Buy Alert: 2 for the Shopping List

Here's one of the most overlooked aspects of investing and trading...

In a (hoped-for) tail end of a bear market...stocks don't all bottom at the same time.

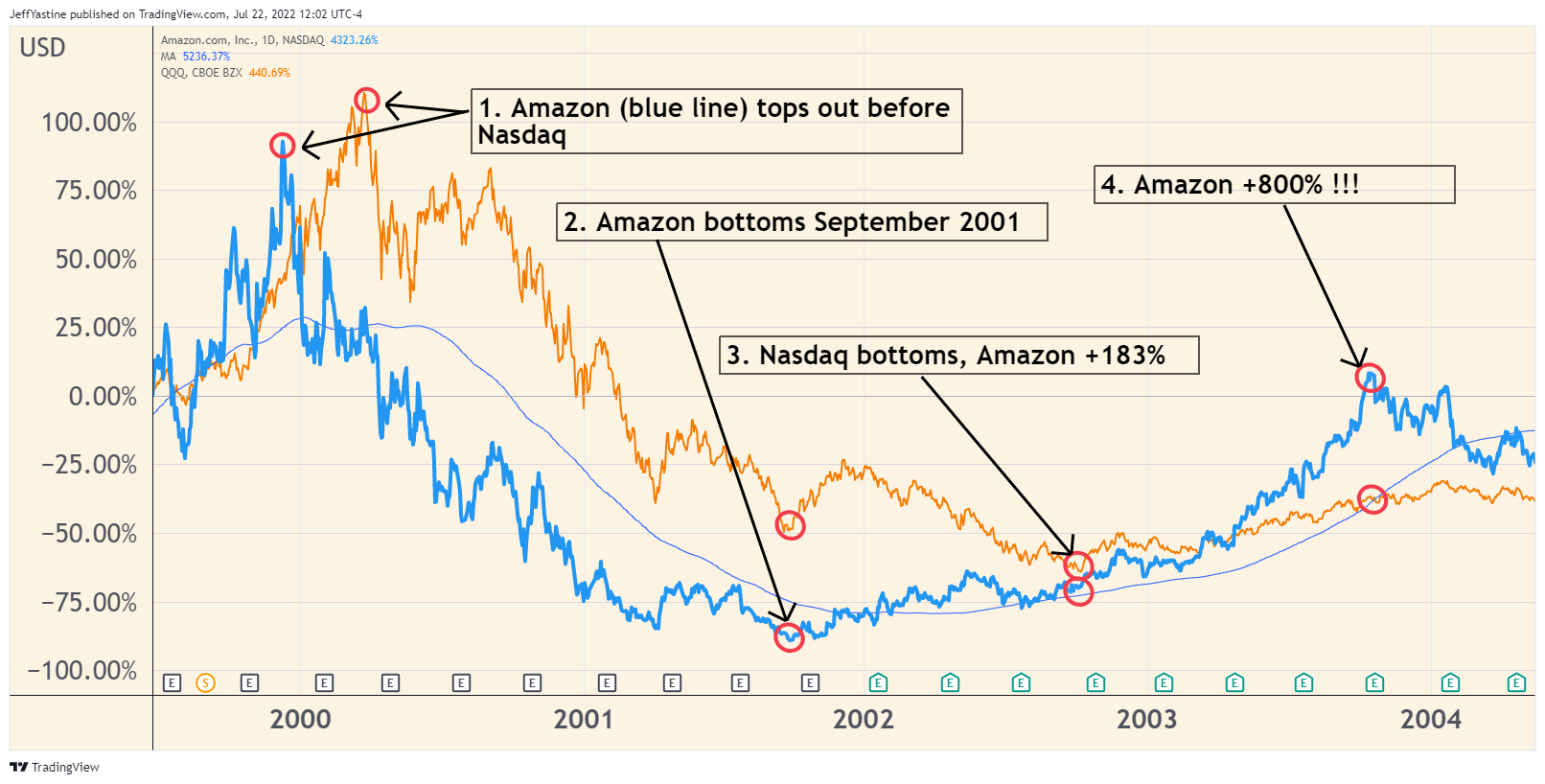

A classic case is Amazon (AMZN) during the 2000-2003 bear market. Check out the chart below...

