Stock Analysis: When Times Get Tough, Cash is King

Today's post was the result of a premium subscriber asking my opinion about a stock that was being talked about a few days ago...a "cloud services" company called Fastly (FSLY).

One of the more valuable aspects of having a premium membership is having access to my "second opinion" service.

I can't advise anyone individually on whether to buy or sell a stock - I'm not a broker or advisor. But I think it's always good to get a second opinion on someone else's hot stock idea.

So my friend Rachel emailed me and asked what I thought of Fastly, which was being touted a few days ago by analysts at Bank of America as a stock rebound play:

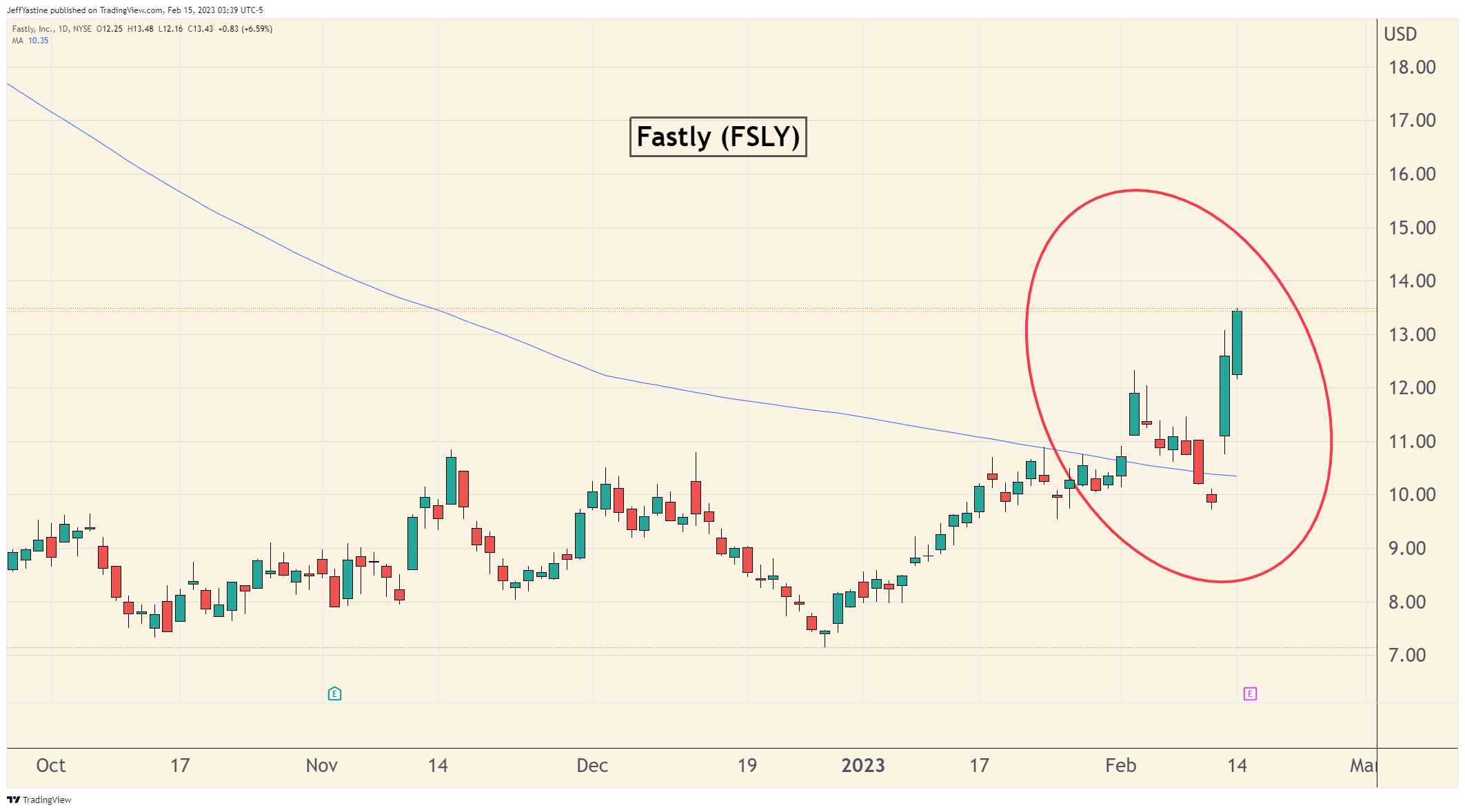

And if you had a crystal ball and an itchy trigger finger - and bought the stock before the analysts' "double upgrade" headline...you would have done pretty well:

And perhaps the stock will continue to climb in coming days, just on pure momentum. But in reality, it's no higher now than it was a year ago, and down nearly 90% from 2 years ago:

Still, it's tempting to think...maybe this company is going to be one of those that in 5 years will be 1,000% higher, and we'll all be kicking ourselves for not buying it.

So how do we judge the odds of a potentially successful turnaround?

Cash is King

A company with lots of cash on hand (or the ability to generate steady amounts of it from its existing operations) has a lot of turnaround potential. It can outlast a recession, out-compete its competitors, and come out as a thriving company in the end.

