New Stock Idea! Profit from the 2nd "Green Revolution"

Profit From the 2nd “Green Revolution”

With my vaccinations progressing, we decided it was time to venture out for a long-delayed winter vacation recently.

The snow-bound slopes of the Grand Tetons awaited, with Jackson Hole, Wyoming as our base of operations for a week’s worth of skiing, snowboarding and winter hiking.

Little did I know I’d stumble across a great stock idea for our Next Gen Profits newsletter!

One morning, after finishing my first ski run (I’m strictly a “green diamond” and bunny slope guy), I fell in with a guy roughly my age as we both waited for the lift to take us back up the slope.

Turns out he’s an Idaho wheat farmer getting a little winter R&R with his family too.

With my curiosity stoked, I put on my ex-reporter’s hat. We talked about the ag business. We talked about the amount of snow on the ground. I’d heard the region around the resort (Teton Village) gets as much as 40 or 50 feet of snow each year.

“That’s all great,” he said with a sigh. “But it’ll take a lot more snow — and better rainfall the rest of the year — to get us past this drought.”

Being an Easterner, I’d forgotten about the long-running lack of rainfall in much of the west over the past decade and more. But it was very much on this guy’s mind.

“But when HB4 gets approved,” he said, “it might help our situation.”

My ears perked up. HB4?

As my acquaintance informed me, HB4 is a next-gen, drought-resistant, genetically modified seed for wheat and soybeans that’s beginning to come on the ag market.

For farmers, it's potentially a very big deal.

With drought conditions, the problem is that standard varieties — when subjected to stress from lack of rainfall and irrigation — typically see sharp reductions in yields.

In other words, a grower might get 45 or 46 bushels from an acre of wheat (or even less) instead of 49 or 50 bushels when water is plentiful.

To give you an example, in the 2012/2013 growing season, a particularly harsh drought reduced global wheat yields by 6% — a decline of more than 40 million tons!

The solution to that problem is HB4 wheat (and soybean) seed, which can withstand lots of “water stress” and still produce a high-yielding crop.

According to testing data, HB4 wheat for instance gives a farmer an increase in crop yields of more than 13% across all environments (lots of water, little water) and growing areas.

But in traditionally “low yielding” areas where drought and other conditions are present much of the time, the same seeds can increase wheat harvests by 42%.

That’s a huge development.

Perhaps I’m overstating its significance, but it reminds me very much of when I was a child in the 1970s. The world was only a few decades into what scientists called the “Green Revolution” where yields for food crops began to inexorably rise, thanks to improved seeds, better fertilizers and other innovations.

So imagine, with this second revolution in farming, being able to grow more food in areas of the world typically not suitable for staple crops like wheat or soybean.s

Or if water conditions are optimal, a farmer could get even more productivity from the same amount of land.

That’s great news for farmers; it gives them new options on how to manage their fields.

It’s also good news for consumers, especially for people in other parts of the world where poor rainfall means most or all protein grains have to be imported, and the specter of “food scarcity” is a serious and growing problem.

When I got back to the resort, I started on my research.

Who develops these new HB4 wheat and soybean seeds?

