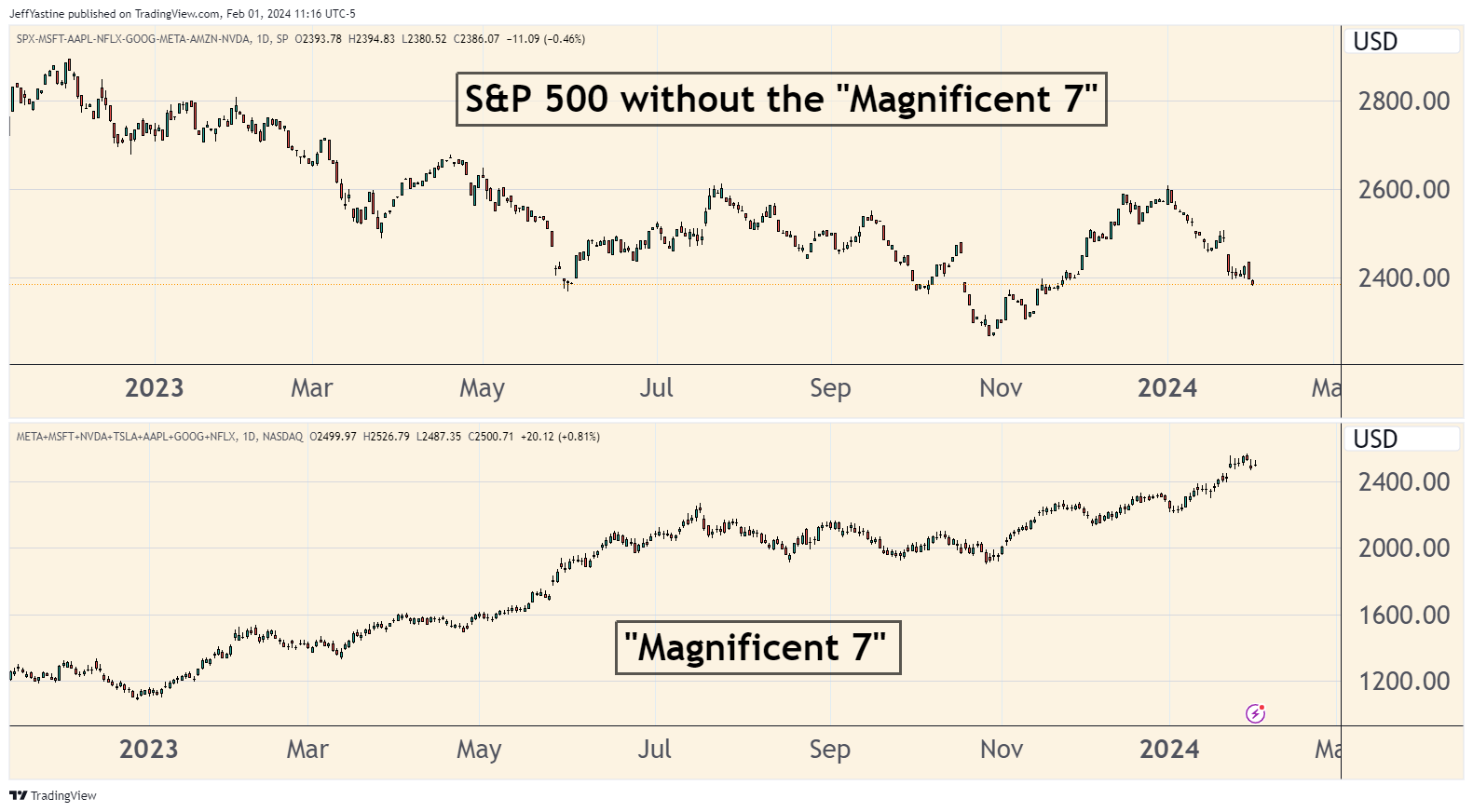

And then there's everything else. Here's an updated chart demonstrating the strong group against the other 493 stocks in the S&P 500 these days:

So we're at a point where a handful of tech stocks now make up 30% of the entire value of the S&P 500. That's where the gains come from when we see the headlines about the S&P 500 and Nasdaq indexes hitting new all-time highs.

Everything else is pretty much getting dragged upward by default, rather than through any particular investor enthusiasm for a non-Mag-7 stock.

I hate to say it, but there's no reason for anyone to even subscribe to a newsletter like mine at this point. What's the use in "stock picking" when the smart move for months is to just buy the Magnificent-7 stocks (which I'm sure many of you have rightly done), and then me just shutting up?

But it is what it is. I don't know when something like this resolves itself, but I've been through similar periods of frustration before.

The main thing is to keep one's composure, and avoid getting emotionally raked over the coals by taking large portfolio-killing losses.

