Mid-Year Market Roadmap

I hope you're having a great 4th of July holiday!

As we coast past 2023's 6-month mark - if you're reading about the stock market lately from a buffet of news sources - then you have an excellent example of why investing and trading can be challenging no matter whether you lean bullish or bearish.

In my case, I'm happy to enjoy this rally - and think it will continue for more weeks ahead. But like I've been saying for a few months now, I have my doubts and don't want to get carried away and throw caution to the wind. More on that below.

The Case for the Bulls

On one side are increasingly bullish folks who, frankly, have a lot of historical and technical evidence on their side.

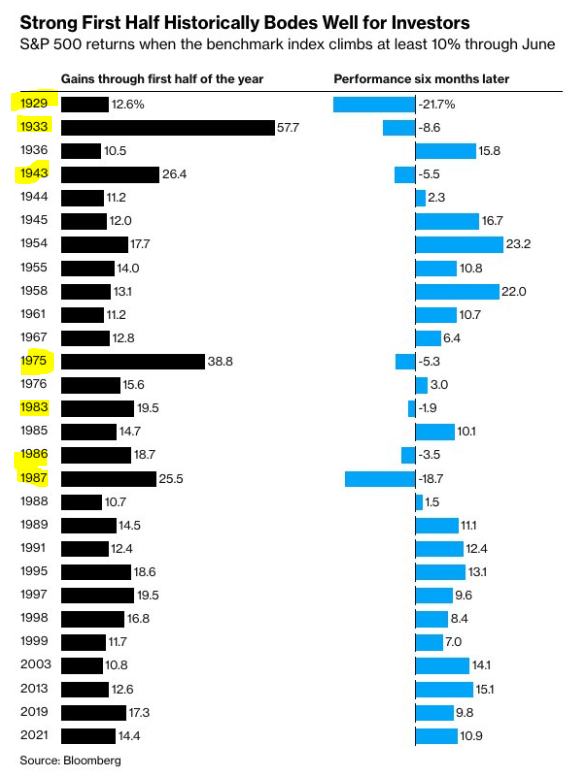

Looking back over past decades (as Bloomberg did in the table below), they're saying that whenever the S&P 500 rises more than 10% in the first half of the year - the second half is rarely bearish.

I took the liberty of highlighting when second-half stock market gains did not occur. But the bulls raise a good point. The economic data so far really isn't bad at all, despite many predictions to the contrary over the past 12 months. So why should 2023 be one of the exceptions, with a renewed bear market decline?

The Case for the Bears

On the other side are stalwart bears - many of them professionals (or dabblers) in macroeconomics. They're reading the economic tea leaves and saying (with a lot of common sense) "Hey, not so fast...!"