The point of the chart...

After falling 90% in 18 months, Amazon's stock bottomed out on October 1, 2001.

But all the major stock indexes kept falling for another 12 months, bottoming out finally on October 7, 2002.

By the time the stock market bottomed, Amazon had risen 183% (a near-triple). By late 2003, just 2 years after its bear market lows, the stock had risen a cool 800%!

That's why I think it's worth taking a chance and doing a little bottom-fishing here and there for the goodBUYs portfolio. Even if the market descends further, there's a chance - though not a certainty - that the best stocks should be more resilient and work their way higher anyway.

We'll see if that assertion turns out to be true or not.

I've tried this a few times over the past 9 months and it hasn't worked out (as the market moved lower).

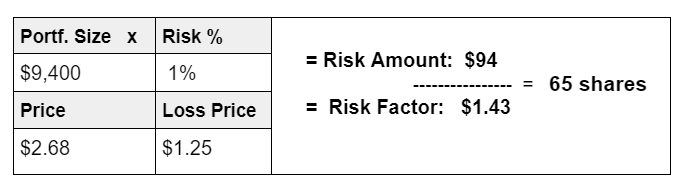

If I'm wrong again, fine - I'm only taking small chances - risking 1% of the portfolio's value to make these entries. I'll "live to fight another day"...fold up the losses and look for better, future opportunities.

New Stocks!

