Following Up on Monday's Market Action

Since we're in a critical zone for the market, I just wanted to weigh in with a couple of observations about yesterday's session, for what it's worth...

In many ways, the session felt worse than it really was - and could be setting up a post-Fed "bounce" to keep things interesting.

There was steady selling all day. And yet after all that, the S&P 500 (shown here on an hourly/intra-day basis) remains above the "panic low" of February 24:

The Nasdaq 100 (see below, also shown on an hourly intraday basis) finished slightly below the February 24th panic lows.

Yet (circled in red) this key index spent the last 2-1/2 hours of the trading session "camped out" at that level. Maybe no one wanted to buy tech stocks at that price. But no one seemed very interested in selling them any further, either.

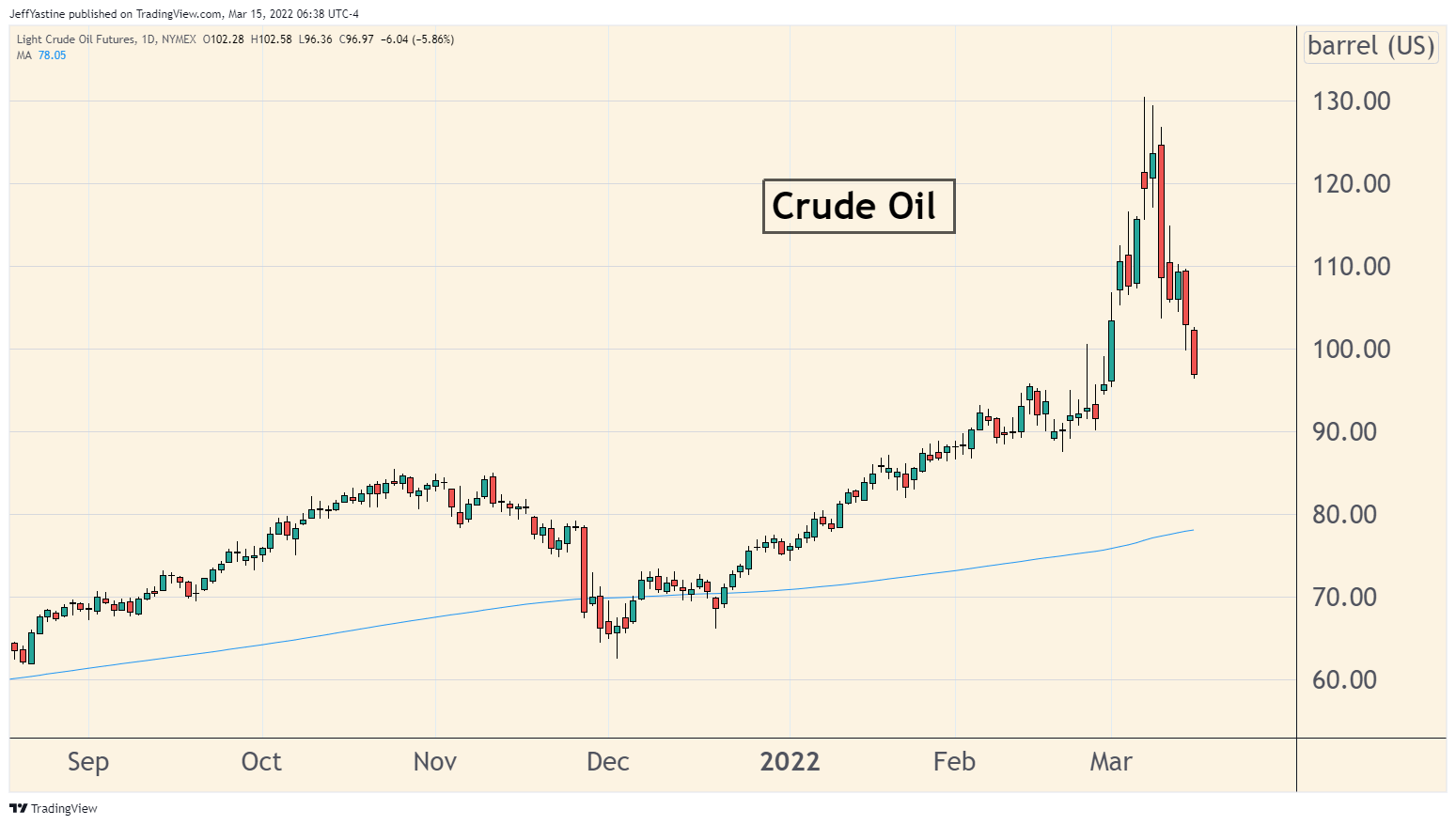

And even though the stock market doesn't seem to care right now - oil prices have been crashing in the last few days, dropping to $96/barrel this morning:

To me, it smells a bit like market-makers - the institutional folks whose computers act as middlemen for stock trades - are trying to engineer a rebound in the next few days.

Keep in mind...

- The big Fed meeting starts tomorrow (the rate-hike announcement won't be until Wednesday at 2:15pm ET).

2. This week happens to be an options-expiration period as well, which lends itself well to up-and-down rebound action as well.

Long story short...

If you like to trade the short-term swings in the market, this might be one of those times where the market has a shot at a nice rebound move - using the Federal Reserve meeting and options-expiration as catalysts.

For the rest of us, we'll need to keep biding our time. As I noted in the Sunday update, we may still be looking at nearly 3 more weeks of this tepid up-and-down drifting - while our individual stocks may "look" better or worse than the market itself - as we wait for the second quarter to begin.

Jeff

Member discussion