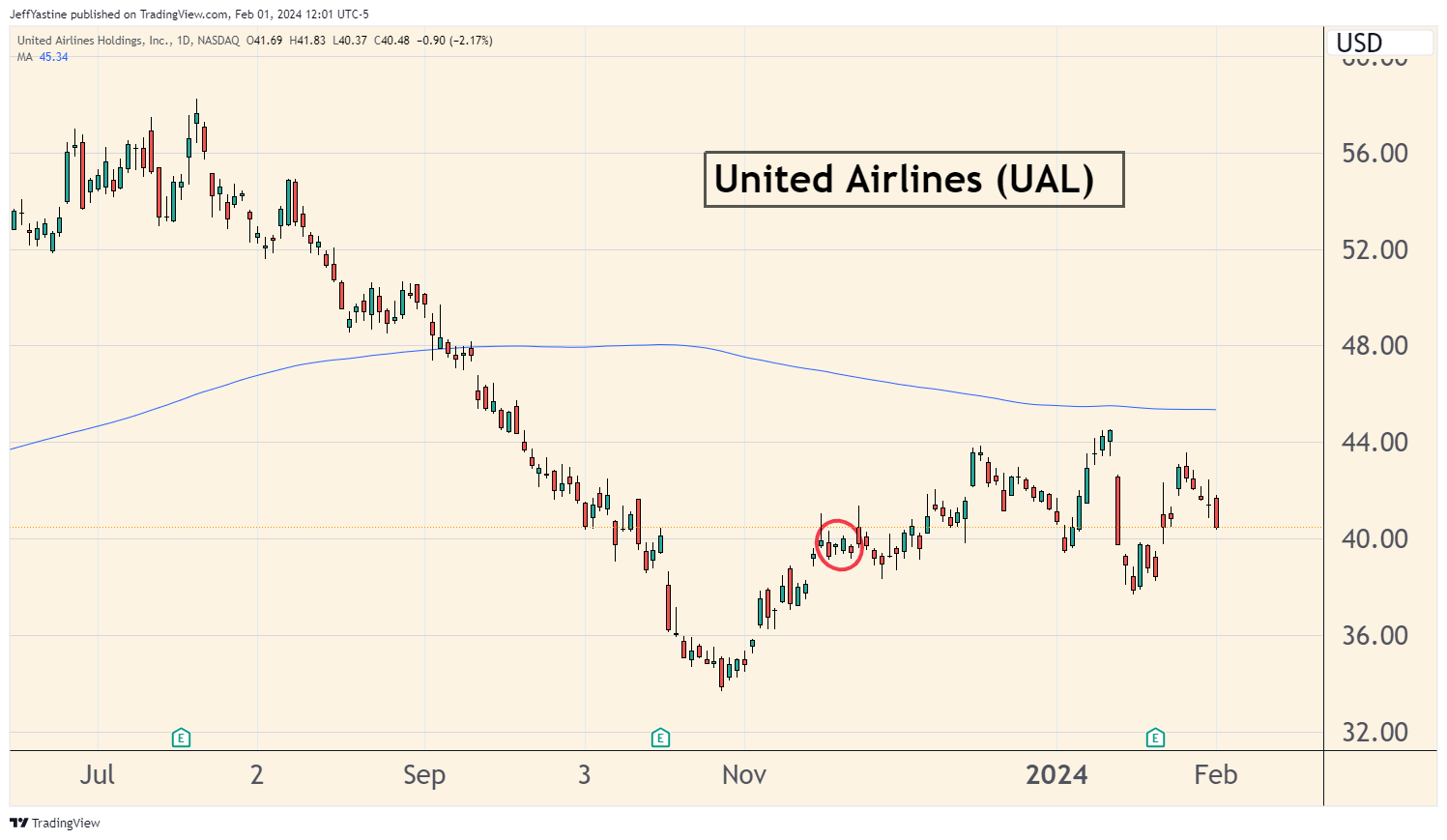

With that in mind, I'm making a handful of portfolio moves today. The first is removing United Airlines (UAL) for a modest gain of 2%:

I'm truly disappointed by the airline stocks' performance, and United in particular. Boeing's "door plug" issue hasn't helped. But in late January, United reported a $600 million profit for the final three months of 2023. Its adjusted earnings of $2 a share beat the $1.69 a share analysts were expecting, according to FactSet.

The airline said it saw durable demand for travel, with growing revenue both from premium offerings and for its basic economy seats that compete with offerings from budget carriers.

But that "good news" hasn't helped the stock - which may be an indication of investors' worries about bigger things like the economy. But that's just a guess.

Perhaps the problem is simply that as long as the "Mag-7" stocks dominate, they'll continue to soak up most investors' dollars.

I'm also removing Jumia Technologies (JMIA) for a 25% loss. When I made the recommendation back in December, I was playing a bet that Jumia and other promising international stocks like it would continue to rise.

Instead, I basically "bought the top." That's an occupational hazard in a market like this one where a group of stocks becomes highly active for a period of time, then grows cold as seasonal- or news-based reasons for temporary market rallies go cold.

It's no fun to take the loss. But it's far tougher to camp out in a losing stock and watch that loss grow even larger over time.

We have 2 valuable resources that we need to guard carefully...

One of course is our portfolio's value. But the other is our own self-confidence.

Both are resources with limited supply. Tricky markets like this one have a way of grinding both down to substantially smaller levels.

Jeff

Member discussion