Remembering the Rules of the "Trader's Trader"

OK, so here's the part where Jeff (that's me!) cues up the nostalgia music, and talks about the "good old days."

Before ChatGPT & AI...

Before Netflix streaming & Amazon prime...

Before the internet itself.

In that respect, the good old days weren't that good.

I much prefer today to the past. But as a financial journalist - and wannabe trader - in that era, I remember how hard it was to find good information.

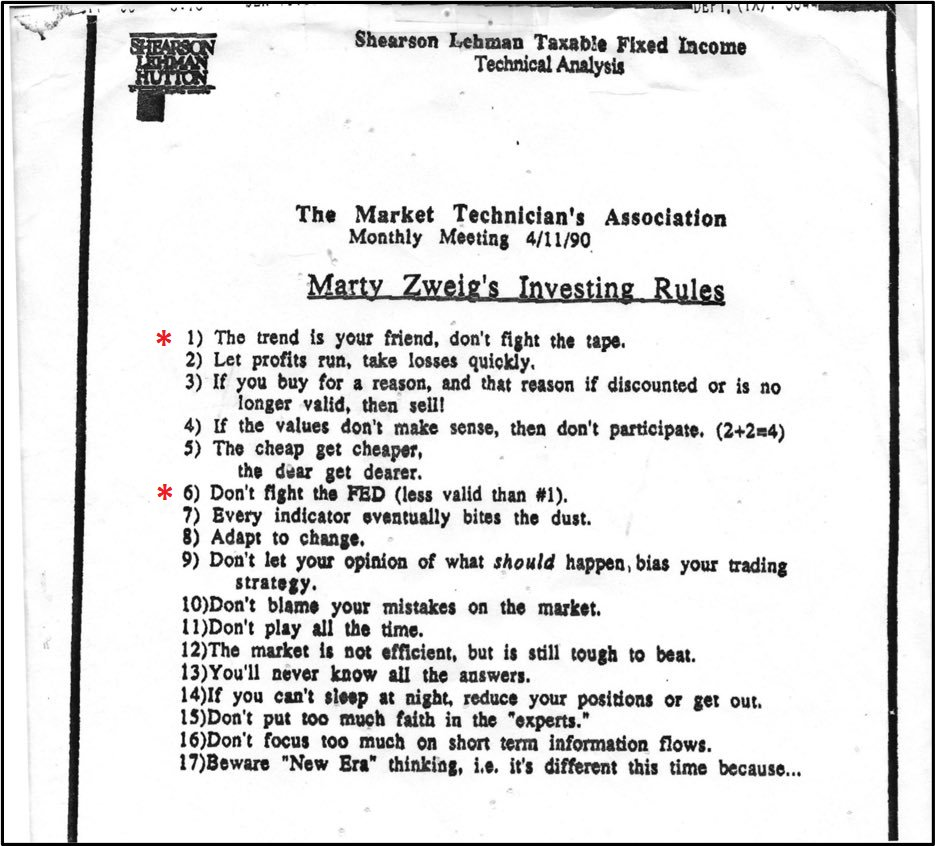

So I want to tell you about some of the best, most succinct info on trading I ever found...the rules of the "Trader's Trader" - Marty Zweig:

The note above is not my own, and has been passed around many corners of the internet already. But I have my own brief Marty Zweig story to tell...

As I struggled to learn the art of trading and investing, I was privileged in my early journalism days to work alongside a wonderful colleague named Paul Kangas, who happened to be my program's main news anchor (and the "Walter Cronkite of financial news" before CNBC came along).

So Paul - a skilled trader and investor himself - tells me about this rich, eccentric, and (to me) obscure Wall Street guy named Marty Zweig.

In reality, Zweig was hardly obscure. But when you struggle to learn any new skill - especially in those pre-internet days - you don't know what you don't know.

So I didn't know about Marty Zweig.

And I can't say I ever did get to meet him personally. But once I learned who he was, and learned about his trading rules - which I'd never read anywhere else before in those days - my trading & investing results slowly began to improve.

His rules are timeless - or perhaps especially timely - for any trader or investor, considering our slow-motion bear market of late.

I won't bore you by reviewing all 17, but here are my favorites:

Rule #1: The trend is your friend, don't fight the tape.

What is the general direction, where does the market appear to be heading these days?

We won't always be right on this one. The corollary to it is that "the trend is your friend...until it ends."

But if one gets in the habit of thinking about the trend - and asking "Am I swimming with the current or against the current?" so to speak - then trading and investing become vastly more rewarding.

Rule #2: Let profits run, take losses quickly.

I tell myself this rule all the time, even now.

