Market Update: Emergency Fed Meeting

Someone at the Federal Reserve must be getting scared.

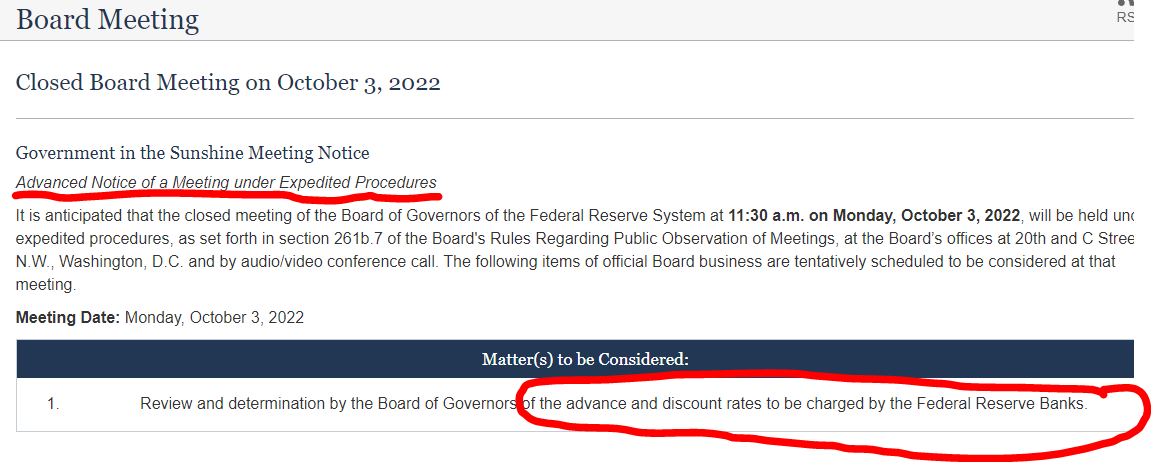

If you haven't read this somewhere else already, the central bank is having an unscheduled "expedited" meeting at 11:30am ET tomorrow (Monday) to discuss interest rates.

We won't know how significant or not this meeting will be until after-the-fact. But expedited sounds like the kind of word a PR person might choose instead of a word like "emergency," which immediately raises lots of bright red flags - too many for the Fed's taste, I'm sure.

Emergency meeting or not, there are all kinds of rumors floating around about a large investment bank (supposedly Credit Suisse, according to the Twitterati) in need of a financial rescue.

We'll see if that turns out to be true. Take everything you hear with a grain of salt. Rumors (and our own worst-held beliefs) run rampant at moments of maximum emotional and financial pain.

And as I continue to state...these are good things to see happening if you're interested in the best opportunities in the stock market.

It means people are scared and stock prices are cheap.

In my opinion, it means a bottom is close at hand.

No doubt the next number of days will be choppy. My guess is that with the emergency Fed meeting on tap, I think we'll see a modest relief rally next week.

After that, I think we could see more general weakness in the days leading up to October 13th (a Thursday) and the scheduled release of the Consumer Price Index (CPI) for last month.

But if the market finds some happiness with the CPI report, then I think that might be it for this cycle of the bear market. Maybe we see more weakness next year some time, who knows? But the time to bet on a longer-lasting rally is now.

Keep in mind some other factors that could feed into a shift to bullish sentiment - observations previously noted by Marketwatch's Mark Hulbert:

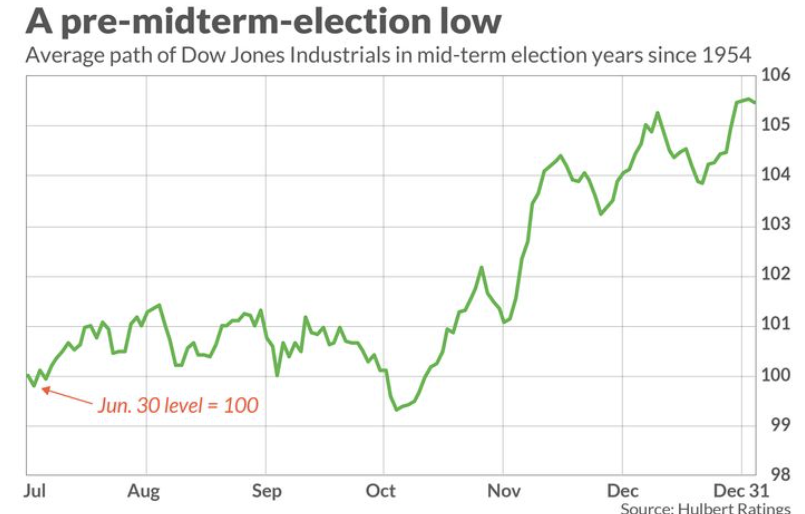

The US midterm elections are a little over a month away. Historically, October is a turning point for the markets in midterm years.

I've shown this chart in past weeks and I'll show it again, because it's important to keep in mind:

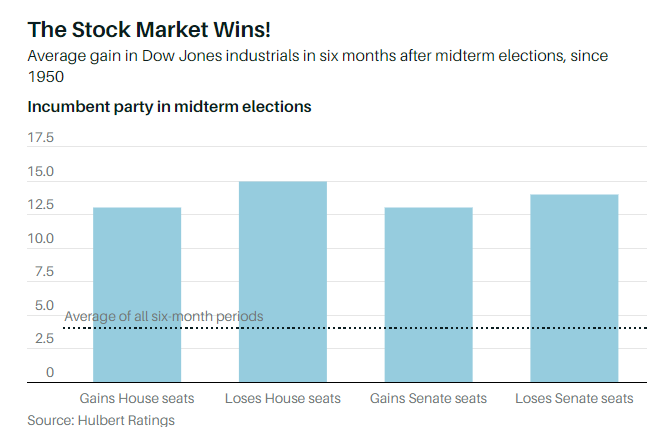

2. No matter how it shakes out between Democrats and Republicans, studies have shown that since 1950, the 6 month period after a midterm election results in some of the strongest, bullish markets.

Some other things to consider...

US defense spending has always been an important component of the economy. Defense plants may well need to expand their hiring and step up the tempo of their manufacturing as we head into 2023.

Why? Senior US and allied defense officials met in Brussels recently and discussed ramping up production of war materiel - weapons systems, artillery shells, tank shells, rockets, you name it.

It's not just to meet Ukrainian needs (if the war drags on) but also to replenish the now-depleted stockpiles of US and NATO forces.

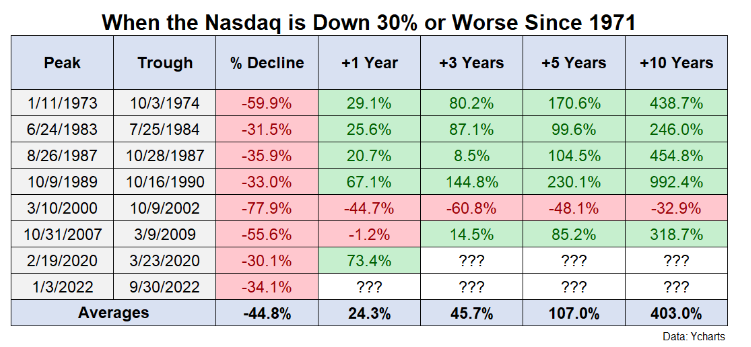

Last point: I'm taking this from Ben Carlson's Wealth of Common Sense, but historically when the S&P 500 and Nasdaq are down this much or more, following years tend to be pretty good for the market as a whole:

As the chart shows, there are always "outliers" too - such as 2000-2002, and 2008-2009.

So what we're talking about here is seasonal, historical, average-tendencies.

As I keep saying...all we have to work with are probabilities. There are no sure things in the stock market. But if we were looking for the right time to make a bet that stocks might move higher instead of lower, this looks like the right time to get into the ballgame, in my opinion.

Jeff Yastine

Member discussion