Is Today "the Shake-Out Day"?

Cutting to the chase.... with the major indexes all down 3% an hour after the opening bell, here's what I sent out on Twitter:

Stocks I added yesterday...not going down.

— Jeff Yastine (@JeffYastine) September 29, 2022

Could easily be a 'shake-out day' where everyone coughs 'em up at the lows, and then later AM or in PM...rally back to breakeven.

Just sayin'...that's what you'd want to see at mkt turning pts.#StocksToBuy #stockmarketcrash

Do I know for sure that stocks won't just keep plummeting into the abyss? No.

But I just want to point out that the trading action of yesterday and today is a good example of what happens when people get really scared (which is want we want to see for an actual bottom).

I call it a "shake out" day. Here's the setup...

Yesterday: The stock market rallied very hard.

All year - up until a week or so ago (the latest Fed meeting and rate hike) - investors and traders would have jumped all over that rally on the following day, in hopes that it was the start of a bigger multi-day or multi-week affair.

But we've also had 9 months of bear market "negative reinforcement." At this stage of the game, most folks are finally conditioned to expect that all rallies - no matter how hopeful they begin - eventually fail.

So what did everyone do today when presented with yesterday's 3% one-day rally?

Today: Sell, sell, sell right at the open. Get out while you can.

I guess my main point - don't give up the ship just yet.

Today could easily be a "shake out" day where the market plummets hard early in the session. And then later - or at the opening bell on the following day - begins to show signs of life and 'market positivity' again.

With that in mind, I'm going to use today's weakness to add a couple more positions to the goodBUYs portfolio:

Palantir Technologies (PLTR): The term "data mining" and AI - artificial intelligence - is almost passe now, but that's what Palantir does.

The company's "gotham" platform detects patterns among diverse sets of data that would otherwise be impossible to note, or the correlation would seem entirely random (and easily dismissed).

Palantir has numerous customers within the US and allied intelligence and counter-terrorism enforcement communities. The US Army is a customer, for instance.

Palantir also deploys the platform for commercial customers eager to develop important insights from reams of marketing data and other behavioral or economic studies. For example, Hyundai Heavy Industries is a customer. So is a firm called Beckett Collectibles.

I remember when my former colleagues at WealthPress were very interested in this stock a few years ago. Thing was, it was a $40 stock and overvalued in my opinion.

These days, Palantir is an $8 stock and looks a lot more attractive, in my opinion:

So why add the stock to the goodBUYs portfolio?

Partly, I like the chart and the opportunity to do a little bottom-fishing. Palantir's share price hasn't touched a new low since early May. As I keep saying, that's a good sign of strength in the midst of a bear market storm.

