Market Roadmap: Where's the Beef?

Being the father of a 16-year old boy is a sort of like trying to master the task of investing and trading successfully...

For one, it's important to have a sense of history - what happened in the past, and how it might impact what happens tomorrow.

And from a generational perspective, it works both ways. For example, he's trying to teach me "the griddy" endzone celebration dance (hint: It's not working).

I'm trying to teach him the most important thing in life: Know your advertising slogans and pop-culture history.

It's the real thing (Coke)

Have it your way (Burger King)

Plop, plop, fizz, fizz (Alka Seltzer)

And the one that comes to mind for the stock market these days...

Where's the beef? (Wendy's)

It comes to mind because there's a whole contingent of gurus, strategists and financial pundits out there right now who are pushing the concept of a "new bull market."

Yesterday, the Fed raised interest rates by a quarter point. The current belief is that's that - no more rate hikes. There are only rate cuts to look forward to, perhaps late this year or in 2024 when the Fed, in its wisdom, inevitably decides to juice the economic recovery that will be in full bloom by then.

That's the gist of the bulls' story, anyway.

But I've seen new bull markets get their early start. And there's very little "beef" on this market "burger" if you will.

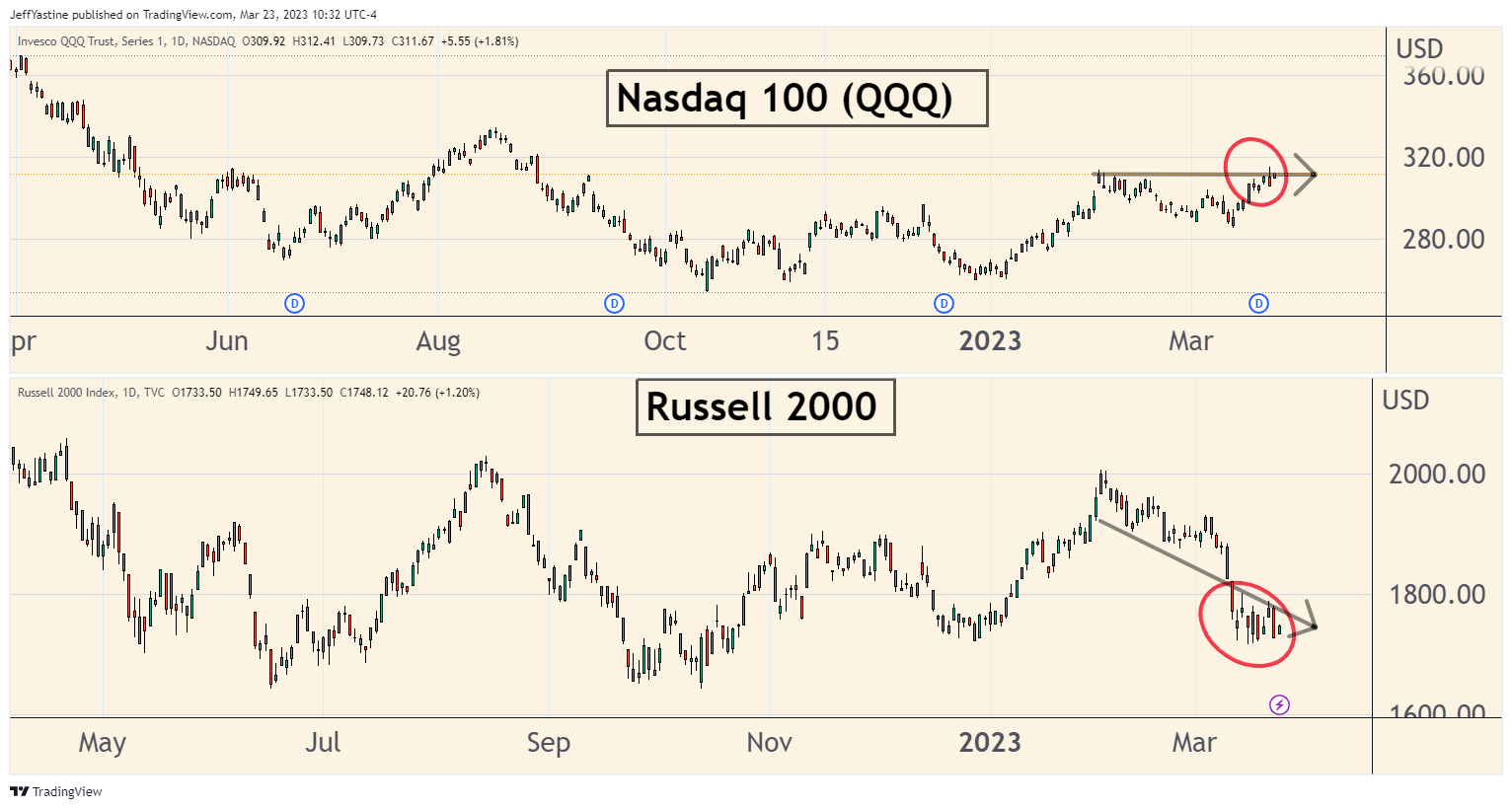

To the bulls' point, the Nasdaq 100 (the QQQ etf) index yesterday briefly hit its highest level since August, before selling off. It's nice to see, I guess, on a day when the Federal Reserve raised interest rates yet again.