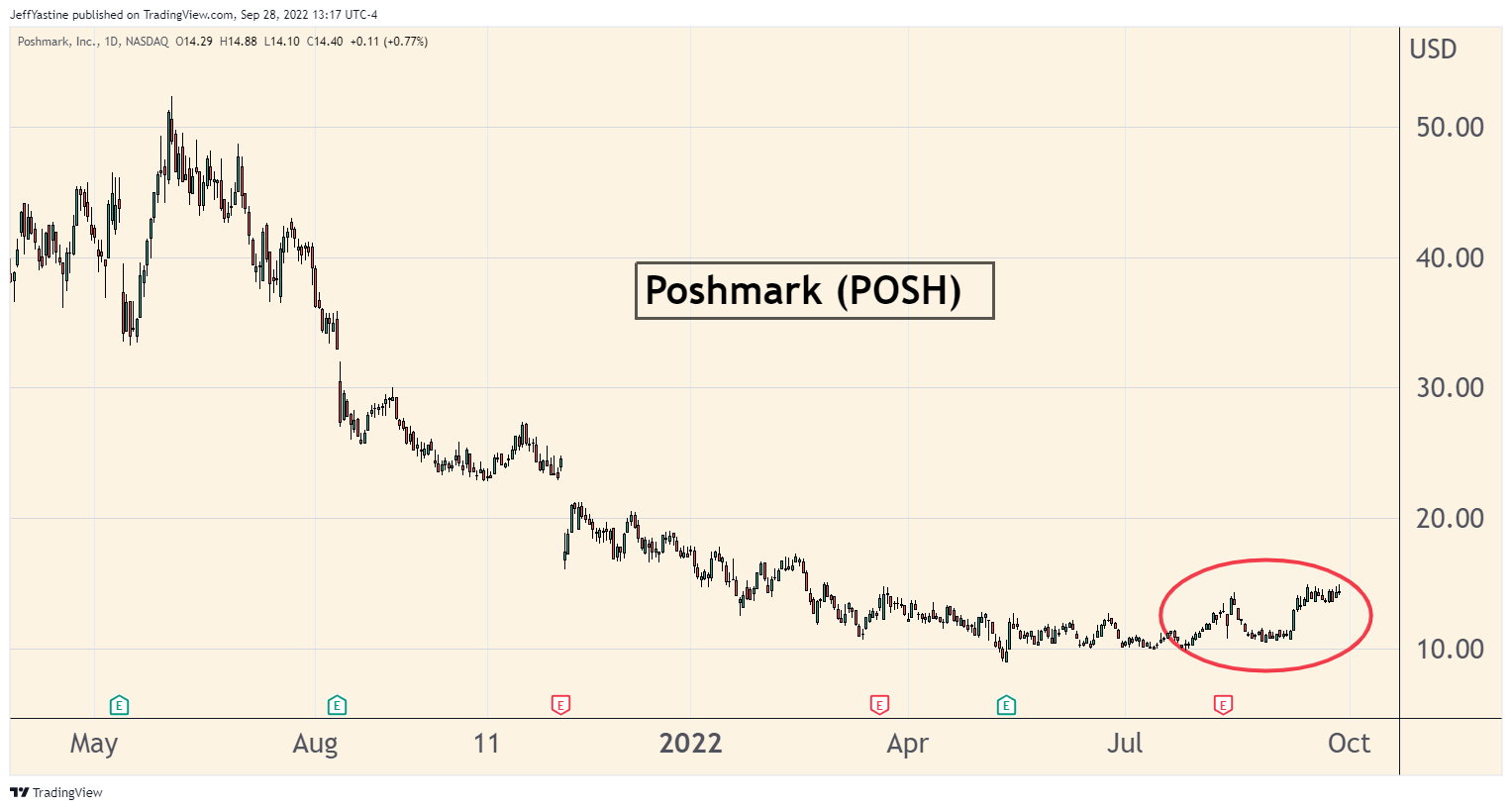

Poshmark (POSH) looks very interesting - the stock has yet to make a new low since early May:

Younger people know POSH already. The CEO likes to say that Poshmark aims to be "the largest network of closets across the world" (as in people selling used items out of their closets).

If you're older, it's like an updated version of eBay - based on an mobile phone app instead of a clunky website. And unlike eBay, Poshmark has already thought through the clunkier aspects of selling stuff yourself online - like printing out shipping labels with the right info, costs and payments for shipping, etc.

POSH doesn't have any profits yet. Analysts expect the company to post losses of...

