Adding to our "radiopharmaceutical" position

In mid-February, I noted that a large drug company, Bristol-Myers Squibb (BMY), had an interesting chart - and there were interesting developments going on inside the company.

Notably, BMY completed the process of purchasing a developer of radiopharmaceutical drugs called Rayzebio. As noted then, I think marrying BMY's strong competence in numerous cancer drugs, with radiopharmaceuticals (which you can read more about here), could be the catalyst for growth and interest from Wall Street, and thus move BMY sharply higher in coming months.

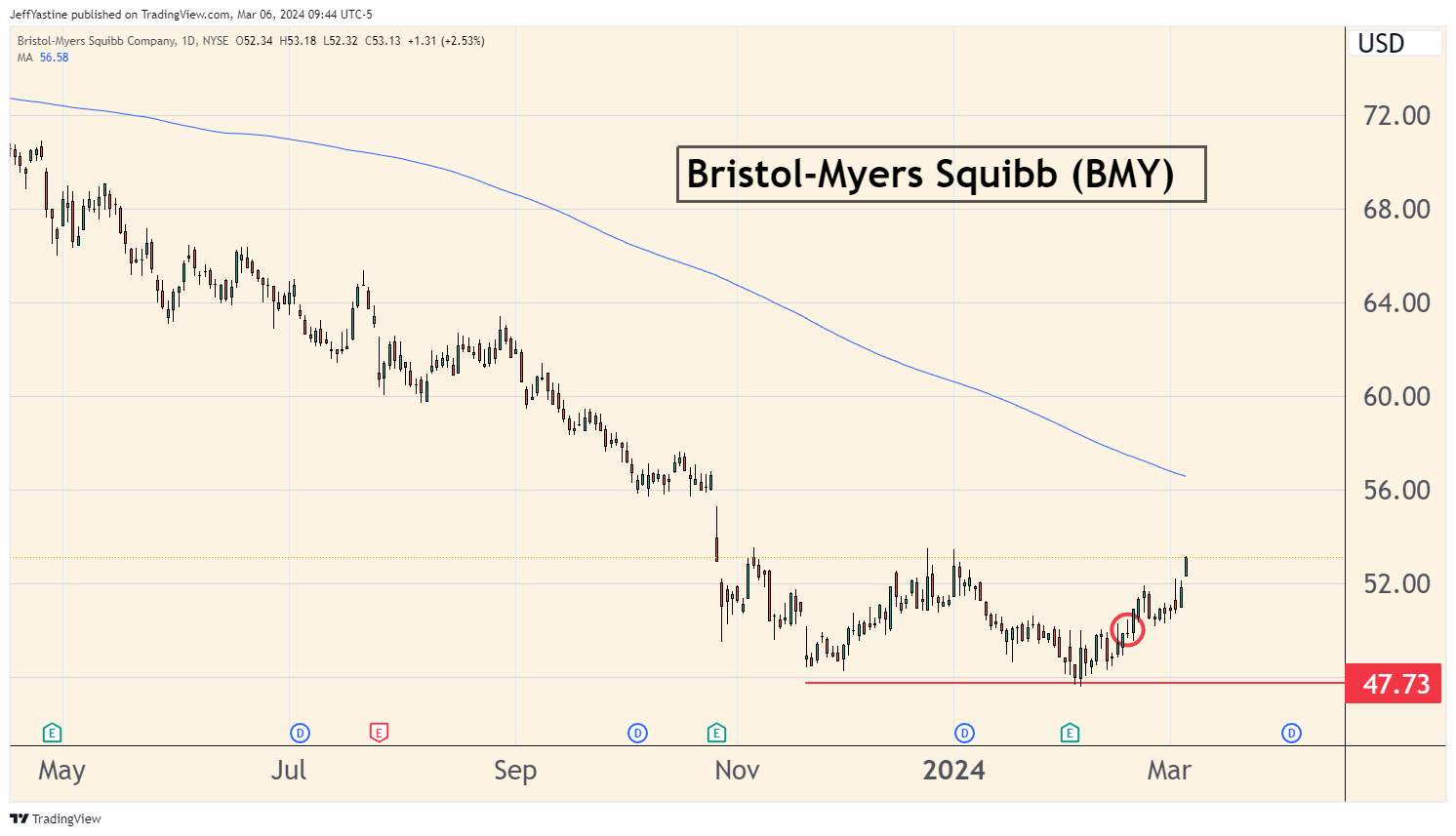

It's been a slow start - BMY's shares are up 6% this morning from the point I put the stock in the portfolio. But I think the shares look promising to deliver even more gains here, and am adding a second position as the stock ticks higher. As usual, I'll exit the position should the shares move much below $50.