The Little Seed Company You’ve Never Heard Of

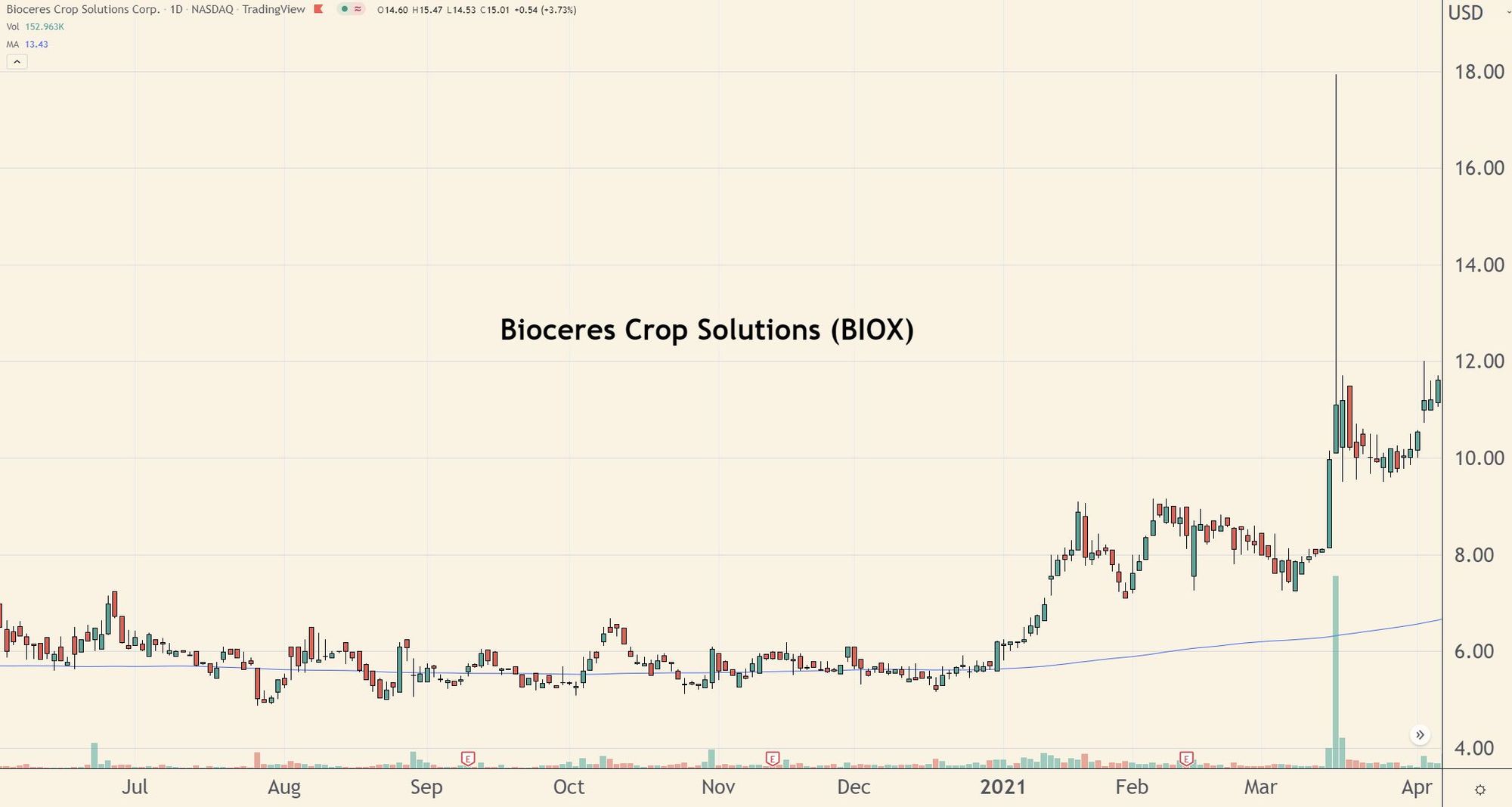

Turns out it’s a tiny company with an $11 stock called Bioceres Crop Solutions (NYSEAmerican: BIOX).

The company has been researching and testing its HB4 technology for the last 18 years, working for much of that time with a U.S.-based partner Arcadia Biosciences. As their work began to pay off and reach the commercialization stage, Bioceres acquired the full license rights to HB4 soybeans late last year from Arcadia, for $5 million in cash and $15 million in equity.

Given the sales potential for its seeds as projected by Wall Street analysts, I think the stock has a shot at perhaps tripling the next 18 months if everything goes right.

Now, before I get into more details I must tell you — this is a small firm with lots of risks.

Source: Tradingviews.com

Nor is it a U.S.-based company. Though it sells its products here and in 37 other countries, Bioceres’ headquarters is in Argentina (which, like the U.S., is a major exporter of wheat into the global market).