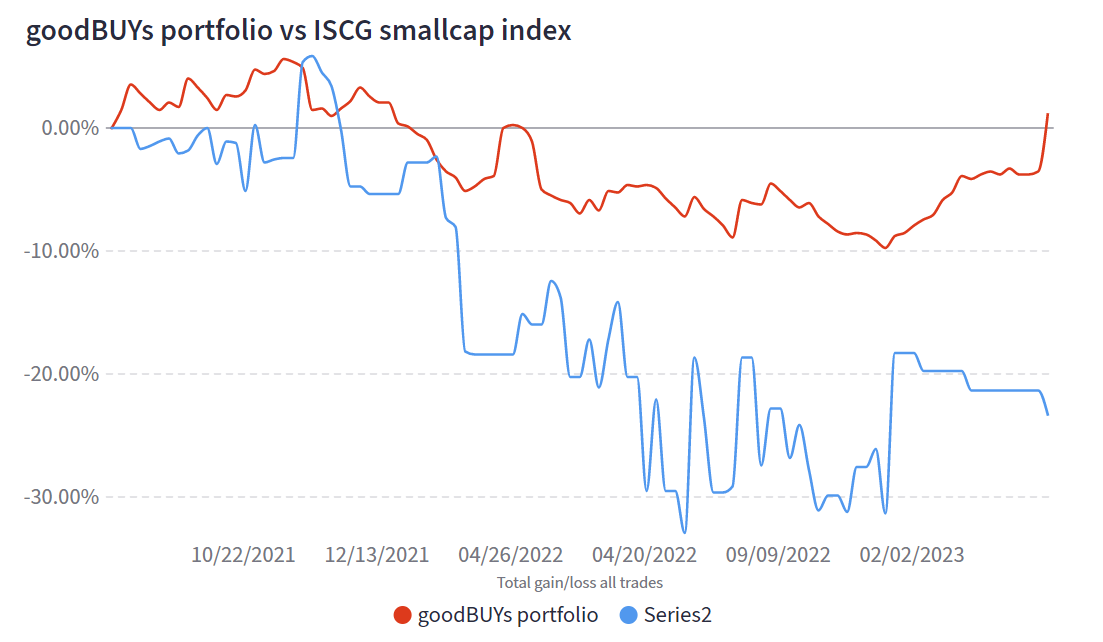

It's what has allowed us to get through the bear market without losing tons of money, even while the indexes continue to struggle at substantially negative double-digit percentage losses:

Rule #4: The cheap get cheaper, the dear get dearer

This one took a long time to bang into my brain...

The best stocks - the biggest growth companies of the future - always look expensive and appear to trade at high valuation ratios.

It's because smart investors and traders aren't thinking about what the stock looks like now. They are anticipating what the company will look like years into the future, when it finally "grows into" its overvalued stock rating.

Rule #7: Every indicator eventually bites the dust

This one also took a long time for me to learn. How much of my early trading life did I spend experimenting with various technical analysis indicators, trying to find one that worked all the time...trying to find the "holy grail" of indicators?

Eventually, you realize that all indicators generally work only half the time or less. And the more they're written about and used by Wall Street, the less likely they are to work on any kind of consistent basis.

Rule #7 is the reason why we can't ever forget Rule #2!

Rule #8: Adapt to change

One of the reasons why Warren Buffett is Warren Buffett...is because the guy actually responds and adapts to change very very well.

For instance, Buffett started out as a value investor in the 1950s and 1960s. But as Wall Street began using mainframe computers, Buffett's "edge" at finding highly undervalued, profitable value stocks eroded away. The computers leveled the playing field, so to speak.

So in the 1970s, Buffett modified his strategies and began buying stocks like Coca Cola (KO) that could grow consistently over long periods of time, even if he was overpaying (by traditional value stock measurements) to own the shares.

Then in 2013 or so, Buffett bought his first tech stock - Apple (AAPL) - even though he said for decades prior that he would not buy tech stocks. He thought technology evolved too quickly to give one company a long-term edge as an investment.

The point is...Buffett adapted to change. We can all do the same.

Rule #9: Don't let your opinion of what should happen, bias your trading strategy.

This was another one that I struggled with. Like everyone else, I have specific ideas in mind about the behavior of stocks and the markets.

Then they go and do the opposite of what I expect.

It's easy, in that situation, to mentally "dig in" and come up with all kinds of reasons why the market is wrong, or why investors - who are bidding up (or selling down) a particular stock - are wrong.

But that's why I try to always remember Zweig's Rule #9.

I can spend days, weeks, months and years trying to defend a position on the stock market. But it's an unproductive argument, ultimately.

Summed up, I always try to tell myself - do I want to prove I'm right (and someone else is wrong).. or do I want to make money?

Rule #13: You'll never know all the answers

Another retired veteran analyst & trader, Walter Deemer, has a big Twitter following. He recently posted a clever way to restate this rule.

"Ours is not to reason why. Ours is just to sell and buy."

It's true. Our brains are evolved in such a way that we want to mentally fill in the blanks on the big and small mysteries around us. That's what science and engineering are all about.

But investing and trading is more art than science. Still, we struggle to find answers to why a stock goes up a lot or down a lot, or why the indexes rise and fall as they do.

Often, the true reasons - if they're even known at all - aren't clear until weeks or months later.

Rule #14: If you can't sleep at night, reduce your positions or get out

This was another rule I always struggled with. If I had earlier losses, I wanted to trade aggressively (and buy a lot of shares) in hopes of making back my earlier losses quickly.

Then I'd lose again, and myself in an even deeper hole.

I learned to sleep at night by developing the "Hidden Formula" to answer the question at the heart of Rule #14, which is "When buying a stock for the first time, how many shares should I purchase?"

I always like to say that the Hidden Formula really is no secret - but it might as well be since so few people are aware of how important that one question - "How many shares should I buy? - is to our long-term success as investors and traders.

Rule #15: Don't put too much faith in the "experts."

Marty Zweig wrote this before the internet, before Bloomberg TV, and before Jim Cramer and CNBC.

But it's still amazing how much importance our brains attach to headlines as first one expert, then another says he or she is bearish, bullish, agnostic, or whatever.

The fact is, we're all going to be wrong. We think a stock goes up - and it goes down. We think the market will plunge - and it rallies.

It's gonna happen, OK?

The goal in Rule #15 should be that we all learn how to make sure our portfolios can survive mistakes of bad judgment and bad luck, and then be able to recover and eventually, thrive in spite of those setbacks.

That's the part they don't teach on CNBC.

Jeff Yastine

Member discussion