Market Update: Rocket Ride after Tax Day?

Call me crazy, but I saw plenty in last week's trading action that sets up - in my mind - the potential for a strong rally.

All we need to do is get through the coming week, which only runs Monday through Thursday. The exchanges are closed for Good Friday, which is also the start of Passover. And don't forget "Tax Day" for all of us here in the U.S. - technically we have until Monday April 18th to get our returns in.

So what happened last week in the markets that's so positive to a future rally?

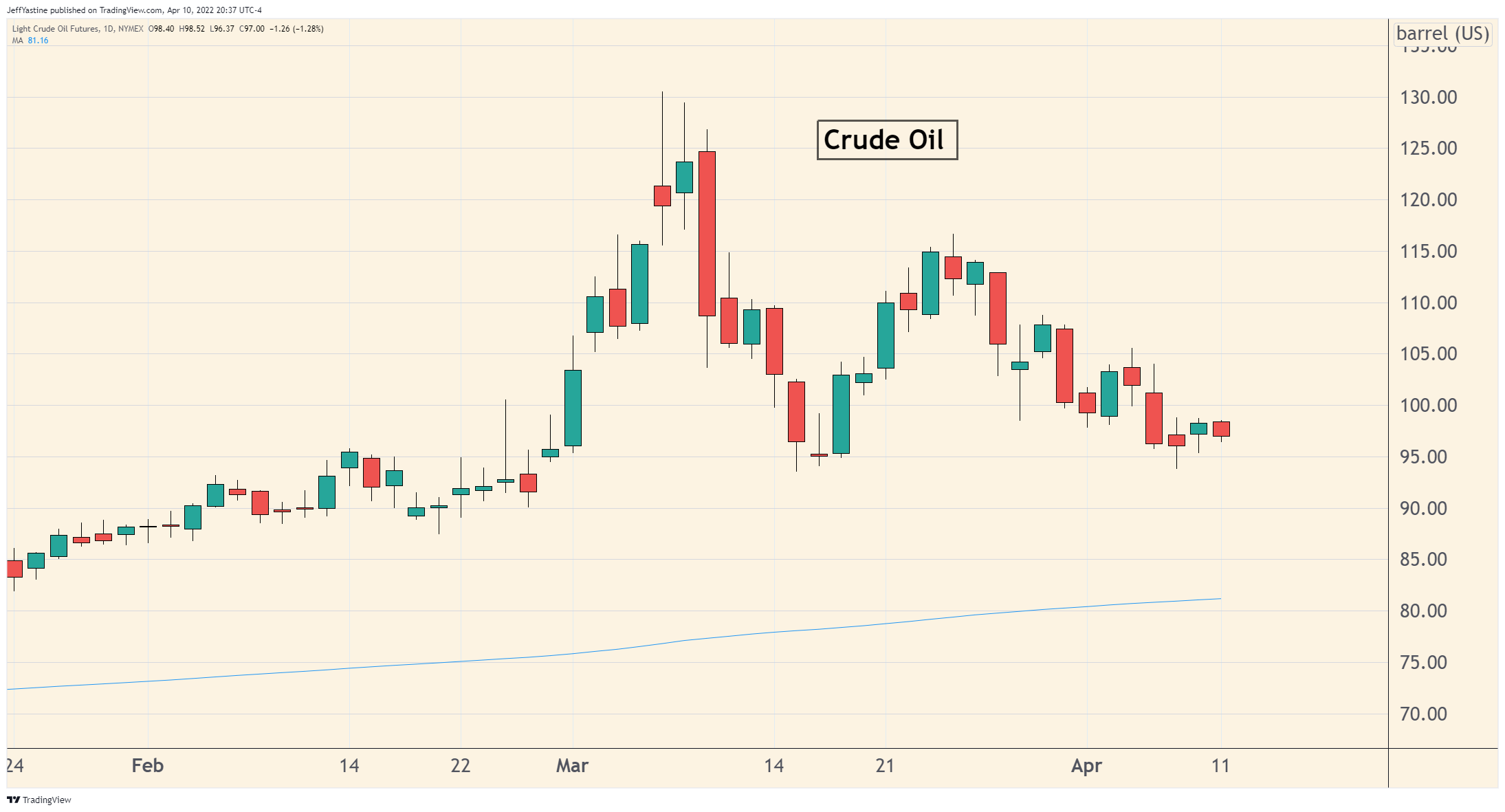

Oil prices are starting to crack to the downside.

Crude oil finished Friday at $96.50/barrel - down 17% in the last 3 weeks.

The stock market doesn't care about it just yet. But just watch. If I'm right and the market does begin to rally hard after Easter, one of the cited reasons will be that oil prices are finally moving (grudgingly) lower.

Consumers will see it at the gas pumps eventually too, which will help improve consumer sentiment as well.

The bond market is doing the Federal Reserve's "heavy lifting" on interest rates - and is due for a break.

The 10-Year Treasury Note tends to go through these periods where it breaks up (or down) in a big way, then pulls back in the opposite direction.

So if we look at the chart above, the yield (the interest rate) soared from 1.8% in early March to 2.7% last week.

So I'm expecting a pullback soon, and when it comes, it's for sure that Wall Street strategists will say "The bond market is giving the stock market a reprieve on interest rates - time to buy stocks!"

"Inverted Head & Shoulders" Coming Soon?

Like I noted in last weekend's video...strong bull markets don't die easily.

So the setup I'm hoping we see after the coming week would take the major indexes don't just a few more percentage points lower...and create another round of bearish exclamation and gnashing of teeth:

I know that the first inclination of many folks is to look at the selloff of the past few weeks and think "Oh no, hear we go again."

And what's the first instinct of a trader who thinks that way? The first instinct is to think it's time to get heavily short, and bet on a deeper decline in stocks.

I think that's just too easy of a conclusion to make, and therefore wrong.

In fact, the stock market feeds off of these kinds of mismatches. We saw it in mid-March when I noted that it appeared (to me) that the market was setting itself up for a big bounce because lots of stocks, appearances to the contrary, just weren't going down anymore.

We got our big bounce - and it was a doozy, far bigger than I even expected. Again, I think the market was trying to tell us something, and keep all of us as "wrong-footed" as possible.

So here we are again. Lots of folks are thinking that the market will continue to fall from here. But given the time of year - April and May aren't known as seasonally-weak times of the year for stocks - I think it's all a big setup.

So like I said, we may see a little further downside this week. But if I'm looking at this correctly, we could all turn our computers on come Monday morning, April 18th and see the market turn sharply higher again, which would once again catch a lot of folks very much off-guard - with sharply higher stock prices the result.