In its financial reports, the company also notes that it uses international accounting standards to compute its financial numbers, rather than the “GAAP” (generally accepted accounting principles) that are the common practice of US companies.

So yes, there are risks and I want to make those clear.

But Bioceres also owns more than 200 ag-related patents. It sells more than a dozen other innovative farming products, with names like RizoSpray, Rizoderma, Signum and Microstar, covering everything from pest control to biofertilizers and seed treatments.

Those products helped Bioceres generate more than $75 million in revenue in the last two quarters of 2020 alone, with no debt on its balance sheet.

But when it comes to genetically modified seeds of any kind, that’s always a controversial topic with some consumers and with regulators, especially in Europe and parts of Asia.

Though the U.S. Department of Agriculture has previously approved the genetic HB4 trait for human consumption in 2017, it’s still studying Bioceres’ HB4 wheat seed product. To date, only regulators in Argentina have said “yes.”

On the other hand, the company’s HB4 soybeans have already been approved by the USDA, as well as Argentina and the world’s largest exporter of soybeans, Brazil.

In fact, with those approvals in hand, Bioceres is readying the global commercial launch for HB4 soybean in the second quarter of 2022. In my opinion, that’s the key thing that will likely be driving the stock in coming quarters.

Growing Profits

Analysts are starting to see the opportunity at hand as well. An analyst at a Minneapolis-based firm, Lake Street Research, recently called the company “the most overlooked, misunderstood stock in the small cap Ag universe” with “compelling organic growth” in large part because of its forthcoming rollout of HB4 soybeans.

I agree (while recognizing this is a tiny company with lots of risk).

For one, the company is already starting to show some ability to generate profits. Its seasonally strongest periods are the first three quarters of the calendar year. In those quarters for its fiscal 2020 reporting year, Bioceres showed modest net income instead of losses, allowing the company to post an $0.08/share annual profit for the first time.

While the cost of commercialization and production will likely mean a loss of $0.03 for 2021 (the company is already halfway through its fiscal year), analysts believe Bioceres could earn as much as $1 a share in profits for 2022 as the HB4 soybean rollout begins in earnest.

Needless to say, if the company can earn anywhere close to that amount, Bioceres’ stock could be a huge winner over the next 18 months or so.

For a ‘back of the envelope’ estimate, all we have to do is take that projected $1/share in earnings and multiply by its earnings multiple (otherwise known as its price/earnings ratio). For instance, institutional investors typically assign a p/e ratio of 30, 40 or higher to a company with rapid profit growth.

With that in mind, if we take Bioceres’ $1/share in forecast profits, and multiply by a p/e of 30, we get a stock price of $30.

But there’s an additional “kicker” I want you to keep in mind: China.

With its 1.4 billion people, the country has become the largest consumer of wheat and soybeans in the world.

Last year, China imported more than 8 million metric tons of wheat, while its farms produced an additional 134 million tons. With soybeans, it only grew around 18 million tons, while importing roughly 90 million tons.

Growing much of either crop is a challenge in China. Given its typically “semi-arid” climate, which means there isn’t plentiful water from rainfall, rivers or underground aquifers for large-scale agriculture.

So you can imagine how attractive HB4 soybeans and wheat might be to meeting China’s long-term food production goals.

According to published reports, Chinese ag regulators have been reviewing plans to import and plant HB4 seeds since at least the middle of last year.

While it’s impossible to know what their final decision will be or when it might be announced, an approval would almost instantly create a huge new market for Bioceres’ revolutionary products.

So another part of my bet is that such a decision would also get this small agtech seed company a lot more attention from investors and Wall Street institutions, and possibly bid the stock yet higher.

Like I said, there are a lot of moving parts. There’s lots that could go wrong. But that’s the way it is when it comes to next-generation innovations. So while there are risks, I think the size of the potential rewards make this one stock that will likely be getting a much closer look from investors in coming quarters.

Best of Good Buys,

Jeff

Member discussion