But Fastly has always been a deeply unprofitable company (and therefore without any ability to generate cash from its own operations) since it went public in 2019.

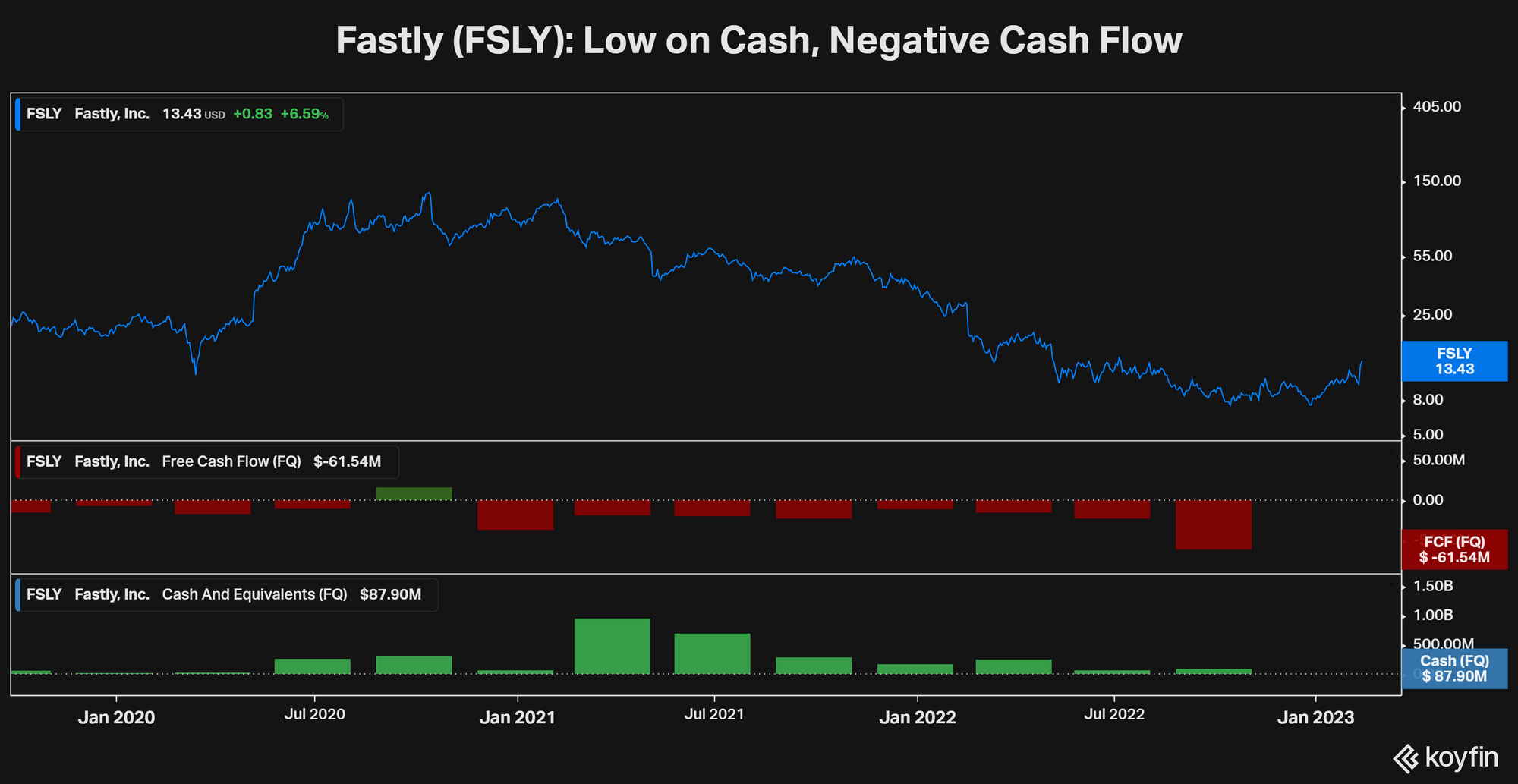

So Fastly's probabilities for a successful turnaround seem rather doubtful if you look at the chart below:

In Fastly's case, there is no cash flow (the red bars in the chart above). It's burning cash at a rising rate - most recently losing nearly $62 million in the most recent quarter.

Meanwhile, its stockpile of "cash and equivalents" (the green bars above) continues to dwindle lower and lower, most recently pegged at roughly $88 million.

And do you see the largest of the green bars on the chart, around the second quarter of 2021? That influx of cash was thanks to Fastly borrowing $900 million in the bond market.

There are some good "moving parts" to Fastly's story. It still has fast-rising sales. It also has a new CEO who came over from Cisco Systems (CSCO). And he's laid out a new business strategy to try and turn things around.

But the lack of cash is going to be a huge challenge and priority #1 for the new CEO.

I won't belabor the point. I'm as curious as anyone to see how Fastly does in coming quarters.

My main message is that you can sketch out the greatest turnaround plan ever - but without a steady, cheap supply of cash to fund operations, a company won't survive long enough to see those plans to success.

Jeff

Member discussion