- ($1.04)/share this year

- ($0.91) in 2023

- ($0.64) in 2024

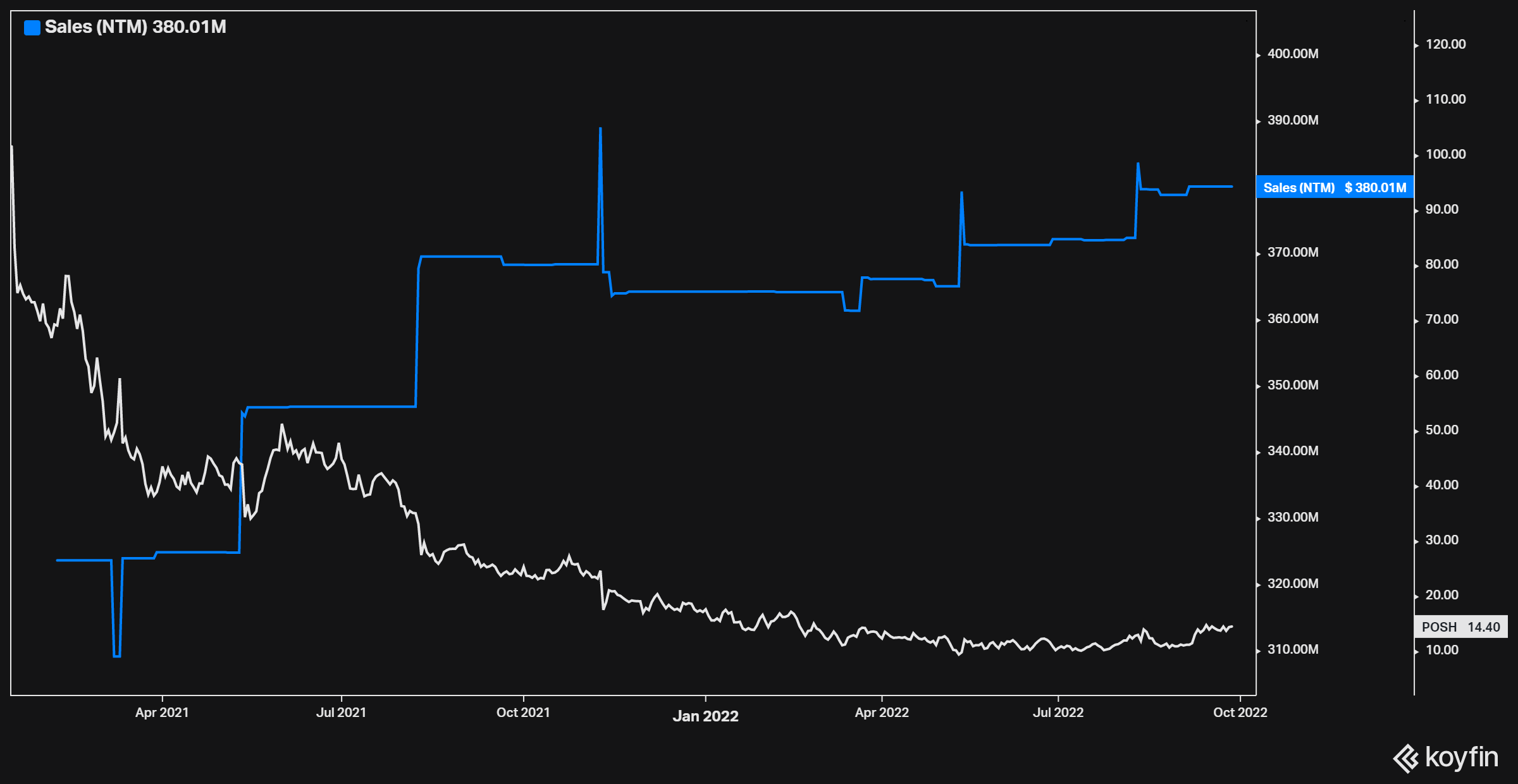

But the company has no debt, which is always good. Companies without debt can't go bankrupt. And its annual sales (the blue line in the chart below) look promising, despite the selloff in the stock's share price:

With the stock's strength in the face of the market's overall weakness, I'd like to think that buyers are accumulating shares and that this one could be a nice winner as we approach the holidays. Time will tell on that assumption.

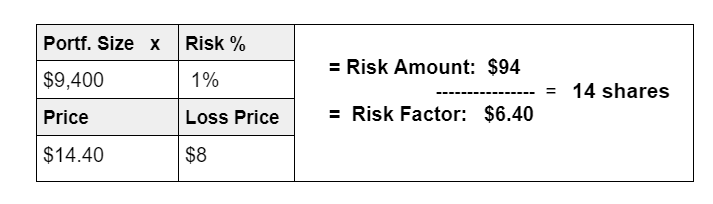

Here's what the purchase will look like in the goodBUYs portfolio - I'm risking 1% of the value of the portfolio (or $94).

My assumption is that the stock will move higher from here, but if I'm wrong and it falls to new all-time lows at $8, I'll exit the trade for a reasonable loss.