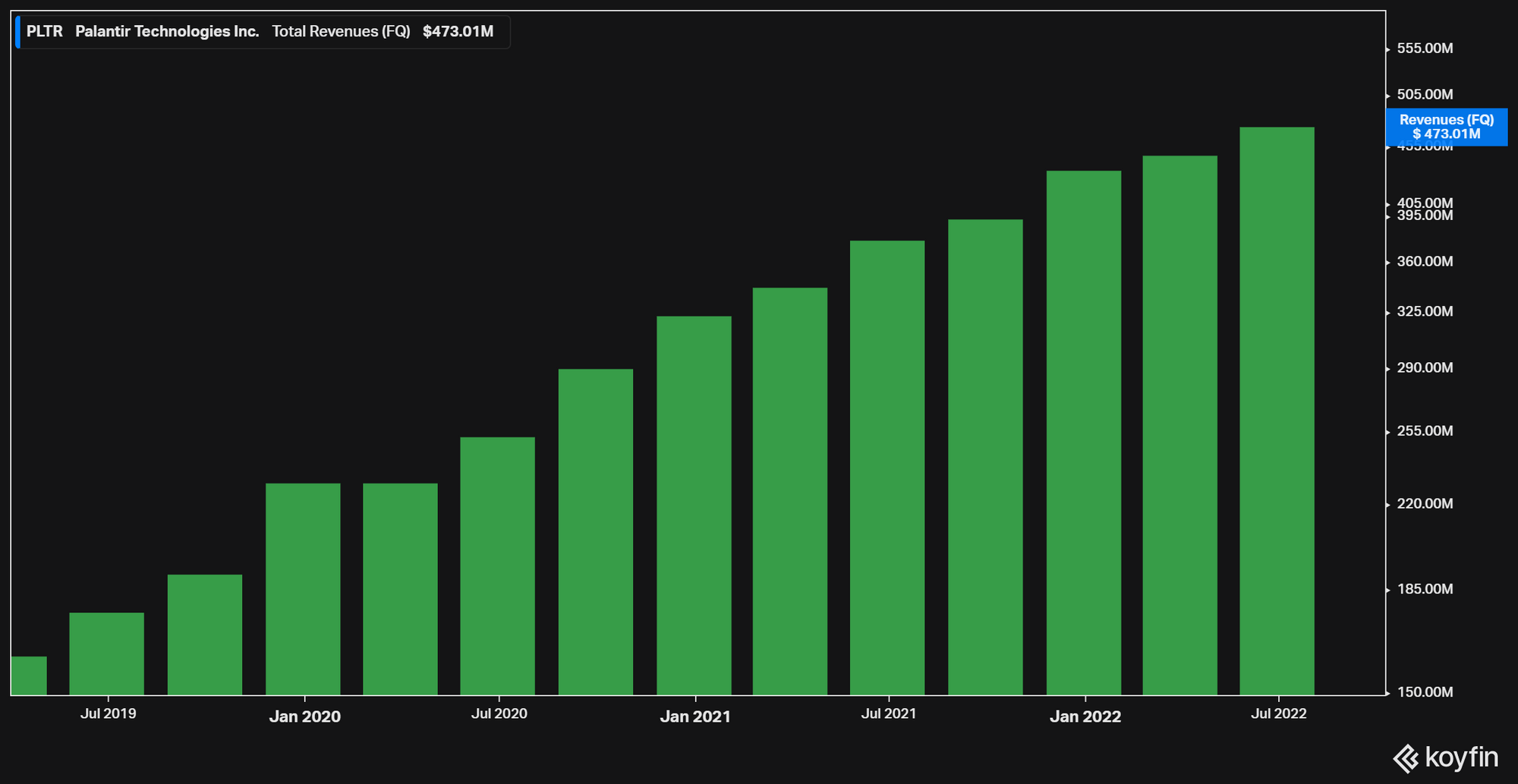

It's also hard to argue with its sales/revenue growth, which is rising in a nice steady fashion:

But one of the reasons I was slow to warm up to the stock a few years ago, is that Palantir's profits (analysts like to use non-GAAP results) - while growing fast, are starting from a small base.

That was a concern with the stock at $40. But at $8...the shares look a lot more attractive from a valuation perspective:

- $0.05/share for 2022

- $0.16/share for 2023

- $0.25/share for 2024

So the opportunity here is that - if things go right for us and the company - PLTR's profits are set to rise more than 200% next year, and another 50% in the year after that.

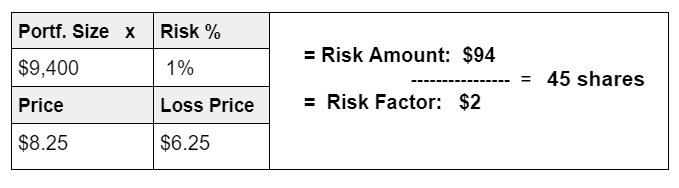

So here's how the stock will look in the goodBUYs portfolio - always with one eye on the opportunity, and the other on the potential loss if I am wrong:

Outset Medical (OM): If you've been a subscriber for a while, you know this company's name already and what it does - FDA-approved mobile kidney dialysis units.

Legacy dialysis systems are the size of a room, requiring very specific maintenance and cleaning. Patients have to drive to a clinic or treatment center 3 or 4 times a week in order to use the machine.

Outset's "Tablo" device packs all of that into a unit they can have at home. It's the size of a filing cabinet with wheels, with high-tech filters, computerized pumps and a wi-fi connected data feed.

We've bought OM - and sold it - 3 times, most recently in May - always for a loss as the stock worked its way lower down the chart.

