What Halts the Selloff?

When I was a student journalist at the University of Florida years ago, one of my professors would have us run through a little mental exercise.

He'd have us read an article out of the local newspaper - then figure out the unanswered questions, the "holes of information" - that could still be filled in with a more reporting work on our part.

It's not a bad way to approach the stock market either - looking for information that could change the market's story from good to bad, and vice-versa.

We have a bit of a selloff going on, obviously. Since March 29, the Nasdaq is down 4.5%. The S&P 500 is off about 3.5%.

What could be the catalyst to stop the decline in its tracks - and create another unexpected surge in buying?

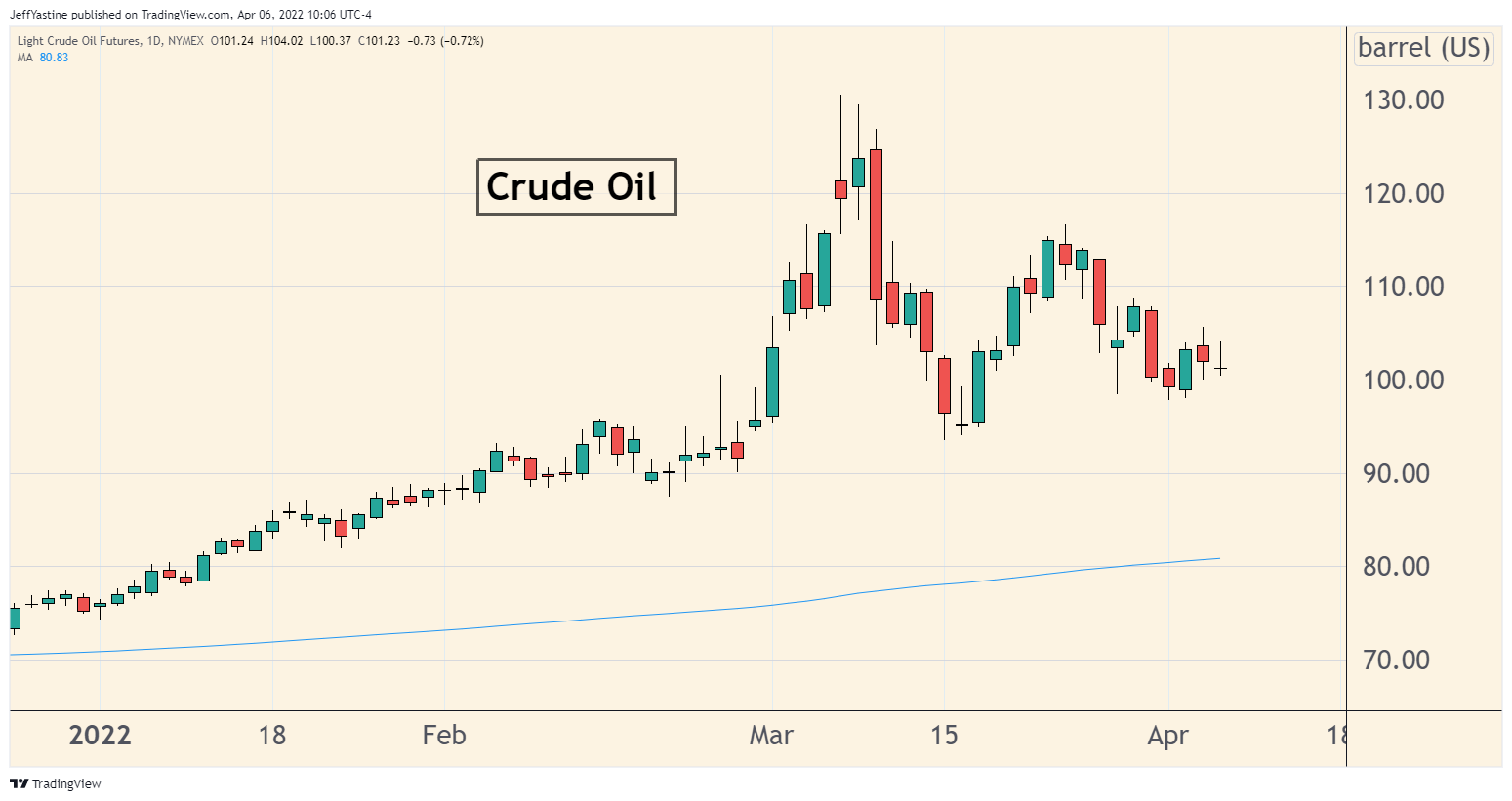

Further declines in the price of oil, in my opinion. As you can see on the chart below, it's hovering at $101 a barrel right now - down from $130 in March.

In reality, it could go either way I suppose - higher or lower. Obviously, I'm biased towards "lower."

The reasons for a deeper drop in oil prices from here could be any number of things that might seem highly unlikely now - like serious peace talks in Ukraine, or a coup attempt against Putin.

But the IEA just said that members will coordinate an additional release of global strategic oil reserves, alongside the Biden administration's SPR announcement last week.

Energy analysts are also wondering if US demand for gasoline is actually weaker than anticipated, based on recent US government (EIA) data.

If oil were to break below $100 to $95/barrel - and in keeping with the idea that bull markets don't die an easy death - we could be looking at the prospect of another move back towards the old highs of late last year.

All I'm saying is... keep an open mind. As unlikely as it might seem, this rebound may not be over yet.

Jeff

Member discussion