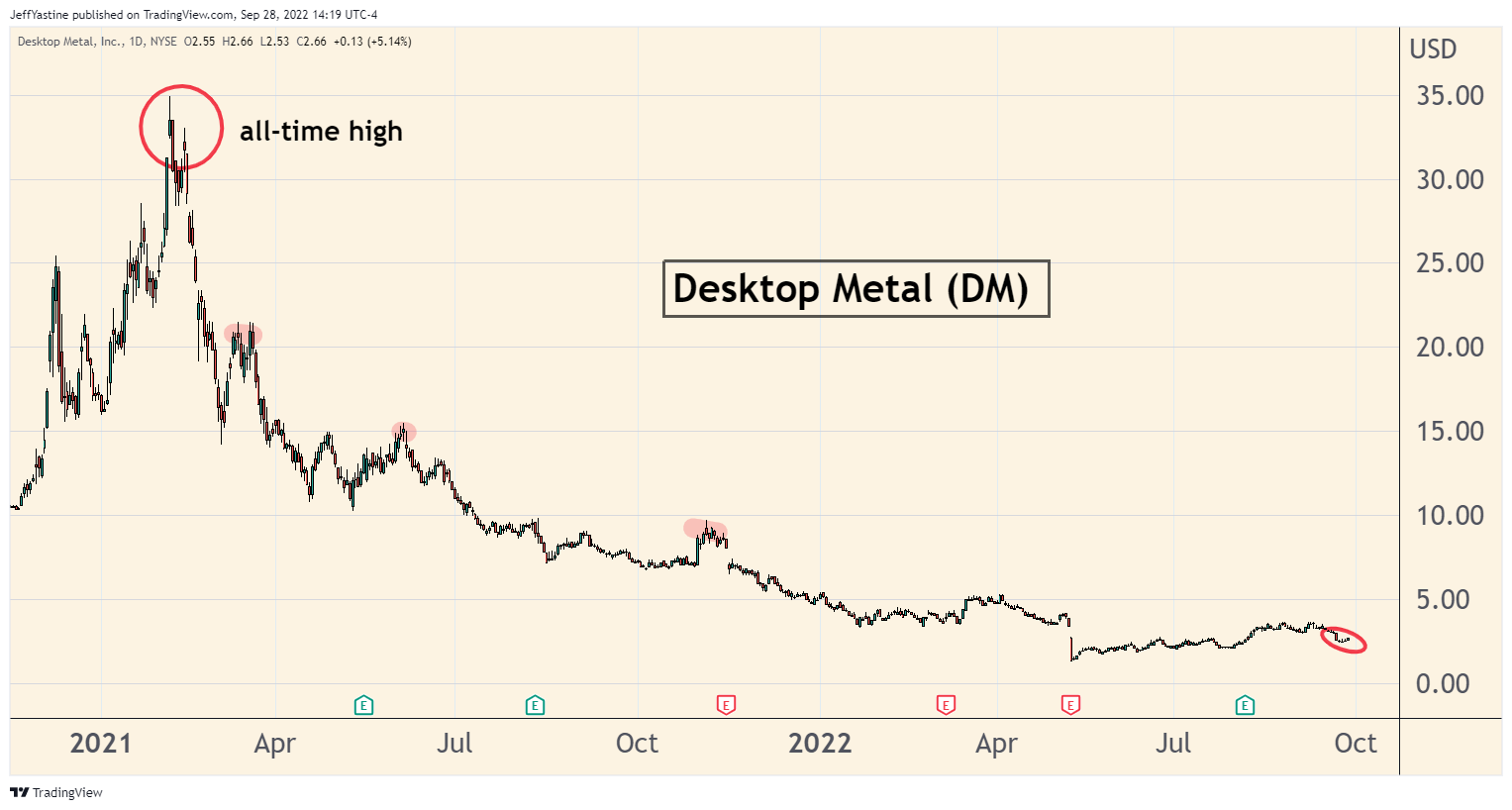

Desktop Metal (DM): Are we all tired yet hearing about the wonders of 3D-printing systems, when 3D printing stocks are such massive disappointments?

