New Buy: The Next Big Thing in Semis?

First thing... let's talk about "TaaS" - which is NOT a stock symbol in this article, but a tech industry abbreviation for "technology-as-a-service."

To understand the proposition behind TaaS, let me pose a quick question: What if you were a manufacturer of high-tech industrial equipment?

Typically, you buy the chips you need off-the-shelf, and tell your engineers to figure out how to make those chips work best inside your product.

But in the last few years, there's an emerging alternative: "TaaS" - technology-as-a-service - with microchips and other digital components that are custom manufactured for your specific business needs.

It's sort of like having your own subscription-only technology "tailor."

Instead of buying "off the rack" from Intel, AMD and other chip companies, your technology is custom-fitted for your specific needs. And if you need a faster chip or with a different set of specs, six months, a year or 2 years later - the "tailor" will continue to make adjustments as specified by you and only you.

In a nutshell, that's the semiconductor business model being pioneered by a chip company called Skywater Technologies (SKYT), which I'm adding to the goodBUYs portfolio at current market prices.

SkyWater Technology operates as an entirely US-owned pure-play chip foundry. It already serves customers operating in the computation, aerospace and defense, automotive and transportation, bio-health, consumer, and industrial/internet of things industries.

The company was incorporated in 2017 and is headquartered in Bloomington, Minnesota. Skywater's foundry (or "fab" as some call it) is right down the street from Bloomington's famous Mall of America.

Skywater went public in late 2021. But as you can tell from the chart above, the shares fell hard over the past 2 years during the small-cap bear market.

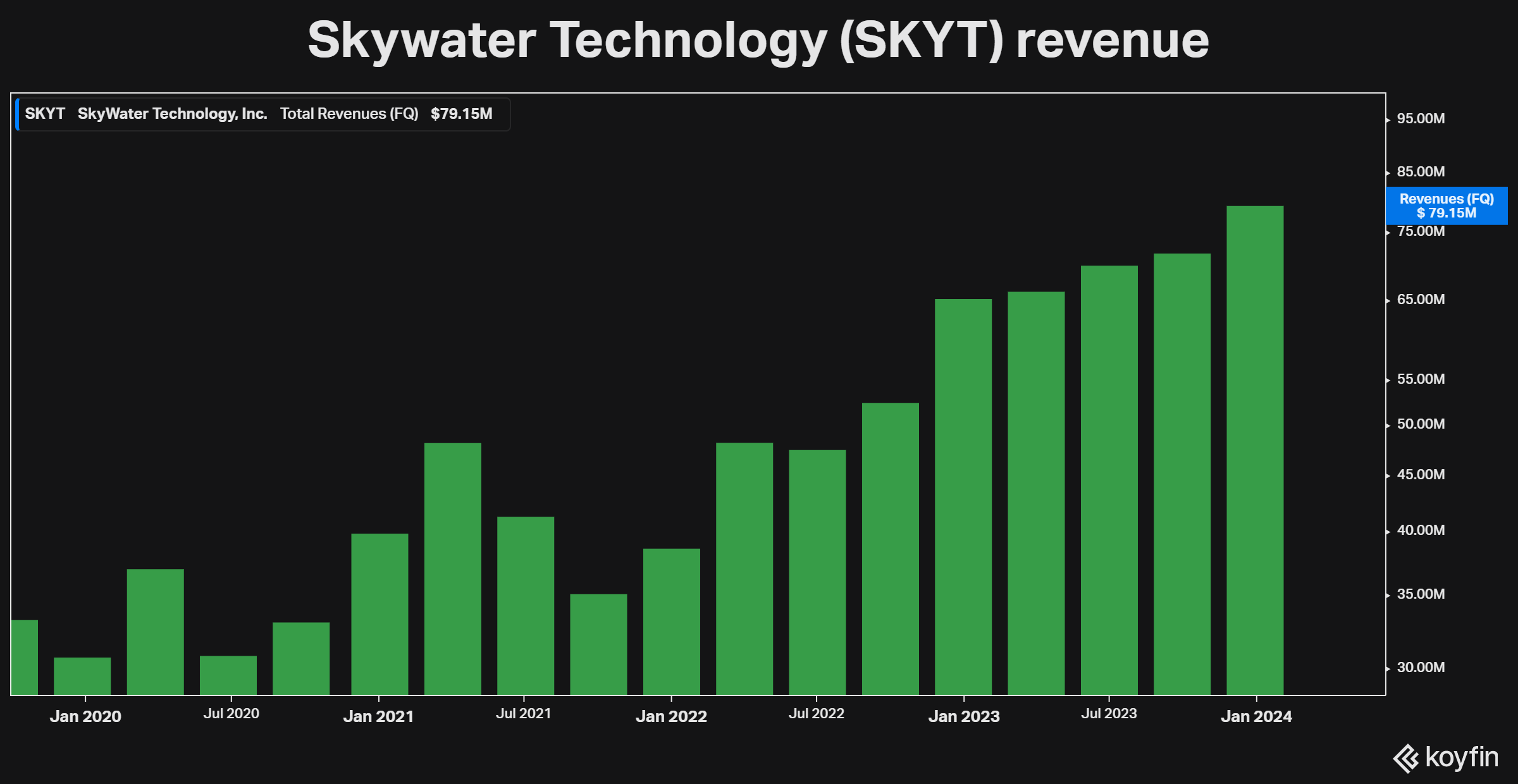

Yet look at the revenue growth of this company during the same period:

The reason I like Skywater at this juncture - even with the Nasdaq and S&P 500 at what might be dangerous, bubbly levels - is because analysts project 2024 will be the company's first-ever year with profitable earnings per share:

- 2024: $0.03 a share

- 2025: $0.42 a share

- 2026: $1.12 a share

A rise from $0.03 to $1.12 a share in 3 years would be phenomenal growth (while recognizing that "projections" may get re-adjusted lower depending on the economy and other conditions).