But all the other major indexes - S&P 500, DJIA, Nasdaq Composite Index - are still wandering below their highs of February, much less last August.

All the Nasdaq's recent out-performance demonstrates is that big-cap tech stocks are now the new "safety stocks."

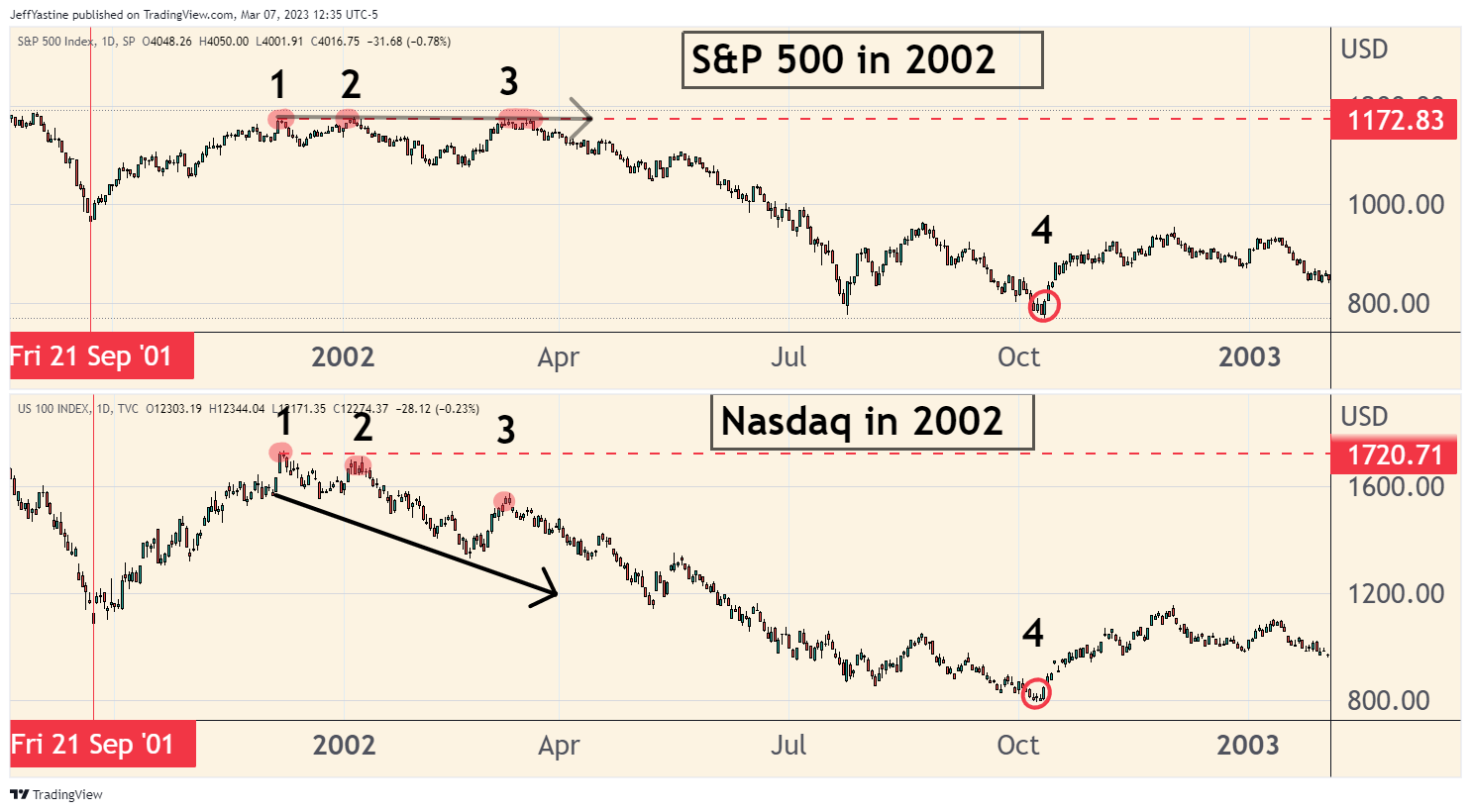

The dangerous part to that "safety stock" argument is that we may be repeating a pattern that was very evident in the last, most dangerous phase of the 2000-2003 bear market:

Back then, the S&P 500 held more "old economy" stocks. As the economy weakened in late 2002 and early 2003, pro investors flocked to those as "s stocks, buoying the index.

Yet the Nasdaq of that era - much like the Russell 2000 now - could never muster the same level of strength and kept fading as the weeks and months passed.

I keep hoping the market will prove me wrong.

But the same divergent pattern may be playing out now as well:

I'm not going to belabor the point. I really do hope I'm wrong because bull markets are a lot more fun (and easier to make money) than bear markets.

But bear markets also have a financially tragic history of lulling investors like us - asleep - before another round of carnage begins.

As my 16 year old son told me to be careful, as we walked across his baseball field the other day with his buddies hitting batting practice...

Keep your eyes on stalks, and your head on a swivel.

Best of goodBUYs,

Jeff Yastine

Member discussion