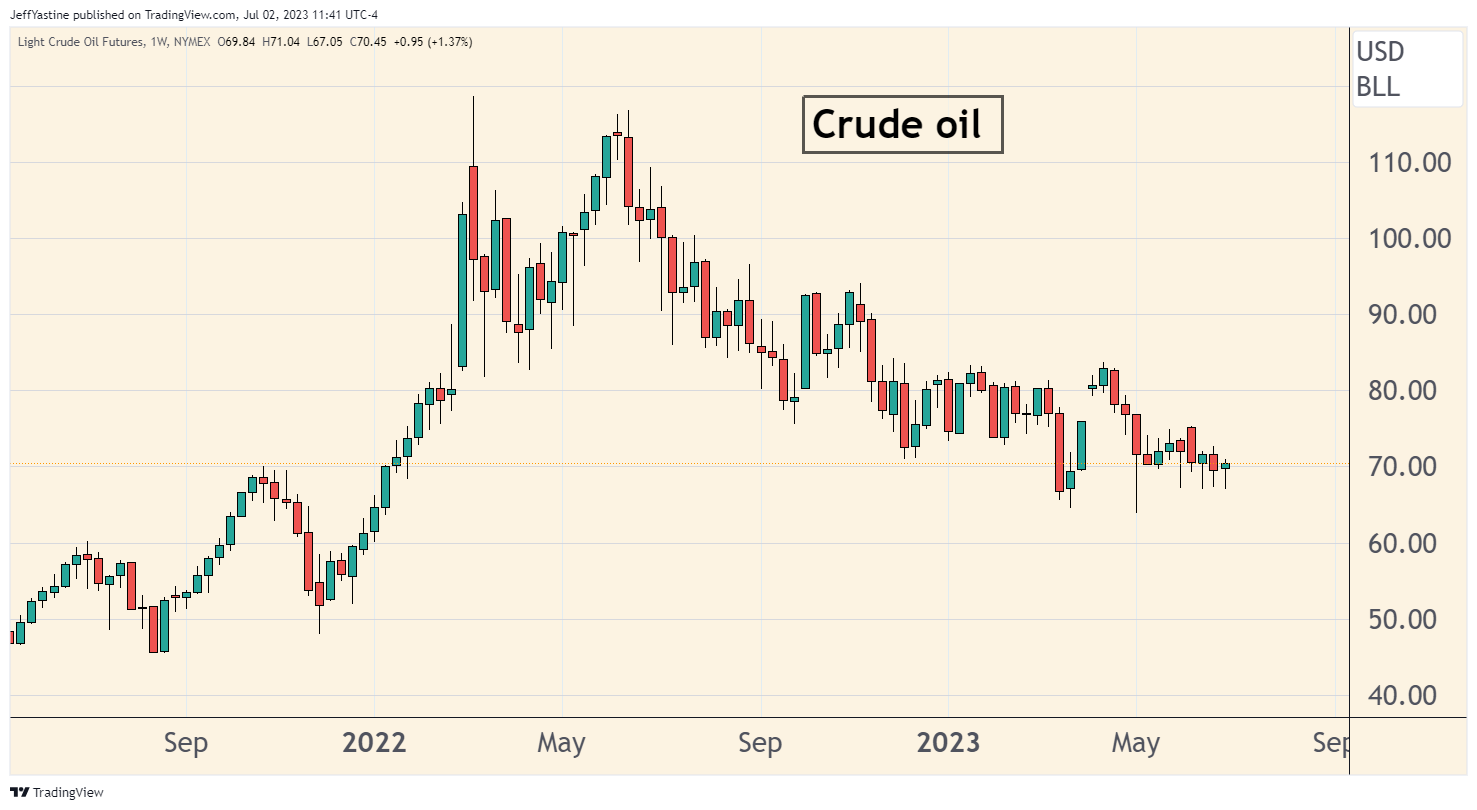

For example, if the economy's starting to take off, oil prices ought to be moving higher. Instead, oil is stuck at its lows of the year (around $70 a barrel) thus far, and looks like it could decline even further:

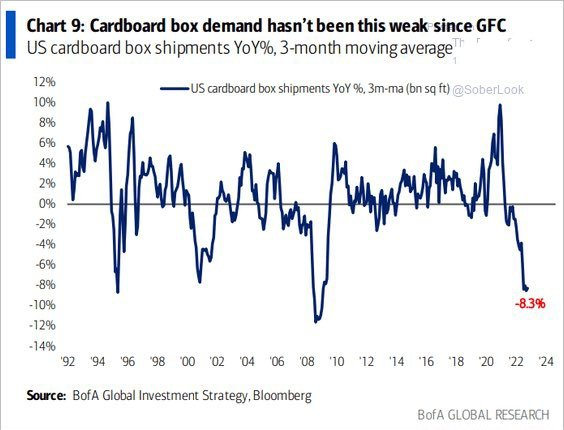

And if the economy's improving, shouldn't other basic measures of economic demand - like the consumption of cardboard - also be on the upswing (instead of its deepest decline since 2008's GFC - Great Financial Crisis)?

Keep Looking at Labor Day 2023

So where does this bulls-bears debate leave my market opinion?

- I've been happily buying stocks (and recommending them to premium subscribers) despite having doubts about the longevity of this rally.

- My view remains - keep enjoying the ride, but don't get too comfortable.

- I think "the ride" can continue through Labor Day (more on that below).

The way I view it, big rallies like this one are a necessary part of the "priming process" for a renewed bear market decline.

Back in April, record numbers of institutions were shorting the stock market.

That was the easy play. So it's not uncommon for crazy things to happen in the opposite direction - like our current rally being mostly attributed to the rise of 7 stocks, META, AAPL, AMZN, NFLX, GOOG, MSFT, NVDA - while dragging everything else only a little higher in its wake.