On the first (daily) chart, the shares are still below the 200 day moving average. So there's plenty of room for the stock to run if we give it time and patience.

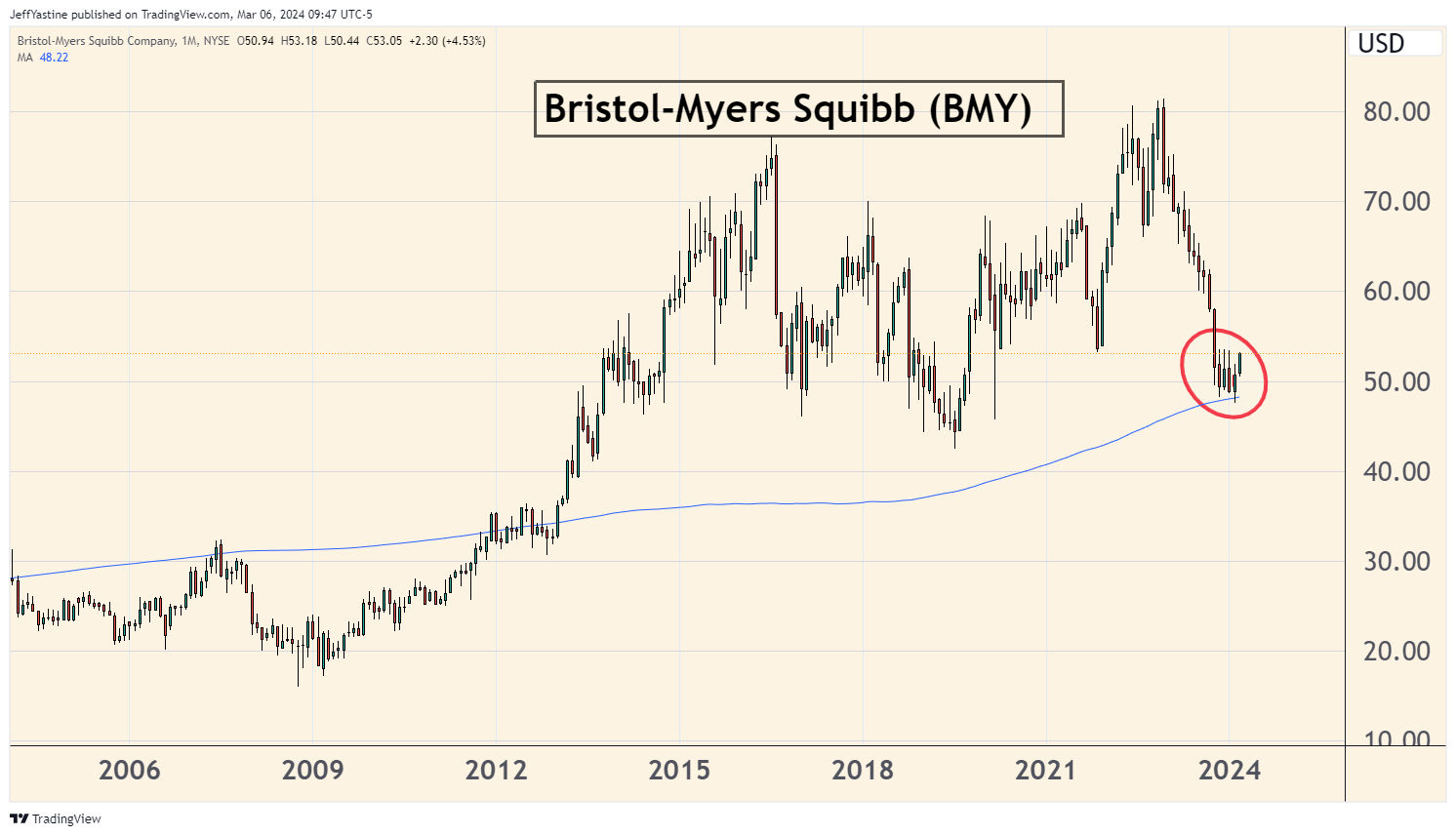

And in the second chart, which shows BMY's stock with each bar representing one week's worth of pricing data, we can see that the shares have basically been going sideways for a decade. Bristol-Myers' stock price is the same now as it was going back to 2013-2014.

So there's plenty of room to run for BMY.

Jeff

Member discussion