Robinhood's New Strategy: Should You "Trade 24 Hours a Day"?

Back in my financial news reporting days, a broker told me an old Wall Street joke...

Question: "Do you know Wall Street's secret to having a $1 million stock trading account?"

Punchline: "Start with $2 million."

And that's kinda where I see Robinhood (HOOD)'s recent decision to encourage 24-hour trading in 43 of the most liquid, popular stocks and ETFs. We're talking stocks like Apple (AAPL), Tesla (TSLA), Meta (META), Microsoft (MSFT), the Nasdaq 100 (QQQ) ETF, and all the other usual suspects.

Robinhood is touting it as a revolutionary breakthrough in trading. It's not.

Most brokerages have offered after-hours and pre-session access to many stocks for the last 20 years (though liquidity and volume in most is seriously lacking).

And as far back as the early 2000s, the Chicago Mercantile Exchange (CME) has offered round-the-clock trading in S&P 500 and Nasdaq 100 futures contracts on its highly-popular (and very liquid) "e-mini" electronic platform.

So "24-hour stock market trading" is nothing new, despite Robinhood's claims.

Should You Do It?

My advice is to say "no."

I've done my share of 24-hour trading. In the early and mid-2000s, I used to trade the CME's stock index futures all the time, including late at night and mornings before the stock market opened for trading.

I will tell you from experience, there's no significant edge to be had in 24-hour stock trading, versus trading during the regular session of the stock market.

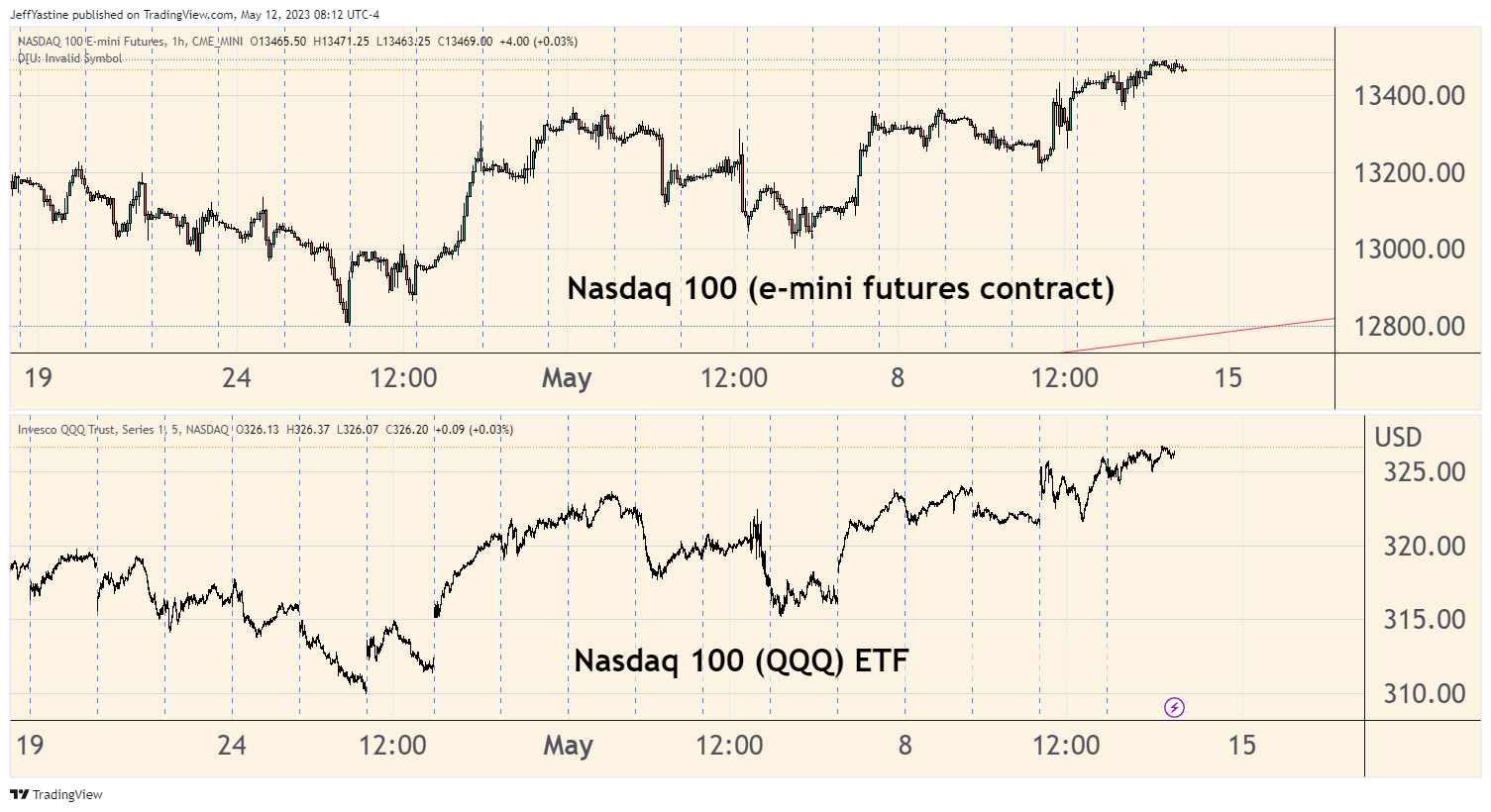

For example, the chart below features the 24-hour traded Nasdaq 100 e-mini futures contract versus the Nasdaq 100 (QQQ) ETF.

If you could zoom in on the e-mini part of the chart, you'd see a few more up-and-down squiggles in the overnight and early morning hours. The patterns are more jagged. But the major up-and-down trends are all mostly the same.

Yes, there are occasions when a major company announces important quarterly earnings that push the market higher or lower. The same can be said for important pre-session or post-session economic announcements.

But if you thought that you had an edge by buying or selling ahead of those news events on a 24-hour stock trading platform....well, no - it doesn't work like that.

The Truth about 24-Hour Trading

You'll find that you're getting the information at the same time (or even slower) than everyone else. By the time you hit the overnight-session "buy" button because Tesla just reported a big quarterly earnings number...a few million other traders with a lot more money got there many milliseconds ahead of you.

That's not to say one cannot make money trading during non-regular market periods.

If one is very disciplined, with a chart-based entry and exit system, and a keen eye to managing risk - it's possible to make money. I was able to do so myself trading the e-mini contracts back in the day.

(I used to trade watching the "5-minute candles" for the overnight S&P 500 futures contract. But I gave up my overnight trading habit after my son was born. There's nothing like diaper-changing, feedings, and other childcare duties to wreak havoc on the concentration ((and sleep)) needed for proper trading).

The factors listed above - discipline, a system of signals, and risk management - were my edge.

But just having 24-hour access to trading indexes and stocks via Robinhood (or any other trading platform)...is not an edge. It's just another chance to lose more money.

Let me put it this way - 24-hour trading is not a magic elixir, holy grail sort of thing. If one is unsuccessful trading during the regular daytime session of the stock market, the results in the overnight/24-hour session won't be better and could be a lot worse.

Best of goodBUYs,

Jeff Yastine

Member discussion