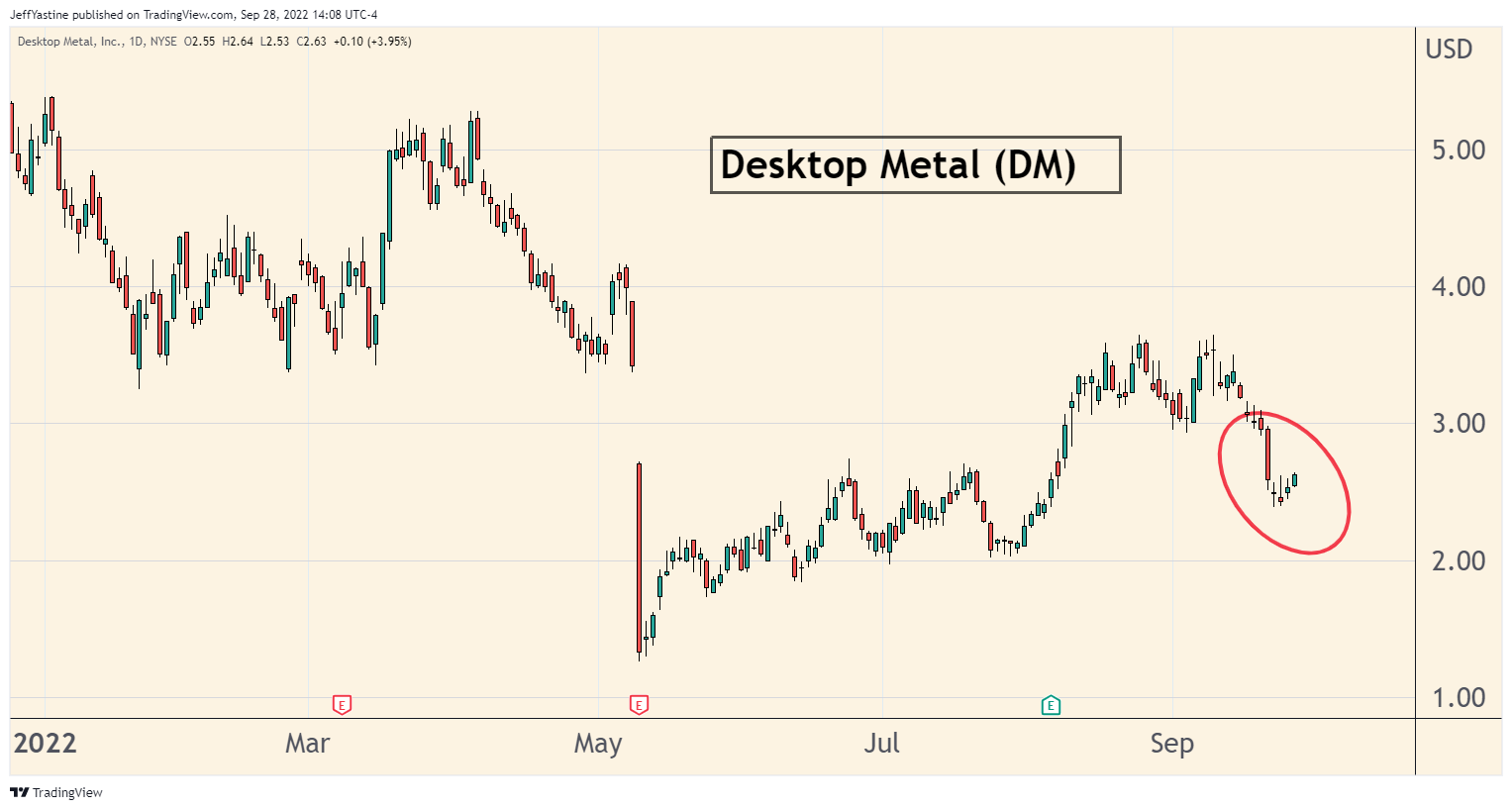

If the answer is "yes" then you have a clue why DM can now be purchased. It's way, way, waaaay down from its all-time high - and yet this stock hasn't hit a new low since the beginning of May:

Desktop Metal is a leading manufacturer of additive-manufacturing machines that do their "printing" through metal alloys or carbon fiber.

[Note: "Additive manufacturing" is a fancy word for commercial 3D printers that are big, fast, flexible and tough enough to work in an industrial/factory floor, production-line environment].