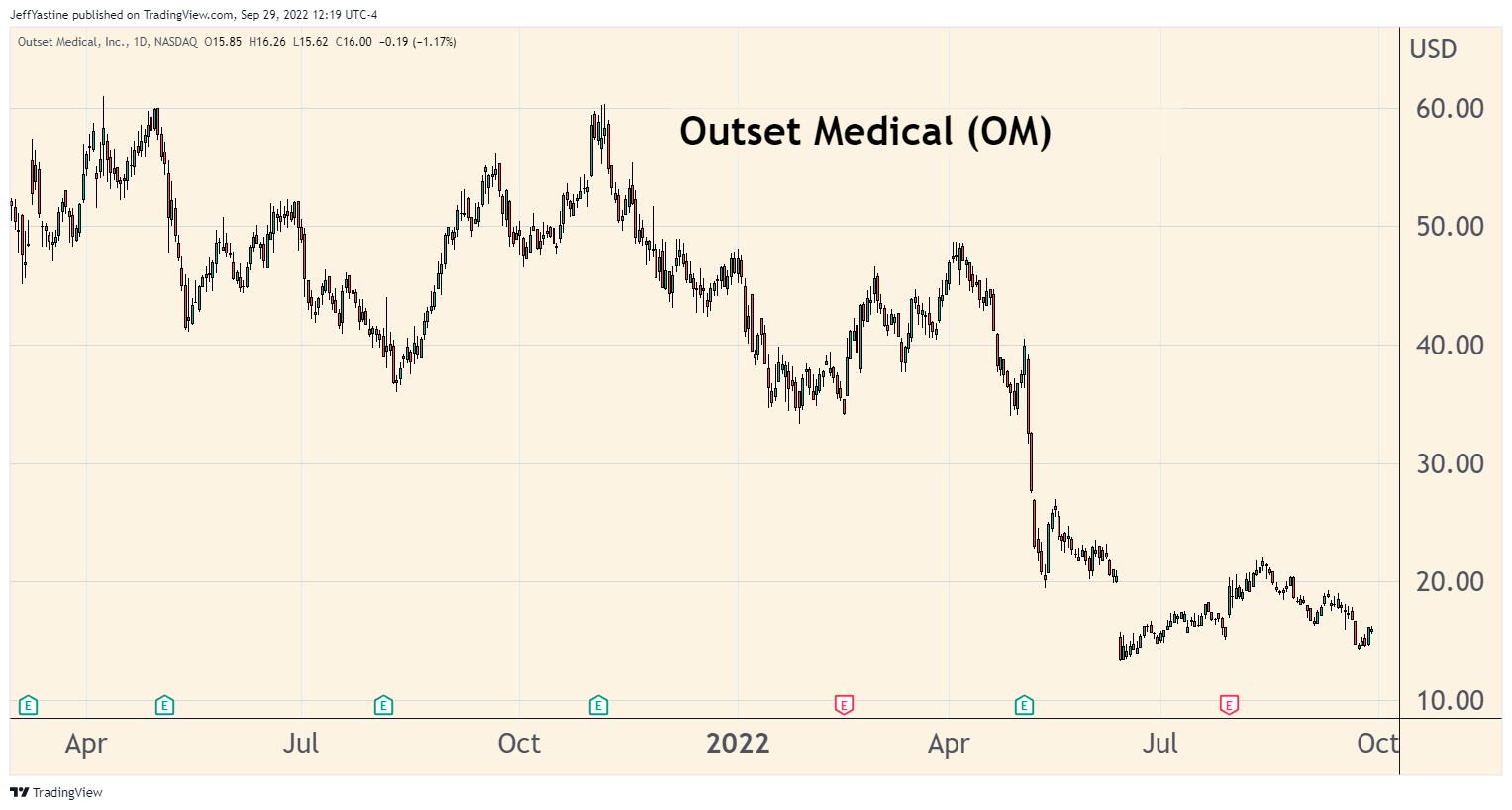

But again, I like OM's chart at this point. The major indexes are hitting new lows for the year - and Outset Medical stock remains perched above its June lows.

If you're a new subscriber, you can read the initial recommendation here. But in my opinion, the reason to try buying it yet again (and hopefully catch the bottom) is even more compelling.

Since the last time I recommended Outset (in May)...

- The company was awarded a national contract to sell its Tablo mobile dialysis units into 106 Veterans Affairs hospitals and clinics around the US.

- Outset resumed shipment of its units in August (after a brief pause starting in June while the FDA reviewed improvements the company made to the units since the initial agency approval in 2020).

Last year, CMS (the agency in charge of Medicare and Medicaid) determined that Outset's device "is a substantial clinical improvement" over the traditional treatment option of going to a dialysis treatment center, and recommended system payments for use of the machine.

Best of all, Outset already has sales growth for its product, and estimates of sizable growth ahead:

2021: $102 million

2022: $108 million

2023: $157 million (est.)

2024: $238 million (est.)

Outset is not a profitable company. At this stage, it's really about building up its manufacturing capabilities to meet demand for the machines. But OM's losses are projected to head lower over the next few years:

2021: ($2.51)/share

2022 ($2.85)/share (est.)

2023: ($2.32)/share (est.)

2024 ($1.90)/share (est.)

The best kinds of businesses are those that have the "razor and razor blades" model. You may purchase the razor once, but you'll be buying replacement blades far into the future.

So that's the other thing I really like about Outset Medical. It has a similar "razor and razor blades" potential because of the high-tech filters that go into its machines.

An insurance company, the VA, or a Medicare provider may buy or lease one of Outset's mobile dialysis machines for a patient. But new replacement filters must be purchased over and over again.

That's where Outset's biggest profits and cash-flow will be as the company builds its "installed base" of machines to serve dialysis patients nationwide.

Jeff Yastine

Member discussion