But considering the stock still trades at less than $12, I have to believe that the stock may only be starting to reflect the potential growth ahead.

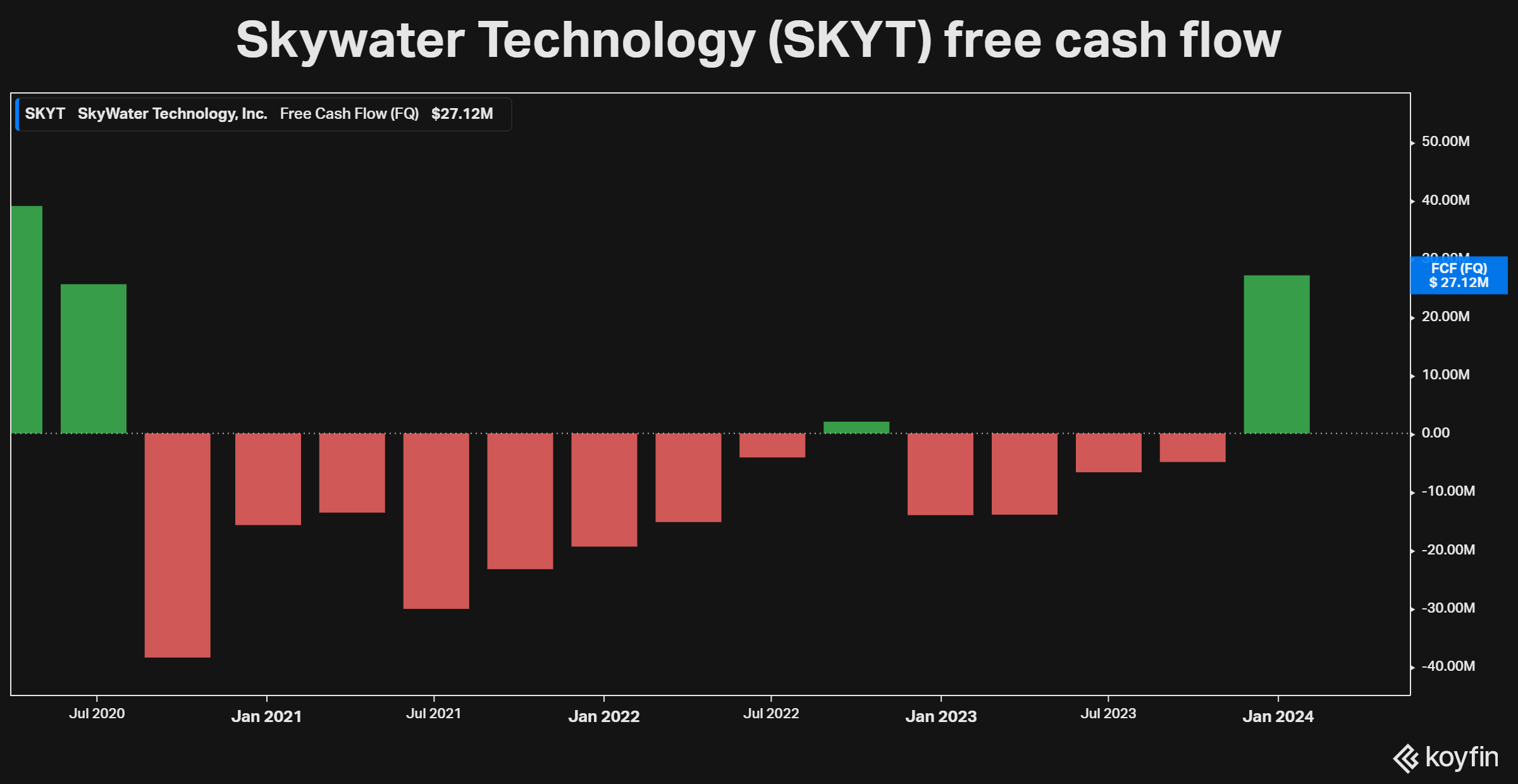

The other reason I think the stock may have "legs" here is that as SKYT's operations have matured since the IPO, it's now starting to generate free cash flow:

I think there's more where that came from in the quarters ahead.

The company has already paid down its long-term debt from $81 million in 2021 to $30 million at the end of 2023. Meanwhile Skywater's cash position has grown 300%, to $18 million, over the same post-IPO time period.

The interesting thing about Skywater's "technology as a service" is that its industrial and tech customers essentially pay the development costs for their chips (or other digital components), which are then produced in Skywater's foundry.

So Skywater has the makings of a potentially very good business.

In essence, Skywater is the chip foundry's landlord. Industrial/tech companies "rent" the foundry and pay Skywater a steady stream of cash for access to the foundry and Skywater's chip-development services.

As you can tell from the chart above, the stock has already had a nice run. So there's not necessarily a need to plunge in. Most stocks are going to pull back, sooner or later, at least to the 200-day moving average - which is 30% below the current price of the stock.

On the other hand, if Skywater remains on track to earn perhaps $1.12 a share by 2026, as analysts project, SKYT could easily be a $30 or $40 stock by then or sooner.

Best of goodBUYs,

Jeff

Member discussion