And it will probably keep going in that direction until the "last bear" (often a prominent bearish strategist at a major Wall Street institution) finally "throws in the towel" and gets bullish.

Then, and only then, is the market primed to start moving lower again.

That's my belief in part because of what the data is telling us (such as oil, and cardboard demand mentioned earlier, along with other economic inputs), and because of my instinct that the story that bulls tell about the rally (i.e. "it's a new bull market!") seems too neat and clean.

#1: The Federal Reserve is primed to continue raising interest rates at least 2 more times before the end of this year.

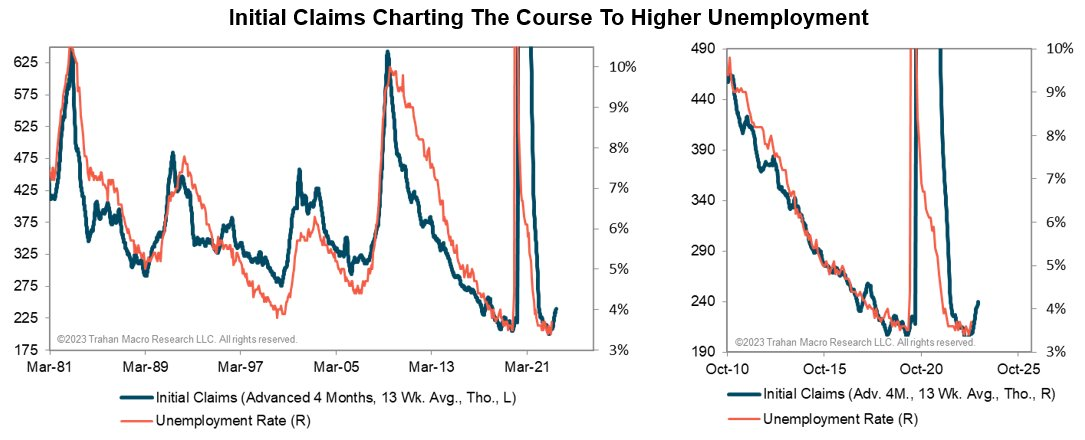

#2: Initial claims for unemployment benefits are starting to turn higher, which means that the Fed's rate hikes are starting to bite into economic demand and supply:

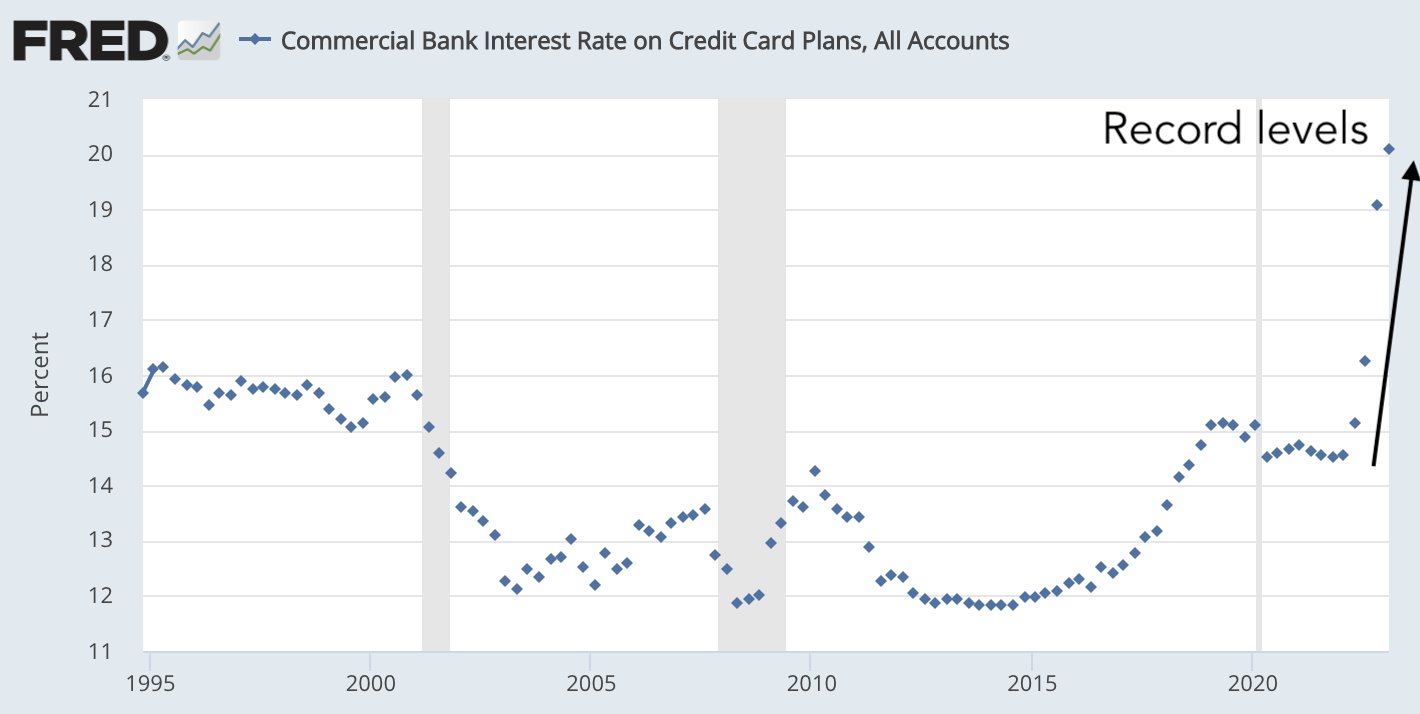

#3: With APY's on credit card interest rates north of 20%, I have to believe that it is steadily forcing many Americans to curtail their purchases and financing activity:

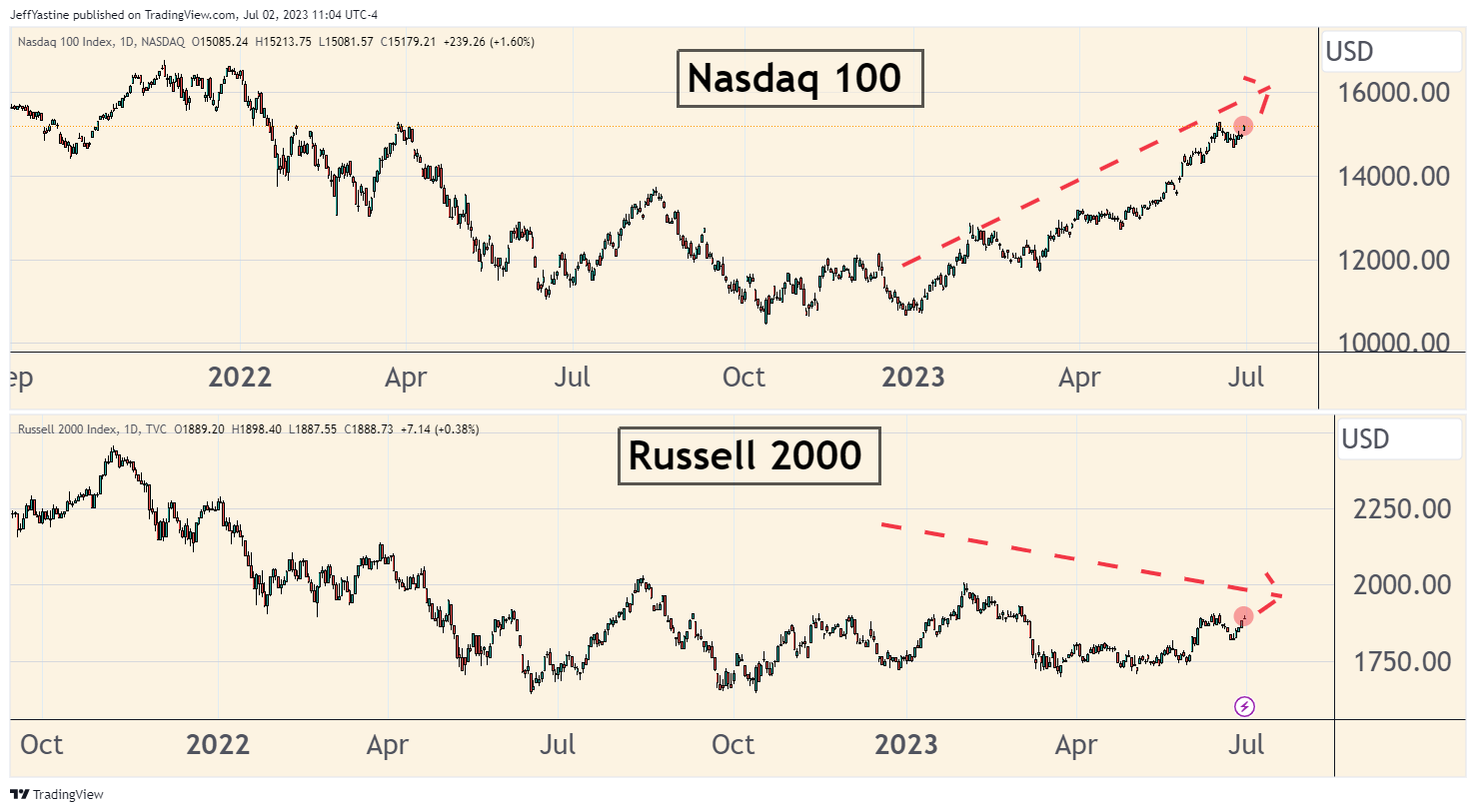

Lastly, I remain suspicious whenever small-cap stocks continue to lag.

They've been making some nice strides lately, but after 6 months of this broad market rally, the small-stock Russell 2000 index has yet to make a new "higher high" (although it has a chance to finally do so in coming weeks if the rally continues):

Keep Thinking "Labor Day"

So I think the current slow-motion rally we're all enjoying - will keep going for a while longer.

As I've been saying since early May, I think this rally can keep rolling along (with occasional mini-selloffs) through Labor Day weekend (September 4th).

Conversely, if we saw a steeper extended selloff starting sometime this month in July, I think it might help cool off the rally. It could cool it off in such a way that we could start thinking about a stronger rally later this year.

To that end, the best, longest-lasting bull market rallies are the kind that steadily grow in momentum, surging higher - then drifting lower when bullish enthusiasm gets too high. The decline provides the opportunity to keep investor expectations from getting too "hot" too fast, before it gets out of hand.

In such a way, it leaves the opportunity for the market to slowly build momentum again, as it surges towards yet another new high weeks or months later.

But I doubt we'll see such a selloff begin here in July.

From a seasonal perspective, July (especially the first half of the month) tends to be pretty intense. And if that turns out to be the case, I think the odds are pretty low that a steeper selloff (or true bear market decline) could take shape during a period of the year when many Wall Street trading staffs are on vacation and otherwise "out to lunch."

So my bet remains that we'll see a slow-motion rally that keeps drifting higher through Labor Day weekend - but with the potential to cause deeper damage to the stock market.

So let's pause to consider that for a moment.

I'm talking about 2 more months of lazy, late summer trading action where the sense or feel of market momentum is often lacking. (By that I mean that we often see a group of stocks rocket forward, while so many other stocks lag behind or drift lower).Yet if one owns the right stocks - easier said than done - it's still possible to log some decent gains in the "wins" column.

Why do I keep talking about Labor Day as a date to set for your trading calendar?

Mainly, it's just instinct and experience. I've noticed over the past 20-30 years that when the stock market rallies without a major pause into Labor Day, look out - because a sharper, more intense selloff is likely right around the corner.

Consider the following rallies exactly into Labor Day (or within 2 weeks afterward) and subsequent declines in the S&P 500:

- 2021: -5% decline in 1 month

- 2020: -10% decline in 1 month

- 2018: -20% decline in 4 months

- 2014: -10% decline in 1 month

- 2008: -40% decline in 6 months

- 2001: -30% decline in 8 months

It's also worth noting the market activity of 1987. The S&P 5oo rallied all the way into late August - fell 7% into the September 7th Labor Day holiday, before declining another 30% (most of it on "Black Monday" October 19th).

Wrapping things up, enjoy the holiday. Enjoy the rally, while keeping in mind strong risk management tactics (buy small amounts with the expectation of lots of volatility in either direction) to survive and thrive over the next few months.

Best of goodBUYs,

Jeff Yastine

Member discussion