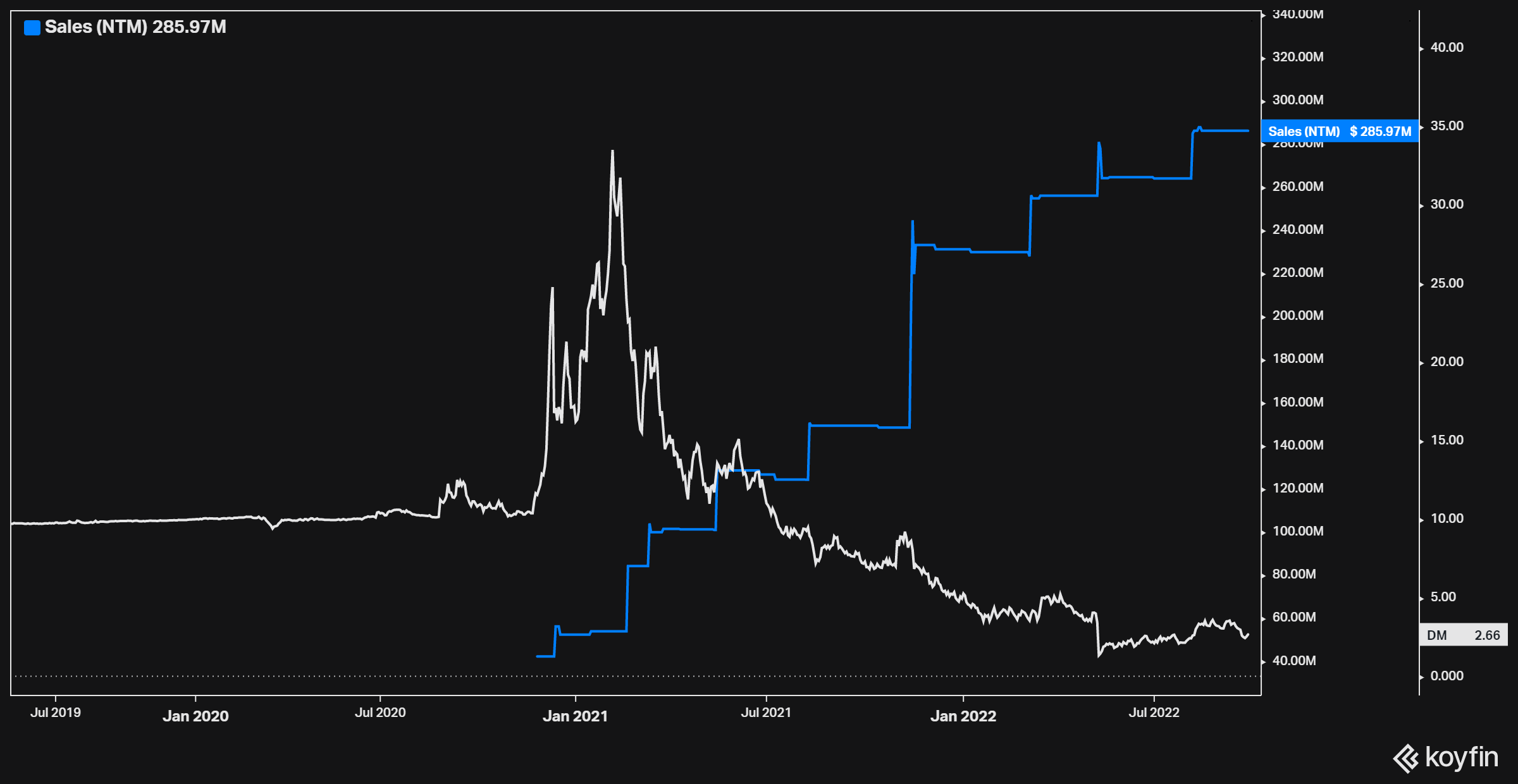

The company's done a nice job building strong sales (the blue line) even if investors are still busy trying to run away from the stock:

Sales should hit $250 million this year. Analysts expect a rise to $331 million in 2023, and another big sales leap to $550 million in 2024.

Desktop Metal isn't profitable yet either. But if things go right, the company should post a loss of ($0.99)/share this year, dropping to ($0.34) next year and the possibility of breakeven results in 2024.

The key reason to own this stock is the idea that 3D printing systems have finally come of age, and are ready to be adopted on a massive scale.

I can see the rationale very easily. In an inflationary environment, the less waste there is when turning basic inputs into finished products, the better. It also means a company can better match the production of its goods to the ups and downs of demand.

Here's how it's going to look in the goodBUYs portfolio:

I'll be adding more in coming days. But let's start sticking a toe in the water while we see how things shake out for the market at large.

Jeff

Member discussion